Insurance Risk Management: Protecting Your Future, One Step at a Time

Related Articles

- The US Trade Deficit: A Deep Dive Into The Numbers And The Debate

- The Fed’s Inflation Target: Keeping The Economy On Track

- The Big Spender: Unpacking The US Government’s Spending Habits

- Cyber Liability Insurance: Your Digital Shield In A World Of Threats

- Navigating The Maze: Employer Health Insurance Mandates Explained

Introduction

Join us as we explore Insurance Risk Management: Protecting Your Future, One Step at a Time, packed with exciting updates

Insurance Risk Management: Protecting Your Future, One Step at a Time

Life is full of uncertainties. From unexpected medical emergencies to natural disasters, the world throws curveballs our way. That’s where insurance comes in, offering a safety net to help us navigate these unpredictable situations. But insurance isn’t just about buying a policy and forgetting about it. It’s about actively managing risk, ensuring you have the right coverage, and making informed decisions to protect your future.

What is Insurance Risk Management?

Insurance risk management is the process of identifying, assessing, and controlling risks that could potentially impact your financial well-being. It’s about taking proactive steps to minimize potential losses and maximize your peace of mind. Think of it as a strategic plan for navigating life’s uncertainties.

Why is Insurance Risk Management Important?

- Financial Security: Insurance protects your assets and income from unexpected events, preventing financial ruin.

- Peace of Mind: Knowing you have adequate insurance coverage reduces stress and worry, allowing you to focus on what truly matters.

- Business Continuity: For businesses, insurance risk management ensures operations can continue even after a disaster, safeguarding employees, customers, and reputation.

- Compliance: Many industries have regulatory requirements for specific insurance coverage, ensuring compliance with legal obligations.

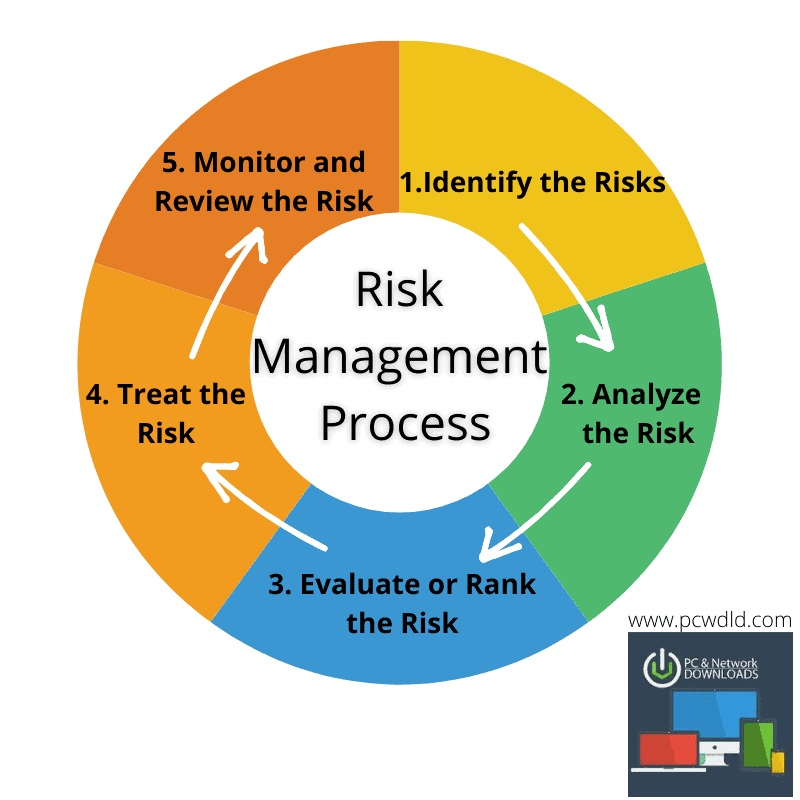

Key Steps in Insurance Risk Management:

1. Identify Potential Risks:

- Personal Risks: Health issues, accidents, disability, death, property damage, liability claims.

- Business Risks: Natural disasters, fire, theft, cyberattacks, lawsuits, product liability, employee accidents.

2. Assess Risk Severity:

- Probability: How likely is the risk to occur?

- Impact: What would be the financial and non-financial consequences if the risk materializes?

3. Develop Risk Management Strategies:

- Risk Avoidance: Avoiding activities or situations that pose significant risk (e.g., not driving in dangerous areas).

- Risk Reduction: Implementing measures to minimize the likelihood or impact of risks (e.g., installing smoke detectors, maintaining your car regularly).

- Risk Transfer: Transferring risk to an insurer through insurance policies (e.g., purchasing health insurance, home insurance).

- Risk Acceptance: Accepting the risk and taking no action (e.g., choosing a higher deductible to lower your premium).

4. Implement and Monitor:

- Put your plan into action: Purchase appropriate insurance policies, implement risk reduction measures, and review your plan regularly.

- Monitor performance: Track the effectiveness of your strategies, adjust as needed, and stay updated on changing risks.

Types of Insurance for Risk Management:

- Health Insurance: Protects against medical expenses, including hospitalizations, surgeries, and doctor visits.

- Life Insurance: Provides financial support to loved ones in case of death, helping cover expenses like funeral costs, mortgage payments, and living expenses.

- Disability Insurance: Replaces lost income if you become unable to work due to illness or injury.

- Homeowners/Renters Insurance: Covers damage to your property and liability claims from accidents on your property.

- Auto Insurance: Protects you from financial losses due to car accidents, including damage to your vehicle, medical expenses, and liability claims.

- Business Insurance: Covers various risks businesses face, including property damage, liability claims, and employee injuries.

Choosing the Right Insurance Coverage:

- Assess your individual needs: Consider your age, health, family situation, assets, and lifestyle.

- Seek professional advice: Consult with an insurance broker or agent to discuss your options and find the best coverage for your specific needs.

- Compare quotes: Get quotes from multiple insurers to ensure you’re getting the most competitive rates.

- Read the fine print: Understand the terms and conditions of your policy, including coverage limits, deductibles, and exclusions.

Beyond Insurance:

While insurance is a crucial component of risk management, it’s not the only solution. Other proactive steps can further minimize risks:

- Financial Planning: Develop a budget, save for emergencies, and manage your debt responsibly.

- Preventive Measures: Take steps to reduce the likelihood of accidents or health problems (e.g., wearing seatbelts, eating healthy, exercising regularly).

- Risk Awareness: Stay informed about potential risks in your area and industry, and take steps to mitigate them.

Insurance Risk Management for Businesses:

For businesses, risk management is critical for long-term success. It involves:

- Identifying and assessing risks: From operational hazards to financial uncertainties, businesses need to identify and assess the potential impact of various risks.

- Developing a comprehensive risk management plan: This plan should outline strategies for mitigating risks, including insurance coverage, safety procedures, and contingency plans.

- Regularly monitoring and updating the plan: Businesses need to adapt their risk management strategies as their operations evolve and new risks emerge.

FAQs:

Q: How often should I review my insurance policies?

A: It’s recommended to review your insurance policies at least annually, or more frequently if your circumstances change (e.g., marriage, birth of a child, purchase of a new home, major life events).

Q: What are some common insurance scams?

A: Be wary of unsolicited calls or emails offering insurance deals, companies promising unrealistic coverage, and requests for personal information before you’ve established a relationship.

Q: How can I find a reputable insurance broker or agent?

A: Ask for referrals from friends, family, or colleagues, check online reviews, and look for professionals with experience in your specific insurance needs.

Q: What are some tips for negotiating insurance premiums?

A: Consider increasing your deductible, bundling your policies, maintaining a good driving record, and shopping around for competitive rates.

Q: What are the benefits of having a comprehensive risk management plan?

A: A well-developed plan can help you avoid financial losses, protect your assets, ensure business continuity, and enhance your peace of mind.

Conclusion:

Insurance risk management is an ongoing process that requires proactive planning and informed decision-making. By understanding your risks, implementing effective strategies, and staying vigilant, you can protect your financial future and navigate life’s uncertainties with greater confidence. Remember, it’s not about eliminating risks entirely but about minimizing their impact and ensuring you have the right tools to cope with the unexpected.

Source:

- Insurance Information Institute

- National Association of Insurance Commissioners

- Federal Emergency Management Agency

- Small Business Administration

Closure

We hope this article has helped you understand everything about Insurance Risk Management: Protecting Your Future, One Step at a Time. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Insurance Risk Management: Protecting Your Future, One Step at a Time!

Feel free to share your experience with Insurance Risk Management: Protecting Your Future, One Step at a Time in the comment section.

Stay informed with our next updates on Insurance Risk Management: Protecting Your Future, One Step at a Time and other exciting topics.