Decoding the Deductible: Your Business Insurance’s Hidden Cost

Related Articles

- Navigating The Maze: Your Guide To Business Loan Application Forms

- Fueling Your Dream: A Comprehensive Guide To Business Loans For Startups

- Unlocking Growth: Your Guide To Business Loan Pre-Approval

- Navigating The Maze Of Business Insurance Rates: A Comprehensive Guide

- Unlocking Your Business Potential: A Guide To Self-Employed Business Loans

Introduction

Welcome to our in-depth look at Decoding the Deductible: Your Business Insurance’s Hidden Cost

Decoding the Deductible: Your Business Insurance’s Hidden Cost

Business insurance is a crucial safety net for entrepreneurs. It protects your company from unforeseen events like fire, theft, lawsuits, and more. But, hidden within the policy details lies a crucial factor that can significantly impact your financial burden during a claim: the deductible.

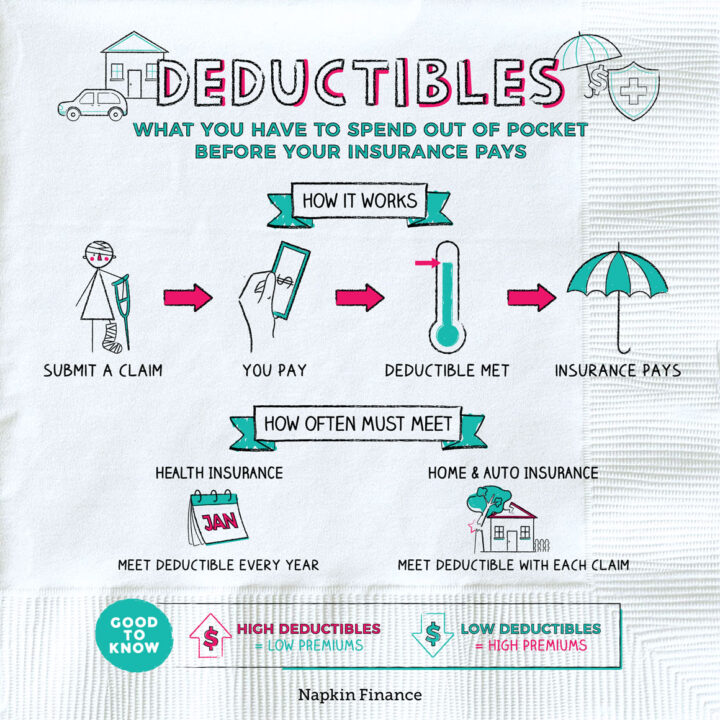

Think of a deductible as your share of the risk. When a covered event occurs, you pay the deductible upfront before your insurance kicks in to cover the rest. This upfront payment might seem like a minor detail, but it can have a major impact on your financial recovery.

This article dives into the world of business insurance deductibles, demystifying their role and helping you make informed decisions about your coverage.

What Exactly is a Deductible?

In simple terms, a deductible is the amount of money you agree to pay out-of-pocket before your insurance company starts covering the remaining costs of a claim.

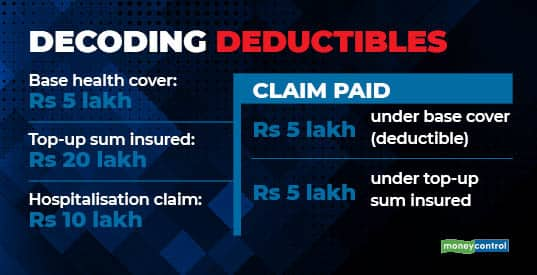

Imagine this: you have a business insurance policy with a $5,000 deductible for property damage. A fire breaks out in your office, causing $20,000 worth of damage. You’ll be responsible for the first $5,000, while your insurance company covers the remaining $15,000.

Why Do Deductibles Exist?

Deductibles serve a dual purpose:

- Lower Premiums: By agreeing to shoulder a portion of the risk, you essentially share the burden with your insurance company. This allows them to offer you lower premiums.

- Discouraging Small Claims: Deductibles act as a deterrent for filing claims for minor incidents. It encourages you to handle smaller issues yourself, reducing the administrative burden on the insurance company and keeping premiums lower for everyone.

Choosing the Right Deductible: Finding the Sweet Spot

The choice of deductible is a balancing act between premium cost and your financial preparedness. Here’s a breakdown of the factors to consider:

1. Financial Capacity:

- High Deductible: A higher deductible usually translates to lower premiums. This is a good option if you have a healthy cash flow and can comfortably absorb the cost of a potential claim.

- Low Deductible: A lower deductible means higher premiums but provides greater financial protection if a claim arises. This is a good option for businesses with limited cash reserves or facing higher risks.

2. Risk Tolerance:

- High Risk: If your business operates in a high-risk industry (like construction or manufacturing), a lower deductible might offer more peace of mind.

- Low Risk: If your business operates in a low-risk industry (like retail or services), a higher deductible could be more financially viable.

3. Claim History:

- Frequent Claims: If your business has a history of frequent claims, a higher deductible might not be the best choice.

- Few Claims: A history of fewer claims can allow you to negotiate a lower premium with a higher deductible.

4. Type of Insurance:

- Property Insurance: Deductibles for property insurance are typically fixed amounts, while deductibles for liability insurance can be expressed as percentages.

- Liability Insurance: Liability insurance deductibles are often a percentage of the policy limit, meaning the higher the policy limit, the higher the deductible.

The Impact of Deductibles on Your Business:

The choice of deductible can have a significant impact on your business:

- Financial Stability: A high deductible can strain your cash flow if you experience a claim, potentially impacting your operations and profitability.

- Claim Filing Decisions: A high deductible might discourage you from filing claims for smaller events, potentially leading to accumulated costs that could have been covered by insurance.

- Premium Costs: Lower deductibles mean higher premiums, which can impact your bottom line.

Navigating the Deductible Landscape:

- Negotiation: Don’t be afraid to negotiate with your insurance broker to find the best deductible for your business.

- Understanding Your Policy: Read your policy carefully to understand the specific deductible terms and conditions.

- Regular Reviews: Review your insurance policy and deductibles annually to ensure they still meet your business needs and risk profile.

Beyond the Basics: Deductible Variations

The world of deductibles isn’t always straightforward. Here are some common variations to be aware of:

- Per-Incident Deductible: This is the most common type, where you pay a fixed amount for each separate incident, regardless of the claim amount.

- Aggregate Deductible: This type applies a single deductible to all claims within a specific period (e.g., a year). Once the deductible is met, the insurance company covers all subsequent claims within that period.

- Franchise Deductible: This type requires you to pay a certain percentage of the claim amount, up to a maximum limit. For example, a 20% franchise deductible with a $10,000 limit means you pay 20% of the claim amount, up to a maximum of $10,000.

Deductibles and Business Continuity:

Deductibles are a crucial factor in business continuity planning. When a major event disrupts your operations, a high deductible can significantly impact your ability to recover quickly.

- Emergency Funds: Having sufficient emergency funds to cover a potential deductible is essential for ensuring your business can weather the storm.

- Insurance Coverage: Review your insurance policies to understand the deductibles and their potential impact on your business continuity plan.

FAQs about Business Insurance Deductibles:

Q: Can I change my deductible after I buy a policy?

A: You can usually adjust your deductible during policy renewal. However, changing it mid-term might involve penalties.

Q: What happens if my deductible is higher than the claim amount?

A: You’ll be responsible for the entire claim amount, as the insurance company won’t cover anything.

Q: What if I can’t afford to pay my deductible?

A: If you’re facing financial hardship, you can reach out to your insurance broker for assistance. They may be able to offer payment plans or explore other options.

Q: Does a higher deductible mean lower premiums for all types of insurance?

A: While higher deductibles generally lead to lower premiums, the specific relationship can vary depending on the type of insurance and the insurer.

Conclusion:

Deductibles are an integral part of business insurance, and understanding them is crucial for making informed decisions about your coverage. Balancing premium costs with your financial preparedness is key. By carefully considering your risk profile, financial capacity, and claim history, you can choose the deductible that best protects your business while minimizing your financial burden.

Reference:

This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified insurance professional for personalized guidance.

Source:

[Insert relevant source URL here]

Closure

Thank you for reading! Stay with us for more insights on Decoding the Deductible: Your Business Insurance’s Hidden Cost.

Don’t forget to check back for the latest news and updates on Decoding the Deductible: Your Business Insurance’s Hidden Cost!

Feel free to share your experience with Decoding the Deductible: Your Business Insurance’s Hidden Cost in the comment section.

Stay informed with our next updates on Decoding the Deductible: Your Business Insurance’s Hidden Cost and other exciting topics.