The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do?

Related Articles

- The Ripple Effect: How US Economic Sanctions Shape The World

- Climate Change: A Growing Threat To The Insurance Industry

- Navigating The Maze: Cybersecurity Insurance Challenges In A Digital World

- The Rise Of De-Dollarization: A World Beyond The Greenback?

- The Renewable Energy Revolution: More Than Just Clean Air, It’s Big Business

Introduction

In this article, we dive into The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do?, giving you a full overview of what’s to come

The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do?

Life insurance, a cornerstone of financial security, is becoming increasingly expensive. This trend has left many individuals and families questioning the affordability of this essential protection. In this comprehensive guide, we’ll delve into the factors driving the rising cost of life insurance, explore the implications for consumers, and offer actionable tips for navigating this challenging landscape.

Understanding the Factors Behind the Rising Cost:

The cost of life insurance is influenced by a complex interplay of economic, demographic, and industry-specific factors. Here’s a breakdown of the key drivers:

1. Increased Life Expectancy:

As medical advancements extend lifespans, insurance companies face a longer period of potential payouts. This extended payout horizon translates to higher premiums to ensure the financial sustainability of the insurance pool.

2. Low Interest Rates:

Life insurance companies invest premiums to generate returns that cover policy payouts. In an era of historically low interest rates, investment returns have dwindled, forcing insurers to adjust premiums to maintain profitability.

3. Inflation:

Inflation erodes the purchasing power of money over time. To maintain the value of death benefits, insurance companies need to increase premiums to keep pace with rising costs.

4. Increased Healthcare Costs:

Rising healthcare expenses, including medical treatments and prescription drugs, directly impact life insurance premiums. As healthcare costs climb, insurers need to factor in the increased likelihood of health-related claims.

5. Changing Demographics:

Aging populations, coupled with rising obesity rates and chronic diseases, contribute to higher mortality rates. This trend necessitates increased premiums to cover the growing risk of payouts.

6. Competition and Consolidation:

The life insurance industry is becoming increasingly consolidated, with a smaller number of large players dominating the market. This reduced competition can lead to less competitive pricing and higher premiums for consumers.

The Impact on Consumers:

The rising cost of life insurance presents a significant challenge for consumers. It can:

- Reduce affordability: Higher premiums can strain household budgets, making it difficult for individuals and families to secure adequate coverage.

- Limit access to coverage: For those with limited financial resources, rising premiums can make life insurance inaccessible, leaving them vulnerable in the event of an untimely death.

- Increase financial stress: The burden of higher premiums can contribute to financial anxiety and stress, especially for families already facing financial challenges.

Navigating the Rising Cost:

While the rising cost of life insurance is a reality, there are strategies to mitigate its impact:

1. Shop Around:

Compare quotes from multiple insurers to find the most competitive rates. Online comparison tools can streamline this process.

2. Consider Term Life Insurance:

Term life insurance offers temporary coverage at a lower cost than permanent policies. It’s an effective option for individuals seeking affordable protection for a specific period.

3. Review Existing Policies:

Regularly review your life insurance policy to ensure it still meets your needs and consider adjusting coverage or making changes to reduce premiums.

4. Improve Your Health:

Maintaining a healthy lifestyle and avoiding risky behaviors can lower your premiums. Insurers often offer discounts for non-smokers and individuals with healthy habits.

5. Consider a Smaller Death Benefit:

Reducing the death benefit can significantly lower your premiums. However, ensure the remaining amount is sufficient to meet your family’s financial needs.

6. Explore Group Life Insurance:

If available through your employer, group life insurance can offer lower premiums than individual policies.

7. Consider a Guaranteed Universal Life Policy:

Guaranteed universal life policies offer a fixed premium for a set period, providing predictability and financial stability.

8. Explore Alternatives:

Consider alternative options like final expense insurance, which is designed to cover funeral and other end-of-life costs.

9. Seek Professional Advice:

Consult with a financial advisor or insurance broker to develop a personalized life insurance strategy that aligns with your budget and needs.

FAQ:

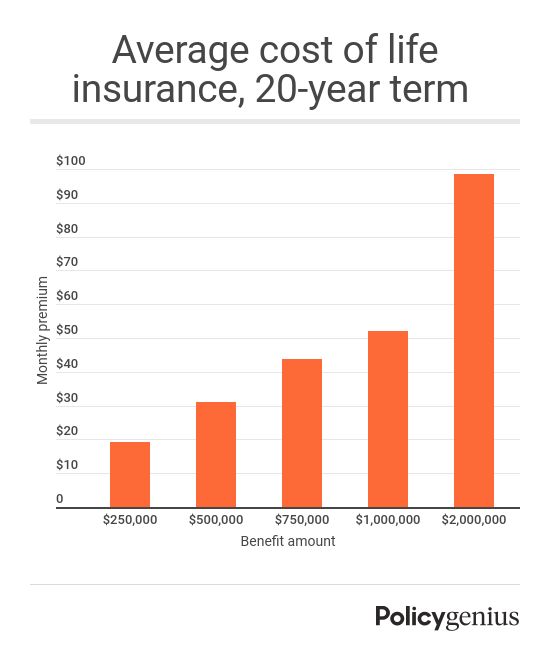

Q: What is the average cost of life insurance?

A: The cost of life insurance varies significantly depending on factors like age, health, coverage amount, and policy type. However, you can expect to pay anywhere from a few hundred dollars to several thousand dollars per year.

Q: How often should I review my life insurance policy?

A: It’s recommended to review your life insurance policy at least every two to three years, or whenever you experience significant life changes like marriage, childbirth, or a change in financial circumstances.

Q: What are the benefits of life insurance?

A: Life insurance provides financial protection for your loved ones in the event of your death. It can help cover funeral expenses, outstanding debts, mortgage payments, and provide income replacement for surviving dependents.

Q: Is it worth buying life insurance if I’m young and healthy?

A: While younger individuals may have a lower risk of death, life insurance can still be valuable. It offers peace of mind knowing your loved ones are financially protected in case of an unexpected event.

Q: What should I do if I can’t afford life insurance?

A: If you’re struggling to afford life insurance, consider exploring alternative options like term life insurance, group life insurance, or final expense insurance. You can also prioritize other financial goals and revisit life insurance later when your financial situation improves.

Conclusion:

The rising cost of life insurance is a complex issue with far-reaching implications for consumers. Understanding the factors driving this trend and exploring available strategies can help you navigate this challenging landscape and secure the financial protection you need for your family. Remember to shop around, review your existing policies, and seek professional advice to make informed decisions that align with your individual circumstances.

Source URL:

[Insert relevant source URL for your article. Make sure the source is credible and provides accurate information.]

Closure

Thank you for reading! Stay with us for more insights on The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do?.

Don’t forget to check back for the latest news and updates on The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do?!

Feel free to share your experience with The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do? in the comment section.

Stay informed with our next updates on The Rising Cost of Life Insurance: What’s Behind the Price Hike and What Can You Do? and other exciting topics.