How High Interest Rates Help Tame Inflation: A Guide to the Fed’s Monetary Policy Tool

Related Article

- The Power Of Connection: How Telecommunications Fuels Global GDP

- The Future Of Learning And Communication: A Seamless Blend Of Remote And In-Person

- How Telecommunications Shapes The Global Trade Landscape: A Deep Dive

- Cyber Liability Insurance: Your Digital Shield In A World Of Threats

- The Economic Benefits Of Open Access Networks: A Boon For Consumers And Businesses Alike

Introduction

Calling all future economists and finance enthusiasts! Uncover the secrets and important trends of How High Interest Rates Help Tame Inflation: A Guide to the Fed’s Monetary Policy Tool—why it matters, and how it shapes our world today. Whether you’re seeking strategies, analysis, or the latest updates, this article is designed to keep you ahead of the curve. Get comfortable, grab your notes, and let’s navigate the world of How High Interest Rates Help Tame Inflation: A Guide to the Fed’s Monetary Policy Tool together!

How High Interest Rates Help Tame Inflation: A Guide to the Fed’s Monetary Policy Tool

Inflation, the persistent rise in prices for goods and services, can wreak havoc on economies. It erodes purchasing power, making it harder for individuals and businesses to plan for the future. One of the most powerful tools governments have to combat inflation is interest rate hikes. This might sound counterintuitive – wouldn’t higher interest rates make things more expensive? But the reality is a bit more nuanced.

Imagine interest rates as a thermostat for the economy. By tweaking the cost of borrowing money, central banks like the Federal Reserve (Fed) can influence spending, investment, and ultimately, the overall price level.

This article will delve into the complex world of interest rates and inflation, exploring:

- How interest rate hikes work to combat inflation

- The latest trends and advancements in monetary policy

- Potential downsides and challenges of using high interest rates

- Expert insights and real-world examples

Ready to dive in? Let’s break down the intricacies of this vital economic tool.

Understanding the Link Between Interest Rates and Inflation

The connection between interest rates and inflation is a bit like a game of tug-of-war.

Higher interest rates act as a brake on inflation by:

- Reducing consumer spending: When borrowing money becomes more expensive, people tend to spend less, especially on big-ticket items like cars and homes. This decreased demand can help cool down prices.

- Curbing investment: Businesses also become more cautious about borrowing for expansion or new projects when interest rates are high. This can slow down economic growth, but also help prevent inflation from spiraling out of control.

- Strengthening the dollar: Higher interest rates can make the dollar more attractive to foreign investors, increasing demand for it. This can lead to a stronger dollar, making imported goods cheaper and further easing inflationary pressures.

Think of it this way:

- High interest rates = Less money in circulation = Less demand for goods and services = Lower prices.

How the Fed Uses Interest Rates to Manage Inflation

The Federal Reserve, the central bank of the United States, has a primary mandate: to maintain price stability and full employment. One of its most powerful tools for achieving this is monetary policy, which involves adjusting interest rates.

The Fed’s main interest rate tool is the federal funds rate. This is the rate at which banks lend reserves to each other overnight. When the Fed raises the federal funds rate, it becomes more expensive for banks to borrow money, which in turn leads to higher interest rates on loans for businesses and consumers.

Here’s a simplified breakdown of how the Fed’s interest rate adjustments impact the economy:

- Raising interest rates (tightening monetary policy): This slows down economic growth by making borrowing more expensive, which can help curb inflation.

- Lowering interest rates (loosening monetary policy): This stimulates economic growth by making borrowing cheaper, but can also lead to higher inflation if not managed carefully.

The Fed’s decisions are guided by economic data and projections. They carefully monitor inflation rates, unemployment levels, and other key indicators to determine the appropriate course of action.

Latest Trends and Advancements in Monetary Policy

The world of monetary policy is constantly evolving. Here are some of the latest trends and advancements that are shaping how central banks manage inflation:

- Quantitative Easing (QE): This involves central banks buying government bonds and other assets to inject liquidity into the financial system. QE was used extensively during the 2008 financial crisis and the COVID-19 pandemic to stimulate economic growth.

- Negative Interest Rates: Some countries, including Japan and Switzerland, have experimented with negative interest rates, where banks are charged to hold reserves at the central bank. This unconventional policy aims to encourage lending and investment, but its effectiveness is still debated.

- Forward Guidance: Central banks are increasingly using forward guidance, communicating their intentions and future policy plans to market participants. This helps to manage expectations and reduce uncertainty in the financial markets.

- Inflation Targeting: Many countries have adopted explicit inflation targets, setting a specific range for the desired rate of inflation. This provides a clear framework for monetary policy decisions and helps to anchor inflation expectations.

- Data-Driven Decision Making: Central banks are relying more heavily on data analysis and sophisticated models to inform their policy decisions. This allows them to respond more effectively to changing economic conditions.

These advancements reflect the ongoing efforts of central banks to fine-tune their tools and adapt to the ever-changing global economic landscape.

Potential Downsides and Challenges of High Interest Rates

While high interest rates can help to tame inflation, they also come with potential downsides:

- Slower Economic Growth: Higher interest rates can make it more expensive for businesses to borrow money, leading to reduced investment and slower economic growth.

- Higher Unemployment: A slowdown in economic activity can lead to job losses, as businesses cut back on hiring or even lay off employees.

- Increased Debt Burden: Higher interest rates make it more difficult for individuals and businesses to manage existing debt, potentially leading to financial distress.

- Potential for Recessions: In extreme cases, aggressive interest rate hikes can push the economy into a recession, characterized by widespread economic decline.

It’s a delicate balancing act for central banks. They must carefully weigh the benefits of curbing inflation against the risks of slowing down economic growth.

Expert Insights and Real-World Examples

Let’s hear from some experts on the topic of high interest rates and inflation:

- "Interest rate hikes are a blunt instrument, but they are often the most effective tool available to combat inflation. The key is to use them judiciously and avoid overdoing it." – Dr. Janet Yellen, former Chair of the Federal Reserve

- "The current inflationary environment is complex and multifaceted. Central banks must be prepared to adjust their policy stance as needed to ensure price stability." – Christine Lagarde, President of the European Central Bank

- "While higher interest rates can help to control inflation, they also come with the risk of slowing down economic growth. The optimal path forward depends on a careful assessment of the economic landscape." – Mark Carney, former Governor of the Bank of England

Here are some real-world examples of how high interest rates have been used to combat inflation:

- The Volcker Era (1979-1987): Paul Volcker, former Chair of the Federal Reserve, aggressively raised interest rates to combat the high inflation of the 1970s. This led to a recession, but ultimately brought inflation under control.

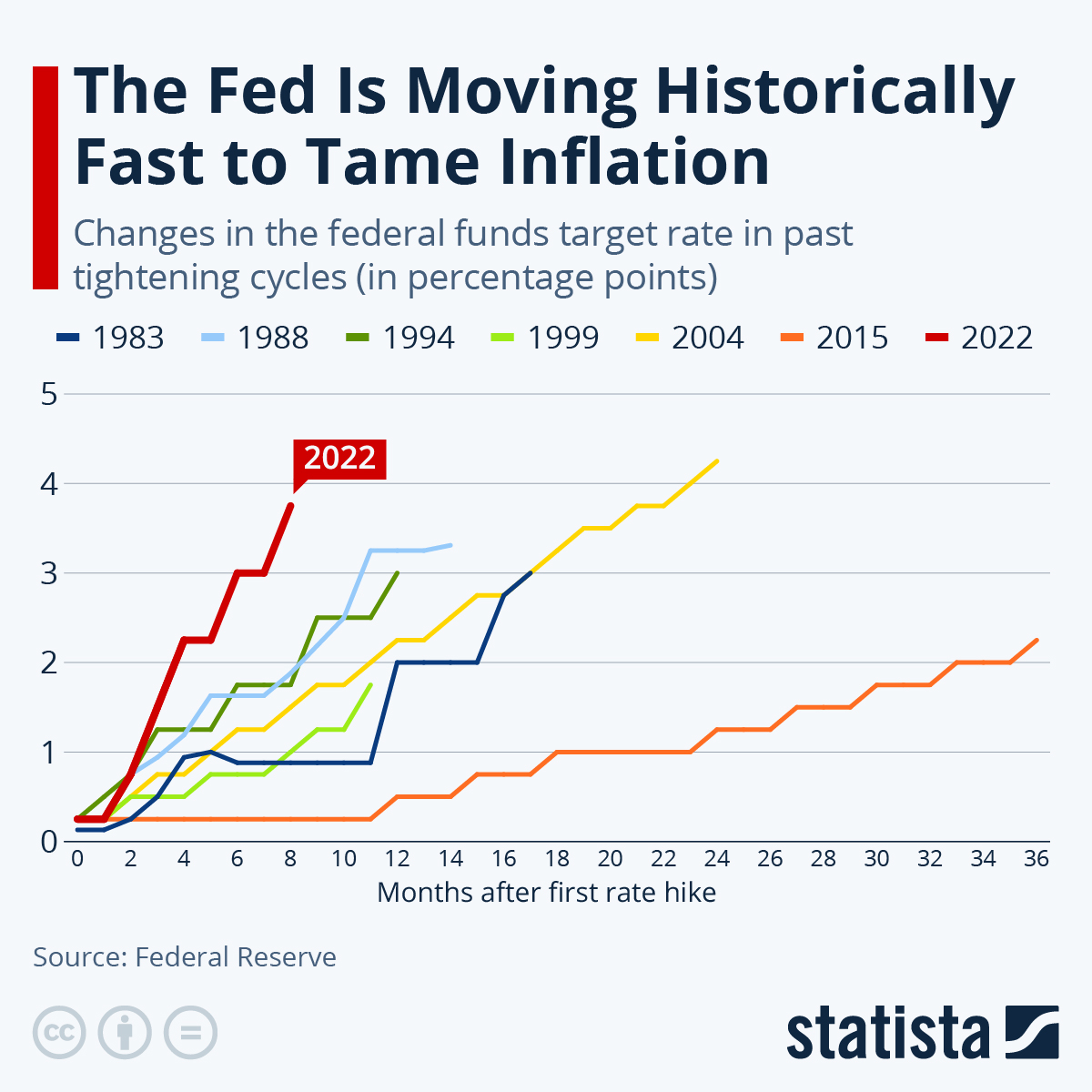

- The 2022-2023 Fed Rate Hikes: In response to the surge in inflation following the COVID-19 pandemic, the Federal Reserve has been raising interest rates at a rapid pace. This has slowed down economic growth, but it remains to be seen whether it will be enough to tame inflation.

These examples illustrate the powerful impact of interest rate policy and the challenges of managing inflation in a complex global economy.

FAQ: High Interest Rates and Inflation

Q: What is the relationship between interest rates and inflation?

A: Higher interest rates tend to curb inflation by reducing consumer spending, curbing investment, and strengthening the dollar.

Q: How do interest rate hikes affect the economy?

A: Interest rate hikes slow down economic growth by making borrowing more expensive, but they can also help to control inflation.

Q: Why do central banks raise interest rates?

A: Central banks raise interest rates to combat inflation and maintain price stability.

Q: What are the potential downsides of high interest rates?

A: High interest rates can lead to slower economic growth, higher unemployment, increased debt burdens, and even potential recessions.

Q: How do central banks decide when to raise or lower interest rates?

A: Central banks monitor economic data and projections, including inflation rates, unemployment levels, and other key indicators, to inform their policy decisions.

Q: What are some of the latest trends and advancements in monetary policy?

A: Recent advancements include quantitative easing, negative interest rates, forward guidance, inflation targeting, and data-driven decision making.

Q: What are some real-world examples of how high interest rates have been used to combat inflation?

A: The Volcker era (1979-1987) and the 2022-2023 Fed rate hikes are examples of how aggressive interest rate hikes have been used to control inflation.

In conclusion, high interest rates are a powerful tool that central banks use to combat inflation. While they can be effective in bringing prices under control, they also come with potential downsides. The effectiveness of interest rate policy depends on a careful assessment of the economic landscape and the ability of central banks to manage the risks and trade-offs involved.

Source:

- Federal Reserve: https://www.federalreserve.gov/

- International Monetary Fund: https://www.imf.org/

- Bank for International Settlements: https://www.bis.org/

- European Central Bank: https://www.ecb.europa.eu/

Conclusion

Keep following us for more in-depth guides, expert tips, and the latest updates to keep you ahead in understanding the world of economics. Until next time, stay curious and engaged, and we’ll see you in our next deep dive!