High Interest Rates: Friend or Foe to the Economy?

Related Article

- Riding The Rollercoaster: Understanding The Impact Of Rising Interest Rates

- Bridging The Digital Divide: How Telecommunications Are Transforming Education Access In The US

- Navigating The Storm: Understanding Recession Risks In The Insurance Industry

- Reaching New Heights: The Economic Benefits Of Satellite Telecommunications

- The Global Workforce Transformed: How Telecommunications Is Reshaping Labor Markets

Introduction

Ready to boost your understanding of the economic landscape with our in-depth look into High Interest Rates: Friend or Foe to the Economy?!

High Interest Rates: Friend or Foe to the Economy?

Interest rates are the lifeblood of any economy, influencing everything from borrowing costs to investment decisions. But when interest rates climb, the economic landscape can shift dramatically. Are high interest rates a blessing or a curse? The answer, as with most things in economics, is complex and depends on the specific context.

Understanding the Basics: Interest Rates and Their Impact

Before we dive into the debate, let’s define our terms. Interest rates are the cost of borrowing money. When you take out a loan, you pay interest to the lender for the privilege of using their money. The higher the interest rate, the more expensive it becomes to borrow.

The Dual Nature of High Interest Rates:

High interest rates can be both a boon and a bane to the economy. Here’s a breakdown of the key arguments:

The Case for High Interest Rates:

- Curbing Inflation: High interest rates are a powerful tool for combating inflation. When borrowing becomes more expensive, consumers and businesses tend to spend less, reducing demand for goods and services. This can help slow down price increases.

- Attracting Foreign Investment: Higher interest rates can make a country’s currency more attractive to foreign investors. This influx of capital can strengthen the exchange rate and boost economic growth.

- Encouraging Savings: When interest rates rise, people are incentivized to save more, as their savings earn higher returns. This can lead to a more stable financial system.

- Promoting Financial Stability: High interest rates can help to prevent excessive borrowing and lending, which can contribute to financial bubbles and crashes.

The Case Against High Interest Rates:

- Stifling Economic Growth: High interest rates can make it more expensive for businesses to borrow money for investment and expansion. This can lead to slower economic growth and job losses.

- Increased Debt Burden: High interest rates make it more difficult for individuals and businesses to repay existing debts, leading to financial distress and potentially even bankruptcies.

- Housing Market Slowdown: Rising interest rates can significantly impact the housing market, making mortgages more expensive and reducing affordability. This can lead to a decrease in home sales and construction activity.

- Risk of Recession: In extreme cases, excessively high interest rates can push the economy into a recession by dampening consumer spending and business investment.

Navigating the Complexities: Current Trends and Insights

The debate over high interest rates is particularly relevant in the current economic climate. Global inflation remains elevated, prompting central banks worldwide to raise interest rates aggressively.

The Global Context:

- The Federal Reserve: The US Federal Reserve has been raising interest rates since March 2022, with the target federal funds rate now in the range of 5.25% to 5.5%. The Fed’s goal is to bring inflation back down to its 2% target.

- The European Central Bank: The European Central Bank (ECB) has also been raising interest rates to combat inflation, but at a slower pace than the Fed.

- Emerging Markets: Many emerging market economies face the challenge of managing inflation while also dealing with the potential negative effects of higher interest rates on their economies.

Expert Insights:

- "High interest rates are a double-edged sword. They can help tame inflation, but they can also slow economic growth. The key is to find the right balance." – Janet Yellen, former Chair of the Federal Reserve

- "We need to be cautious about raising interest rates too quickly, as this could lead to a recession." – Larry Summers, former US Treasury Secretary

- "The impact of high interest rates on the economy is highly dependent on the specific circumstances and the overall health of the economy." – Nouriel Roubini, Professor of Economics at New York University

The Future of Interest Rates:

Predicting the future of interest rates is a challenging task. The path forward will depend on a multitude of factors, including:

- Inflation Trajectory: If inflation remains stubbornly high, central banks will likely continue to raise interest rates.

- Economic Growth: If economic growth weakens, central banks may become more cautious about raising interest rates.

- Geopolitical Events: Global events, such as the war in Ukraine and the ongoing tensions between the US and China, can also influence interest rate decisions.

Conclusion:

High interest rates are a powerful economic tool, but they are not a magic bullet. They can be used to combat inflation and promote financial stability, but they can also stifle economic growth and increase the burden of debt. The optimal level of interest rates depends on a complex interplay of factors, and policymakers must navigate these complexities carefully to achieve a balance between controlling inflation and supporting economic growth.

Visuals:

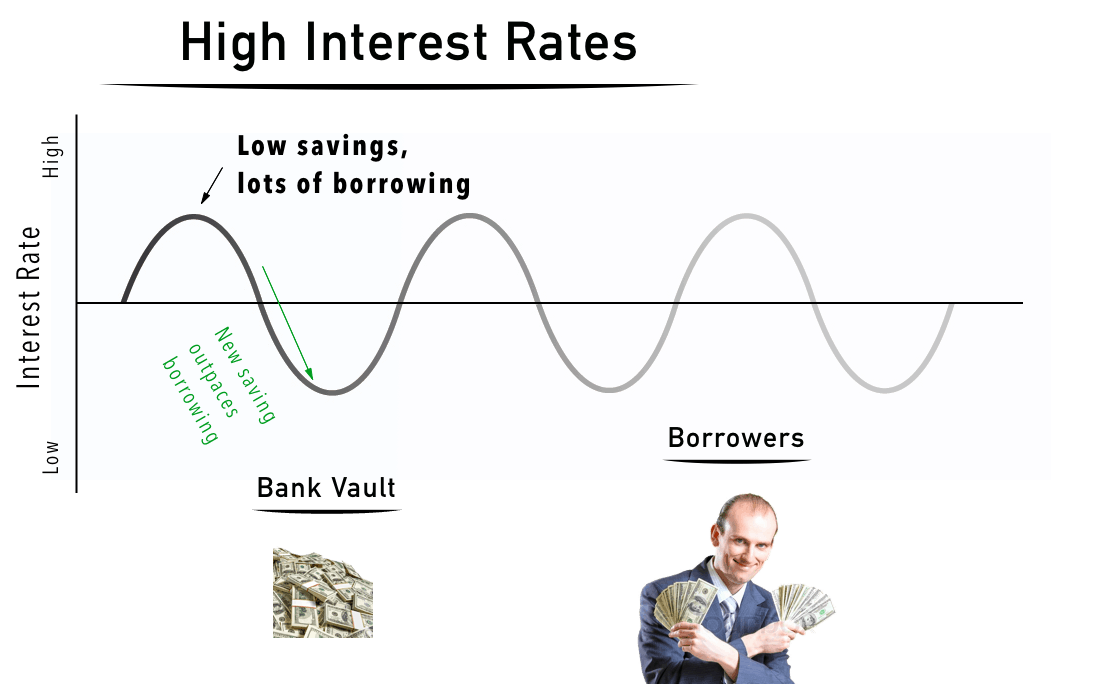

- Infographic: A visual representation of the key arguments for and against high interest rates.

- Graph: A time series graph showing the historical evolution of interest rates and inflation.

- Map: A map showing the current interest rate levels in major economies around the world.

FAQs:

- What are the different types of interest rates? There are various types of interest rates, including the federal funds rate, prime rate, and mortgage rates. Each rate plays a different role in the economy.

- How do interest rates affect the stock market? High interest rates can put downward pressure on stock prices, as they make it more expensive for companies to borrow money and grow their businesses.

- What are the potential consequences of keeping interest rates too low for too long? Keeping interest rates too low for too long can lead to asset bubbles and inflation.

- How do interest rates affect the value of the dollar? Higher interest rates can make the dollar more attractive to foreign investors, which can strengthen the exchange rate.

Sources:

- https://www.federalreserve.gov/

- https://www.ecb.europa.eu/

- https://www.investopedia.com/

- https://www.bloomberg.com/

Conclusion

As we close, we hope this article has broadened your perspective and brought valuable insights on High Interest Rates: Friend or Foe to the Economy?. Thanks for joining us on this economic journey!