The Rise of the Machines: How AI is Revolutionizing the Insurance Industry

Related Articles

- Inflation’s Shadow: How Rising Prices Eat Away At Your Savings

- Navigating The Economic Shoals: A Look At Challenges In 2024

- Decoding The Consumer Confidence Index: A Guide To Understanding The Economic Pulse

- Behind The Scenes: Unveiling The World Of Life Insurance Underwriters

- The Road To Recovery: Navigating The Economic Aftermath Of COVID-19

Introduction

Uncover the latest details about The Rise of the Machines: How AI is Revolutionizing the Insurance Industry in this comprehensive guide.

The Rise of the Machines: How AI is Revolutionizing the Insurance Industry

Remember those sci-fi movies where robots took over the world? Well, while that’s still a long way off, artificial intelligence (AI) is already making significant strides in the real world, and the insurance industry is no exception. From automating tasks to personalizing customer experiences, AI is rapidly changing the way insurance is bought, sold, and even claimed.

The AI Revolution: More Than Just a Buzzword

AI isn’t just a fancy buzzword. It’s a powerful tool with the potential to transform the insurance industry in ways we’re only just beginning to understand. But what exactly is AI? In simple terms, it’s the ability of a computer to learn, reason, and solve problems like a human. This isn’t about replacing humans entirely; it’s about empowering them with tools that can make their jobs easier and more efficient.

AI in Action: Real-World Applications in Insurance

The impact of AI on insurance is already evident in a variety of ways:

- Underwriting: Gone are the days of tedious manual data analysis. AI can now crunch vast amounts of data to assess risk, predict claims, and determine premiums with unprecedented accuracy. This means faster processing times and more personalized pricing for customers.

- Claims Processing: AI-powered chatbots and virtual assistants are revolutionizing the claims process. They can handle routine inquiries, gather information efficiently, and even assess the validity of claims, freeing up human agents to focus on more complex cases.

- Fraud Detection: AI algorithms can analyze patterns in data to identify fraudulent claims with remarkable accuracy. This helps insurance companies save money and protect their customers from scams.

- Customer Service: AI-powered chatbots are available 24/7 to answer customer questions, provide personalized recommendations, and even assist with policy changes. This improves customer satisfaction and reduces the workload on human agents.

- Personalized Pricing: AI can analyze individual customer profiles, driving habits, and other factors to create customized insurance premiums. This allows customers to pay only for the coverage they need, while insurers can offer competitive rates based on individual risk profiles.

- Risk Management: AI can help insurers identify and manage risks more effectively. This includes analyzing weather patterns to predict natural disasters, monitoring driver behavior to prevent accidents, and even using predictive analytics to identify potential health risks.

Beyond the Hype: The Benefits of AI in Insurance

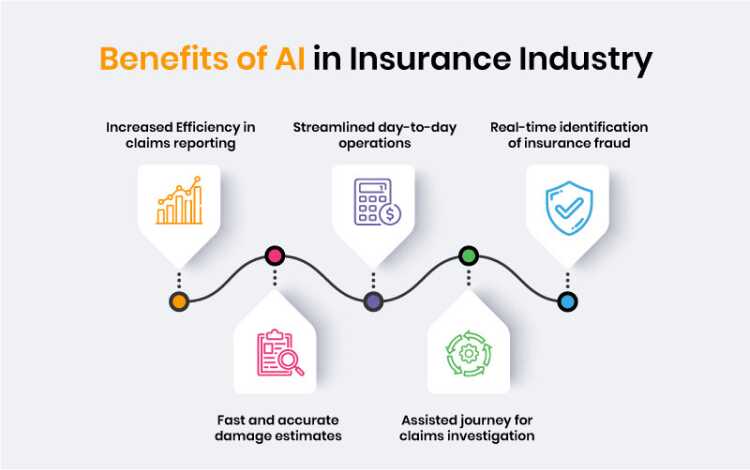

The benefits of AI in insurance are undeniable:

- Increased Efficiency: AI automates repetitive tasks, freeing up human agents to focus on more strategic and complex work. This leads to significant cost savings and improved productivity.

- Enhanced Accuracy: AI algorithms are less prone to human error, resulting in more accurate risk assessments, claims processing, and fraud detection. This improves the overall efficiency and fairness of the insurance process.

- Improved Customer Experience: AI-powered tools provide faster and more personalized service, leading to increased customer satisfaction and loyalty.

- Greater Transparency: AI can provide insurers with a deeper understanding of their customer base and the factors that influence risk. This allows them to offer more transparent and competitive pricing.

- Competitive Advantage: Companies that embrace AI will have a significant competitive advantage in the long run. They will be able to offer more efficient, personalized, and affordable insurance products.

The Future of Insurance: A Human-AI Collaboration

It’s important to remember that AI is not a replacement for human expertise. Instead, it’s a powerful tool that can enhance human capabilities. The future of insurance lies in a collaborative approach, where AI and humans work together to deliver the best possible outcomes.

Challenges and Concerns: Navigating the AI Landscape

While the benefits of AI are undeniable, there are also some challenges and concerns that need to be addressed:

- Data Privacy: AI relies on vast amounts of data, raising concerns about data privacy and security. Ensuring responsible and ethical use of data is crucial.

- Job Displacement: AI automation may lead to job displacement in certain roles within the insurance industry. It’s essential to address this issue through retraining and upskilling programs.

- Bias and Fairness: AI algorithms can inherit biases from the data they are trained on, leading to unfair outcomes. It’s important to develop and implement AI systems that are fair and unbiased.

- Transparency and Explainability: AI decision-making can be complex and opaque, making it difficult to understand how decisions are made. Improving transparency and explainability is crucial for building trust in AI systems.

Overcoming the Challenges: Building a Responsible Future

Addressing these challenges is essential for ensuring a responsible and ethical future for AI in insurance. This requires:

- Strong Data Privacy Regulations: Implementing robust data privacy regulations to protect customer data and ensure its responsible use.

- Investing in Training and Upskilling: Providing training and upskilling opportunities for employees whose roles may be impacted by AI.

- Developing Ethical AI Guidelines: Establishing ethical guidelines for the development and deployment of AI systems to ensure fairness, transparency, and accountability.

- Collaboration and Openness: Encouraging collaboration between insurance companies, technology providers, and regulators to address the challenges and opportunities of AI.

The Future is Here: Embracing the AI Revolution

The AI revolution in insurance is already underway. Companies that embrace this technology will be well-positioned to thrive in the years to come. By addressing the challenges and leveraging the opportunities, we can create a future where AI empowers the insurance industry to serve its customers better than ever before.

FAQ: Your AI Insurance Questions Answered

Q: Will AI replace human insurance agents?

A: No, AI is not meant to replace human agents. Instead, it’s designed to augment their capabilities and free them up to focus on more complex tasks. Human agents will continue to play a vital role in providing personalized advice and building relationships with customers.

Q: Is my data safe with AI-powered insurance systems?

A: Data privacy is a major concern with AI. Reputable insurance companies are committed to using data responsibly and ethically. They invest in robust security measures and adhere to data privacy regulations to protect customer information.

Q: Will AI make insurance more expensive?

A: AI has the potential to make insurance more affordable for some customers. By analyzing individual risk profiles, AI can personalize pricing and offer more competitive rates. However, it’s important to note that the cost of insurance is influenced by many factors, including claims frequency and economic conditions.

Q: How can I learn more about AI in insurance?

A: There are many resources available to learn about AI in insurance. Start by reading industry publications, attending webinars, and following thought leaders on social media. You can also explore online courses and certifications to gain a deeper understanding of the topic.

The Future of Insurance is AI-Powered: Are You Ready?

The insurance industry is on the cusp of a major transformation, and AI is at the heart of it. By embracing this technology and addressing its challenges, we can unlock a future where insurance is more efficient, personalized, and accessible than ever before.

References:

- Insurance AI Market Size, Share & Trends Analysis Report By Technology (Machine Learning, Natural Language Processing, Computer Vision), By Application (Underwriting, Claims Processing, Customer Service), By End-use (Life, Non-Life), And Segment Forecasts, 2022-2030

- AI in Insurance: The Future of Risk Assessment and Claims Processing

- The Future of Insurance: How AI Is Changing the Industry

Closure

We hope this article has helped you understand everything about The Rise of the Machines: How AI is Revolutionizing the Insurance Industry. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on The Rise of the Machines: How AI is Revolutionizing the Insurance Industry!

Feel free to share your experience with The Rise of the Machines: How AI is Revolutionizing the Insurance Industry in the comment section.

Stay informed with our next updates on The Rise of the Machines: How AI is Revolutionizing the Insurance Industry and other exciting topics.