Wage inflation vs real inflation

Related Articles

- The Slowdown Symphony: Understanding Economic Growth Stagnation

- Navigating The Choppy Waters: Job Market Uncertainty In The 21st Century

- The Future Of The US Dollar: A Balancing Act

- The Great American Wage Stagnation: Why Your Paycheck Isn’t Keeping Up

- Navigating The Shifting Sands: A Look At Corporate Tax Policies In 2024

Introduction

In this article, we dive into Wage inflation vs real inflation, giving you a full overview of what’s to come

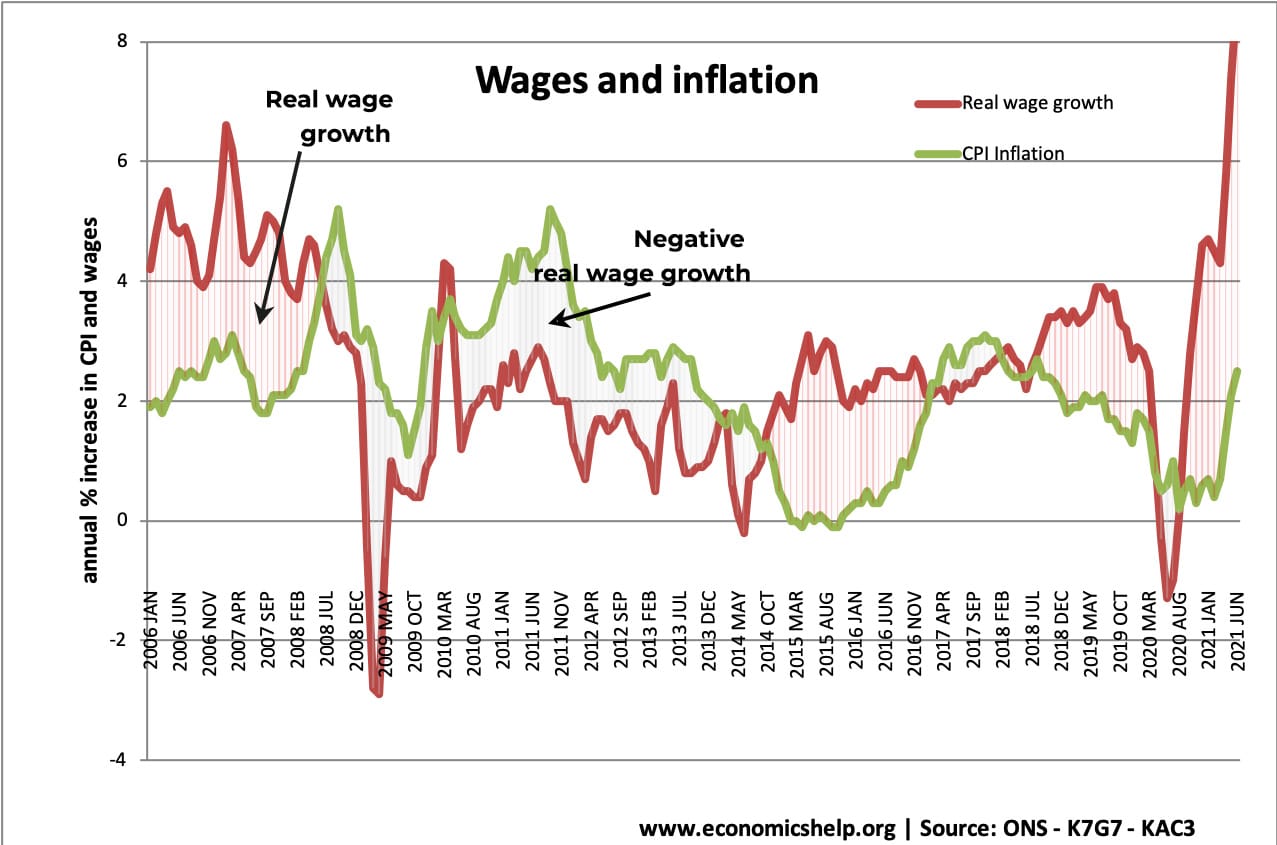

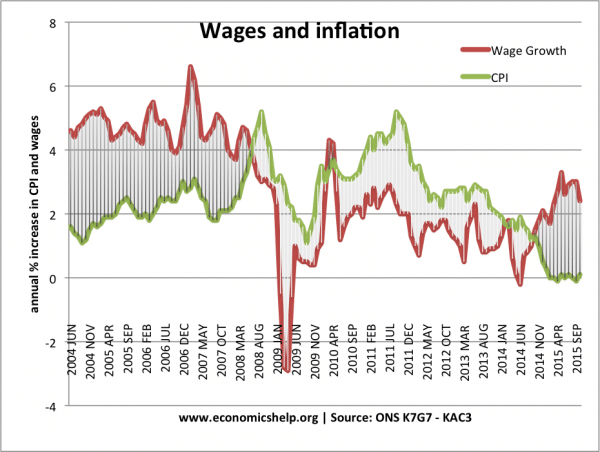

Wage Inflation vs. Real Inflation: A Battle for Your Paycheck

We all know the feeling: prices are going up, but our paychecks don’t seem to be keeping pace. This is the classic tug-of-war between inflation and wages, a battle that impacts every household. But what exactly are we talking about when we say "inflation"? And how does it differ from "wage inflation"? Understanding these concepts is key to navigating the economic landscape and making informed decisions about your finances.

Inflation: The Silent Thief of Purchasing Power

Inflation, in its simplest form, is the rate at which prices for goods and services increase over time. Think of it as the silent thief that slowly eats away at your purchasing power. Imagine buying a loaf of bread for $2 a few years ago. Now, that same loaf might cost $3. That $1 difference represents inflation – the erosion of your money’s value.

There are two main types of inflation:

- Demand-pull inflation: This occurs when there’s too much money chasing too few goods. Think of it as a bidding war. When demand outstrips supply, prices naturally rise as consumers compete for limited resources. This can happen during economic booms or when there’s a sudden increase in government spending.

- Cost-push inflation: This type arises when the cost of production for goods and services increases. Think of rising oil prices pushing up transportation costs, leading to higher prices for everything from groceries to clothing. Factors like supply chain disruptions, natural disasters, or increased labor costs can contribute to cost-push inflation.

Wage Inflation: The Race to Keep Up

Wage inflation, as the name suggests, is the increase in wages over time. It’s the opposite side of the coin to price inflation. Ideally, wages should rise at a rate that keeps pace with inflation, allowing people to maintain their purchasing power. However, this ideal scenario isn’t always the reality.

Wage inflation can be driven by several factors:

- Increased demand for labor: When businesses are booming and need more workers, they often have to offer higher wages to attract and retain talent.

- Government policies: Minimum wage laws, collective bargaining agreements, and other government policies can influence wage growth.

- Productivity gains: As workers become more efficient and productive, they may demand higher wages to reflect their increased output.

- Competition: Companies may be forced to raise wages to stay competitive with other employers in the same industry.

The Great Inflation-Wage Dance: A Delicate Balance

The relationship between wage inflation and price inflation is a complex dance. Ideally, they should move in sync, ensuring a stable economy. However, the reality is often more nuanced.

- Wage inflation lagging behind price inflation: This is the scenario we often see during periods of high inflation. Prices rise faster than wages, leading to a decline in real wages (the purchasing power of wages after accounting for inflation). This can create a vicious cycle, as workers demand higher wages to compensate for the rising cost of living, further pushing up prices.

- Wage inflation outpacing price inflation: This scenario can lead to a surge in consumer spending, driving up demand and potentially contributing to higher inflation. However, it can also lead to a more robust economy with higher levels of employment and economic growth.

Real Inflation: The True Measure of Your Paycheck

To truly understand the impact of inflation on your wallet, you need to consider real inflation. This refers to the change in the purchasing power of money over time, taking inflation into account. In essence, it tells you how much less your money is worth today compared to the past.

For example, if your salary increased by 5% but inflation was 3%, your real wage increase is only 2%. This means you can only buy 2% more goods and services with your higher salary compared to the previous year.

The Impact of Inflation and Wage Inflation: A Ripple Effect

The interplay between inflation and wage inflation has far-reaching consequences for individuals, businesses, and the economy as a whole.

- Individuals: When inflation outpaces wage growth, individuals experience a decline in their standard of living. They have less money to spend on necessities and discretionary items, leading to financial stress and potentially impacting their ability to save for the future.

- Businesses: High inflation can make it challenging for businesses to plan and manage their costs. Rising input prices can eat into profit margins, forcing them to raise prices or cut costs, which can impact their competitiveness and growth.

- Economy: Inflation can lead to economic uncertainty and volatility. It can discourage investment and hinder economic growth. Uncontrolled inflation can even lead to hyperinflation, a catastrophic economic event characterized by rapid and uncontrolled price increases.

Navigating the Inflationary Landscape: Strategies for Individuals

While we can’t control inflation, we can take steps to mitigate its impact on our finances:

- Understand your spending habits: Track your expenses and identify areas where you can cut back. This can help you free up more money to offset rising prices.

- Negotiate your salary: Don’t be afraid to ask for a raise, especially if your salary hasn’t kept pace with inflation. Highlight your skills, experience, and contributions to justify your request.

- Diversify your investments: Investing in a diversified portfolio can help you hedge against inflation. Consider assets like real estate, stocks, and commodities that tend to perform well during inflationary periods.

- Consider alternative income streams: Explore side hustles or freelance opportunities to supplement your income and offset the impact of inflation.

- Shop around for better deals: Compare prices and look for discounts to stretch your budget further. Consider buying in bulk, using coupons, and taking advantage of loyalty programs.

The Future of Inflation and Wages: A Look Ahead

Predicting the future of inflation and wages is a tricky business. However, several factors suggest that inflation may remain elevated for the foreseeable future:

- Supply chain disruptions: The ongoing global supply chain issues are contributing to higher prices for goods and services.

- Rising energy costs: The war in Ukraine and other geopolitical tensions are driving up energy prices, which have a ripple effect on the entire economy.

- Strong consumer demand: With unemployment low and wages rising, consumer demand remains strong, potentially fueling further price increases.

FAQ

Q: What is the relationship between inflation and interest rates?

A: Interest rates and inflation have an inverse relationship. When inflation is high, central banks typically raise interest rates to slow down economic growth and curb inflation. Higher interest rates make it more expensive to borrow money, which can reduce consumer spending and investment.

Q: How does inflation impact the value of savings?

A: Inflation erodes the purchasing power of savings. If you save money in a low-yield account, the real value of your savings may decline over time due to inflation. It’s important to consider inflation when planning for retirement and other long-term financial goals.

Q: Is inflation always bad?

A: While high inflation can be detrimental to the economy, a moderate level of inflation is generally considered healthy. It encourages spending and investment, which can drive economic growth. However, prolonged periods of high inflation can lead to economic instability and social unrest.

Q: What are some ways to protect my savings from inflation?

A: To protect your savings from inflation, consider investing in assets that tend to perform well during inflationary periods, such as:

- Real estate: Real estate prices tend to rise with inflation, providing a hedge against inflation.

- Stocks: Companies with pricing power can pass on higher costs to consumers, potentially boosting their stock prices during inflationary periods.

- Commodities: Commodities like gold and oil can also act as a hedge against inflation.

Conclusion: A Constant Vigilance

Understanding the dynamics between wage inflation and real inflation is crucial for navigating the ever-changing economic landscape. It’s a constant battle for your paycheck, and staying informed and proactive is essential to protecting your financial well-being. By staying informed, making smart financial decisions, and advocating for fair wages, you can ensure that your hard-earned money keeps pace with the rising cost of living.

Source URL: [Insert URL of a reputable source on inflation and wages]

Closure

We hope this article has helped you understand everything about Wage inflation vs real inflation. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Wage inflation vs real inflation in the comment section.

Keep visiting our website for the latest trends and reviews.