Navigating the Maze: Medicare and Your Private Insurance Options

Related Articles

- Inflation Vs Recession Risks

- The Rollercoaster Ride Of US Unemployment: A Look At The Trends And What They Mean

- The Rise Of The Machines: How Automation Is Reshaping The Job Market

- Business Interruption Insurance: Protecting Your Bottom Line From Unexpected Disruptions

- Pumping The Economy: A Deep Dive Into Economic Stimulus Packages

Introduction

Join us as we explore Navigating the Maze: Medicare and Your Private Insurance Options, packed with exciting updates

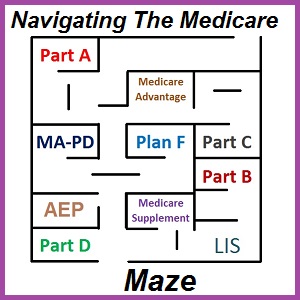

Navigating the Maze: Medicare and Your Private Insurance Options

Medicare, the federal health insurance program for Americans 65 and older (and some younger individuals with disabilities), is a vital lifeline for millions. But it’s not always a one-size-fits-all solution. The complexity of Medicare, coupled with a plethora of private insurance options, can leave many feeling overwhelmed. This comprehensive guide will equip you with the knowledge to navigate the maze and find the coverage that best suits your needs and budget.

Understanding the Basics of Medicare

Medicare is divided into four parts, each offering distinct benefits:

Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services. Most people don’t pay a monthly premium for Part A because they’ve already paid into it through payroll taxes during their working years.

Part B (Medical Insurance): Covers doctor’s visits, outpatient care, preventive services, and some durable medical equipment. You pay a monthly premium for Part B, which varies based on your income.

Part C (Medicare Advantage): Offered by private insurance companies, Medicare Advantage plans combine the benefits of Parts A and B, often adding extra coverage like vision, dental, and hearing. These plans have monthly premiums and may have copayments and deductibles.

Part D (Prescription Drug Coverage): Offered by private insurance companies, Part D plans cover prescription drugs. You pay a monthly premium, copayments, and may have a deductible.

The Role of Private Insurance in Medicare

While Medicare provides essential coverage, it doesn’t cover everything. Private insurance companies fill the gaps with supplemental plans and Medicare Advantage programs.

Medicare Supplement (Medigap) Plans:

These plans help pay for out-of-pocket costs not covered by Original Medicare (Parts A and B). They are offered by private insurance companies and come in ten different plans, each with its own benefits and costs.

- Pros: Medigap plans offer predictable out-of-pocket costs and comprehensive coverage.

- Cons: Medigap premiums can be expensive, and they don’t cover prescription drugs.

Medicare Advantage (Part C) Plans:

Offered by private insurance companies, Medicare Advantage plans combine the benefits of Parts A and B, often adding extra coverage like vision, dental, and hearing. They also typically have lower out-of-pocket costs than Original Medicare.

- Pros: Medicare Advantage plans can be more affordable than Original Medicare and offer additional benefits.

- Cons: They have limited networks, may require prior authorization for certain services, and may have restrictions on out-of-network coverage.

Choosing the Right Medicare Plan for You

The best Medicare plan for you depends on your individual needs and financial situation. Consider these factors:

- Your health: If you have pre-existing conditions or anticipate needing significant medical care, a plan with comprehensive coverage is essential.

- Your budget: Medicare premiums and out-of-pocket costs vary significantly between plans.

- Your preferred providers: Some plans have limited networks, so ensure your doctors and hospitals are in-network.

- Your prescription drug needs: If you take multiple medications, consider a Part D plan that covers your specific drugs.

Navigating the Enrollment Process

Medicare enrollment periods can be confusing. Here’s a breakdown:

- Initial Enrollment Period: This period starts three months before your 65th birthday, includes your birthday month, and continues for three months after.

- Open Enrollment Period: This period runs from January 1st to March 31st each year. You can switch between Medicare Advantage plans, Part D plans, or enroll in a Medigap plan.

- Special Enrollment Period: You may be eligible for a Special Enrollment Period if you experience a qualifying life event, such as moving to a new area or losing your job.

Tips for Saving Money on Medicare

- Shop around: Compare plans from different insurance companies to find the best rates and benefits.

- Enroll in a Part D plan during the Open Enrollment Period: You can switch plans each year to find the best deal.

- Take advantage of preventive services: Medicare covers many preventive services, which can help you avoid costly medical issues down the road.

- Consider a Medicare Advantage plan: These plans can be more affordable than Original Medicare.

- Negotiate with providers: Ask for discounts or payment plans if you’re struggling to pay for medical bills.

Frequently Asked Questions (FAQs)

Q: When should I enroll in Medicare?

A: You should enroll in Medicare three months before your 65th birthday, during your birthday month, or within three months after your birthday.

Q: What if I’m working past 65?

A: You can delay enrolling in Medicare until you retire, but you may face a late enrollment penalty if you don’t enroll within a certain timeframe.

Q: Do I need a Medigap plan?

A: A Medigap plan can be helpful if you want to protect yourself from high out-of-pocket costs, but it’s not necessary for everyone.

Q: What’s the difference between Medicare Advantage and Original Medicare?

A: Medicare Advantage is offered by private insurance companies and combines the benefits of Parts A and B, often adding extra coverage. Original Medicare is the traditional Medicare program offered by the federal government.

Q: How can I find a Medicare plan that meets my needs?

A: You can use the Medicare Plan Finder tool on the Medicare.gov website to compare plans and find one that meets your needs and budget.

Conclusion

Navigating the Medicare system can be challenging, but with the right information and resources, you can find the coverage that best meets your needs and budget. By understanding the different parts of Medicare, exploring private insurance options, and carefully considering your individual circumstances, you can make informed decisions about your health insurance and ensure you receive the care you need in your later years.

References:

Note: This article is intended for informational purposes only and should not be considered medical or legal advice. Please consult with a qualified healthcare professional or legal expert for personalized guidance.

Closure

We hope this article has helped you understand everything about Navigating the Maze: Medicare and Your Private Insurance Options. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Navigating the Maze: Medicare and Your Private Insurance Options!

We’d love to hear your thoughts about Navigating the Maze: Medicare and Your Private Insurance Options—leave your comments below!

Keep visiting our website for the latest trends and reviews.