Global Economic Impact of U.S. Interest Rate Hikes

Related Article

- Navigating The Shifting Sands: Economic Strategies For The Telecommunications Industry In The US

- Connecting Care: How Telecommunications Is Revolutionizing Healthcare Access

- Behind The Scenes: Unveiling The World Of Life Insurance Underwriters

- Connecting The Unconnected: How Telecommunications Is Revolutionizing Accessibility

- Predicting The Future Of Premiums: A Guide To Insurance Premium Forecasting

Introduction

Calling all future economists and finance enthusiasts! Uncover the secrets and important trends of Global Economic Impact of U.S. Interest Rate Hikes—why it matters, and how it shapes our world today. Whether you’re seeking strategies, analysis, or the latest updates, this article is designed to keep you ahead of the curve. Get comfortable, grab your notes, and let’s navigate the world of Global Economic Impact of U.S. Interest Rate Hikes together!

The Ripple Effect: How U.S. Interest Rate Hikes Impact the Global Economy

The world is interconnected, and the decisions of one nation can have far-reaching consequences. This is especially true when it comes to the United States, a global economic powerhouse. The Federal Reserve’s recent interest rate hikes, aimed at curbing inflation, are sending ripples across the globe, impacting economies, currencies, and markets in complex and sometimes unexpected ways.

This article delves into the intricate web of connections between U.S. interest rate hikes and the global economic landscape. We’ll explore the mechanisms behind these impacts, analyze the latest trends, and consider the potential implications for different regions and sectors.

Understanding the Mechanism: How Interest Rate Hikes Work

Before diving into the global impact, it’s crucial to grasp the basics of how U.S. interest rate hikes function. When the Federal Reserve raises interest rates, it becomes more expensive for businesses and individuals to borrow money. This can have several cascading effects:

- Slower Economic Growth: Higher borrowing costs can dampen investment and consumer spending, leading to a slowdown in economic growth.

- Stronger Dollar: A higher interest rate makes the U.S. dollar more attractive to foreign investors, leading to a stronger dollar. This can make U.S. exports more expensive and imports cheaper, impacting trade balances.

- Inflation Control: By making borrowing more expensive, the Fed aims to reduce spending and slow down inflation.

The Global Impact: A Multifaceted Picture

The impact of U.S. interest rate hikes on different parts of the world is complex and varies depending on factors like:

- Economic Vulnerability: Countries with high levels of debt or dependence on U.S. capital flows are more susceptible to negative impacts.

- Currency Strength: A strong dollar can hurt countries whose currencies are pegged to the dollar or whose exports are priced in dollars.

- Trade Relationships: Countries with significant trade ties to the U.S. are likely to experience more direct effects.

Let’s examine some key areas of impact:

1. Emerging Markets:

Emerging markets are particularly vulnerable to U.S. interest rate hikes due to their dependence on foreign capital. Here’s why:

- Capital Flight: As U.S. interest rates rise, investors tend to move their money back to the U.S. seeking higher returns, leading to capital flight from emerging markets.

- Currency Depreciation: Capital flight can weaken emerging market currencies, making imports more expensive and fueling inflation.

- Debt Servicing: Higher interest rates can make it more difficult for emerging markets to service their dollar-denominated debts.

2. Developed Economies:

While developed economies are generally more resilient, they too are affected by U.S. interest rate hikes:

- Economic Slowdown: Higher borrowing costs can lead to slower economic growth in developed economies, particularly those heavily reliant on investment and consumer spending.

- Currency Fluctuations: Developed economies with currencies pegged to the dollar or with strong trade ties to the U.S. can experience currency fluctuations.

- Inflationary Pressures: A stronger dollar can make imports cheaper, potentially contributing to inflationary pressures.

3. Commodity Markets:

U.S. interest rate hikes can impact commodity markets in several ways:

- Demand Reduction: A slowdown in global economic growth due to higher U.S. interest rates can reduce demand for commodities, leading to price declines.

- Currency Fluctuations: A stronger dollar can make commodities priced in dollars less attractive to foreign buyers, further contributing to price declines.

- Investment Shifts: Investors may shift their capital away from commodities and towards U.S. assets as interest rates rise, impacting market prices.

4. Financial Markets:

U.S. interest rate hikes can lead to volatility in global financial markets:

- Bond Markets: Higher interest rates generally lead to lower bond prices, as investors seek higher returns.

- Equity Markets: Stock markets can experience volatility as investors adjust their portfolios in response to changing interest rate expectations.

- Currency Markets: Currency markets can experience fluctuations as investors seek to capitalize on interest rate differentials.

5. Trade and Investment:

U.S. interest rate hikes can impact global trade and investment flows:

- Export Competitiveness: A stronger dollar can make U.S. exports less competitive in global markets, potentially impacting trade balances.

- Foreign Investment: Higher U.S. interest rates can attract foreign investment, potentially diverting capital from other countries.

- Global Trade Flows: Changes in interest rate differentials can influence global trade flows as businesses adjust their sourcing and investment strategies.

Navigating the Landscape: Strategies for Businesses and Governments

The global economic impact of U.S. interest rate hikes presents challenges and opportunities for businesses and governments alike. Here are some strategies for navigating this complex landscape:

For Businesses:

- Currency Hedging: Businesses can use currency hedging strategies to mitigate the risks associated with currency fluctuations.

- Diversification: Businesses can diversify their operations and supply chains to reduce dependence on any single market.

- Cost Management: Businesses need to carefully manage their costs and expenses to remain competitive in a potentially slower economic environment.

- Strategic Planning: Businesses should have a robust strategic plan that takes into account the potential impacts of U.S. interest rate hikes.

For Governments:

- Fiscal Policy: Governments can use fiscal policy tools like tax cuts and spending programs to stimulate economic growth and offset the negative impacts of higher interest rates.

- Monetary Policy: Central banks can adjust their monetary policy to manage inflation and currency fluctuations.

- Debt Management: Governments need to manage their debt levels carefully to avoid becoming vulnerable to rising interest rates.

- Trade and Investment: Governments can promote trade and investment to support economic growth and mitigate the negative impacts of U.S. interest rate hikes.

The Future Outlook: Uncertainties and Potential Shifts

The future impact of U.S. interest rate hikes remains uncertain. The path of inflation, global economic growth, and geopolitical tensions will all play a role in shaping the landscape.

- Inflation: If inflation remains high, the Fed may need to continue raising interest rates, potentially leading to a more pronounced slowdown in global economic growth.

- Global Economic Growth: The trajectory of global economic growth will depend on factors like consumer spending, business investment, and government policies.

- Geopolitical Tensions: Geopolitical tensions can add further uncertainty to the global economic outlook, potentially impacting trade, investment, and financial markets.

Expert Insights: Perspectives on the Global Impact

[Insert Expert Quote 1]

[Insert Expert Quote 2]

[Insert Expert Quote 3]

Conclusion: A Balancing Act

The global economic impact of U.S. interest rate hikes is a complex and evolving issue. While these hikes aim to control inflation in the U.S., they can have significant spillover effects on other economies. Businesses and governments need to carefully navigate this evolving landscape, employing strategies to mitigate risks and capitalize on opportunities.

The future outlook is uncertain, but understanding the mechanisms and trends will be crucial for navigating the global economic landscape in the years to come.

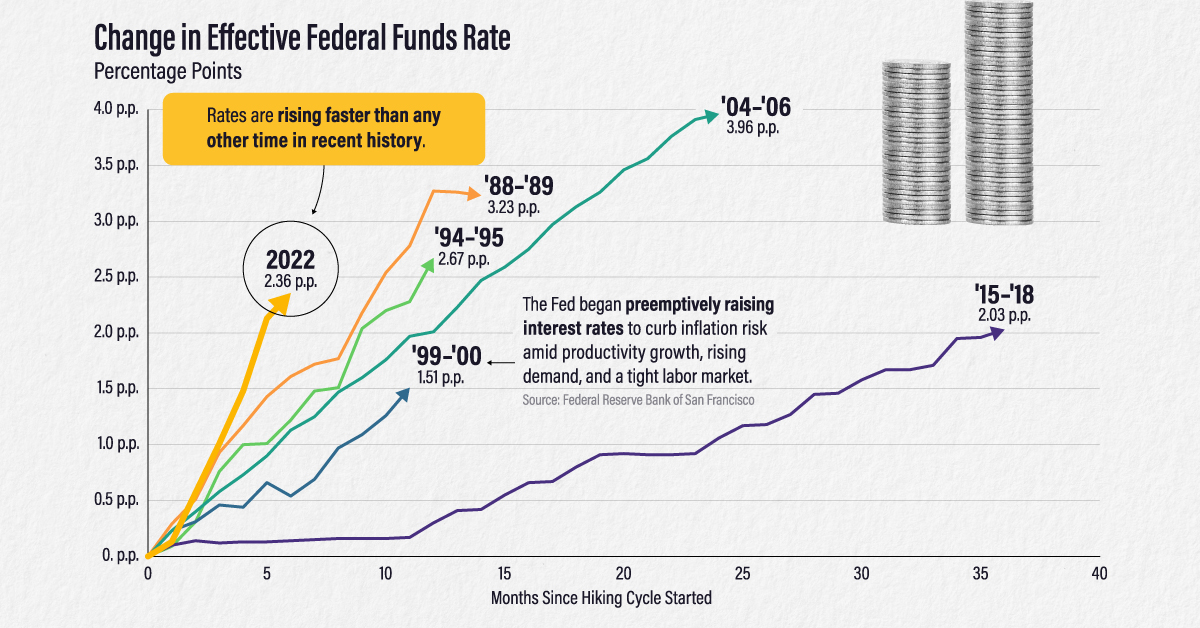

[Insert Visuals: Charts, Graphs, or Infographics illustrating key points and trends]

[Insert Source URLs for Expert Quotes and Data]

Frequently Asked Questions (FAQ)

Q: Why are U.S. interest rates rising?

A: The Federal Reserve is raising interest rates to combat inflation. By making borrowing more expensive, the Fed aims to reduce spending and slow down the rate at which prices are rising.

Q: What are the main risks of rising U.S. interest rates?

A: The main risks include slower economic growth, currency depreciation for emerging markets, higher debt servicing costs, and volatility in financial markets.

Q: How can businesses mitigate the risks of rising U.S. interest rates?

A: Businesses can use currency hedging strategies, diversify their operations, manage costs carefully, and develop robust strategic plans that account for potential economic slowdowns.

Q: What can governments do to address the impact of rising U.S. interest rates?

A: Governments can use fiscal and monetary policy tools, manage debt levels, and promote trade and investment to support economic growth and mitigate the negative impacts.

Q: What are the potential long-term implications of rising U.S. interest rates?

A: The long-term implications are uncertain, but they could include changes in global trade flows, shifts in investment patterns, and adjustments in currency valuations.

Q: How can individuals prepare for the impact of rising U.S. interest rates?

A: Individuals can review their financial plans, manage debt levels, consider alternative investment options, and stay informed about economic developments.

Note: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial professional for personalized guidance.

Conclusion

Keep following us for more in-depth guides, expert tips, and the latest updates to keep you ahead in understanding the world of economics. Until next time, stay curious and engaged, and we’ll see you in our next deep dive!