Navigating the Labyrinth: A Guide to Comparing Business Loan Interest Rates in 2023

Related Article

- Role Of AI In The U.S. Digital Economy

- Unlocking Funding: Business Loans For Low Credit Scores

- Apple Pay Setup Guide

- The Digital Economy And U.S. Education

- Business Loan Quick Approval

Introduction

We warmly welcome you to explore Navigating the Labyrinth: A Guide to Comparing Business Loan Interest Rates in 2023 with us. Our aim is to provide you with fresh insights and valuable knowledge about this intriguing topic. Let’s begin and discover what Navigating the Labyrinth: A Guide to Comparing Business Loan Interest Rates in 2023 has to offer!}

Video About

Navigating the Labyrinth: A Guide to Comparing Business Loan Interest Rates in 2023

Starting a business or expanding an existing one often requires a financial boost. Business loans can be a lifeline, but navigating the complex world of interest rates can feel like walking through a maze. Don’t worry, this comprehensive guide will equip you with the knowledge to confidently compare business loan interest rates and secure the best financing for your venture.

The Basics: Understanding Business Loan Interest Rates

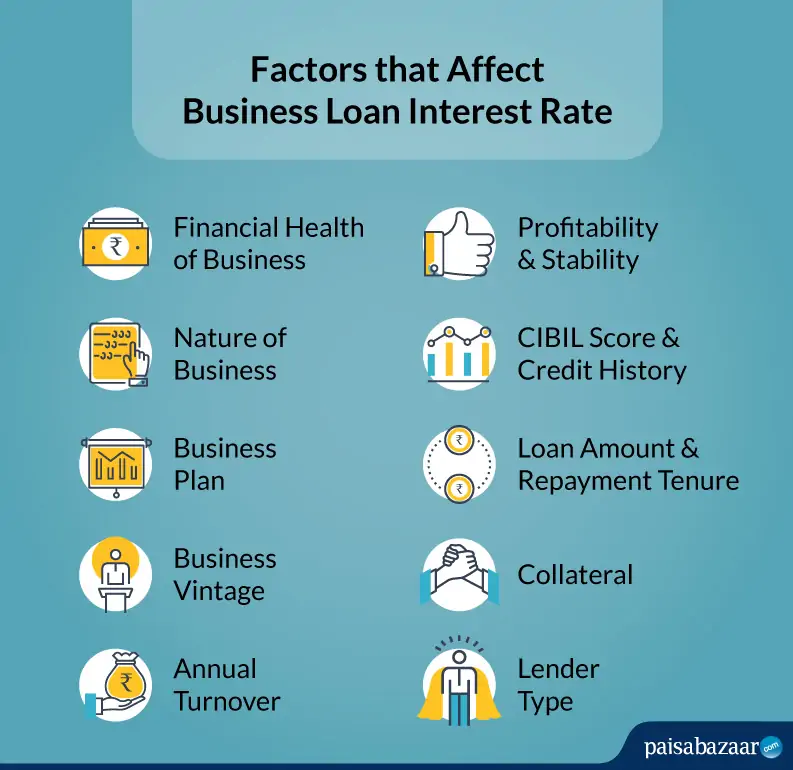

Imagine interest rates as the price you pay for borrowing money. The higher the interest rate, the more you’ll pay back over the loan’s lifetime. Here’s a breakdown of the key factors that influence business loan interest rates:

- Your Credit Score: Your creditworthiness is paramount. A strong credit score signals to lenders that you’re a reliable borrower, leading to lower interest rates.

- Loan Amount: Larger loans often come with lower interest rates, reflecting the lender’s confidence in your ability to manage a significant amount.

- Loan Term: Shorter loan terms generally have higher interest rates. This is because lenders have less time to recoup their investment.

- Loan Type: Different loan types, such as SBA loans or term loans, carry varying interest rates based on their specific features and risk profiles.

- Industry: Some industries are considered riskier than others, potentially leading to higher interest rates for businesses operating in those sectors.

- Current Economic Conditions: Interest rates are influenced by broader economic factors like inflation and the Federal Reserve’s monetary policy.

Navigating the Maze: Key Tools for Comparing Business Loan Interest Rates

With so many variables at play, comparing business loan interest rates can feel overwhelming. Fortunately, we’ve got you covered with these essential tools:

1. Online Loan Comparison Platforms: These platforms, like LendingTree, NerdWallet, and Credible, allow you to input your loan needs and receive personalized quotes from multiple lenders. This streamlined approach saves you time and effort.

2. Loan Calculators: Use online loan calculators to estimate monthly payments, total interest paid, and the overall cost of different loan options. This helps you visualize the financial impact of each choice.

3. Direct Lender Websites: Explore the websites of individual lenders, such as banks, credit unions, and online lenders. This allows you to compare specific loan offerings and understand their terms and conditions.

4. Financial Advisors: A qualified financial advisor can provide tailored guidance on choosing the right loan based on your individual circumstances and financial goals.

Beyond Interest Rates: Looking Beyond the Obvious

While interest rates are a crucial factor, it’s essential to consider other aspects of a business loan to make an informed decision:

- Fees: Pay attention to origination fees, closing costs, and other associated charges. These fees can add up and significantly impact the overall cost of the loan.

- Repayment Terms: Understand the loan’s repayment schedule, including the frequency of payments and the grace period for late payments.

- Loan Purpose: Ensure the loan is suitable for your specific business needs. Some loans are designed for specific purposes, like equipment financing or working capital.

- Customer Service: Choose a lender with a strong reputation for customer service and responsiveness. You want a partner who’s there to support you throughout the loan process.

The Shifting Landscape: Latest Trends in Business Loan Interest Rates

The business loan landscape is constantly evolving. Here’s a glimpse into some key trends shaping interest rates in 2023:

- Rising Interest Rates: The Federal Reserve’s aggressive interest rate hikes have impacted borrowing costs for businesses. Expect interest rates to remain elevated in the near future.

- Increased Competition: The online lending market is becoming increasingly competitive, with new players entering the scene. This could lead to more favorable interest rates for borrowers.

- Focus on Alternative Data: Lenders are increasingly using alternative data, such as business revenue and cash flow, to assess creditworthiness. This could benefit businesses with strong financial performance, even if their credit scores are lower.

- Rise of Fintech: Fintech companies are disrupting traditional lending practices, offering faster loan approvals and more flexible repayment options. This could lead to more competitive interest rates and personalized financing solutions.

Expert Insights: Tips from the Pros

We reached out to industry experts for their insights on navigating business loan interest rates:

- "Don’t focus solely on the lowest interest rate. Consider the overall cost of the loan, including fees and repayment terms." – Sarah Miller, Financial Advisor

- "Build a strong credit history. A good credit score is your biggest asset when securing favorable loan terms." – David Jones, Business Loan Specialist

- "Shop around and compare offers from multiple lenders. This will give you a clear picture of the market and help you negotiate better rates." – Emily Chen, Fintech Entrepreneur

FAQs: Addressing Your Questions

Q: What is a good interest rate for a business loan?

A: A good interest rate varies based on factors like your credit score, loan amount, and industry. Generally, aim for an interest rate that’s competitive within your industry and aligns with your financial goals.

Q: How can I improve my chances of getting a lower interest rate?

A: Build a strong credit history, secure a business loan with a shorter term, and consider a larger loan amount if possible.

Q: What are the risks of taking out a business loan with a high interest rate?

A: High interest rates can significantly increase the overall cost of the loan, making it more difficult to repay and potentially hindering your business growth.

Q: What are some alternatives to traditional bank loans?

A: Consider alternative financing options like online lenders, crowdfunding, or SBA loans. These options may offer more flexible terms and potentially lower interest rates.

Conclusion: Empowering Your Financial Journey

Understanding business loan interest rates is crucial for making informed financial decisions. By using the tools and strategies outlined in this guide, you can navigate the complex landscape of loan options and secure the best financing for your business. Remember, comparing interest rates is just the beginning. Evaluate the entire loan package, including fees, repayment terms, and lender reputation, to make a decision that aligns with your long-term financial goals.

Source URL:

[Insert URL of relevant source material here]

Conclusion

In conclusion, we hope this article has provided you with helpful insights about Navigating the Labyrinth: A Guide to Comparing Business Loan Interest Rates in 2023. Thank you for spending your valuable time with us! Stay tuned for more exciting articles and updates!