US Insurance Market Trends Overview 2025 and Future Projections

US insurance market trends overview 2025 and future projections – The US insurance market in 2025 is poised for significant transformation, driven by a confluence of technological advancements, evolving regulatory landscapes, and shifting economic factors. This overview delves into the key trends shaping this dynamic market, offering insights into premium projections, technological impacts, regulatory changes, and future growth potential.

Market Overview

The US insurance market in 2025 will continue to be dominated by health, auto, and property & casualty segments. Competition will be fierce across all sectors, with insurers striving to adapt to changing consumer preferences and regulatory requirements. Established players like State Farm, Geico, and Blue Cross Blue Shield will face challenges from innovative startups and digital-first entrants, highlighting the necessity for a robust digital strategy.

- Health Insurance: Rising healthcare costs and increasing demand for affordable coverage will be major factors influencing this sector. Insurers will focus on preventative care and cost-effective solutions to attract and retain customers.

- Auto Insurance: Telematics-driven usage-based insurance models will gain traction, while accident frequency and severity will remain a key concern. The rise of autonomous vehicles will also require insurers to adapt their coverage offerings.

- Property & Casualty Insurance: Climate change will significantly impact claims frequency and severity, necessitating new risk assessment methodologies. Insurers will need to offer flexible and resilient solutions in response to increasingly frequent and severe weather events.

| Insurance Segment | Projected Premium Growth (2025) |

|---|---|

| Health | 3-5% |

| Auto | 2-4% |

| Property & Casualty | 4-6% |

Technological Advancements, US insurance market trends overview 2025 and future projections

Source: startus-insights.com

Emerging technologies like AI, big data, and telematics are reshaping the insurance landscape. These technologies are revolutionizing claims processing, risk assessment, and customer service, leading to greater efficiency and personalization.

- AI: AI is being deployed for fraud detection, claims processing automation, and personalized risk assessment. Its use in customer service chatbots and predictive modeling will become increasingly common.

- Big Data: Data analytics are allowing insurers to better understand customer behavior, identify risk patterns, and develop more targeted products and pricing strategies.

- Telematics: Driver behavior data collected via telematics systems is enabling insurers to offer usage-based insurance products, rewarding safe driving habits.

| Technology | Impact on Insurance Operations |

|---|---|

| AI | Fraud detection, claims processing, personalized risk assessment |

| Big Data | Customer insights, risk modeling, pricing optimization |

| Telematics | Usage-based insurance, driver behavior analysis, claims reduction |

Regulatory Landscape

Regulatory changes will continue to impact the US insurance market in 2025. State-level regulations and federal policies will influence pricing, coverage, and access to insurance. A more competitive market is expected as insurers adapt to these changing standards.

- State Regulations: Varied state regulations can create complexities for insurers operating across multiple jurisdictions. Ensuring compliance with diverse state-level rules is crucial.

- Federal Policies: Federal policies on healthcare affordability and insurance accessibility will significantly influence health insurance market dynamics.

Economic Projections

Economic factors like inflation, interest rates, and unemployment will influence insurance premiums and consumer demand. The potential impact of economic downturns and fluctuating market conditions must be carefully considered by insurers.

- Inflation: Rising inflation could increase insurance premiums across all segments to reflect the escalating costs of repair and replacement.

- Interest Rates: Changes in interest rates will affect investment returns for insurance companies, influencing their financial performance.

Consumer Behavior

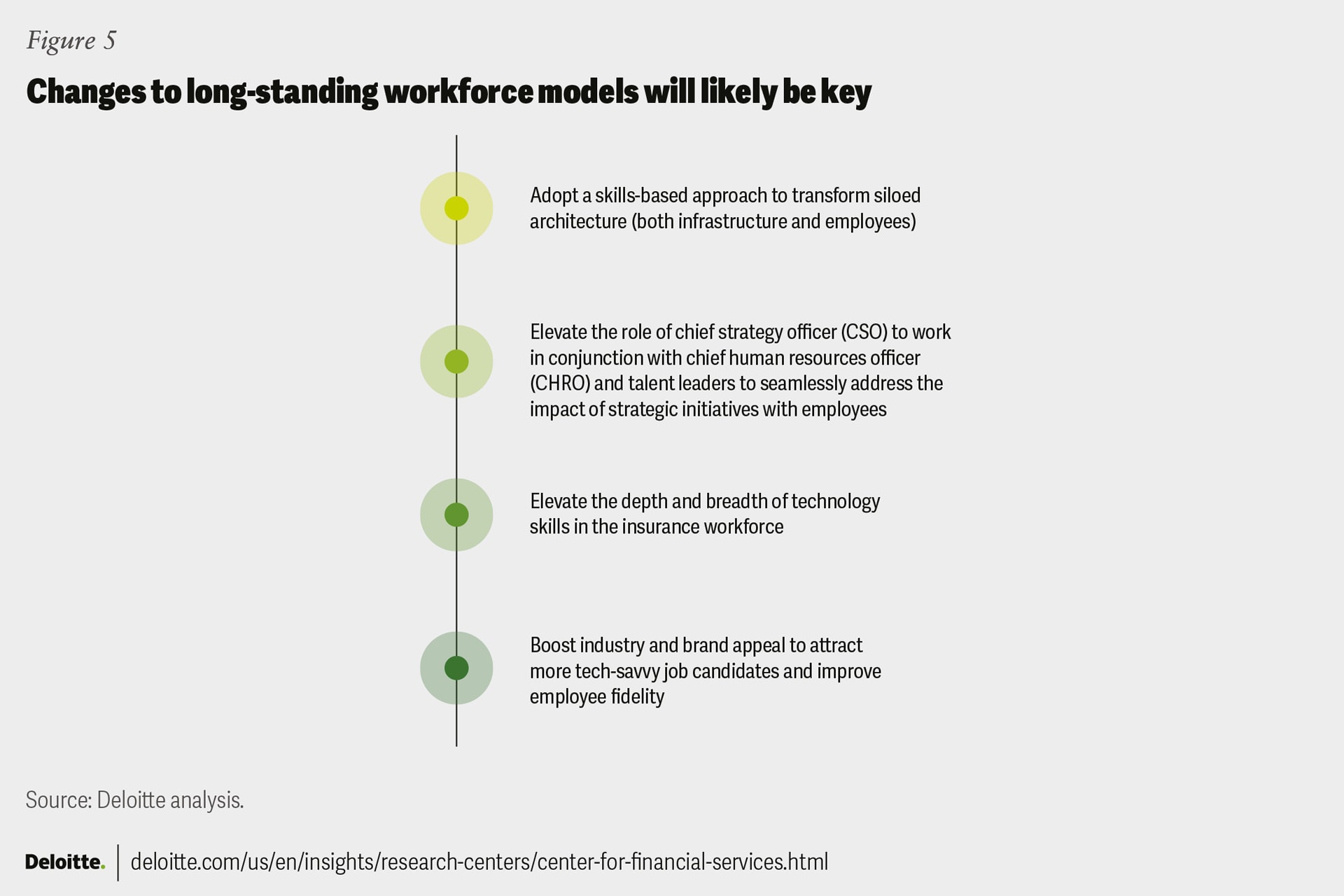

Source: deloitte.com

Consumer behavior in the US insurance market will shift towards greater personalization and digital interaction. Consumers will expect more tailored products and services, and insurers will need to meet these expectations through efficient and accessible digital channels.

- Digital Channels: Consumers are increasingly utilizing digital channels for insurance interactions, leading to a greater demand for user-friendly online platforms.

- Customized Products: Personalized insurance options will be a significant factor influencing consumer choices. The demand for customized products will push insurers to tailor their offerings.

Future Projections

Source: wns.com

The US insurance market is expected to continue growing in the years following 2025, driven by population growth and evolving consumer needs. Each insurance segment will see varying rates of growth, with health insurance likely to be a significant driver of market expansion.

- Long-Term Growth: The long-term growth of the insurance industry hinges on adapting to the aforementioned trends. Insurers that successfully embrace innovation and customer-centric strategies are more likely to flourish.

Query Resolution: US Insurance Market Trends Overview 2025 And Future Projections

What are the most significant technological advancements impacting the US insurance market in 2025?

AI, big data, and telematics are significantly altering claims processing, risk assessment, and customer service. AI is improving fraud detection, big data is enabling more accurate risk profiling, and telematics is driving usage-based insurance, changing the relationship between customers and their insurance policies.

How will economic fluctuations affect different insurance segments in 2025?

Economic downturns could put pressure on all segments, but the impact may vary. Health insurance may see increased demand due to job losses, while property & casualty could face lower claims if the construction industry slows. Auto insurance might see fluctuations based on consumer spending and vehicle sales.

What consumer behavior trends will shape the US insurance market in 2025?

Consumers are increasingly demanding customized insurance products and services, and they’re leveraging digital channels more for interactions. Expect an emphasis on customer experience as a key factor in purchasing decisions.

What are the key regulatory changes impacting the US insurance market in 2025?

Regulations are evolving to address issues like accessibility, affordability, and consumer protection. These changes will affect pricing, coverage, and the competitive landscape for insurers.