Introduction to Senior Citizen Insurance in the USA (2025)

Best insurance plans for senior citizens in the USA 2025 specific needs – The US healthcare system plays a crucial role in the lives of senior citizens, offering a complex tapestry of options for managing healthcare costs and needs. Navigating these options can be daunting, especially as the senior population evolves and healthcare demands change. This article provides a comprehensive overview of the best insurance plans for senior citizens in the USA, focusing on 2025 specific needs.

Overview of the US Healthcare System’s Relevance to Senior Citizens

The US healthcare system’s role in supporting senior citizens is multifaceted. It encompasses a range of government-sponsored programs and private insurance options designed to cover healthcare expenses. Understanding the interplay of these elements is key to making informed choices about insurance plans.

Changing Demographics and Healthcare Needs in 2025

The senior population in 2025 is projected to be larger and more diverse than in previous decades. This demographic shift necessitates insurance plans that address a wider range of healthcare needs, including chronic disease management, preventative care, and long-term care options.

Common Challenges Faced by Seniors When Choosing Insurance Plans, Best insurance plans for senior citizens in the USA 2025 specific needs

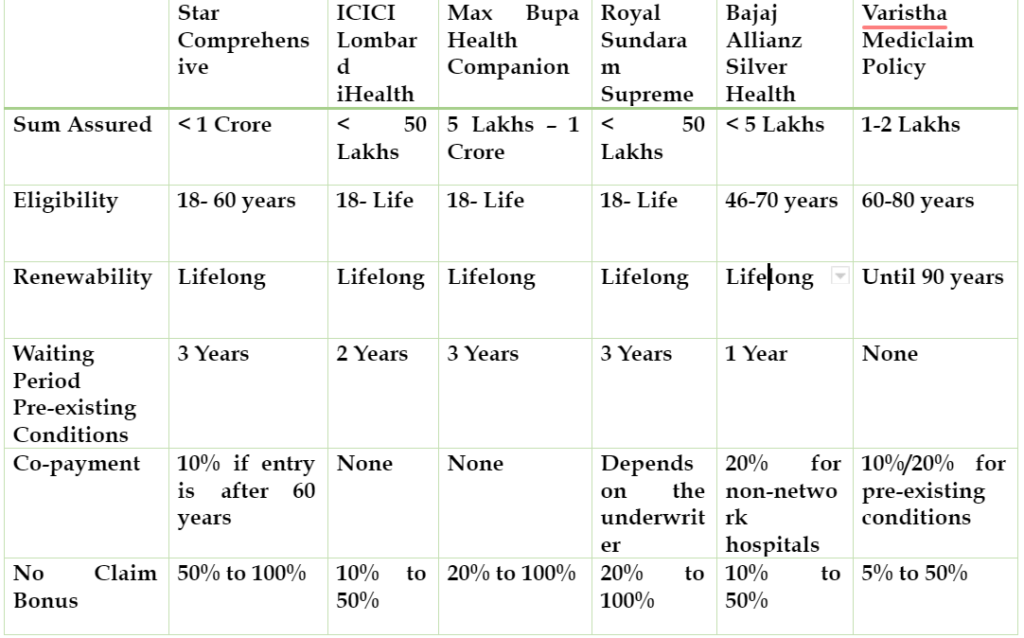

Source: silvertalkies.com

Seniors often face challenges when choosing insurance plans, including understanding complex coverage details, navigating high premiums, and ensuring adequate coverage for specific health conditions. Understanding these challenges is crucial for developing appropriate insurance solutions.

Brief History of Insurance Options for Senior Citizens in the USA

The landscape of senior insurance options in the USA has evolved significantly over time. Early options were often limited and expensive. More recently, government programs like Medicare and Medicaid have expanded coverage, while private insurance options have diversified to meet specific needs. This evolution has brought about greater access to care but also increased complexity in plan selection.

Key Considerations for Insurance Selection

- Specific health conditions and potential future needs (e.g., chronic conditions, potential need for long-term care).

- Financial capacity to afford premiums and out-of-pocket expenses.

- Desired level of coverage and benefits, including preventive care, prescription drugs, and hospital stays.

- Geographic location, as plan availability and costs can vary regionally.

- Reputation and financial stability of the insurance provider.

Types of Senior Insurance Plans: Best Insurance Plans For Senior Citizens In The USA 2025 Specific Needs

Several types of health insurance plans are available for senior citizens in the USA. Understanding these plans, their coverage, costs, and eligibility criteria is essential for informed decision-making.

Detailing Different Plan Types

The key types of plans include Medicare, Medicare Advantage, Medigap, and private plans. Each plan type has unique characteristics that impact its suitability for individual circumstances.

Coverage and Benefits of Each Plan Type

Medicare provides a federal program with multiple parts offering varying levels of coverage. Medicare Advantage plans are private plans that supplement Medicare. Medigap plans fill gaps in Medicare coverage. Private plans provide comprehensive coverage tailored to individual needs but may come with higher premiums.

Costs and Premiums Associated with Each Type

Premiums for Medicare, Medicare Advantage, and Medigap plans vary based on factors such as location and plan specifics. Private plans often have higher premiums but offer greater flexibility in coverage choices. Out-of-pocket costs can also vary substantially across different plans.

Eligibility Criteria for Each Plan Type

Source: medium.com

Eligibility for Medicare is generally based on age and work history. Medicare Advantage plans and Medigap plans build upon Medicare coverage and often have their own specific eligibility criteria. Private plans may have different requirements depending on the specific provider.

Key Differences Between Plan Types

Source: medium.com

| Plan Type | Coverage | Cost | Eligibility |

|---|---|---|---|

| Medicare | Basic coverage for hospital care, doctor visits, and preventive services. | Premiums vary based on location and plan specifics. | Age 65 and older, or with certain disabilities. |

| Medicare Advantage | Expanded coverage beyond basic Medicare benefits, often with extra benefits like vision, dental, and hearing care. | Premiums often lower than Medigap, but may have higher out-of-pocket costs. | Eligible for Medicare Part A and B. |

| Medigap | Fills gaps in Medicare coverage, covering some out-of-pocket expenses. | Premiums vary significantly based on the specific Medigap plan chosen. | Eligible for Medicare Part A and B. |

| Private Plans | Comprehensive coverage options tailored to individual needs. | Generally higher premiums than other plans. | Can be purchased regardless of age, though often a good option for those who don’t qualify for Medicare. |

Q&A

What are the most common health issues prevalent among senior citizens in 2025?

Common health concerns for seniors include chronic conditions like heart disease, diabetes, and arthritis, along with vision and hearing loss, and cognitive decline. Preventive care and managing these conditions are key to ensuring healthy aging.

How important is long-term care insurance for senior citizens?

Long-term care insurance can be crucial for covering potential future needs, like assisted living or nursing home care. The costs of such care can be substantial, making long-term care insurance a valuable consideration.

What role does telehealth play in senior insurance in 2025?

Telehealth is expected to become increasingly important, providing convenient and accessible healthcare services for senior citizens, potentially reducing costs and improving overall access to care.

What are some tips for researching insurance plans effectively?

Compare plans based on coverage, costs, and eligibility criteria. Understand policy details, exclusions, and the claims process. Contact insurance providers and agents for clarification and personalized advice.