Navigating the Maze: Your Guide to Business Loan Application Forms

Related Articles

- Safeguarding Your Business: A Comprehensive Guide To Business Insurance Coverage

- Unlocking Your Business Dreams: Navigating Business Loans With Less-Than-Perfect Credit

- Protecting Your Dreams: A Comprehensive Guide To Small Business Insurance

- Unlocking Growth: A Guide To Business Loans Without Collateral

- General Liability Insurance: Your Business’s Safety Net

Introduction

Discover everything you need to know about Navigating the Maze: Your Guide to Business Loan Application Forms

Navigating the Maze: Your Guide to Business Loan Application Forms

Starting a business or expanding your existing one often requires a financial boost. Business loans can be the lifeline you need, but the application process can feel like navigating a maze. This comprehensive guide will equip you with the knowledge to confidently tackle the business loan application form and increase your chances of securing the funding you need.

Understanding the Application Process: A Step-by-Step Breakdown

The business loan application process might seem daunting, but it’s more about gathering the right information and presenting it clearly. Here’s a breakdown of the typical steps:

-

Pre-Application Research:

- Identify your needs: What kind of loan are you seeking? How much do you need? What’s the purpose of the loan?

- Explore lenders: Compare different banks, credit unions, and online lenders. Consider their loan terms, interest rates, fees, and eligibility criteria.

- Assess your creditworthiness: Check your credit score and history. Address any negative marks to improve your chances.

-

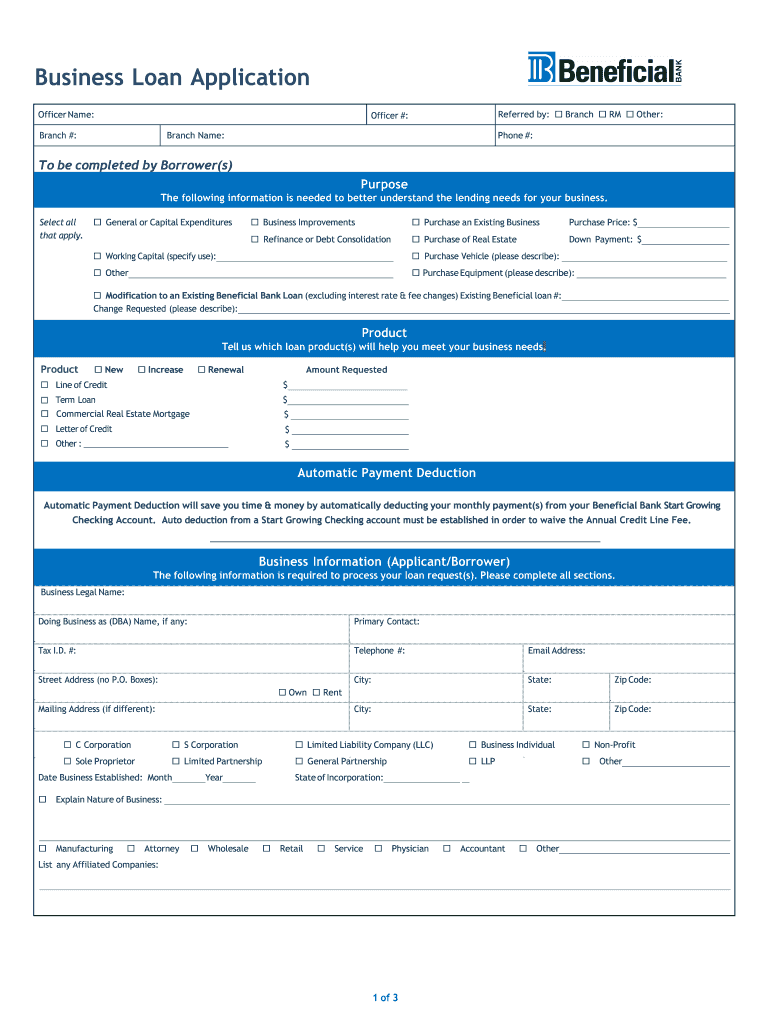

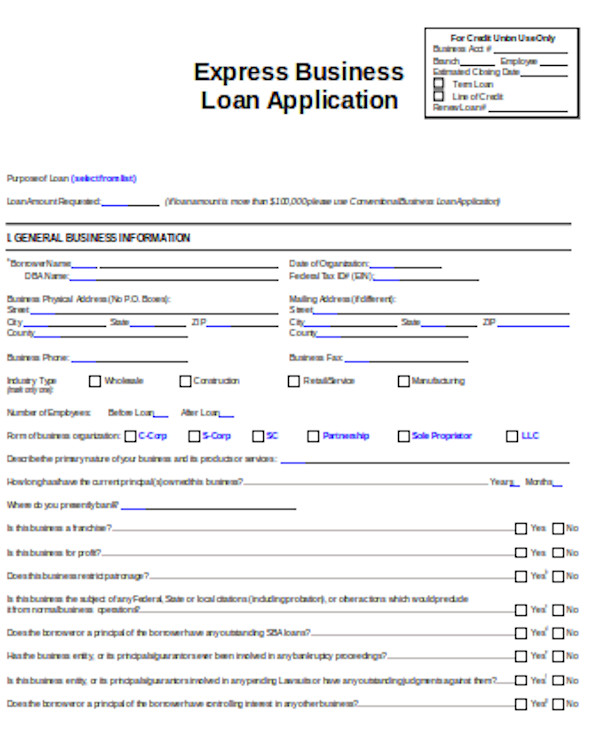

Gathering Essential Documents:

- Personal Information: Name, address, Social Security number, contact details.

- Business Information: Business name, legal structure (sole proprietorship, LLC, etc.), date of establishment, industry, location, website, and contact information.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements. These should be accurate and up-to-date.

- Tax Returns: Most recent tax returns (personal and business).

- Bank Statements: Recent bank statements showing business transactions.

- Collateral: If required, provide details of assets you’re willing to pledge as security (e.g., equipment, real estate).

- Business Plan: A well-written business plan outlining your business goals, market analysis, financial projections, and management team.

-

Completing the Application Form:

- Thoroughness is key: Fill out the form accurately and completely.

- Be specific: Provide detailed information about your business, its operations, and your financial needs.

- Highlight your strengths: Emphasize your positive aspects, like strong revenue growth, solid credit history, and experienced management team.

- Address potential concerns: If there are any challenges or weaknesses, acknowledge them and explain how you plan to overcome them.

-

Submitting the Application:

- Review your application carefully: Ensure all information is accurate and complete before submitting.

- Follow the instructions: Adhere to the lender’s specific guidelines and deadlines for submission.

- Consider online applications: Many lenders offer online application portals for convenience and faster processing.

-

The Review Process:

- Lender evaluation: The lender will assess your application based on various factors, including your creditworthiness, business plan, financial health, and industry outlook.

- Verification: They may request additional information or documentation for verification.

- Decision: The lender will notify you of their decision, which could be approval, denial, or a counteroffer.

Boosting Your Application: Tips for Success

To make your business loan application stand out, consider these strategies:

- Build a Strong Credit History: A good credit score is a crucial factor. Pay bills on time, manage your debt responsibly, and avoid excessive credit inquiries.

- Develop a Compelling Business Plan: A well-structured business plan demonstrates your vision, market understanding, and financial feasibility.

- Prepare Financial Statements: Accurate and detailed financial statements provide a clear picture of your business’s financial health.

- Highlight Your Strengths: Showcase your business’s unique value proposition, competitive advantages, and growth potential.

- Address Potential Challenges: Acknowledge any weaknesses and outline your strategies to mitigate them.

- Seek Professional Guidance: Consider consulting with a business advisor or loan officer for personalized advice.

Common Loan Application Errors to Avoid

- Inaccurate or Incomplete Information: Mistakes or missing details can raise red flags and lead to rejection.

- Poorly Presented Business Plan: A weak or poorly written business plan can undermine your credibility.

- Lack of Financial Documentation: Insufficient financial information makes it difficult for lenders to assess your risk.

- Overstating Revenue or Assets: Exaggerating your financial position can result in a denial or even legal consequences.

- Ignoring Credit History Issues: Failing to address negative credit history can jeopardize your application.

Beyond the Application: Post-Approval Considerations

Once your loan application is approved, remember these important points:

- Read the Loan Agreement Carefully: Understand the terms, interest rates, fees, repayment schedule, and any collateral requirements.

- Maintain Good Financial Practices: Continue to manage your business effectively and meet your financial obligations.

- Communicate with Your Lender: Stay in touch with your lender, especially if you encounter any financial difficulties.

FAQs: Addressing Common Concerns

Q: What is the difference between a secured and unsecured business loan?

A: A secured loan requires collateral, which is an asset you pledge as security. If you default, the lender can seize the collateral. Unsecured loans don’t require collateral but typically have higher interest rates due to increased risk.

Q: What are some common types of business loans?

A: Common types include:

- Term loans: Fixed repayment terms with regular installments.

- Lines of credit: Flexible funding that you can draw from as needed.

- SBA loans: Government-backed loans with favorable terms for small businesses.

- Equipment loans: Specific loans for purchasing equipment.

- Commercial real estate loans: Loans for financing commercial properties.

Q: What is a good credit score for a business loan?

A: A credit score of 680 or higher is generally considered good for a business loan. However, lenders may have their own specific requirements.

Q: How long does it take to get approved for a business loan?

A: The approval process can vary depending on the lender and the complexity of your application. It can take anywhere from a few days to several weeks.

Q: What happens if my loan application is denied?

A: If your application is denied, the lender will typically provide you with a reason. You can use this feedback to improve your application or explore alternative funding options.

Conclusion: Navigating the Loan Application Process with Confidence

Obtaining a business loan can be a significant step towards achieving your business goals. By understanding the application process, gathering essential documents, and presenting a compelling case, you can increase your chances of securing the funding you need. Remember, thorough preparation, clear communication, and a strong commitment to your business are key to success.

Source:

[Insert relevant source URL here]

Closure

We hope this article has helped you understand everything about Navigating the Maze: Your Guide to Business Loan Application Forms. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Navigating the Maze: Your Guide to Business Loan Application Forms in the comment section.

Keep visiting our website for the latest trends and reviews.