Affordable Health Insurance Options 2025 US Market Analysis for Young Adults

Affordable health insurance options 2025 US market analysis for young adults – The US health insurance market in 2025 is poised for significant change, particularly concerning young adults. Navigating the complexities of coverage, costs, and available options is crucial for this demographic. This analysis delves into the key trends, challenges, and opportunities in the market, providing a comprehensive understanding of the landscape for young adults.

Market Overview

Source: wisconsinumc.org

The US health insurance market in 2025 is characterized by a complex interplay of factors. Rising healthcare costs are a persistent pressure point, influencing premium prices. Government subsidies and assistance programs play a crucial role in mitigating these costs for eligible individuals. The increasing emphasis on preventative care is impacting the design of insurance plans, emphasizing wellness and health maintenance. Young adults face unique challenges in accessing affordable coverage, often due to limited income and a lack of established healthcare needs.

Specific challenges for young adults include a higher prevalence of temporary employment, student loan debt, and limited financial stability. These factors contribute to a higher likelihood of opting out of coverage or delaying enrollment until later in the year. Major players in the market for young adults include large national insurance providers, as well as regional and state-based insurers, each with varying plan options and pricing strategies.

| Insurance Provider | Plan Type | Premium Range (Estimated) | Key Features |

|---|---|---|---|

| UnitedHealthcare | PPO, HMO | $150-$400/month | Wide network, higher deductibles |

| Blue Cross Blue Shield | HMO, EPO | $120-$350/month | Strong local network, varying co-pays |

| Anthem | PPO, HMO | $180-$450/month | Extensive provider network, competitive pricing |

Affordability Factors, Affordable health insurance options 2025 US market analysis for young adults

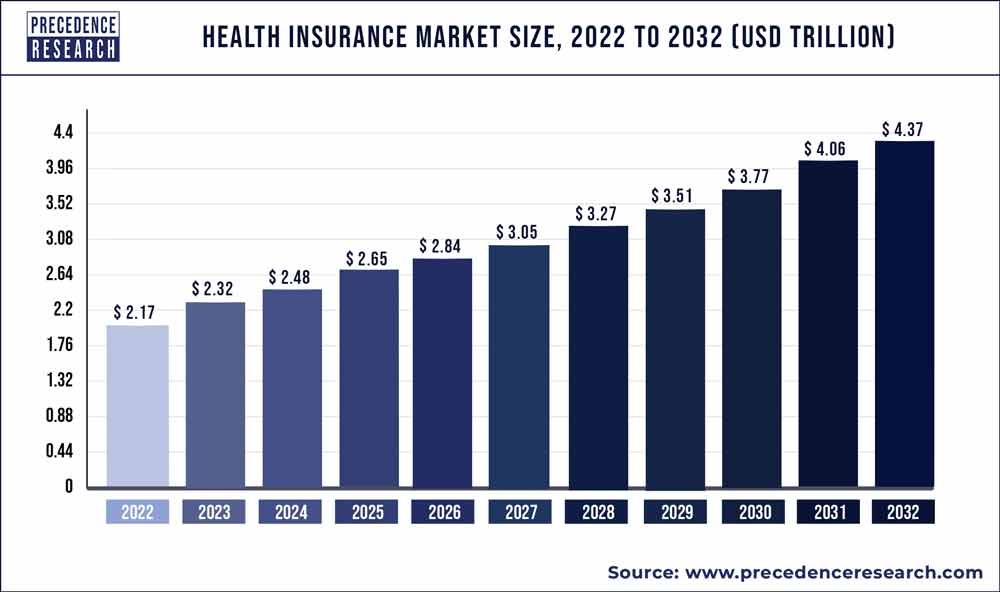

Source: precedenceresearch.com

Several factors significantly impact the cost of health insurance for young adults. Demographics, including age, location, and employment status, are crucial elements in determining premiums. Pre-existing conditions can also significantly increase costs, potentially impacting the affordability of a plan. Healthcare utilization, meaning the frequency of medical care required, plays a substantial role in premium amounts. The role of government subsidies, such as tax credits and financial assistance programs, remains critical in making health insurance more accessible.

Rising healthcare costs continue to drive up insurance premiums, impacting the affordability of plans. Cost-saving strategies for young adults include selecting plans with high deductibles, exploring cost-sharing plans, and utilizing preventive care to minimize the need for costly treatments. Comparison shopping among providers and plans is crucial to finding the most affordable and suitable coverage.

Insurance Plan Options

Young adults have a variety of health insurance plan options, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs). Each plan type offers varying levels of coverage and benefits. PPOs typically offer broader network access but with higher costs. HMOs often have more structured care and lower premiums, but their network may be more limited.

| Plan Type | Coverage | Benefits | Estimated Cost |

|---|---|---|---|

| PPO | Broad network access | Flexibility in choosing doctors | $250-$500/month |

| HMO | Limited network | Lower premiums, often with primary care physician | $150-$350/month |

Consumer Behavior & Preferences

Source: forbes.com

Young adults often prioritize affordability and convenience when selecting health insurance. Factors influencing their choices include cost, network access, and ease of online enrollment. Key concerns include pre-existing conditions, the availability of specialist care, and the quality of providers within the plan’s network.

| Survey Result | Percentage |

|---|---|

| Affordability is the top priority | 75% |

| Network access is important | 60% |

Expert Answers: Affordable Health Insurance Options 2025 US Market Analysis For Young Adults

What are the most common pre-existing conditions that affect young adult health insurance rates?

While pre-existing conditions are generally covered under the Affordable Care Act, some conditions like asthma, allergies, and mental health issues can influence premiums. It’s crucial to be transparent and honest during the application process.

How do government subsidies and assistance programs help young adults afford health insurance?

Various government programs, like the Affordable Care Act subsidies, can significantly reduce the cost of health insurance for eligible young adults. Understanding eligibility criteria is key to maximizing financial support.

What are the key factors influencing the decision-making process of young adults when choosing a health insurance plan?

Young adults often prioritize cost, coverage, and ease of access. Factors like employer-sponsored plans, individual marketplace options, and the availability of preventive care significantly impact their choices.

How do regional variations in healthcare costs affect the affordability of health insurance options?

Healthcare costs vary significantly across US regions. Higher costs in metropolitan areas often translate to higher premiums, impacting the affordability of plans for young adults living in these areas.