Medicare Advantage Plans: What’s New in 2024?

Related Articles

- Is The US Heading For A Recession? Understanding The Current Economic Landscape

- The US-China Trade War: A Rollercoaster Ride For Global Economies

- Charting The Course: Long-Term Economic Trends In The US

- Riding The Waves Of Change: A Deep Dive Into Flood Insurance Coverage Trends

- Decoding The Consumer Confidence Index: A Guide To Understanding The Economic Pulse

Introduction

Join us as we explore Medicare Advantage Plans: What’s New in 2024?, packed with exciting updates

Medicare Advantage Plans: What’s New in 2024?

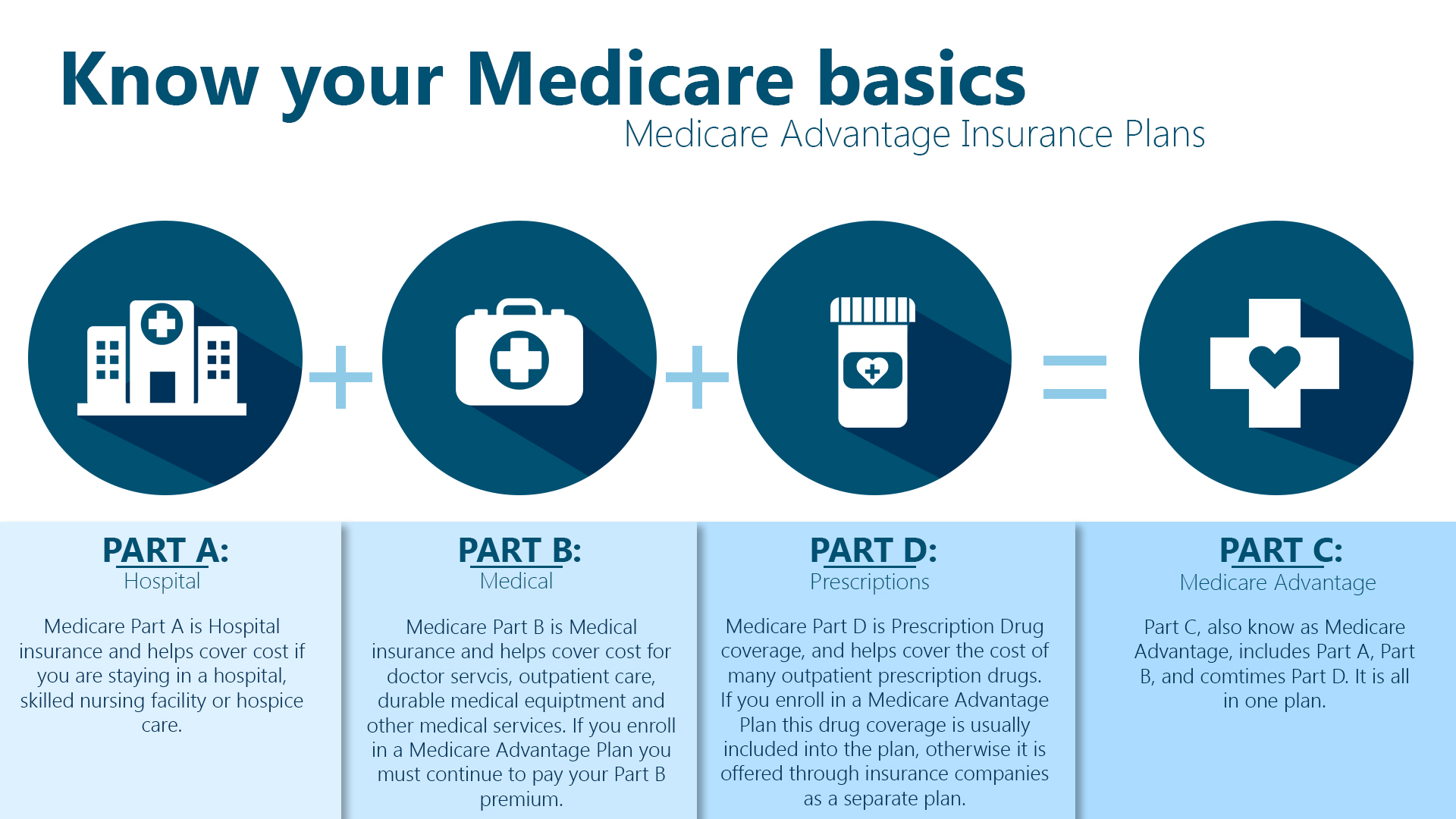

Medicare Advantage plans, also known as Medicare Part C, are becoming increasingly popular, offering a more comprehensive alternative to traditional Medicare. But with every new year comes a wave of changes, leaving many beneficiaries wondering what’s new and how it might impact their coverage.

This guide delves into the key changes to Medicare Advantage plans for 2024, helping you navigate the evolving landscape and make informed decisions about your healthcare.

1. The Big Picture: What’s Driving the Changes?

The Medicare Advantage landscape is constantly evolving, driven by a combination of factors:

- Increased Enrollment: More and more seniors are opting for Medicare Advantage plans, attracting more private insurance companies to the market. This competition fuels innovation and pushes for improved benefits.

- Government Regulations: The Centers for Medicare & Medicaid Services (CMS) regularly updates regulations to ensure quality, affordability, and accessibility of Medicare Advantage plans.

- Technological Advancements: New technologies are impacting healthcare delivery, leading to changes in how Medicare Advantage plans are structured and managed.

- Healthcare Costs: The rising cost of healthcare is a major factor influencing changes in Medicare Advantage plans.

2. Key Changes for 2024: A Closer Look

Here’s a breakdown of some of the most significant changes impacting Medicare Advantage plans in 2024:

a) Expanded Benefits:

- More Coverage for Mental Health: Many Medicare Advantage plans are expanding coverage for mental health services, including therapy, medication, and addiction treatment. This addresses the growing need for mental health support among seniors.

- Improved Dental and Vision Coverage: Some plans are offering enhanced dental and vision benefits, including more comprehensive coverage for procedures and a wider network of providers.

- Enhanced Prescription Drug Coverage: Medicare Advantage plans are often known for their prescription drug coverage, and many are expanding their formularies (lists of covered medications) and lowering co-pays for commonly prescribed drugs.

b) Increased Flexibility and Choice:

- More Plan Options: The number of Medicare Advantage plans available in many areas is increasing, offering seniors a wider range of choices to find the plan that best meets their needs and budget.

- More Provider Networks: Medicare Advantage plans are expanding their provider networks, giving beneficiaries access to a wider range of doctors, hospitals, and other healthcare professionals.

- More Telehealth Options: Telehealth services are becoming increasingly integrated into Medicare Advantage plans, offering convenient and accessible virtual care options.

c) Focus on Quality and Affordability:

- Quality Improvement Initiatives: CMS is implementing new quality improvement initiatives to ensure Medicare Advantage plans provide high-quality care. This includes measures to track patient satisfaction, access to care, and health outcomes.

- Transparency and Cost-Sharing: CMS is increasing transparency around plan costs and benefits, helping beneficiaries make informed decisions about their coverage.

- Efforts to Control Costs: Medicare Advantage plans are using various strategies to control healthcare costs, such as negotiating lower prices for medications and promoting preventive care.

3. Navigating the Changes: Tips for Beneficiaries

With all these changes, it’s essential to stay informed and make sure your Medicare Advantage plan remains the best fit for your needs. Here are some tips:

- Review Your Plan Annually: Medicare Advantage plans can change each year, so it’s crucial to review your plan’s benefits, costs, and provider network annually.

- Compare Plans: Don’t assume your current plan is the best option. Use online comparison tools or consult with a Medicare specialist to compare plans from different insurers.

- Consider Your Health Needs: Evaluate your health needs and medication requirements to ensure your chosen plan provides adequate coverage.

- Pay Attention to Premiums and Out-of-Pocket Costs: Compare premiums, deductibles, co-pays, and other out-of-pocket costs to find the plan that fits your budget.

- Understand the Provider Network: Check if your preferred doctors, hospitals, and specialists are included in the plan’s network.

- Ask Questions: Don’t hesitate to contact your insurer or a Medicare specialist to clarify any questions you have about your plan or the changes.

4. The Future of Medicare Advantage: What’s Next?

The future of Medicare Advantage is likely to continue evolving, driven by:

- Growing Demand: As the baby boomer generation ages, the demand for Medicare Advantage plans is expected to increase.

- Technological Innovations: Advancements in telehealth, data analytics, and artificial intelligence are likely to shape the delivery of Medicare Advantage services.

- Focus on Value-Based Care: Medicare Advantage plans are expected to continue moving towards value-based care models that emphasize quality of care and patient outcomes.

5. FAQ: Your Questions Answered

Q: What are the key differences between traditional Medicare and Medicare Advantage?

A: Traditional Medicare (Parts A and B) is a government-run program, while Medicare Advantage (Part C) is offered by private insurance companies. Traditional Medicare offers more flexibility in choosing providers but may have higher out-of-pocket costs. Medicare Advantage offers a more comprehensive package with lower out-of-pocket costs but may have limitations on provider choices.

Q: Do I have to switch to a Medicare Advantage plan?

A: No, you are not required to switch to a Medicare Advantage plan. You can continue with traditional Medicare if you prefer.

Q: How do I enroll in a Medicare Advantage plan?

A: You can enroll in a Medicare Advantage plan during the Annual Enrollment Period (AEP) from October 15 to December 7 each year. You can also enroll during the Medicare Advantage Open Enrollment Period from January 1 to March 31.

Q: Can I change my Medicare Advantage plan after I’ve enrolled?

A: Yes, you can switch to a different Medicare Advantage plan during the AEP or the Medicare Advantage Open Enrollment Period. You can also switch if you move to a new area or experience a significant life change.

Q: How can I find out more about Medicare Advantage plans?

A: You can visit the Medicare website (www.medicare.gov) for comprehensive information about Medicare Advantage plans, including plan comparisons, enrollment information, and resources. You can also contact your local Medicare office or a Medicare specialist for personalized guidance.

6. Conclusion

The Medicare Advantage landscape is dynamic, with new changes and innovations emerging each year. By staying informed, comparing plans, and understanding your health needs, you can make informed decisions about your Medicare coverage and ensure you have the best possible healthcare experience. Remember, your health is your greatest asset, and choosing the right Medicare Advantage plan can help you protect it.

Source URL:

This article is for informational purposes only and should not be considered medical or financial advice. Please consult with a healthcare professional or financial advisor for personalized guidance.

Closure

We hope this article has helped you understand everything about Medicare Advantage Plans: What’s New in 2024?. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

We’d love to hear your thoughts about Medicare Advantage Plans: What’s New in 2024?—leave your comments below!

Keep visiting our website for the latest trends and reviews.