Navigating the Labyrinth: A Comprehensive Guide to Business Insurance Comparison

Related Articles

- Unlocking Growth: Your Guide To Low-Interest Business Loans

- Protecting Your Business: A Guide To Finding The Right Insurance Near You

- Startups And Insurance: A Love-Hate Relationship

- Unlocking The Power Of Business Insurance Online: A Comprehensive Guide

- Unlocking Growth: A Guide To Small Business Loan Options

Introduction

Join us as we explore Navigating the Labyrinth: A Comprehensive Guide to Business Insurance Comparison, packed with exciting updates

Navigating the Labyrinth: A Comprehensive Guide to Business Insurance Comparison

Running a business is a rollercoaster ride. One minute you’re soaring high with a successful launch, the next you’re scrambling to deal with unexpected challenges. While you can’t predict every bump in the road, you can prepare for them. And one of the most crucial ways to do that is by securing the right business insurance.

But with so many different types of policies and providers, finding the perfect fit can feel like navigating a labyrinth. Fear not! This comprehensive guide will equip you with the knowledge and tools to confidently compare business insurance options and make the best choice for your unique needs.

Why Business Insurance Matters: A Safety Net for Your Dreams

Think of business insurance as a safety net, catching you when unexpected events threaten to derail your progress. Here’s why it’s essential:

- Protecting Your Assets: Insurance safeguards your physical assets, like equipment, inventory, and property, from damage caused by fire, theft, natural disasters, and other unforeseen events.

- Financial Security: Unexpected legal claims, lawsuits, or accidents can cripple your business financially. Insurance provides financial protection, covering legal expenses, settlements, and potential losses.

- Maintaining Business Continuity: Disasters or incidents can disrupt your operations, causing downtime and lost revenue. Business insurance can help you recover quickly and minimize the impact on your business.

- Protecting Your Reputation: Accidents or incidents can damage your reputation and erode customer trust. Insurance can help manage the fallout and protect your brand image.

- Peace of Mind: Knowing you have adequate insurance coverage allows you to focus on running your business, knowing you’re protected from potential risks.

Types of Business Insurance: Understanding the Options

The world of business insurance is vast, offering a wide array of policies tailored to different industries and needs. Here’s a breakdown of some common types:

1. General Liability Insurance: The cornerstone of most business insurance plans, general liability protects you from third-party claims related to bodily injury, property damage, and advertising injuries. This coverage is crucial for businesses that interact with the public or operate in physical spaces.

2. Property Insurance: This policy safeguards your physical assets, including buildings, equipment, inventory, and furniture, against damage caused by fire, theft, vandalism, natural disasters, and other perils.

3. Workers’ Compensation Insurance: If you employ others, workers’ compensation insurance is mandatory in most states. It covers medical expenses, lost wages, and disability benefits for employees injured on the job.

4. Business Interruption Insurance: This policy helps you recover lost revenue and cover ongoing expenses if your business is forced to shut down due to a covered event, such as a fire or natural disaster.

5. Product Liability Insurance: For businesses that manufacture or sell products, product liability insurance protects you from claims arising from injuries or damages caused by your products.

6. Professional Liability Insurance (Errors & Omissions): This coverage protects professionals, such as doctors, lawyers, and accountants, from claims arising from negligence, errors, or omissions in their professional services.

7. Commercial Auto Insurance: If your business owns or uses vehicles, commercial auto insurance provides coverage for accidents, theft, and other incidents involving your vehicles.

8. Cyber Liability Insurance: In today’s digital age, cyber liability insurance is crucial for protecting your business from data breaches, cyberattacks, and other cyber threats.

9. Directors & Officers (D&O) Liability Insurance: This coverage protects directors and officers of a company from personal liability for financial losses or legal claims arising from their decisions or actions while serving in their roles.

10. Employment Practices Liability Insurance: This policy provides protection against claims related to employment practices, such as discrimination, harassment, wrongful termination, and wage and hour violations.

Beyond the Basics: Tailored Coverage for Specific Needs

While these core types of insurance are essential, many businesses require additional coverage to address specific risks. Here are a few examples:

- Liquor Liability Insurance: For businesses that serve alcohol, this policy protects you from claims related to alcohol-related injuries or damages.

- Crime Insurance: This coverage protects your business from losses caused by theft, embezzlement, forgery, and other criminal acts.

- Environmental Liability Insurance: For businesses that handle hazardous materials or operate in environmentally sensitive areas, environmental liability insurance provides protection against pollution-related claims.

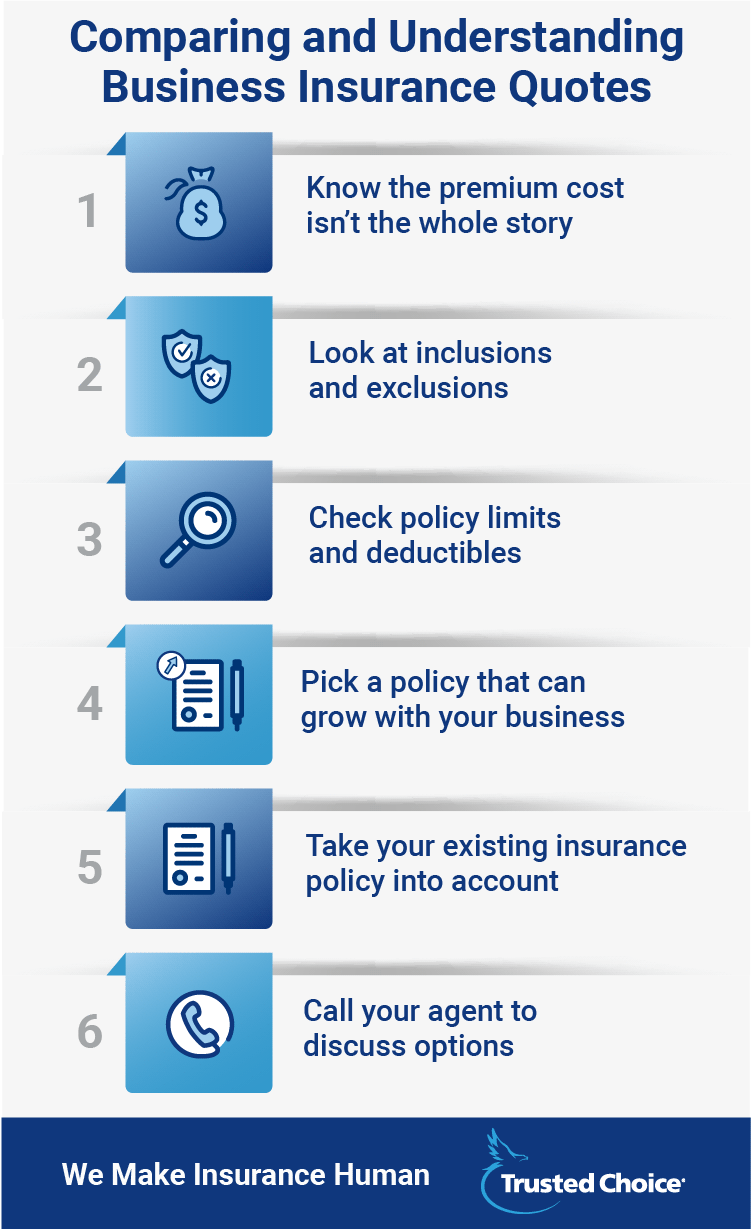

The Art of Comparing Business Insurance Quotes: A Step-by-Step Guide

Once you understand the types of coverage you need, it’s time to start comparing quotes from different insurance providers. Here’s a step-by-step guide to ensure you get the best value for your money:

1. Identify Your Needs: Start by creating a comprehensive list of your business’s potential risks and liabilities. This will help you determine the types of insurance you need and the coverage amounts you require.

2. Gather Information: Before contacting insurance providers, gather essential information about your business, such as:

- Business type and industry: Your industry will determine the specific risks you face and the types of insurance you need.

- Number of employees: This will affect your workers’ compensation insurance needs.

- Annual revenue: Your revenue will influence the coverage amounts you need.

- Location: Your location will determine your risk profile and the cost of insurance.

- Assets and property: Provide details about your buildings, equipment, inventory, and other assets.

3. Contact Multiple Providers: Don’t settle for the first quote you receive. Contact at least three to five insurance providers to get a range of options and compare prices.

4. Request Detailed Quotes: When requesting quotes, be specific about the coverage you need and the amounts you want. Ask for detailed policy breakdowns, including:

- Coverage limits: These are the maximum amounts the insurance company will pay for a claim.

- Deductibles: This is the amount you pay out-of-pocket before the insurance company starts covering claims.

- Exclusions: These are specific events or circumstances that are not covered by the policy.

- Premium: This is the cost of the insurance policy.

5. Compare Apples to Apples: When comparing quotes, ensure you’re comparing policies with similar coverage amounts, deductibles, and exclusions. This will help you make an informed decision based on price alone.

6. Consider the Provider’s Reputation: Check the insurer’s financial stability and track record of customer service. Look for companies with a strong reputation for paying claims fairly and promptly.

7. Negotiate: Don’t be afraid to negotiate the premium or coverage amounts. Many insurers are willing to work with you to find a policy that meets your needs and budget.

8. Review and Understand the Policy: Before signing on the dotted line, carefully review the policy documents and ensure you understand all the terms and conditions. Don’t hesitate to ask questions if anything is unclear.

9. Stay Informed: Once you have a policy, stay informed about your coverage and make sure your policy remains relevant to your business’s changing needs. Review your policy annually and consider making adjustments as your business grows or your risk profile changes.

Beyond Price: Factors to Consider When Choosing a Provider

While price is an important factor, it shouldn’t be the sole deciding factor when choosing a business insurance provider. Consider these additional factors:

- Customer Service: Look for a provider with a reputation for excellent customer service. You want to be able to easily reach a representative when you need help with a claim or have questions about your policy.

- Financial Stability: Choose a provider with a strong financial track record. This ensures they’ll be able to pay claims when you need them.

- Claims Handling: Look for a provider with a streamlined claims process and a history of fair and prompt claim settlements.

- Online Resources: A provider with a user-friendly website and online resources makes it easier to manage your policy, pay premiums, and file claims.

FAQs: Addressing Your Burning Questions

1. How much business insurance do I need?

The amount of coverage you need will depend on your specific industry, business size, assets, and risk profile. It’s best to consult with an insurance broker or agent who can help you assess your risks and determine the appropriate coverage amounts.

2. How often should I review my business insurance policy?

It’s recommended to review your policy annually, or more frequently if your business experiences significant changes, such as growth, expansion, or a shift in your risk profile.

3. What happens if I don’t have business insurance?

Operating without insurance can leave you financially vulnerable to lawsuits, claims, and other unexpected events. It can also make it difficult to secure loans or attract investors.

4. Can I get business insurance online?

Yes, many insurance providers offer online quotes and policy applications. However, it’s still recommended to speak with an insurance broker or agent to ensure you get the right coverage for your needs.

5. What are some tips for saving money on business insurance?

- Shop around: Get quotes from multiple providers to compare prices and coverage options.

- Increase your deductible: A higher deductible will typically result in a lower premium.

- Improve your risk management: Implementing safety measures and risk management practices can reduce your premiums.

- Bundle your policies: Combining multiple policies, such as property and liability insurance, can often lead to discounts.

Conclusion: Empowering Your Business with the Right Insurance

Navigating the world of business insurance can be daunting, but with the right knowledge and approach, you can find the perfect policy to protect your business from the unexpected. By understanding the different types of coverage, comparing quotes diligently, and considering factors beyond price, you can make an informed decision that provides peace of mind and financial security for your business. Remember, securing the right insurance is an investment in your business’s future, allowing you to focus on growth and success knowing you’re protected from potential risks.

Source:

[Insert your source URL here]

Closure

Thank you for reading! Stay with us for more insights on Navigating the Labyrinth: A Comprehensive Guide to Business Insurance Comparison.

Don’t forget to check back for the latest news and updates on Navigating the Labyrinth: A Comprehensive Guide to Business Insurance Comparison!

Feel free to share your experience with Navigating the Labyrinth: A Comprehensive Guide to Business Insurance Comparison in the comment section.

Keep visiting our website for the latest trends and reviews.