The Road Ahead: Navigating Insurance Risks in the Age of Self-Driving Cars

Related Articles

- Navigating The Inflation Maze: A Look At The Fed’s Outlook

- The Heat Is On: Climate Risks For Insurers

- America’s Economic Crossroads: Navigating The Path To Prosperity

- Unlocking The Secrets Of The Fed: A Guide To Interest Rates And Their Impact

- Navigating The Maze Of Auto Insurance: A Guide To Finding The Right Policy For You

Introduction

In this article, we dive into The Road Ahead: Navigating Insurance Risks in the Age of Self-Driving Cars, giving you a full overview of what’s to come

The Road Ahead: Navigating Insurance Risks in the Age of Self-Driving Cars

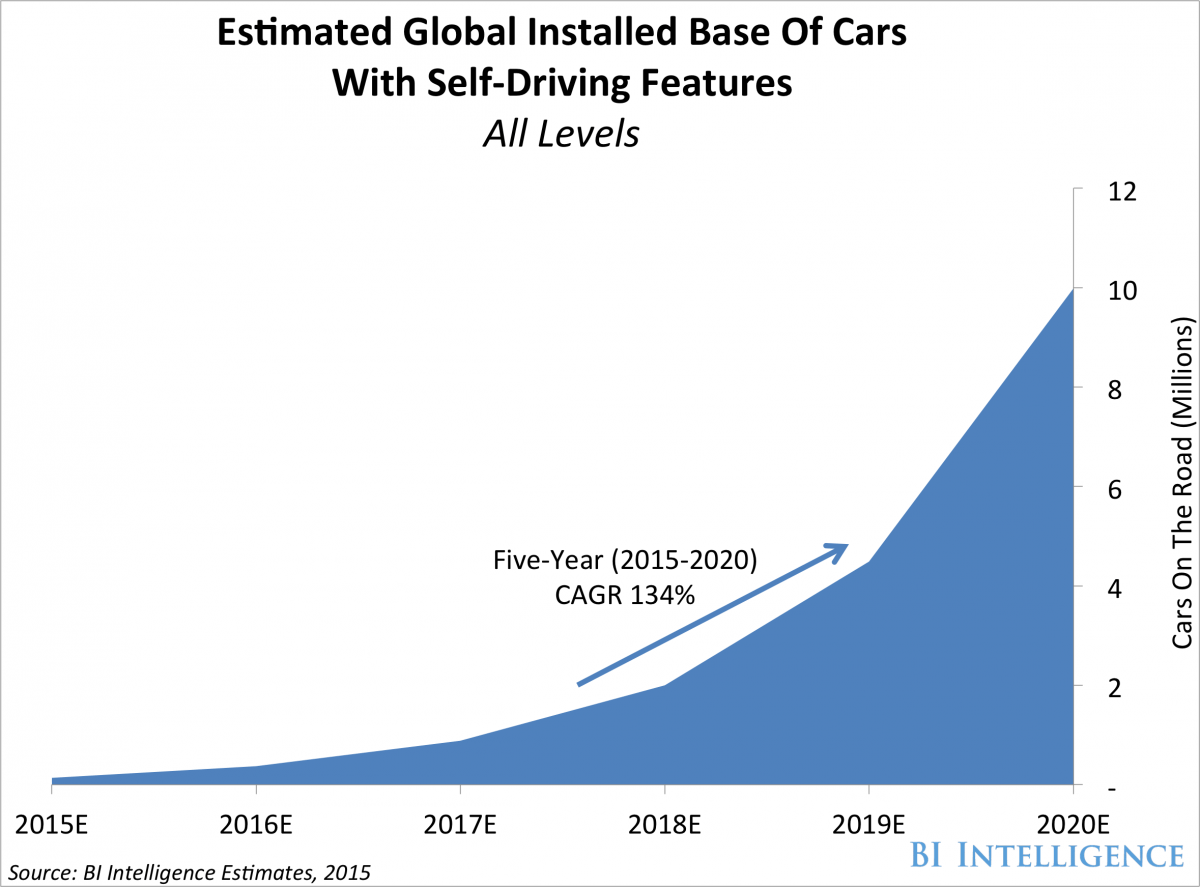

The world of transportation is undergoing a seismic shift, with self-driving cars poised to revolutionize how we get around. While the promise of safer roads and increased mobility is enticing, the advent of autonomous vehicles also brings a wave of complex insurance challenges. As we navigate this uncharted territory, understanding the evolving risks and how they impact insurance is crucial.

Beyond the Steering Wheel: A New Landscape of Risk

Traditional car insurance is built on the premise of human error. Drivers are assessed based on their driving history, age, and other factors that contribute to the likelihood of accidents. With self-driving cars, this equation changes dramatically. The responsibility for safe operation shifts from humans to complex algorithms and sensor systems. This fundamental shift introduces a new set of risks that require a fresh approach to insurance.

The Shifting Fault Lines: Liability in the Autonomous Age

One of the most significant challenges is determining liability in the event of an accident. Who is responsible when a self-driving car crashes? Is it the manufacturer, the software developer, the owner, or the passenger? The answer is not straightforward.

- Manufacturer Liability: The manufacturer is responsible for designing and building the vehicle, including the autonomous driving system. If a defect in the vehicle’s design or manufacturing causes an accident, the manufacturer could be held liable.

- Software Developer Liability: The software that powers the self-driving system is crucial. If a software bug or malfunction leads to an accident, the software developer could be held accountable.

- Owner Liability: The owner of the vehicle is responsible for maintaining it and ensuring it is in safe working order. They could be held liable if they fail to properly maintain the vehicle or disregard warnings about potential issues.

- Passenger Liability: While passengers are typically not held liable for accidents caused by the driver, the legal landscape is unclear for self-driving cars. It’s possible that passengers could be held liable if they contributed to the accident, such as by disabling safety features or interfering with the vehicle’s operation.

Navigating the Grey Areas: The Role of Insurance

As the legal framework for self-driving cars evolves, insurance companies are grappling with how to cover the unique risks associated with autonomous vehicles. This includes:

- Coverage for Autonomous Driving Systems: Traditional car insurance policies may not adequately cover the risks associated with autonomous driving systems. New policies will need to address potential failures in the software, sensors, and other components that contribute to the vehicle’s autonomous operation.

- Liability Coverage for Different Parties: Insurance policies will need to clearly define liability coverage for manufacturers, software developers, owners, and passengers in the event of an accident. This will require a nuanced understanding of the legal framework surrounding autonomous vehicles.

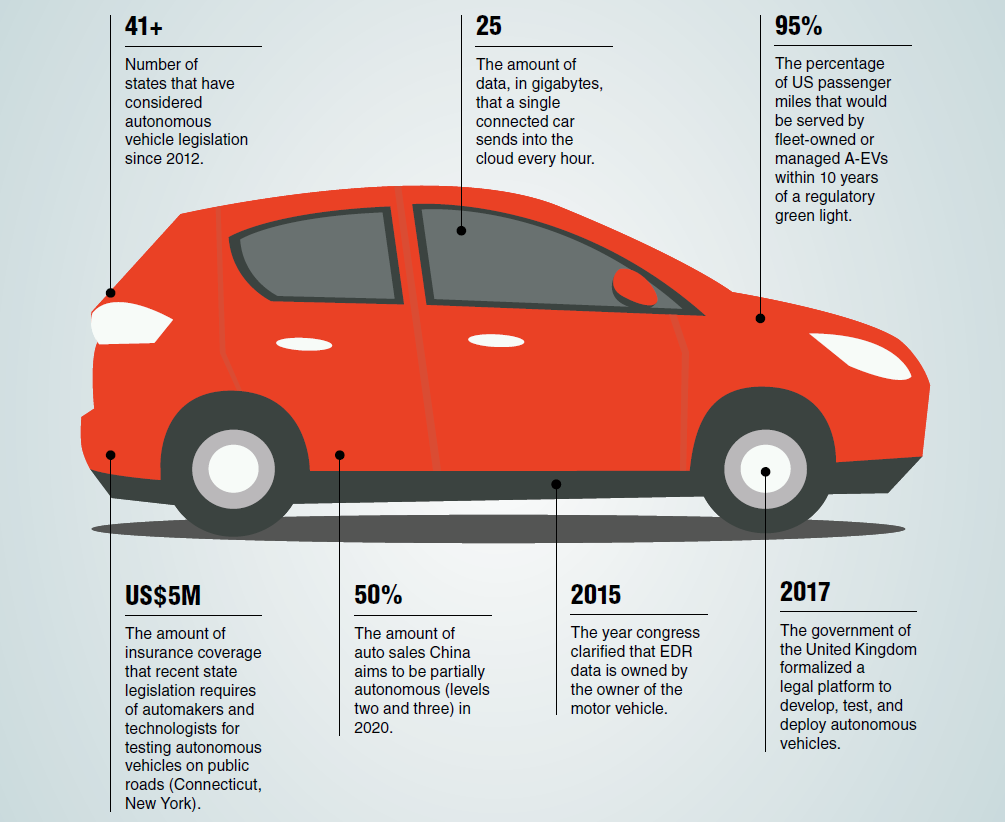

- Data Privacy and Cybersecurity: Self-driving cars collect vast amounts of data about their surroundings, passengers, and driving habits. Insurance companies will need to address data privacy and cybersecurity concerns, ensuring that sensitive information is protected and used responsibly.

- Pricing Models for Autonomous Vehicles: Insurance premiums for self-driving cars will likely be different from those for traditional vehicles. Factors such as the vehicle’s safety rating, driving history, and the level of autonomy will influence pricing.

The Promise of Safer Roads: A Balancing Act

While the insurance landscape for self-driving cars is still evolving, there’s a clear consensus: autonomous vehicles have the potential to significantly improve road safety. Studies have shown that human error is responsible for the majority of car accidents. By removing human drivers from the equation, self-driving cars could reduce the number of accidents, fatalities, and injuries on our roads.

However, the transition to autonomous vehicles is not without its challenges. The potential for accidents caused by software glitches, sensor failures, or malicious hacking remains a concern. Insurance companies are working closely with manufacturers, regulators, and researchers to develop comprehensive solutions that address these risks.

A Collaborative Approach: Shaping the Future of Insurance

The successful integration of self-driving cars into our transportation system requires a collaborative approach. Insurance companies, manufacturers, regulators, and researchers must work together to:

- Develop standardized safety protocols: Clear guidelines for the design, testing, and deployment of autonomous driving systems are crucial.

- Establish a clear legal framework: Defining liability in the event of an accident is essential to ensure fair compensation for victims and prevent legal disputes.

- Promote data sharing and transparency: Open communication and data sharing between stakeholders will help identify and mitigate potential risks.

- Develop innovative insurance products: New insurance policies tailored to the specific risks of autonomous vehicles are needed to provide adequate coverage.

FAQ: Addressing Common Questions

Q: Will insurance for self-driving cars be cheaper?

A: It’s difficult to say definitively whether insurance for self-driving cars will be cheaper. While the potential for fewer accidents due to human error could lead to lower premiums, other factors, such as the cost of repairing or replacing complex autonomous driving systems, could offset these savings.

Q: Will I need a separate insurance policy for my self-driving car?

A: It’s likely that traditional car insurance policies will need to be updated to cover the unique risks associated with autonomous vehicles. However, the exact form of these policies is still being determined.

Q: What happens if a self-driving car crashes due to a software glitch?

A: In such a case, the manufacturer and/or software developer could be held liable for the accident. Insurance policies will need to address this liability, ensuring that victims receive adequate compensation.

Q: Who is responsible for a self-driving car accident if the passenger is driving?

A: The passenger could be held liable if they are driving the vehicle in a way that violates the law or the manufacturer’s guidelines. However, the exact legal implications are still being clarified.

Q: How will insurance companies handle data collected by self-driving cars?

A: Insurance companies will need to comply with data privacy regulations and ensure that the data collected by self-driving cars is used responsibly and ethically. This includes protecting sensitive information from unauthorized access and ensuring transparency in how data is used.

The Road Ahead: Embracing the Future of Mobility

The advent of self-driving cars presents both opportunities and challenges for the insurance industry. By embracing innovation, collaborating with stakeholders, and developing comprehensive solutions, insurance companies can play a vital role in ensuring a safe and secure transition to a future of autonomous mobility. As we navigate this uncharted territory, it’s essential to remember that the ultimate goal is to create a safer, more efficient, and accessible transportation system for everyone.

References:

- National Highway Traffic Safety Administration

- Insurance Information Institute

- Center for Automotive Research

- The National Academies of Sciences, Engineering, and Medicine

- The Brookings Institution

Closure

Thank you for reading! Stay with us for more insights on The Road Ahead: Navigating Insurance Risks in the Age of Self-Driving Cars.

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with The Road Ahead: Navigating Insurance Risks in the Age of Self-Driving Cars in the comment section.

Stay informed with our next updates on The Road Ahead: Navigating Insurance Risks in the Age of Self-Driving Cars and other exciting topics.