Cybersecurity Insurance: Your Shield Against the Digital Storm

Related Articles

- The US-China Trade War: A Rollercoaster Ride For Global Economies

- The US Trade Deficit: A Deep Dive Into The Numbers And The Debate

- The Price Of Progress: Inflation, Wages, And The Growing Gap

- Usage-Based Insurance: Driving Down Your Premiums, One Mile At A Time

- The Rise Of De-Dollarization: A World Beyond The Greenback?

Introduction

Uncover the latest details about Cybersecurity Insurance: Your Shield Against the Digital Storm in this comprehensive guide.

Cybersecurity Insurance: Your Shield Against the Digital Storm

The digital world is a bustling marketplace, a haven for innovation, and unfortunately, a breeding ground for cybercriminals. From data breaches to ransomware attacks, the threats are real, and the consequences can be devastating. Enter cybersecurity insurance, your lifeline in the face of digital storms.

Understanding the Need for Cyber Insurance

Imagine this: your company’s network is compromised, sensitive customer data is stolen, and your operations are brought to a standstill. The financial and reputational damage can be crippling. This is where cybersecurity insurance steps in, offering financial protection and expert guidance to help you weather the storm.

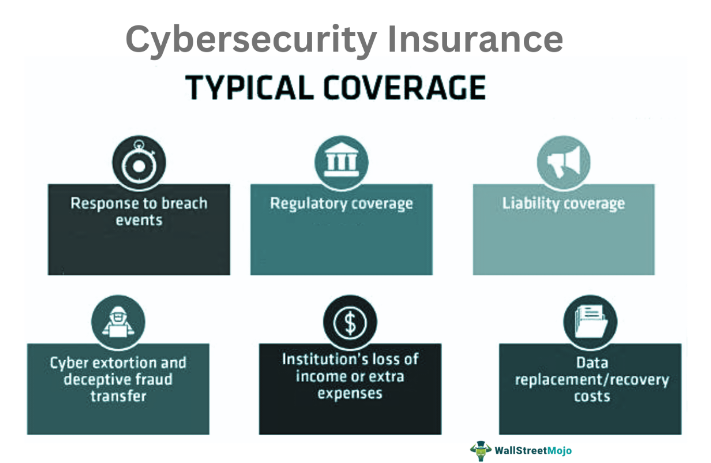

What Does Cybersecurity Insurance Cover?

Cybersecurity insurance is a comprehensive package, designed to address various aspects of a cyberattack:

- Data Breach Response: Covers the costs of notifying affected individuals, credit monitoring, and legal expenses related to data breaches.

- Ransomware Protection: Provides financial assistance to pay ransom demands, but importantly, also covers costs associated with data recovery and system restoration.

- Business Interruption: Compensates for lost revenue and expenses incurred due to downtime caused by a cyberattack.

- Cyber Extortion: Covers extortion attempts where attackers threaten to release sensitive information unless a ransom is paid.

- Cybercrime Liability: Protects against legal liabilities arising from cyberattacks, including lawsuits from affected individuals or businesses.

- Cybersecurity Incident Response: Provides access to expert teams who can help you contain and mitigate the damage caused by a cyberattack.

Who Needs Cybersecurity Insurance?

Cyberattacks are not exclusive to large corporations. Any organization that handles sensitive data, relies on technology for operations, or has a digital presence is at risk. This includes:

- Small and Medium-Sized Businesses (SMBs): Often overlooked as targets, SMBs are increasingly vulnerable due to limited cybersecurity resources.

- Non-profit Organizations: These organizations handle sensitive data, such as donor information, and can be attractive targets for cybercriminals.

- Educational Institutions: Schools and universities are responsible for protecting student and faculty data, making them vulnerable to cyberattacks.

- Healthcare Providers: Healthcare organizations hold sensitive medical records, making them prime targets for ransomware attacks.

Choosing the Right Cybersecurity Insurance Policy

Just like any insurance policy, finding the right cybersecurity insurance is crucial. Here’s what to consider:

- Coverage Limits: Ensure the policy covers the financial risks your organization faces, including data breach costs, ransom demands, and business interruption losses.

- Exclusions and Limitations: Carefully review the policy to understand what is not covered, such as pre-existing vulnerabilities or attacks caused by internal negligence.

- Deductible: The deductible is the amount you pay upfront before the insurance kicks in. Choose a deductible you can afford while balancing it with the overall cost of the policy.

- Policy Language: Understand the specific terms and conditions of the policy to ensure it aligns with your organization’s needs and risk profile.

Benefits of Cybersecurity Insurance

Beyond financial protection, cybersecurity insurance offers several advantages:

- Peace of Mind: Knowing you have insurance in place provides a sense of security and allows you to focus on your business.

- Expert Guidance: Insurance providers offer access to cybersecurity experts who can help you respond to an attack and mitigate the damage.

- Enhanced Security Posture: The process of obtaining cybersecurity insurance often involves a risk assessment, which can identify vulnerabilities and help you strengthen your defenses.

- Improved Reputation: Having cybersecurity insurance demonstrates your commitment to protecting data and can enhance your reputation in the eyes of customers and partners.

Tips for Reducing Your Cyber Risk

While cybersecurity insurance offers a safety net, it’s essential to proactively reduce your risk:

- Implement Strong Security Measures: Use strong passwords, enable two-factor authentication, and keep your software up to date.

- Train Employees: Educate your employees on cybersecurity best practices and how to identify phishing scams and other threats.

- Regularly Back Up Data: Regular backups ensure you can recover your data in case of a cyberattack.

- Monitor Your Network: Use security monitoring tools to detect suspicious activity and respond quickly to threats.

- Develop an Incident Response Plan: Have a plan in place for how to respond to a cyberattack, including communication protocols, data recovery procedures, and legal obligations.

FAQs about Cybersecurity Insurance

1. How much does cybersecurity insurance cost?

The cost of cybersecurity insurance varies depending on factors such as the size and nature of your business, the level of coverage you need, and your risk profile.

2. What are the common exclusions in cybersecurity insurance policies?

Common exclusions include pre-existing vulnerabilities, attacks caused by internal negligence, and losses due to acts of war or terrorism.

3. Do I need cybersecurity insurance if I have other insurance policies?

While other insurance policies may cover some aspects of cyberattacks, they are not specifically designed for cyber risks. Cybersecurity insurance provides specialized coverage tailored to digital threats.

4. How do I find a reputable cybersecurity insurance provider?

Research different insurance providers, compare their coverage options, and look for providers with a strong track record in cybersecurity.

5. What should I do if I experience a cyberattack?

Immediately contact your cybersecurity insurance provider and follow their guidance. They will help you assess the damage, initiate an incident response, and navigate the legal and regulatory requirements.

Conclusion

In today’s digital landscape, cybersecurity insurance is no longer a luxury but a necessity. It provides financial protection, expert guidance, and peace of mind in the face of ever-evolving cyber threats. By investing in cybersecurity insurance and implementing proactive security measures, you can protect your business and its valuable assets from the digital storm.

Source URL: [https://www.cybersecurityinsurance.com/](This is a placeholder. Please replace this with a real source URL for cybersecurity insurance.)

Closure

We hope this article has helped you understand everything about Cybersecurity Insurance: Your Shield Against the Digital Storm. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Cybersecurity Insurance: Your Shield Against the Digital Storm!

We’d love to hear your thoughts about Cybersecurity Insurance: Your Shield Against the Digital Storm—leave your comments below!

Stay informed with our next updates on Cybersecurity Insurance: Your Shield Against the Digital Storm and other exciting topics.