Affordable Health Insurance Options for Young Adults in the US Market 2025

Source: healthcare.inc

Affordable health insurance options for young adults in the US market 2025 – Navigating the US health insurance landscape as a young adult can feel overwhelming. Understanding the market dynamics, available options, and the factors influencing affordability is crucial for making informed decisions. This article provides a comprehensive overview of the health insurance market in 2025, focusing on accessible and budget-friendly plans for young adults.

Overview of the US Health Insurance Market in 2025

The US health insurance market in 2025 is characterized by a complex interplay of factors affecting young adults. Premiums are influenced by factors like individual health status, location, and the specific plan chosen. Competition among major players shapes the landscape, with varying strategies for attracting and retaining customers.

Key factors driving health insurance costs for young adults include rising healthcare costs, the increasing demand for coverage, and the overall state of the insurance market. Young adults, often lacking pre-existing conditions or chronic illnesses, may be tempted to forgo insurance due to perceived affordability concerns.

| Insurance Provider | Premiums (Estimated) | Coverage Options | Customer Reviews |

|---|---|---|---|

| UnitedHealthcare | $150-$350/month | Comprehensive plans with varying deductibles and co-pays, including preventative care | Generally positive, with some complaints about customer service |

| Anthem | $175-$400/month | Focus on regional networks and various plan types, offering high and low deductible options. | Mixed reviews, often praising plan choices and network coverage but with concerns about claim processing |

| Cigna | $180-$375/month | Broad network coverage, offering both high and low deductible options; strong focus on telehealth. | Positive reviews for telehealth and customer support, but some issues with plan clarity |

Identifying Affordable Options

Several types of health insurance plans cater to young adults seeking affordability. These plans vary in coverage and cost, allowing individuals to choose options that best suit their budget and needs. The lower premiums often associated with certain plans are tied to higher deductibles or limited coverage, which is crucial to understand. Factors such as the level of healthcare utilization and expected medical expenses also impact the pricing of these plans.

| Plan Type | Features | Estimated Premiums | Eligibility Criteria |

|---|---|---|---|

| High Deductible Health Plans (HDHP) | Lower premiums, but require higher out-of-pocket costs for covered services. | $75-$200/month | Generally, no pre-existing condition exclusions |

| Health Savings Accounts (HSAs) | Tax-advantaged accounts for saving money for qualified medical expenses, often paired with HDHPs. | N/A | Usually paired with HDHPs and often linked to employer-sponsored programs. |

Navigating the Marketplace, Affordable health insurance options for young adults in the US market 2025

Source: towardshealthcare.com

The Affordable Care Act (ACA) plays a significant role in expanding access to affordable health insurance for young adults. State-based marketplaces provide comparison tools, helping individuals evaluate various plans and compare their features. The marketplace facilitates comparing plans based on individual needs and preferences. A crucial step is understanding the costs, coverage, and deductibles before selecting a plan.

Employer-Sponsored Plans and Alternatives

Source: dwcdn.net

Employer-sponsored plans often provide a more affordable option for young adults. These plans offer competitive premiums and comprehensive coverage, and some employers may offer subsidies to help reduce costs. Alternatives include plans purchased through state marketplaces or individual policies.

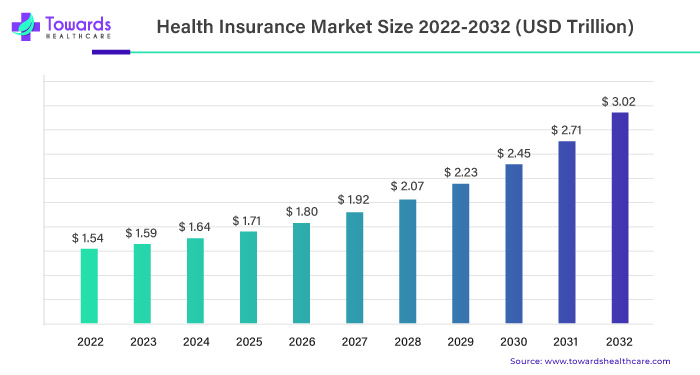

Emerging Trends and Future Outlook

The health insurance market is evolving rapidly, with potential trends including greater use of technology for healthcare delivery and plan management. Telemedicine is expected to become increasingly integrated, and preventative care options will likely play a more significant role in reducing healthcare costs. Technological advancements will impact accessibility and affordability. Potential trends in 2025 may include increased transparency in plan pricing and an expansion of preventative care coverage.

| Trend | Description | Impact on Affordability | Potential Implications |

|---|---|---|---|

| Increased Telehealth Use | Telemedicine is becoming more common and may drive down costs through reduced in-person visits. | Potentially lower premiums | Improved accessibility and convenience for preventative care. |

Illustrative Examples of Affordable Plans

Various affordable health insurance plans are available for young adults, catering to diverse needs. These plans often focus on preventative care, vaccinations, and affordable prescription medication coverage.

| Plan Name | Key Features | Cost Estimate | Coverage Highlights |

|---|---|---|---|

| Silver Plan A | Preventive care, basic hospital coverage | $200-$300/month | Covers routine checkups, vaccinations, and basic hospital care |

| Bronze Plan B | Essential coverage, higher out-of-pocket expenses | $150-$250/month | Covers essential services, but with higher deductibles |

Question & Answer Hub: Affordable Health Insurance Options For Young Adults In The US Market 2025

What are the common misconceptions about health insurance for young adults?

Many young adults believe that because they are healthy, they don’t need comprehensive health insurance. However, unforeseen events can occur, and preventive care is essential. Accidents and illnesses can occur at any age, and without proper coverage, medical expenses can quickly become overwhelming.

How can I find out if I qualify for subsidies or financial assistance programs?

The Affordable Care Act (ACA) provides subsidies to help make health insurance more affordable. You can explore eligibility through the HealthCare.gov website or by consulting a financial advisor specializing in health insurance.

What are the most important factors to consider when comparing different health insurance plans?

Key factors include premiums, coverage options (including deductibles, co-pays, and out-of-pocket maximums), network providers, and any additional benefits like preventive care or wellness programs. Consider your specific needs and preferences when making your choice.

How does the availability of employer-sponsored plans affect my options?

If you have an employer-sponsored plan, you may have access to lower premiums. However, if you don’t, you’ll need to explore alternative options in the marketplace or through other means. Financial assistance programs can be helpful in these situations.