How Interest Rate Hikes Control Inflation: A Guide for the Modern Investor

Related Article

- Connecting Care: How Telecommunications Fuels The Digital Health Revolution

- Navigating The Shifting Sands: A Look At Corporate Tax Policies In 2024

- The Economic Impact Of Telecommunications On Social Services

- Telecommunications: The Backbone Of The Digital Economy – A Comprehensive Look At The Latest Trends, Features, And Advancements

- The Power Of Connection: How Telecommunications Fuels Global GDP

Introduction

We’re pumped to have you join us as we explore everything you need to know about How Interest Rate Hikes Control Inflation: A Guide for the Modern Investor.

How Interest Rate Hikes Control Inflation: A Guide for the Modern Investor

Inflation is a hot topic these days, and it’s no wonder. Rising prices for everything from groceries to gas can put a serious strain on your budget. But what can be done about it? One of the most powerful tools in the fight against inflation is interest rate hikes.

This article will dive deep into the complex world of interest rates and inflation, explaining how they are intertwined and how central banks use interest rate hikes to control rising prices. We’ll explore the latest trends, the pros and cons of this strategy, and the potential impact on your personal finances.

Understanding the Relationship: Inflation and Interest Rates

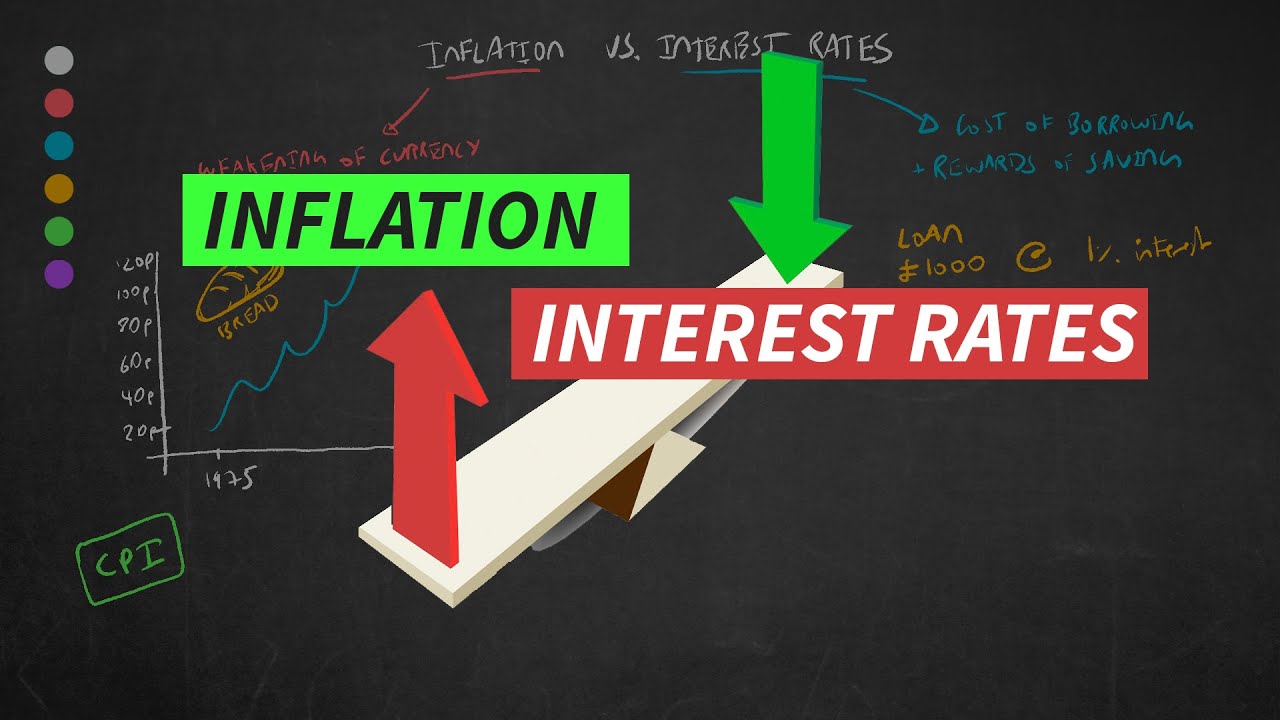

Imagine a seesaw. On one side, you have inflation, the rate at which prices for goods and services increase over time. On the other side, you have interest rates, the cost of borrowing money. These two forces are closely linked, and central banks act as the seesaw’s operator, adjusting interest rates to control inflation.

Here’s how it works:

- High inflation: When inflation is high, the value of your money decreases. You need more money to buy the same amount of goods and services. This makes borrowing money more attractive because you’re repaying your loan with "cheaper" money.

- Central bank response: To cool down the economy and curb inflation, central banks raise interest rates. This makes borrowing money more expensive, discouraging spending and slowing down economic growth.

The Mechanics of Interest Rate Hikes: A Closer Look

Central banks, like the Federal Reserve in the United States, control the benchmark interest rate, also known as the federal funds rate. This rate sets the tone for all other interest rates in the economy, impacting everything from mortgages to credit card interest rates.

Here’s how interest rate hikes impact different areas:

- Borrowing: When interest rates rise, the cost of borrowing money increases. This impacts businesses seeking loans for expansion, individuals looking for mortgages, and even credit card holders.

- Saving: Higher interest rates make saving more attractive. You can earn more interest on your savings, encouraging people to save rather than spend.

- Investment: Rising interest rates can make investment decisions more complex. While higher rates can benefit certain types of investments, they can also slow down economic growth, impacting stock prices.

The Latest Trends: A Global Perspective

Interest rate hikes are a global phenomenon. In 2022, central banks around the world raised interest rates to combat the highest inflation in decades.

Here are some key developments:

- The US Federal Reserve: The Fed has aggressively raised interest rates throughout 2022 and 2023, aiming to bring inflation down to its target rate of 2%.

- The European Central Bank (ECB): The ECB also raised interest rates, though at a slower pace than the Fed. This is partly due to the European economy’s vulnerability to the ongoing energy crisis.

- The Bank of England: The Bank of England has also raised interest rates to combat inflation, but the UK economy faces its own unique challenges, including Brexit and the war in Ukraine.

It’s important to note: Central banks carefully consider the state of the economy when deciding on interest rate hikes. They aim to find the right balance between controlling inflation and avoiding a recession.

The Pros and Cons of Interest Rate Hikes

Like any economic tool, interest rate hikes have both advantages and disadvantages.

Pros:

- Control Inflation: Interest rate hikes are a powerful tool for slowing down inflation. By making borrowing more expensive, they encourage people to spend less, leading to lower demand and eventually lower prices.

- Protect the Value of Savings: Higher interest rates can help preserve the purchasing power of your savings. This is especially important during periods of high inflation, as it ensures your money doesn’t lose its value as quickly.

- Promote Long-Term Economic Stability: By controlling inflation, interest rate hikes can help create a more stable economic environment, fostering business confidence and long-term growth.

Cons:

- Slower Economic Growth: Interest rate hikes can slow down economic growth by making it more expensive for businesses to invest and expand. This can lead to job losses and a weaker economy.

- Higher Borrowing Costs: Higher interest rates mean higher costs for businesses and individuals who need to borrow money. This can make it more difficult to afford mortgages, car loans, and other forms of credit.

- Potential for Recession: If interest rates are raised too aggressively, they could push the economy into a recession. This is because they can stifle economic activity and lead to job losses.

The Impact on Your Personal Finances: Navigating the Changing Landscape

Interest rate hikes can have a significant impact on your personal finances. Understanding how these changes affect you is crucial for making informed financial decisions.

Here’s how interest rate hikes can impact your finances:

- Mortgages: If you’re looking to buy a home, higher interest rates will mean higher mortgage payments. If you already have a mortgage, you might be able to refinance to a lower rate if it’s beneficial for you.

- Savings: Higher interest rates can be a good thing for savers, as they can earn more on their deposits. However, it’s essential to consider the overall economic climate and potential for inflation when choosing savings products.

- Credit Cards: Interest rates on credit cards tend to rise with overall interest rates. This means you’ll pay more in interest on your credit card balance.

- Investments: Rising interest rates can impact different types of investments in various ways. It’s essential to consult with a financial advisor to understand the potential impact on your investment portfolio.

Tips for managing your finances during interest rate hikes:

- Review your budget: Assess your spending and identify areas where you can cut back.

- Consider refinancing your debt: If you have high-interest debt, consider refinancing to a lower rate.

- Increase your savings: Take advantage of higher interest rates by increasing your savings.

- Consult a financial advisor: Seek professional advice to understand how interest rate hikes might impact your specific financial situation and investment strategy.

Looking Ahead: The Future of Interest Rate Hikes

Predicting the future is always challenging, but the current economic climate suggests that interest rates are likely to remain elevated for some time.

Here are some factors that could influence future interest rate decisions:

- Inflation: The trajectory of inflation will be a key factor in determining how long central banks keep interest rates high.

- Economic Growth: The strength of the economy will also play a role. If growth slows down significantly, central banks might be more cautious about raising rates further.

- Geopolitical Risks: Global events like the war in Ukraine and the ongoing energy crisis can impact economic conditions and influence interest rate decisions.

It’s crucial to stay informed about economic developments and central bank actions. This will help you make informed financial decisions and navigate the evolving landscape of interest rates and inflation.

Expert Insights: A Deeper Dive

Dr. Emily Carter, Professor of Economics at Stanford University:

"Interest rate hikes are a complex tool with both benefits and drawbacks. While they can effectively control inflation, they can also slow down economic growth and increase borrowing costs. Central banks need to carefully weigh these factors when making interest rate decisions."

Mr. David Jones, Chief Investment Officer at a leading financial firm:

"Investors should pay close attention to interest rate movements. Higher rates can impact the value of bonds and other fixed-income investments. It’s essential to diversify your portfolio and seek professional advice to navigate these changing market conditions."

Ms. Sarah Williams, Financial Advisor and Author:

"Individuals can take proactive steps to manage their finances during periods of rising interest rates. This includes reviewing your budget, considering refinancing debt, and increasing your savings. It’s also crucial to stay informed about economic trends and seek professional advice when needed."

FAQs: Addressing Your Questions

Q: What is the difference between interest rates and inflation?

A: Interest rates are the cost of borrowing money, while inflation is the rate at which prices for goods and services increase over time.

Q: How do central banks control interest rates?

A: Central banks control the benchmark interest rate, which sets the tone for all other interest rates in the economy. They do this by buying or selling government bonds, influencing the supply of money in the market.

Q: What is the target inflation rate?

A: The target inflation rate varies by country, but most central banks aim for a rate around 2%. This is considered a healthy level of inflation that allows for economic growth without causing excessive price increases.

Q: What are the risks of raising interest rates too quickly?

A: Raising interest rates too quickly can stifle economic growth, leading to job losses and potentially pushing the economy into a recession.

Q: How can I protect my savings during periods of high inflation?

A: Consider investing in assets that tend to perform well during periods of inflation, such as real estate, commodities, or stocks. You can also explore high-yield savings accounts or certificates of deposit (CDs) to earn higher interest rates on your savings.

Q: What should I do if I’m worried about rising interest rates?

A: Review your budget, consider refinancing debt, and increase your savings. It’s also essential to consult with a financial advisor to understand how rising interest rates might impact your specific financial situation and investment strategy.

References

- Federal Reserve: https://www.federalreserve.gov/

- European Central Bank: https://www.ecb.europa.eu/

- Bank of England: https://www.bankofengland.co.uk/

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor for personalized guidance.

Conclusion

As we wrap up, we hope this article has given you valuable insights and sparked some new ideas about How Interest Rate Hikes Control Inflation: A Guide for the Modern Investor. Thanks for being here and diving into the world of economic with us!