Business Life Insurance: Protecting Your Business and Your Legacy

Related Articles

- Unlocking Growth: A Guide To Small Business Loan Options

- Navigating The World Of Business Insurance: A Comprehensive Guide

- Unlocking Growth: A Comprehensive Guide To Business Loan Options

- Protecting Your Dreams: A Guide To Business Insurance For Sole Proprietors

- The Ultimate Guide To Business Loans Without Credit Checks: Navigating The Unconventional Path

Introduction

Welcome to our in-depth look at Business Life Insurance: Protecting Your Business and Your Legacy

Business Life Insurance: Protecting Your Business and Your Legacy

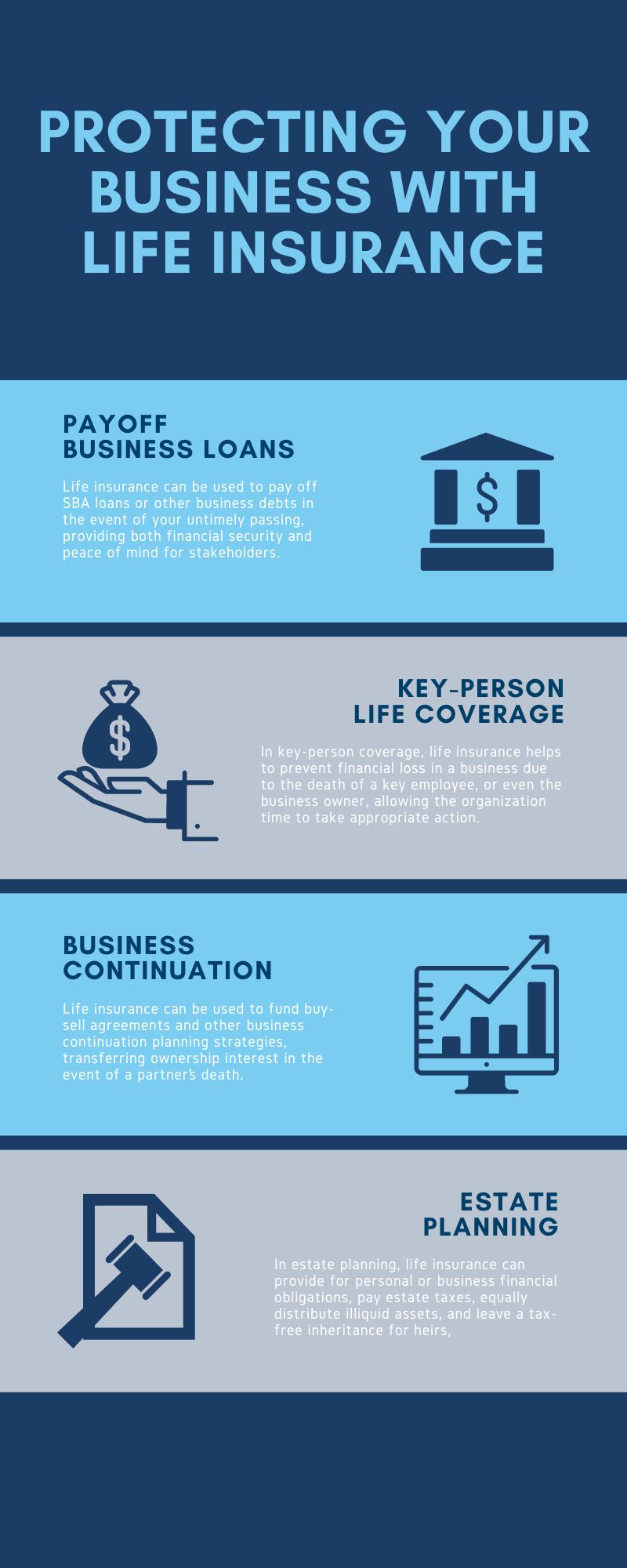

Life insurance is often thought of as a personal financial tool, designed to protect your loved ones in the event of your passing. However, it can also be a crucial component of a successful business strategy. Business life insurance, also known as key person insurance, is a powerful tool that can help safeguard your company’s future by mitigating the financial risks associated with the loss of a key employee or business owner.

This article will delve into the intricacies of business life insurance, exploring its various types, benefits, and how it can be tailored to meet the unique needs of your business. We’ll cover everything from understanding the different types of policies to choosing the right coverage and maximizing the value of your investment.

Understanding the Importance of Business Life Insurance

Imagine your business losing a key employee, someone who holds vital knowledge, skills, and relationships. The impact on your operations, productivity, and even your brand reputation can be devastating. This is where business life insurance steps in to provide a financial safety net, helping you weather the storm and ensure your business’s continued success.

Types of Business Life Insurance Policies

There are several types of business life insurance policies, each designed to address specific needs and scenarios:

1. Key Person Insurance: This type of policy insures the life of a key employee or business owner whose loss would have a significant financial impact on the company. The death benefit is paid to the business, which can use it to cover expenses like:

- Replacing the key employee: Hiring and training a new employee can be costly and time-consuming. The death benefit can help cover these expenses.

- Paying off debts: The policy can be used to pay off business loans or other debts.

- Maintaining business operations: The death benefit can provide the necessary capital to keep the business running smoothly during a transition period.

2. Buy-Sell Agreement Insurance: This type of policy is used to fund a buy-sell agreement between business partners. It ensures a smooth transition of ownership in the event of the death of a partner. The policy’s death benefit can be used to buy out the deceased partner’s share of the business, preventing disputes and maintaining the business’s stability.

3. Corporate Owned Life Insurance (COLI): This type of policy is owned by the business and the death benefit is paid to the business. COLI can be used to cover a variety of business expenses, including:

- Paying off debt: COLI can be used to pay off business loans or other debt obligations.

- Funding retirement plans: The death benefit can be used to fund the business owner’s retirement plan.

- Providing liquidity: COLI can provide the business with liquidity in the event of a major financial event.

4. Split Dollar Life Insurance: This type of policy is a hybrid of personal and business life insurance. The policy is owned by the employee, but the business contributes to the premiums. Upon the employee’s death, the business receives a portion of the death benefit, while the remaining portion goes to the employee’s beneficiaries.

Choosing the Right Business Life Insurance Policy

Selecting the right business life insurance policy requires careful consideration of your specific needs and circumstances. Here are some key factors to consider:

- Type of Business: The nature of your business and its dependence on key employees will influence the type of policy you need.

- Financial Needs: Determine how much coverage you need to mitigate the financial risks associated with the loss of a key employee or business owner.

- Business Goals: Your business goals, such as succession planning or debt repayment, will dictate the type of policy and coverage amount.

- Budget: Consider your budget and the affordability of different policy options.

Benefits of Business Life Insurance

Investing in business life insurance can provide numerous benefits for your company:

- Financial Protection: Business life insurance provides a financial safety net in the event of the death of a key employee or business owner.

- Business Continuity: It helps ensure the smooth operation of your business during a transition period, minimizing disruptions and protecting your brand reputation.

- Succession Planning: Buy-sell agreements funded by life insurance facilitate a smooth transition of ownership, preventing disputes and maintaining the business’s stability.

- Tax Advantages: Premiums paid for business life insurance are often tax-deductible, while the death benefit is generally tax-free.

- Improved Employee Morale: Providing life insurance benefits can boost employee morale and loyalty, as they feel valued and secure.

Maximizing the Value of Your Business Life Insurance Policy

To get the most out of your business life insurance policy, consider the following strategies:

- Regularly Review Your Coverage: As your business grows and evolves, your insurance needs may change. Regularly review your policy to ensure it still meets your current requirements.

- Stay Informed: Stay informed about changes in insurance regulations and market trends.

- Choose a Reputable Insurance Provider: Select a reputable insurance provider with a strong financial standing and a history of reliable service.

- Seek Professional Advice: Consult with a qualified financial advisor or insurance broker who specializes in business insurance to get personalized advice and tailored solutions.

FAQs about Business Life Insurance

1. Who needs business life insurance?

Any business that relies on key employees or business owners should consider business life insurance. This includes small businesses, partnerships, corporations, and even sole proprietorships.

2. How much coverage do I need?

The amount of coverage you need will depend on the financial impact of losing a key employee or business owner. Consider factors like salary, training costs, lost revenue, and outstanding debt.

3. How do I choose the right policy?

Consult with a qualified financial advisor or insurance broker who specializes in business insurance. They can help you assess your needs and recommend the most suitable policy.

4. What are the tax implications of business life insurance?

Premiums paid for business life insurance are generally tax-deductible, while the death benefit is typically tax-free. However, specific tax implications may vary depending on the policy type and your individual circumstances.

5. Can I use business life insurance to fund my retirement?

Yes, you can use COLI (Corporate Owned Life Insurance) to fund your retirement plan. However, it’s crucial to understand the tax implications and consult with a financial advisor.

Conclusion

Business life insurance is a valuable tool that can protect your business from financial risks and ensure its continued success. By understanding the different types of policies, carefully choosing the right coverage, and maximizing the value of your investment, you can create a robust financial safety net for your business and secure its future.

Source:

- https://www.investopedia.com/terms/b/business-life-insurance.asp

- https://www.thebalance.com/business-life-insurance-4173421

- https://www.insurance.com/business-insurance/life-insurance/

- https://www.nerdwallet.com/articles/insurance/business-life-insurance

- https://www.thebalance.com/buy-sell-agreements-and-life-insurance-4173216

Closure

Thank you for reading! Stay with us for more insights on Business Life Insurance: Protecting Your Business and Your Legacy.

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Business Life Insurance: Protecting Your Business and Your Legacy in the comment section.

Stay informed with our next updates on Business Life Insurance: Protecting Your Business and Your Legacy and other exciting topics.