Are High Interest Rates Good or Bad for the Economy? A Deep Dive

Related Article

- The Elusive Shadow: Unpacking Economic Policy Uncertainty

- The Green Signal: How Telecommunications Are Powering A Sustainable Future

- 5G: The Catalyst For A Revolution In Global Supply Chains

- The Call Of The Future: How Telecommunications Reshape Consumer Behavior

- The Power Of Connection: How Telecommunications Fuels Remote Work

Introduction

Calling all gamers! Let’s unlock the secrets and highlights of Are High Interest Rates Good or Bad for the Economy? A Deep Dive and why it’s a must-know for you. Whether you’re here for tips, insights, or the latest updates, this article is crafted to keep you in the loop and ahead in the game. Grab your controller, settle in, and let’s explore the world of Are High Interest Rates Good or Bad for the Economy? A Deep Dive together!

Are High Interest Rates Good or Bad for the Economy? A Deep Dive

Interest rates are like the fuel gauge of the economy. When they rise, it can feel like we’re driving uphill, but when they fall, it’s like coasting downhill. But what exactly does this mean for your wallet, your investments, and the overall health of the economy?

This article will explore the complex relationship between high interest rates and economic performance, examining the pros and cons from various perspectives. We’ll delve into the latest trends, dissect the impact on different economic actors, and offer expert insights to help you navigate this crucial aspect of financial life.

What are Interest Rates?

In simple terms, interest rates are the cost of borrowing money. When you take out a loan, you pay interest to the lender for the privilege of using their money. Conversely, when you deposit money in a savings account, the bank pays you interest for letting them use your money.

The Power of Interest Rates

Interest rates play a crucial role in shaping economic activity. They influence:

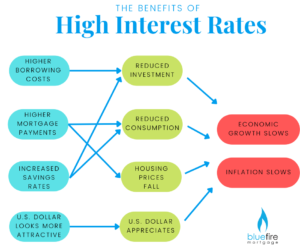

- Consumer Spending: High interest rates make borrowing more expensive, discouraging consumers from taking out loans for big purchases like cars or homes. This can lead to a slowdown in consumer spending, which is a major driver of economic growth.

- Business Investment: Companies rely on loans to finance expansion and new projects. High interest rates can make these investments less attractive, leading to reduced business investment and slower economic growth.

- Inflation: Interest rates are a powerful tool for controlling inflation. When prices rise too quickly, central banks can raise interest rates to make borrowing more expensive, discouraging spending and slowing down inflation.

- Currency Value: High interest rates can attract foreign investment, increasing demand for the local currency and strengthening its value. This can make exports more expensive, potentially harming businesses.

The Pros of High Interest Rates

- Curbing Inflation: As mentioned earlier, high interest rates are a key tool for fighting inflation. By making borrowing more expensive, they can cool down demand and slow down the pace of price increases. This is crucial for maintaining a stable economy and preserving the purchasing power of consumers.

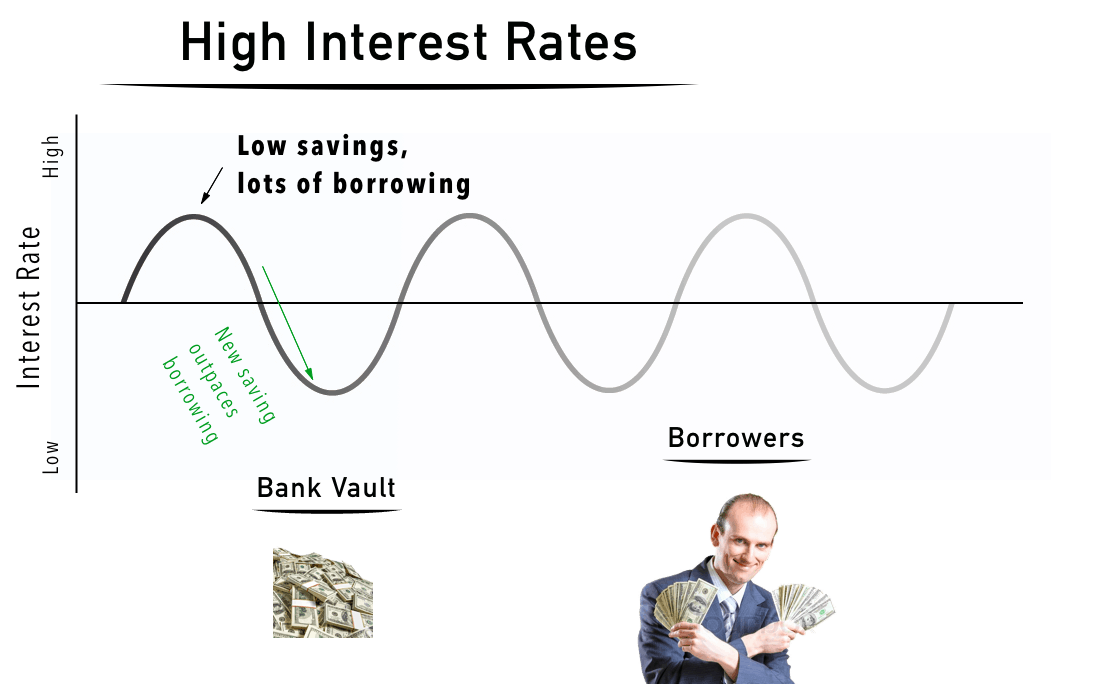

- Encouraging Saving: Higher interest rates make saving more attractive. When people earn more on their savings, they are more likely to put money aside, which can boost long-term economic stability.

- Strengthening the Currency: Higher interest rates can attract foreign investment, as investors seek higher returns on their money. This increased demand for the local currency can strengthen its value, potentially making imports cheaper and benefiting consumers.

The Cons of High Interest Rates

- Slowing Economic Growth: Higher interest rates can dampen consumer spending and business investment, leading to slower economic growth. This can result in job losses, reduced business activity, and a decline in overall economic output.

- Increasing Debt Burden: For individuals and businesses with existing debt, higher interest rates can increase their monthly payments, making it harder to manage their finances. This can lead to financial strain and even defaults.

- Discouraging Investment: Higher interest rates can discourage businesses from investing in new projects and expanding their operations, hindering economic growth and job creation.

The Latest Trends in Interest Rates

In recent years, central banks around the world have been grappling with the challenge of rising inflation. To combat this, they have been raising interest rates, a trend expected to continue in the near future. The US Federal Reserve, for example, has been aggressively raising rates, with more increases anticipated in the coming months.

Expert Insights on High Interest Rates

- Dr. Janet Yellen, Former Chair of the Federal Reserve: "Interest rates are a powerful tool for managing the economy. They can help to control inflation, but they also have the potential to slow down economic growth. It’s a delicate balancing act."

- Professor Nouriel Roubini, Economist and Professor at NYU Stern School of Business: "High interest rates are a necessary evil in the fight against inflation. While they can cause some short-term pain, they are essential for maintaining long-term economic stability."

- Mark Zandi, Chief Economist at Moody’s Analytics: "The impact of high interest rates on the economy is complex and multifaceted. It depends on a variety of factors, including the level of inflation, the strength of the economy, and the response of businesses and consumers."

Navigating the Impact of High Interest Rates

Understanding the impact of high interest rates on your personal finances and investments is crucial. Here are some key considerations:

- Debt Management: If you have existing debt, consider refinancing to a lower interest rate or making extra payments to reduce your principal balance.

- Saving and Investing: High interest rates can make saving more attractive. Explore different savings accounts and consider investing in assets that benefit from rising interest rates, such as bonds.

- Budgeting and Spending: Be mindful of your spending and adjust your budget to account for higher interest costs.

- Stay Informed: Stay informed about economic trends and the actions of central banks. This will help you make informed decisions about your finances.

FAQ

Q: What is the target interest rate?

A: The target interest rate is the level of interest rates that central banks aim to achieve. This rate is adjusted based on economic conditions and the central bank’s inflation goals.

Q: How do interest rates affect home mortgages?

A: Higher interest rates make mortgages more expensive, increasing monthly payments and potentially reducing affordability for homebuyers.

Q: What is the relationship between interest rates and the stock market?

A: High interest rates can negatively impact the stock market, as they make borrowing more expensive for companies and can reduce investor confidence.

Q: What are the potential consequences of keeping interest rates too low for too long?

A: Keeping interest rates too low for too long can lead to inflation, asset bubbles, and financial instability.

Q: What are the potential consequences of raising interest rates too quickly?

A: Raising interest rates too quickly can slow down economic growth and lead to job losses.

Conclusion

High interest rates are a double-edged sword. They can help to control inflation and promote saving, but they can also slow down economic growth and increase the burden of debt. Understanding the complex interplay between interest rates and the economy is crucial for making informed decisions about your finances and investments. As we navigate the current economic landscape, staying informed about interest rate trends and their potential impact is essential.

Sources:

Conclusion

We’re glad to have had you along for the journey through Are High Interest Rates Good or Bad for the Economy? A Deep Dive and hope you found it as exciting as we did.