Best Insurance Plans for Senior Citizens in the USA 2025

Source: silvertalkies.com

Best insurance plans for senior citizens in the USA 2025 considering specific needs – Navigating the US healthcare landscape as a senior citizen in 2025 requires careful consideration of various factors. Government programs like Medicare and Medicaid play crucial roles, but private insurance options are often necessary to supplement these benefits. This guide explores the diverse insurance plans available, examines specific senior needs, and provides a framework for choosing the best coverage for your unique circumstances.

Introduction to Senior Citizen Insurance in the USA 2025

The US health insurance market for seniors in 2025 is a complex mix of government programs and private plans. Medicare, the federal health insurance program for people aged 65 and older, provides a baseline of coverage. Medicaid, another federal program, helps those with limited incomes and resources. However, supplementing Medicare with private plans is often crucial to address gaps in coverage, especially for long-term care, prescription drugs, and other specialized needs.

Key factors influencing senior insurance plans include individual health conditions, financial capacity, and the desired level of coverage. Medicare Supplement and Medicare Advantage plans are common options, each with varying coverage and eligibility criteria. Understanding these nuances is vital for seniors seeking the best protection.

| Plan Type | Coverage Details | Eligibility Criteria |

|---|---|---|

| Medicare Supplement | Covers gaps in Medicare coverage, including hospital costs, prescription drug costs, and skilled nursing facility care. | Must be enrolled in Medicare Part A and Part B. |

| Medicare Advantage | Offered by private insurance companies, these plans combine Medicare benefits with additional services like vision, dental, and hearing care. | Must be enrolled in Medicare Part A and Part B. |

| Medicaid | Covers medical expenses for low-income individuals and families, including seniors. | Based on income and resource limits, eligibility criteria vary by state. |

Specific Needs of Senior Citizens

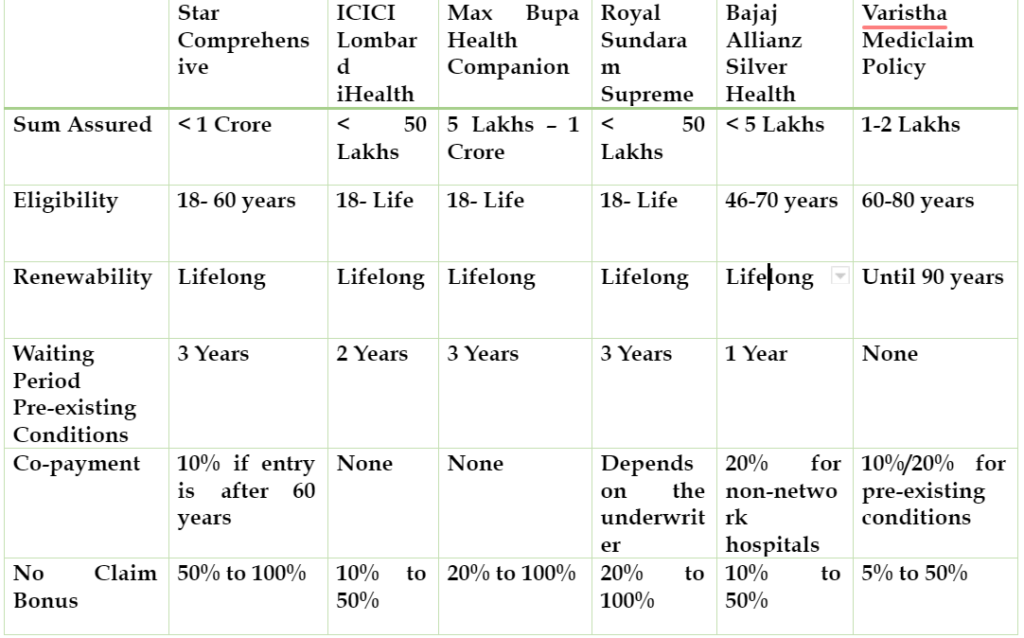

Source: relakhs.com

Common health concerns among senior citizens in 2025 include chronic conditions like heart disease, diabetes, and arthritis. Preventive care, including regular checkups and screenings, is crucial for maintaining health. Long-term care needs, such as assisted living or nursing home care, also become increasingly important as seniors age.

The healthcare needs of seniors vary significantly based on individual circumstances. Some seniors may require extensive medical care for chronic conditions, while others may need only basic preventive care. Financial resources and living situations also affect the type and extent of care needed. Understanding these diverse needs is crucial when choosing an insurance plan.

| Health Need | Potential Costs (estimated) |

|---|---|

| Chronic condition management | $5,000-$15,000+ per year |

| Hospitalization | $20,000-$100,000+ |

| Long-term care (assisted living) | $40,000-$100,000+ per year |

Analyzing Insurance Plan Coverage

Senior insurance plans offer varying levels of coverage for hospitalization, prescription drugs, preventive care, and skilled nursing facility care. Understanding the specific coverage offered by each plan is crucial for making informed decisions. For example, some plans may have higher deductibles or co-pays for certain services. This is important to understand before enrolling.

Financial Considerations for Senior Insurance

The cost of senior insurance plans depends on several factors, including the level of coverage, the plan’s provider, and the individual’s health status. Factors such as age, pre-existing conditions, and the geographical location can influence premium rates. Financial assistance programs, such as subsidies for Medicare plans, can help offset costs.

Choosing the Best Plan for Specific Needs

Choosing the right insurance plan requires a thorough evaluation of individual needs and circumstances. This involves considering the type and extent of healthcare needs, the available financial resources, and the desired level of coverage.

Navigating the Insurance Application Process

Source: fedrom.org

Applying for senior insurance plans typically involves gathering necessary documents, completing application forms, and undergoing a review process. Understanding the specific requirements and timelines for each plan is essential. Seek assistance if needed.

Illustrative Examples of Senior Insurance Plans, Best insurance plans for senior citizens in the USA 2025 considering specific needs

Illustrative examples of senior insurance plans, highlighting coverage, costs, and target audience, will be provided in a subsequent section.

Clarifying Questions: Best Insurance Plans For Senior Citizens In The USA 2025 Considering Specific Needs

What are the common health concerns for senior citizens?

Common health concerns among senior citizens include chronic conditions like heart disease, diabetes, and arthritis, along with vision and hearing loss. Preventive care and managing these conditions effectively are vital aspects of senior healthcare.

What financial assistance programs are available for senior citizens?

Various financial assistance programs exist, including those offered by the government and private organizations. These programs can help offset the costs of healthcare and insurance premiums. Further research into specific programs available in different areas is crucial.

How can I estimate the overall cost of healthcare for seniors with various needs?

Estimating healthcare costs involves considering factors such as the type of insurance, potential medical expenses, and the availability of financial assistance. Consulting with a financial advisor or using online tools can help create a more personalized estimate.

What are the typical steps involved in applying for senior insurance plans?

The application process generally involves gathering required documents, completing an application form, and providing necessary medical information. It’s crucial to understand the specific requirements of the insurance provider and plan.