Top Health Insurance Plans for Families in the USA 2025

Top health insurance plans for families in the USA 2025 – Navigating the complex landscape of health insurance in the USA is crucial for families in 2025. The evolving healthcare system, coupled with rising costs and shifting regulations, demands informed choices. Understanding the different plan types, coverage specifics, and factors influencing selection empowers families to secure the best possible protection for their well-being.

Introduction to Family Health Insurance in 2025

The US healthcare system is undergoing significant transformations in 2025. Technological advancements are impacting diagnostic tools and treatment options, while regulatory changes are reshaping the insurance market. These developments directly affect families’ health insurance choices. Key factors influencing these decisions include family size, pre-existing conditions, location, and employer-sponsored plans. Projected cost trends for premiums show an upward trajectory, necessitating careful consideration and comparison.

Health insurance is paramount for families in 2025. It provides financial security during unforeseen medical emergencies, ensuring access to quality care and mitigating potential financial burdens.

Types of Family Health Insurance Plans

Several plan types are available for families in 2025, each with unique characteristics. These include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs).

- HMOs: These plans typically have a limited network of doctors and hospitals, requiring members to choose a primary care physician (PCP) who coordinates care. This structure often leads to lower premiums, but accessing specialists outside the network may require additional steps and costs.

- PPOs: PPOs offer a broader network of providers, allowing greater flexibility in choosing doctors and specialists. While premiums might be higher than HMOs, out-of-network costs are often less restrictive.

- EPOs: These plans are similar to PPOs in terms of network size but have stricter rules for out-of-network care. While some flexibility exists, costs for out-of-network services can be substantial.

| Plan Type | Network Size | Cost | Coverage Details |

|---|---|---|---|

| HMO | Limited | Lower | PCP required, often lower out-of-pocket costs within network |

| PPO | Broad | Higher | Greater flexibility in choosing providers, potentially higher out-of-pocket costs for out-of-network care |

| EPO | Broader than HMO | Mid-range | Greater flexibility than HMO, but stricter rules for out-of-network care |

Key Coverage Considerations for Families, Top health insurance plans for families in the USA 2025

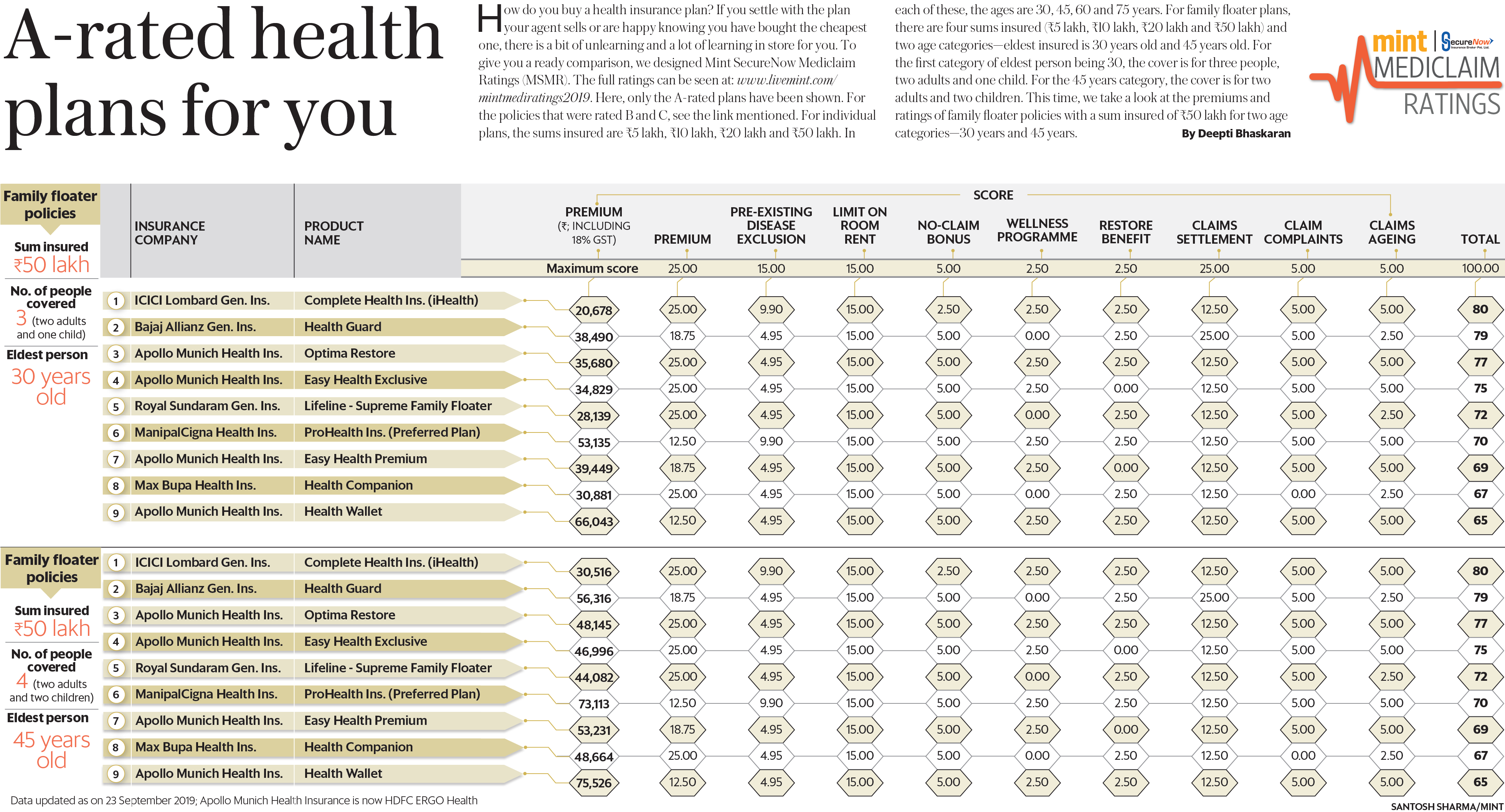

Source: livemint.com

Top-tier family plans typically cover a comprehensive range of essential health services.

- Crucial Health Services: These plans often include preventative care, specialist visits, hospitalizations, and emergency room services.

- Specific Medical Procedures: Coverage for procedures like surgeries, imaging scans, and physical therapies is crucial. Specific details vary among plans.

- Preventative Care: Coverage for checkups, vaccinations, and screenings is essential for maintaining good health.

- Mental Health: Mental health coverage is increasingly important for families, encompassing counseling, therapy, and medication.

- Prescription Drug Coverage: Different plans have various tiers and co-pays for prescription medications.

Factors Affecting Plan Selection

Source: census.gov

Family size, age, pre-existing conditions, location, and employer-sponsored plans significantly impact plan selection.

- Family Size and Age: Larger families and those with older members generally have higher premiums.

- Pre-existing Conditions: Insurers may impose higher premiums or limitations on coverage for individuals with pre-existing conditions.

- Location: Geographic location impacts plan availability and costs due to variations in healthcare market dynamics.

- Employer-Sponsored Plans: Employer-sponsored plans often provide more comprehensive coverage and lower costs, but availability varies.

Analyzing Top Plans of 2025

Several plans are projected to be among the top choices for families in 2025, differing significantly in terms of cost, coverage, and network.

The top 5 plans will vary in their specific features, premium costs, and provider networks.

Tips for Choosing the Right Plan

Source: alivewellzone.com

Choosing the right health insurance plan requires careful consideration and comparison.

- Step-by-Step Guide: Carefully evaluate plan details, comparing coverage, costs, and provider networks.

- Checklist: Create a checklist to compare features like deductibles, co-pays, and coinsurance.

- Plan Providers: Research the reputation and network of plan providers.

- Comparison Strategies: Use comparison tools and online resources to evaluate plans effectively.

- Saving Strategies: Explore strategies for reducing premiums, such as cost-sharing and discount programs.

Illustrative Examples of Top Plans

The following table presents a comparison of 3 potential top family health insurance plans, highlighting key differences in coverage details.

| Plan Name | Premium Cost | Network Size | Key Benefits |

|---|---|---|---|

| Plan A | $1,200/year | Large, nationwide | Comprehensive coverage, low out-of-pocket costs |

| Plan B | $1,500/year | Regional | Extensive mental health coverage, high prescription drug coverage |

| Plan C | $1,000/year | Limited, local | Emphasis on preventative care, low co-pays for routine checkups |

Detailed FAQs: Top Health Insurance Plans For Families In The USA 2025

What are the most common types of health insurance plans for families?

The most common types include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations). Each type offers varying levels of network coverage and cost structures.

How do pre-existing conditions affect health insurance plan choices?

Many plans now offer coverage for pre-existing conditions. However, the extent of coverage and the impact on premiums can vary significantly. It’s crucial to understand the details of the plans before making a choice.

What is the typical cost trend for health insurance premiums in 2025?

Predicting exact premium costs is challenging. However, general trends indicate potential increases influenced by factors such as inflation, healthcare costs, and regulatory changes. Researching current market data is vital for accurate projections.

What preventative care services are typically covered by family health insurance plans?

Most plans cover preventive care like vaccinations, screenings, and check-ups. The extent of coverage may vary, so always review the specific plan details.