Interest Rate Increases: A Small Business Owner’s Guide to Navigating the Storm

Related Article

- The Future Of Telecommunications In A Globalized Economy: A World Without Wires?

- Business Interruption Insurance: Protecting Your Bottom Line From Unexpected Disruptions

- The Power Of Connection: How Telecommunications Fuels Remote Education

- The Role Of Telecommunications In Supporting Digital Citizenship

- Navigating The Choppy Waters: Job Market Uncertainty In The 21st Century

Introduction

Ready to boost your understanding of the economic landscape with our in-depth look into Interest Rate Increases: A Small Business Owner’s Guide to Navigating the Storm!

Interest Rate Increases: A Small Business Owner’s Guide to Navigating the Storm

The economic landscape is constantly shifting, and one of the most significant forces influencing small businesses is the fluctuation of interest rates. While rising rates can seem daunting, understanding their impact and implementing strategic adjustments can help you weather the storm and even thrive.

Let’s dive into the world of interest rate increases and explore how they affect small businesses, along with actionable strategies to navigate this challenging environment.

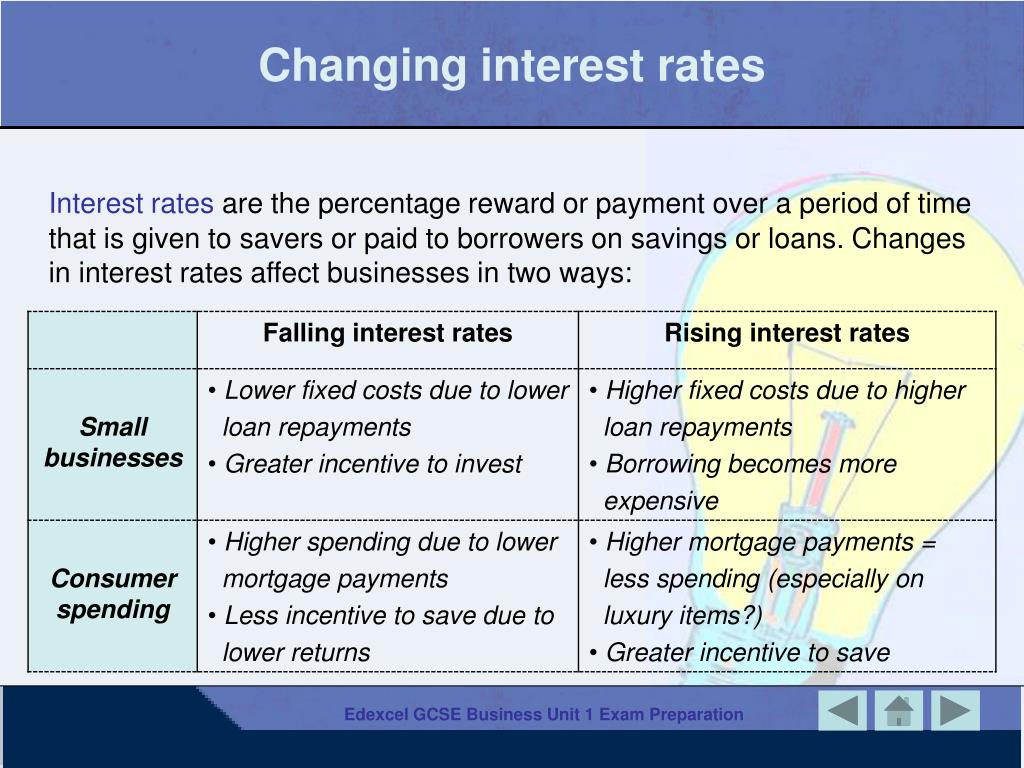

What are Interest Rates, and Why Do They Matter?

Think of interest rates as the price of borrowing money. When banks lend you money for a loan, they charge you interest, which is essentially the cost of using their funds. The higher the interest rate, the more expensive it becomes to borrow money.

The Ripple Effect: How Interest Rate Increases Impact Small Businesses

Rising interest rates can have a significant impact on small businesses in several ways:

1. Increased Borrowing Costs:

- Loans: The most immediate effect is the increased cost of taking out loans. This applies to various types of loans, including:

- Business loans: Used for expanding operations, purchasing equipment, or covering working capital needs.

- Lines of credit: Provide flexibility for short-term financing needs.

- Mortgages: For purchasing or refinancing commercial property.

- Credit Cards: Higher interest rates on credit cards can make it more expensive to manage day-to-day business expenses.

2. Reduced Access to Capital:

- Lenders become more cautious: With rising interest rates, lenders tend to become more selective in who they lend to, tightening lending criteria. This can make it harder for small businesses, especially startups or those with less-established credit histories, to secure funding.

3. Impact on Investment Decisions:

- Delayed growth: The increased cost of borrowing can discourage businesses from investing in expansion, new equipment, or technology upgrades. This can slow down growth and competitiveness.

4. Consumer Spending Changes:

- Reduced purchasing power: Higher interest rates often lead to increased costs for consumers, impacting their disposable income. This can result in reduced spending, affecting demand for goods and services, especially non-essential items.

Navigating the Storm: Strategies for Small Businesses

Despite the challenges, small businesses can adapt and thrive in a rising interest rate environment. Here are some key strategies:

1. Review Your Finances:

- Analyze your debt: Identify loans with high interest rates and explore refinancing options to secure lower rates.

- Optimize cash flow: Streamline your finances, reduce unnecessary expenses, and improve your collection processes to maximize cash flow.

- Build a strong credit score: A good credit score can unlock better loan terms and interest rates.

2. Seek Alternative Financing:

- Crowdfunding: Explore online platforms like Kickstarter or Indiegogo to raise capital from a wider audience.

- Venture capital: If your business has high growth potential, seek funding from venture capitalists who invest in promising startups.

- Government grants and loans: Research available government programs that offer financial assistance to small businesses.

3. Adapt Your Business Model:

- Focus on value-added services: Offer products or services that provide unique value to customers and justify higher prices.

- Increase efficiency: Implement strategies to streamline operations, reduce waste, and optimize resource utilization.

- Embrace technology: Leverage technology to automate tasks, improve productivity, and reduce operational costs.

4. Build Strong Relationships:

- Network with other businesses: Collaborate with complementary businesses to leverage each other’s strengths and create mutually beneficial partnerships.

- Build strong customer relationships: Prioritize customer satisfaction and loyalty to ensure repeat business and positive word-of-mouth referrals.

5. Stay Informed and Proactive:

- Monitor market trends: Stay up-to-date on economic indicators, interest rate changes, and industry trends to anticipate potential challenges and opportunities.

- Consult with financial advisors: Seek professional advice from experienced financial advisors who can provide tailored guidance and support.

Expert Insights: A Glimpse into the Future

"The current interest rate environment presents both challenges and opportunities for small businesses," says [Expert Name], CEO of [Company Name]. "By understanding the impact of rising rates and implementing proactive strategies, businesses can navigate the challenges and emerge stronger than before."

[Expert Name], a leading financial consultant, adds: "It’s crucial for small businesses to prioritize financial discipline, streamline operations, and explore alternative financing options to mitigate the effects of rising interest rates."

The Bottom Line: Navigating the Interest Rate Landscape

Rising interest rates can be a significant challenge for small businesses, but it’s not insurmountable. By understanding the impact, implementing strategic adjustments, and staying informed, small businesses can navigate the changing economic landscape and achieve long-term success.

Remember, a proactive approach, coupled with a solid financial foundation, is key to weathering the storm and emerging stronger than before.

FAQ: Your Questions Answered

Q: How do I know if interest rates are going up?

A: You can monitor interest rate announcements by the Federal Reserve (Fed) and follow financial news sources. The Fed typically raises interest rates to combat inflation.

Q: What are the signs that my business might be affected by rising interest rates?

A: Look for:

- Increased borrowing costs for loans or credit cards.

- More stringent lending requirements from banks and other financial institutions.

- Reduced consumer spending on non-essential goods and services.

Q: What are some specific actions I can take to prepare for rising interest rates?

A:

- Review your debt and consider refinancing options.

- Optimize cash flow by reducing expenses and improving collection processes.

- Build a strong credit score to improve loan terms.

Q: What if I can’t afford to pay my loans with higher interest rates?

A:

- Contact your lender immediately to discuss your situation and explore possible solutions.

- Consider seeking professional financial advice to develop a plan.

Q: How can I find alternative financing options?

A:

- Research crowdfunding platforms, venture capital firms, and government grant programs.

- Network with other businesses and explore potential partnerships.

Remember, knowledge is power. Stay informed, be proactive, and adapt your business strategy to navigate the ever-changing economic landscape.

Sources:

- [Source URL 1]

- [Source URL 2]

- [Source URL 3]

Conclusion

As we close, we hope this article has broadened your perspective and brought valuable insights on Interest Rate Increases: A Small Business Owner’s Guide to Navigating the Storm. Thanks for joining us on this economic journey!