The Insurance Industry’s Digital Transformation: From Paper to Pixels and Beyond

Related Articles

- Bank Collapse Risk: A Looming Threat To The US Economy?

- The Great Labor Shortage: Why Jobs Are Open And Workers Are Scarce

- Charting The Course: A Timeline Of The US Economic Recovery

- The US Manufacturing Slowdown: A Deep Dive Into The Causes And Implications

- Unlocking The World Of Commercial Insurance Risks: A Comprehensive Guide For Business Owners

Introduction

Uncover the latest details about The Insurance Industry’s Digital Transformation: From Paper to Pixels and Beyond in this comprehensive guide.

The Insurance Industry’s Digital Transformation: From Paper to Pixels and Beyond

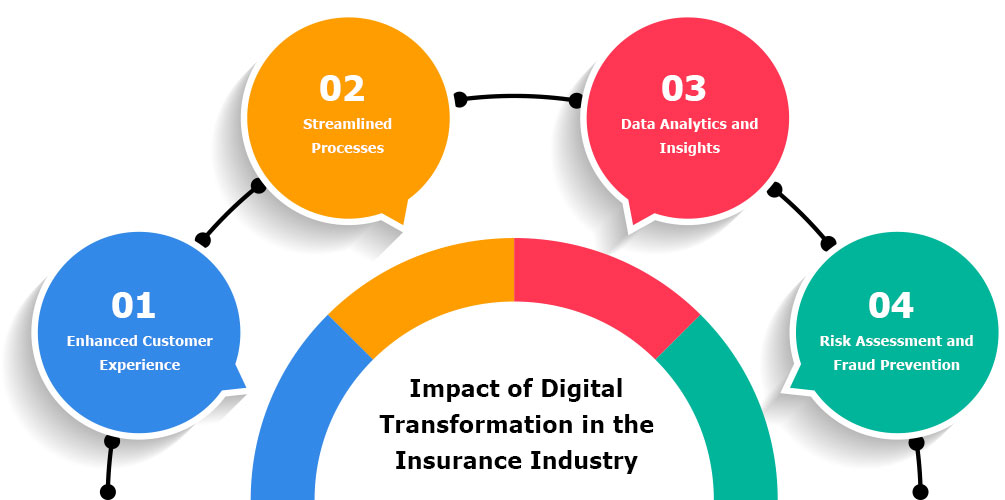

The insurance industry is undergoing a dramatic transformation, fueled by the relentless march of digital technology. Once a sector known for its paper-based processes and slow-moving bureaucracy, insurance is now embracing digital solutions to streamline operations, enhance customer experiences, and unlock new opportunities for growth.

This digital revolution is not simply about replacing paper forms with online applications. It’s a fundamental shift in the way insurance companies operate, interact with customers, and even develop new products and services. Let’s dive into the key aspects of this exciting transformation:

1. Customer Experience: The Digital Front Door

The customer experience is undergoing a complete overhaul. Gone are the days of long wait times on hold, confusing paperwork, and limited communication channels. Digital tools are empowering customers to take control of their insurance journey, making it more convenient, personalized, and efficient:

- Online Platforms: Insurance companies are building robust online platforms where customers can manage their policies, submit claims, access policy documents, and even receive personalized recommendations. These platforms are designed to be intuitive, user-friendly, and accessible 24/7.

- Mobile Apps: Mobile apps are becoming essential for insurance companies to reach customers on the go. These apps allow for policy management, claims reporting, real-time policy updates, and even location-based services, such as roadside assistance.

- Chatbots and Virtual Assistants: AI-powered chatbots and virtual assistants are revolutionizing customer service. They can answer basic questions, provide immediate assistance, and even guide customers through complex processes like filing a claim. These tools free up human agents to focus on more complex tasks and provide personalized support.

- Personalized Recommendations: Data analytics and machine learning algorithms are helping insurance companies understand their customers better. This allows them to offer personalized recommendations, such as suggesting additional coverage or discounts based on individual needs and risk profiles.

2. Operational Efficiency: Streamlining Processes and Reducing Costs

Digital transformation is not just about improving the customer experience; it’s also about streamlining internal operations and reducing costs. Here’s how insurance companies are leveraging technology to achieve operational efficiency:

- Automation: Repetitive tasks, such as data entry, policy processing, and claims verification, are being automated through robotic process automation (RPA) and other AI-driven solutions. This frees up employees to focus on higher-value tasks, such as customer relationship management and strategy development.

- Data Analytics: Insurance companies are collecting vast amounts of data from various sources, including customer interactions, policy information, and market trends. This data is analyzed using advanced analytics tools to identify patterns, predict risks, and optimize pricing models.

- Cloud Computing: Cloud computing platforms provide scalable and secure infrastructure for insurance companies to store and manage their data, applications, and operations. This eliminates the need for expensive on-premises hardware and software, allowing for greater flexibility and agility.

- Blockchain Technology: Blockchain is transforming the insurance industry by providing a secure and transparent platform for managing transactions, claims, and data sharing. This technology can streamline processes, reduce fraud, and improve trust between insurers and policyholders.

3. Product Innovation: Meeting Evolving Needs and Creating New Opportunities

The digital revolution is also pushing insurance companies to innovate and develop new products and services to meet the evolving needs of customers. Here are some key areas of innovation:

- Insurtech Startups: A thriving ecosystem of insurtech startups is disrupting the traditional insurance model with innovative solutions. These startups are leveraging technology to offer personalized insurance products, on-demand coverage, and innovative claims management processes.

- Micro-Insurance: Digital technology is making it easier to offer micro-insurance products, which provide affordable coverage for specific risks, such as mobile phone insurance or travel insurance. This opens up insurance to a wider segment of the population.

- Usage-Based Insurance: Usage-based insurance (UBI) programs leverage telematics data from connected vehicles to provide personalized premiums based on driving behavior. This allows drivers to earn discounts by demonstrating safe driving habits.

- Data-Driven Risk Assessment: Insurance companies are using data analytics and machine learning to develop more accurate and personalized risk assessment models. This allows them to offer more competitive premiums and tailor coverage to individual needs.

4. The Future of Insurance: Emerging Trends and Opportunities

The digital transformation of the insurance industry is still in its early stages, and exciting new trends are emerging that will continue to reshape the sector in the years to come:

- Artificial Intelligence (AI): AI is playing an increasingly important role in insurance, from automating tasks to personalizing customer experiences and developing new products. AI-powered chatbots, virtual assistants, and risk assessment models are transforming the way insurance companies operate.

- Internet of Things (IoT): The proliferation of connected devices is creating a wealth of data that can be used to assess risks, personalize insurance policies, and develop new products. For example, smart home devices can be used to monitor risk factors and provide discounts for homeowners with security systems.

- Cybersecurity: As insurance companies rely more heavily on digital technology, cybersecurity becomes increasingly critical. Insurance companies need to invest in robust security measures to protect their data and systems from cyberattacks.

- Regulation and Compliance: Governments and regulators are adapting to the changing landscape of insurance. New regulations are being introduced to address issues such as data privacy, cybersecurity, and the use of AI in insurance.

Challenges and Opportunities

While the digital transformation of the insurance industry offers numerous opportunities, it also presents some challenges:

- Data Privacy and Security: Insurance companies collect vast amounts of data about their customers, which raises concerns about data privacy and security. They need to implement robust measures to protect this data and ensure compliance with regulations.

- Adapting to New Technology: Insurance companies need to invest in training and development to ensure their workforce is equipped to handle the new technologies and processes involved in digital transformation.

- Competition from Insurtech Startups: The emergence of insurtech startups is increasing competition in the insurance market. Traditional insurance companies need to innovate and adapt to stay competitive.

- Changing Customer Expectations: Customers are increasingly demanding digital-first experiences. Insurance companies need to meet these expectations by providing convenient, personalized, and efficient services.

Conclusion

The digital transformation of the insurance industry is a journey that is still unfolding. Insurance companies that embrace technology, innovate, and adapt to the changing landscape will be well-positioned for success in the years to come. By leveraging digital tools to improve customer experiences, streamline operations, and develop new products, the insurance industry can unlock new opportunities for growth and create a more efficient, customer-centric, and innovative future.

FAQ

Q: What are the main benefits of digital transformation for insurance companies?

A: Digital transformation offers numerous benefits for insurance companies, including:

- Improved customer experience: More convenient, personalized, and efficient services.

- Increased operational efficiency: Streamlined processes, reduced costs, and improved productivity.

- New product development: Innovative products and services to meet evolving customer needs.

- Enhanced risk assessment: More accurate and personalized risk assessment models.

- Competitive advantage: Staying ahead of the curve in a rapidly changing market.

Q: What are the key technologies driving the digital transformation of insurance?

A: Key technologies driving the digital transformation of insurance include:

- Artificial Intelligence (AI)

- Cloud Computing

- Blockchain

- Internet of Things (IoT)

- Data Analytics

- Mobile Technology

Q: What are some of the challenges facing the insurance industry in its digital transformation?

A: Challenges facing the insurance industry in its digital transformation include:

- Data privacy and security

- Adapting to new technology

- Competition from insurtech startups

- Changing customer expectations

- Regulation and compliance

Q: What are some examples of successful digital transformation initiatives in the insurance industry?

A: Examples of successful digital transformation initiatives in the insurance industry include:

- Progressive Insurance’s usage-based insurance program (Snapshot)

- Lemonade’s AI-powered insurance platform

- Geico’s mobile app for policy management and claims reporting

Q: What advice would you give to insurance companies looking to embark on a digital transformation journey?

A: Advice for insurance companies looking to embark on a digital transformation journey:

- Start with a clear strategy: Define your goals, target audience, and key technology investments.

- Focus on customer experience: Make it easy for customers to interact with your company online.

- Embrace innovation: Be open to new technologies and ideas from insurtech startups.

- Invest in data and analytics: Use data to understand your customers and improve your products and services.

- Build a strong cybersecurity posture: Protect your data and systems from cyberattacks.

- Develop a culture of agility and change: Be prepared to adapt to the rapidly evolving landscape of the insurance industry.

References:

- Insurance Industry Digital Transformation: Trends, Opportunities, and Challenges

- The Future of Insurance: Digital Transformation and the Rise of Insurtech

- How Digital Transformation Is Changing the Insurance Industry

Closure

Thank you for reading! Stay with us for more insights on The Insurance Industry’s Digital Transformation: From Paper to Pixels and Beyond.

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with The Insurance Industry’s Digital Transformation: From Paper to Pixels and Beyond in the comment section.

Keep visiting our website for the latest trends and reviews.