Affordable Homeowners Insurance Quotes 2025 Nationwide

Source: lemonade.com

Affordable homeowners insurance quotes 2025 nationwide for various coverage levels – Navigating the homeowners insurance market in 2025 requires a strategic approach. Understanding the current landscape, factors influencing costs, and potential trends is crucial for securing affordable coverage. This comprehensive guide will provide insights into nationwide quotes, coverage levels, and factors impacting premiums, ultimately empowering you to make informed decisions.

Introduction to Affordable Homeowners Insurance Quotes 2025

The homeowners insurance market in 2025 is characterized by a complex interplay of factors. Rising inflation, evolving risk assessments, and technological advancements all contribute to the dynamic nature of premiums. Predicting precise figures is challenging, but analyzing trends allows for informed decision-making. Understanding the various factors influencing costs and comparing quotes for different coverage levels is vital for finding affordable options.

Factors influencing the cost of homeowners insurance nationwide include:

- Location: Geographic risk factors, such as hurricane frequency in coastal regions or wildfire risk in specific areas, significantly impact premiums.

- Home characteristics: Features like age, construction materials, and security systems influence the perceived risk and consequently, the insurance cost.

- Claims history: Past claims filed on the property or by the homeowner can increase premiums, reflecting the risk assessment.

- Coverage levels: The chosen coverage level, ranging from basic to comprehensive, directly affects the cost of insurance.

Potential trends for homeowners insurance premiums in 2025 include:

- Inflationary pressures: Rising construction and repair costs will likely translate into higher premiums.

- Climate change impacts: Increased frequency of extreme weather events, like floods and wildfires, could lead to higher premiums in vulnerable regions.

- Technological advancements: Advanced risk assessment tools and technologies might lead to more precise premium calculations.

| Coverage Level | Description |

|---|---|

| Basic | Covers fundamental damages. |

| Comprehensive | Provides broader protection against a wider range of perils. |

Nationwide Comparison of Quotes

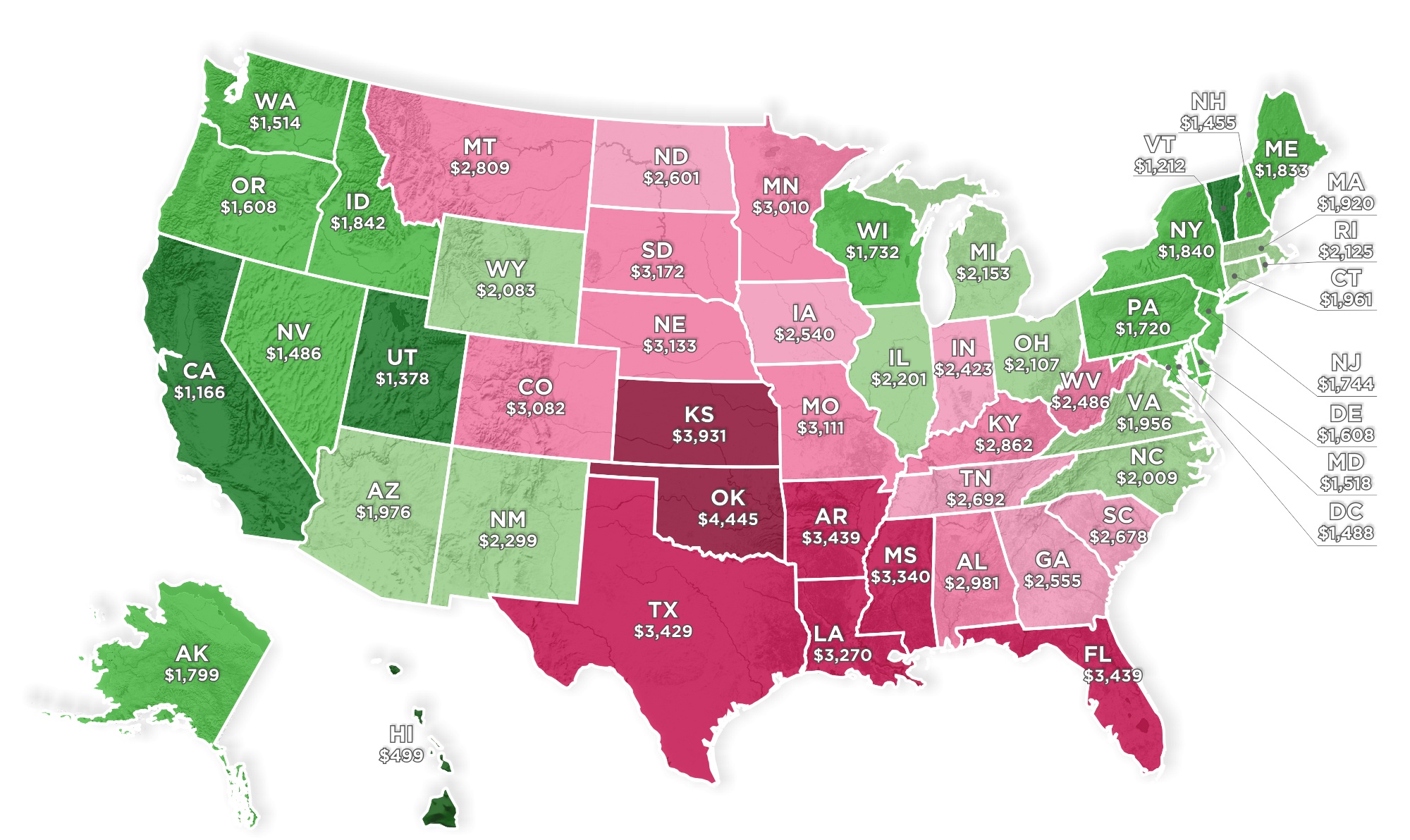

Average homeowners insurance costs nationwide in 2025 are anticipated to be in the range of $1,500 to $3,000 annually, varying significantly by region and coverage level. Finding reliable online resources is crucial. Websites like Insure.com and Policygenius offer extensive comparison tools.

Comparing costs across regions highlights disparities. The Northeast, known for severe winter storms, may have higher premiums compared to the South, which faces hurricane risks. The West, with wildfire hazards, could also see higher costs.

Coverage Levels and Their Impact on Quotes

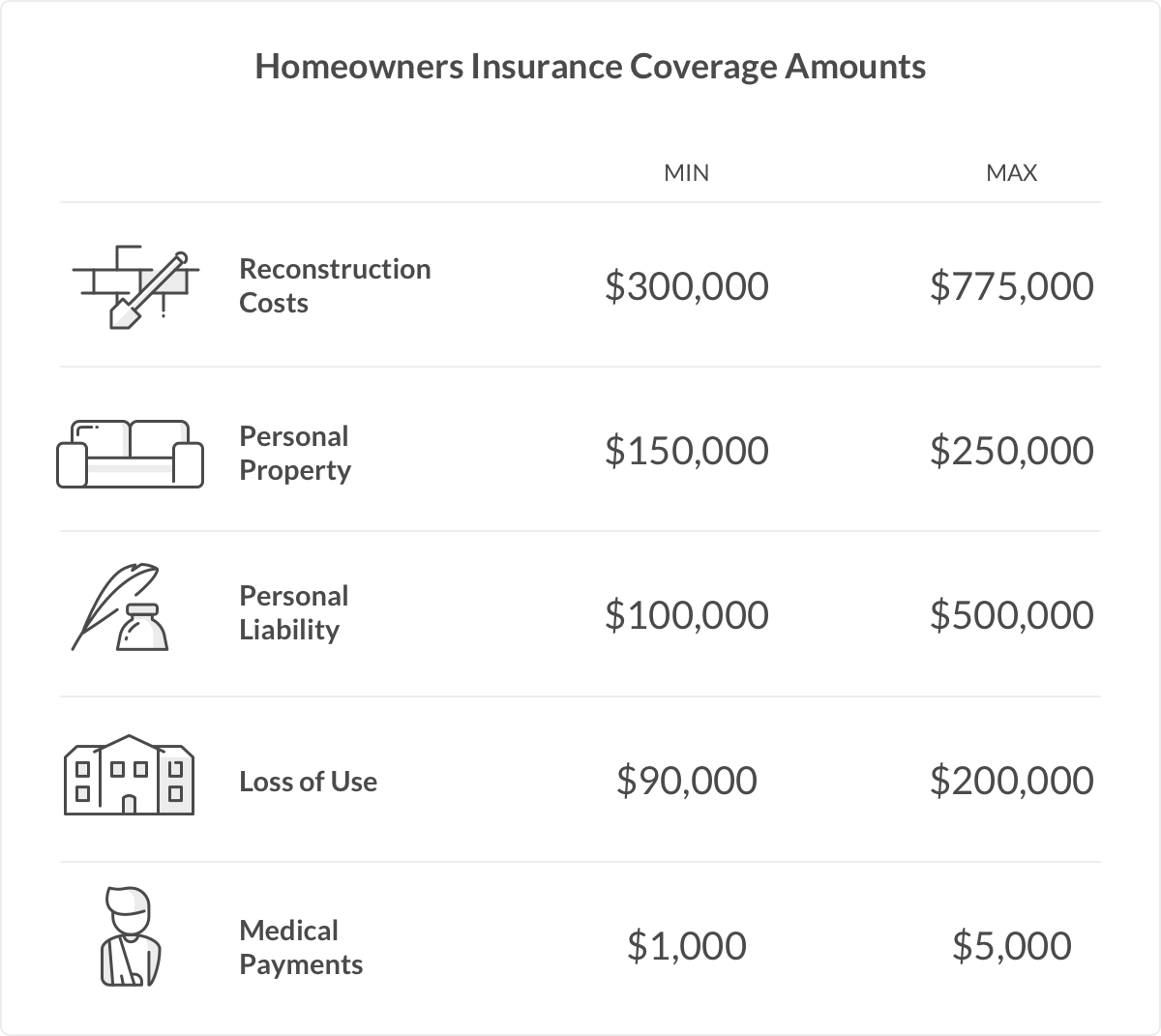

Understanding the differences between HO-3 and HO-5 policies is vital. HO-3, the most common policy, provides broad coverage, while HO-5 offers more extensive protection, including more comprehensive property and liability coverage. HO-3 usually covers basic perils, such as fire, while HO-5 extends this to cover more extensive damages.

| Coverage Level | Perils Covered | Estimated Cost Difference (California Example) |

|---|---|---|

| HO-3 | Fire, windstorm, hail, vandalism, etc. | $100-$200/year higher than HO-5 |

| HO-5 | More extensive coverage, including water damage and earthquake damage. | (Sample cost for HO-5 will be lower in the example) |

Factors Affecting Homeowners Insurance Costs

Home location significantly impacts premiums. Coastal areas with higher flood risk or regions prone to wildfires will see higher premiums. Home features, like fire sprinklers and security systems, can reduce risk and potentially lower premiums. Claims history, the value of the property, and the home’s age all contribute to the overall cost.

Tips for Finding Affordable Quotes, Affordable homeowners insurance quotes 2025 nationwide for various coverage levels

Source: ctfassets.net

Comparing multiple quotes from different providers is essential. Understanding policy exclusions and limitations is vital to avoid unexpected gaps in coverage. Compare deductibles and their impact on premiums. Negotiating with providers can sometimes lead to lower premiums. Obtain multiple quotes to ensure you get the best possible deal.

Future Trends in Homeowners Insurance

Future trends suggest increasing premiums due to climate change impacts and rising inflation. Legislative changes could impact policy specifics, and technology may play a more significant role in risk assessment.

Illustrative Example of a Homeowners Insurance Quote

A sample home in San Francisco, valued at $1.5 million, with HO-3 coverage, standard features, and no claims history, might see a premium of around $2,500 annually. This quote would detail the coverage, costs, and steps for obtaining a quote from a specific provider. (This example is hypothetical and should not be considered financial advice.)

General Inquiries: Affordable Homeowners Insurance Quotes 2025 Nationwide For Various Coverage Levels

Q: What are some common factors affecting homeowners insurance costs?

A: Home location, home features, claims history, risk assessment, property value, and the home’s age all significantly impact premiums. Even the security features installed can affect your rates.

Q: How do I compare quotes from different providers?

A: Use online comparison tools, contact insurers directly, and gather multiple quotes. Be sure to understand policy exclusions and limitations. Also, compare deductibles carefully. The lower the deductible, the higher the premium.

Q: What are the different types of homeowners insurance coverage?

A: HO-3 (basic), HO-5 (comprehensive) are common types. HO-3 covers most risks, while HO-5 offers broader coverage, including certain additional perils.

Q: What are the potential future trends in homeowners insurance rates?

A: Climate change, legislative changes, and technology advancements are key factors influencing future insurance rates. Expect premiums to adjust based on these emerging risks and changes in the insurance landscape.