Navigating the World of Business Insurance: A Guide to Using Calculators for Coverage

Related Articles

- Protecting Your Business: A Comprehensive Guide To Business Property Insurance

- Business Liability Insurance: Your Safety Net Against The Unexpected

- Business Auto Insurance: Protecting Your Wheels And Your Bottom Line

- Empowering Dreams: A Guide To Small Business Loans For Women

- Unlocking Growth: Your Guide To Business Loans Online

Introduction

Welcome to our in-depth look at Navigating the World of Business Insurance: A Guide to Using Calculators for Coverage

Navigating the World of Business Insurance: A Guide to Using Calculators for Coverage

Owning a business is a thrilling adventure, but it comes with its fair share of risks. From unexpected accidents to legal liabilities, the potential for financial loss is a reality every entrepreneur must consider. This is where business insurance steps in, providing a safety net to protect your hard-earned investments and keep your business running smoothly. But with so many different types of insurance available, figuring out what you need and how much coverage you require can feel overwhelming.

Enter the business insurance calculator, a powerful tool that can simplify the process and help you make informed decisions about your insurance needs. This article will dive deep into the world of business insurance calculators, exploring how they work, what they can do for you, and how to choose the right one for your specific situation.

Understanding the Value of Business Insurance

Before we delve into calculators, let’s first understand why business insurance is crucial for your success. Here are just a few of the key reasons:

- Protection Against Financial Ruin: Accidents happen, and legal claims can arise even if you’re not at fault. Business insurance acts as a financial buffer, covering costs associated with lawsuits, property damage, employee injuries, and more.

- Peace of Mind and Business Continuity: Knowing you have adequate insurance coverage allows you to focus on running your business without the constant worry of potential financial disasters. It also helps ensure your business can continue operating even after a significant event.

- Meeting Legal Requirements: Many industries and jurisdictions require businesses to carry specific types of insurance. Failure to comply can result in hefty fines and legal penalties.

- Building Trust and Credibility: Having insurance demonstrates to customers, partners, and investors that you are a responsible and reliable business.

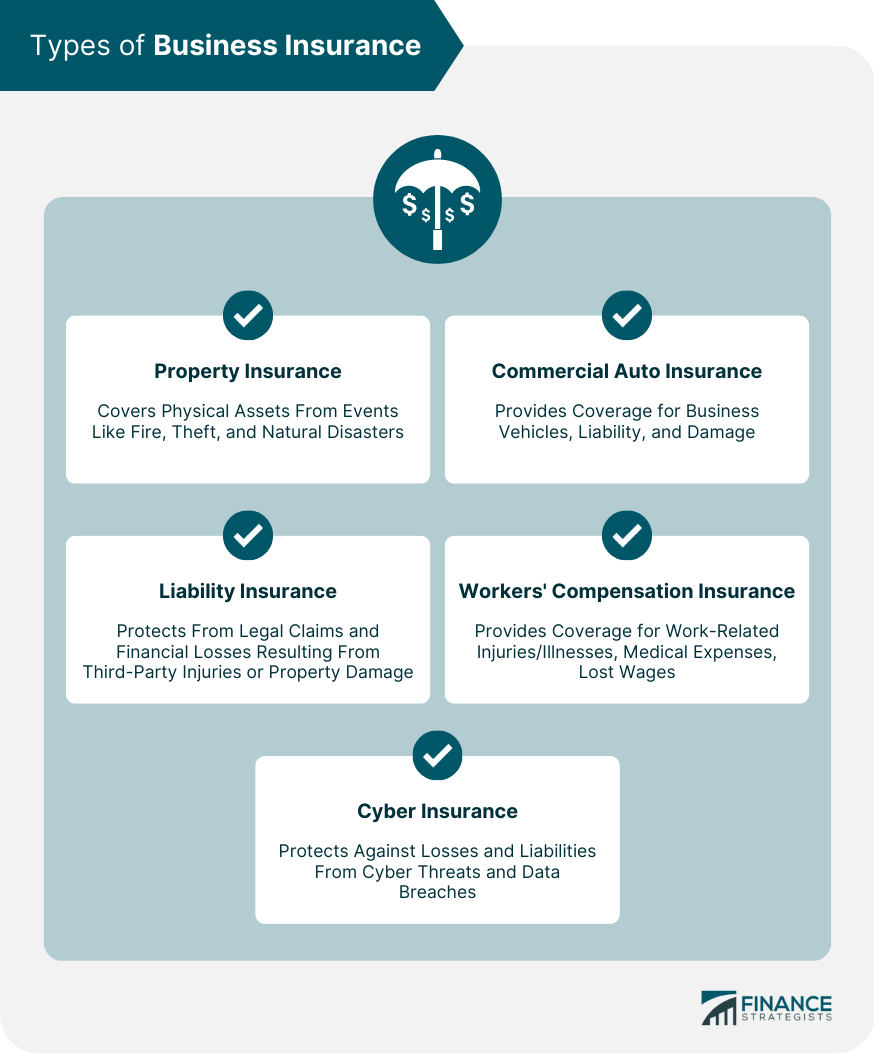

Types of Business Insurance: A Comprehensive Overview

The world of business insurance is vast and diverse, offering a range of coverages to address different risks. Here’s a breakdown of some of the most common types:

1. General Liability Insurance:

This is the cornerstone of most business insurance policies. It provides coverage for third-party bodily injury and property damage, as well as legal defense costs, arising from your business operations.

2. Property Insurance:

Protects your business property, including buildings, equipment, inventory, and even furniture, against damage or loss caused by fire, theft, vandalism, natural disasters, and other perils.

3. Workers’ Compensation Insurance:

Mandatory in most states, this policy covers medical expenses, lost wages, and other benefits for employees injured on the job.

4. Product Liability Insurance:

Protects your business from claims arising from injuries or damages caused by your products. This is essential for businesses that manufacture, sell, or distribute goods.

5. Professional Liability Insurance (Errors and Omissions):

This policy covers financial losses resulting from professional negligence, mistakes, or errors in judgment. It’s crucial for businesses providing professional services, such as consulting, accounting, or legal services.

6. Business Interruption Insurance:

Provides financial support to cover lost income and expenses if your business is forced to shut down due to a covered event, such as a fire or natural disaster.

7. Cyber Liability Insurance:

Protects businesses from financial losses and legal liabilities arising from data breaches, cyberattacks, and other cyber-related incidents.

8. Commercial Auto Insurance:

Covers vehicles used for business purposes, including company cars, delivery trucks, and even company-owned bicycles.

9. Directors and Officers (D&O) Liability Insurance:

Protects directors and officers of a company from personal liability for financial losses or legal claims arising from their decisions or actions.

10. Employment Practices Liability Insurance (EPLI):

Provides coverage for claims related to wrongful termination, discrimination, harassment, and other employment-related issues.

11. Crime Insurance:

Covers losses resulting from criminal activity, such as theft, embezzlement, and forgery.

12. Equipment Breakdown Insurance:

Protects businesses from financial losses caused by the breakdown of essential equipment, such as machinery or computers.

13. Flood Insurance:

Provides coverage for damages caused by flooding, which is often excluded from standard property insurance policies.

14. Earthquake Insurance:

Covers damages caused by earthquakes, which are typically not covered by standard property insurance policies.

15. Business Owner’s Policy (BOP):

A package policy that combines several essential coverages, including property, liability, and business interruption insurance, into one convenient policy.

The Power of Business Insurance Calculators

Now that you have a better understanding of the different types of business insurance, let’s explore how calculators can help you navigate this complex world.

1. Personalized Recommendations:

Business insurance calculators are designed to ask you specific questions about your business, such as industry, revenue, number of employees, and the type of work you do. Based on your answers, they provide personalized recommendations for the types of insurance you need and the appropriate coverage levels.

2. Quick and Easy Quotes:

Calculators streamline the quoting process, allowing you to get instant estimates for various insurance policies without having to contact multiple insurance agents. This saves you valuable time and effort.

3. Cost Comparisons:

By comparing quotes from different insurance providers, you can easily identify the most competitive rates and find the best value for your money.

4. Understanding Coverage Options:

Calculators often provide detailed explanations of different insurance policies, helping you understand the specific risks they cover and the benefits they offer.

5. Identifying Gaps in Coverage:

By analyzing your current insurance policies, calculators can help you identify any gaps in coverage and recommend additional policies to address potential risks.

Choosing the Right Business Insurance Calculator

With so many calculators available online, selecting the right one for your needs can be challenging. Here are some key factors to consider:

- Coverage Options: Ensure the calculator offers a wide range of insurance types relevant to your industry and business operations.

- Customization: Look for calculators that allow you to customize your quote based on your specific business needs and risk factors.

- User-Friendliness: Choose a calculator with a clear and intuitive interface that is easy to navigate and understand.

- Reputation and Trustworthiness: Select a calculator from a reputable source, such as a trusted insurance provider or a well-known financial website.

- Data Security: Ensure the calculator uses secure data encryption to protect your personal and business information.

Using Business Insurance Calculators Effectively

Once you’ve chosen a calculator, follow these steps to get the most out of it:

- Be Honest and Accurate: Provide accurate information about your business, including revenue, employees, and any specific risks you face.

- Consider All Coverage Options: Don’t limit yourself to just a few insurance types. Explore the calculator’s full range of options to ensure you’re adequately protected.

- Review Your Quotes Carefully: Pay close attention to the coverage details, deductibles, and premiums associated with each quote.

- Compare Quotes from Multiple Providers: Get quotes from several different insurance providers to compare rates and coverage.

- Consult with an Insurance Agent: Once you’ve narrowed down your choices, it’s always a good idea to consult with an experienced insurance agent to discuss your needs and get personalized advice.

Frequently Asked Questions (FAQs)

Q: Are business insurance calculators free to use?

A: Most business insurance calculators are free to use. However, some may require you to provide personal information or contact details to access quotes.

Q: Do I need to provide my social security number to use a business insurance calculator?

A: You usually don’t need to provide your social security number to use a business insurance calculator. However, you may need to provide your business name, address, and other basic information.

Q: Are the quotes generated by calculators accurate?

A: Business insurance calculators provide estimated quotes based on the information you provide. The actual premium may vary depending on factors not included in the calculator, such as your credit score or claims history.

Q: Can I trust the information provided by business insurance calculators?

A: Reputable business insurance calculators provide accurate and reliable information. However, it’s always a good idea to verify the information with a trusted insurance agent.

Q: What if I can’t find a calculator that covers my specific needs?

A: If you’re unable to find a calculator that addresses all of your business insurance needs, contact an insurance agent directly for personalized advice and quotes.

Q: Is it better to use a calculator or contact an insurance agent directly?

A: Both options have their advantages. Calculators offer a quick and convenient way to get estimated quotes, while insurance agents can provide personalized advice and help you choose the right coverage.

Conclusion

Business insurance calculators are valuable tools that can simplify the process of finding the right insurance for your business. By providing personalized recommendations, quick quotes, and detailed coverage information, they empower you to make informed decisions about your insurance needs and protect your business from financial risks. While calculators can be a helpful starting point, it’s always a good idea to consult with an experienced insurance agent to ensure you have the right coverage in place.

Remember, protecting your business is an investment in its future success. By leveraging the power of business insurance calculators and working with a trusted insurance professional, you can create a strong safety net and focus on building a thriving business.

Source:

- https://www.investopedia.com/articles/insurance/10/business-insurance-calculator.asp

- https://www.thebalance.com/business-insurance-calculator-4161186

- https://www.nerdwallet.com/insurance/business/business-insurance-calculator

Closure

We hope this article has helped you understand everything about Navigating the World of Business Insurance: A Guide to Using Calculators for Coverage. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Navigating the World of Business Insurance: A Guide to Using Calculators for Coverage in the comment section.

Keep visiting our website for the latest trends and reviews.