Introduction to US Insurance Types in 2025: Comparing Different Insurance Types USA 2025 For Individuals And Families

Comparing different insurance types USA 2025 for individuals and families – Navigating the US insurance landscape in 2025 requires understanding the diverse range of options available for individuals and families. This involves not only the core types of coverage but also the nuances of coverage, benefits, and exclusions within each category. The regulatory environment plays a significant role, shaping consumer choices and influencing pricing structures. This overview will delve into the essential types of insurance, their key differences, and the regulatory backdrop.

Major Insurance Types

The primary types of insurance available in the USA in 2025 for individuals and families include health, life, auto, homeowners, and potentially emerging specialized coverage for specific needs like pet insurance. Each type serves a distinct purpose, offering varying degrees of financial protection against unforeseen circumstances.

| Insurance Type | Brief Description |

|---|---|

| Health Insurance | Provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. |

| Life Insurance | Offers financial protection to beneficiaries in the event of the policyholder’s death. |

| Auto Insurance | Covers damages or injuries arising from car accidents. |

| Homeowners Insurance | Protects against damage to a home and personal belongings, and provides liability coverage. |

| Other (Emerging Types) | These may include pet insurance, travel insurance, and more, tailored to specific lifestyle needs and potential risks. |

Regulatory Environment

The US insurance industry is regulated at both the federal and state levels. Federal regulations, like the Affordable Care Act (ACA), impact health insurance markets. State regulations often dictate specific requirements and standards for individual insurance types. These regulations aim to protect consumers, promote fair pricing, and ensure appropriate coverage. The specific details and impact of regulations will vary depending on the type of insurance and the state in question.

Comparing Health Insurance Options

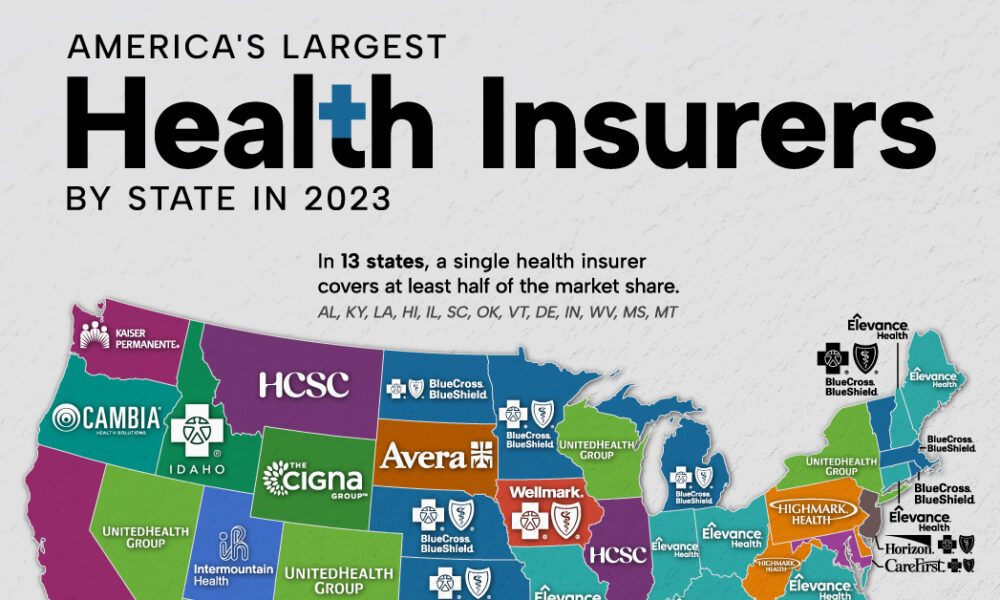

Source: visualcapitalist.com

Health insurance in 2025 presents a range of options, each with its own cost structure and coverage level. Understanding the differences between traditional, managed care, and high-deductible plans is crucial for making informed choices.

Plan Types and Cost Structures

Source: carneyteam.com

Traditional plans often provide broader coverage but may have higher premiums. Managed care plans, like HMOs and PPOs, typically have lower premiums but may require referrals for certain services. High-deductible plans have lower premiums but require substantial out-of-pocket expenses before coverage kicks in.

| Plan Type | Premium | Deductible | Coverage Examples |

|---|---|---|---|

| Traditional Plan | Potentially higher | Potentially lower | Broader network of providers, higher out-of-pocket costs until deductible met. |

| Managed Care (HMO/PPO) | Potentially lower | Potentially lower | Limited network of providers, potential need for referrals, lower out-of-pocket costs once in-network. |

| High-Deductible Plan | Lower | Higher | Significant out-of-pocket expenses before coverage, potential for lower premiums. |

Factors Influencing Premiums, Comparing different insurance types USA 2025 for individuals and families

Source: trucompare.in

Factors like age, health status, location, and family size can significantly impact health insurance premiums. The availability of pre-existing condition coverage and the changing healthcare landscape are also relevant.

Clarifying Questions

What are the most common types of insurance available in the USA in 2025?

The most common types include health, life, auto, homeowners, and potentially some specialized insurance like disability or pet insurance. Each type covers different risks and has varying levels of coverage.

How do I compare the cost of insurance policies for families versus individuals?

Family policies often offer bundled discounts, but individual premiums may still be lower, especially if the family has significant coverage needs. Consider whether the savings of a family policy outweigh the need for separate policies for specific situations.

How can I find the best insurance plan for my needs in 2025?

Carefully consider your needs and risk tolerance, then research and compare various policies. Utilize online comparison tools, consult with insurance agents, and look at the detailed coverage information of each plan. Compare costs and features to make an informed decision.

What factors influence the cost of auto insurance premiums in 2025?

Driving record, vehicle type, location, and coverage level all impact auto insurance premiums. A clean driving record and a newer, safer vehicle will usually result in lower premiums.