US Insurance Market Trends 2025 Overview

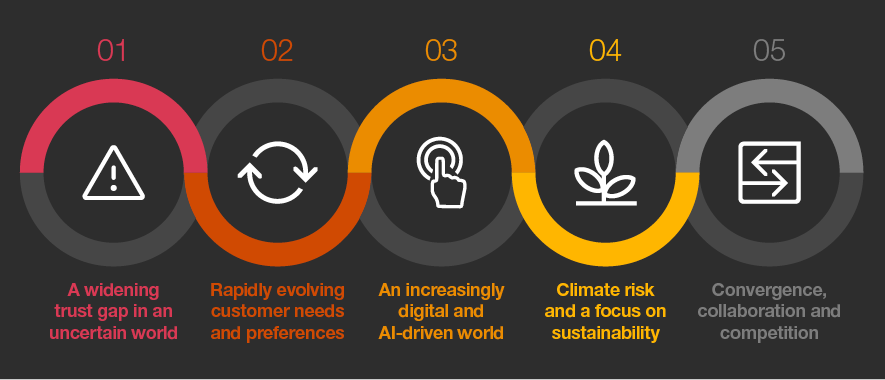

US insurance market trends 2025 overview – The US insurance market in 2025 is poised for significant transformation, driven by evolving consumer expectations, technological advancements, and shifting economic landscapes. This overview explores key segments, consumer behavior, technological impacts, regulatory frameworks, competitive dynamics, economic influences, and the projected future outlook.

Market Overview

The US insurance market in 2025 will be characterized by continued growth, though at a potentially slower pace compared to previous years. Health insurance, despite ongoing challenges, remains a significant segment, with projections for modest growth. Auto insurance is anticipated to experience stable growth, tied to the consistent demand for vehicle ownership. Property insurance, however, faces increased uncertainty due to rising climate-related risks and potential premium adjustments.

Major segments include health, auto, and property insurance, each with unique characteristics and growth projections.

| Segment Name | Market Share (Estimated) | Growth Projection (2024-2025) | Key Drivers |

|---|---|---|---|

| Health Insurance | 30% | 2% | Increasing awareness of preventive care, expanding telehealth options, and ongoing government initiatives. |

| Auto Insurance | 25% | 1.5% | Sustained vehicle ownership, evolving safety technologies, and potential shifts in usage patterns (e.g., ride-sharing). |

| Property Insurance | 20% | 1% (or potentially negative, depending on climate-related events) | Climate change impacts, rising construction costs, and potential regulatory changes concerning catastrophe modeling. |

Disruptions such as rising inflation, evolving consumer expectations for personalized services, and the integration of emerging technologies will shape the market’s trajectory. The introduction of new insurance products tailored to specific needs and evolving consumer behaviors are also potential transformative events.

Consumer Behavior

Source: asee.io

Consumers in 2025 are increasingly seeking personalized insurance solutions, demonstrating a preference for transparent pricing, flexible coverage options, and seamless digital interactions. Technology plays a critical role in shaping these preferences.

| Insurance Type | Key Consumer Preferences | Technology Influence |

|---|---|---|

| Health | Accessibility, transparency, preventative care options | Telemedicine, online portals, personalized risk assessments |

| Auto | Safety features, usage-based pricing, digital claims processing | Telematics, connected car technology, online claim portals |

| Property | Climate-resilient options, transparent pricing models | Advanced risk assessments, predictive modeling, digital policy management |

Technological Advancements

Source: startus-insights.com

Emerging technologies like data analytics, AI, and automation are transforming the US insurance market, impacting risk assessment, claims processing, and customer experience. These technologies are expected to become integral to the industry’s future operations.

| Technological Tool | Application in Insurance Market |

|---|---|

| Data Analytics | Predictive modeling, personalized pricing, fraud detection |

| AI | Claims processing automation, customer service chatbots, risk assessment |

| Automation | Policy issuance, underwriting, claims processing |

Regulatory Landscape, US insurance market trends 2025 overview

Source: pwc.com

The US insurance market operates within a complex regulatory framework, with various agencies playing a role in oversight and policymaking. Regulatory bodies ensure market stability and protect consumers.

| Agency | Role | Key Impact on Market |

|---|---|---|

| National Association of Insurance Commissioners | Sets standards, coordinates regulatory efforts | Influences pricing structures and consumer protection measures |

| State Insurance Departments | Oversees insurance operations within their states | Impacts local insurance policies and regulations |

FAQ Section

What are the key consumer preferences in the US insurance market in 2025?

Consumers are increasingly seeking personalized, transparent, and convenient insurance solutions. Digital interactions and mobile accessibility are becoming paramount. Price, coverage, and service are still crucial, but ease of access and personalized features are now top priorities.

How will economic downturns affect insurance demand in 2025?

Economic downturns typically lead to a decrease in insurance demand as consumers prioritize essential expenses. The impact can vary based on the specific type of insurance (e.g., health insurance demand might be less impacted than auto insurance). Insurance companies may need to adjust their strategies and pricing models to navigate these challenging economic periods.

What are the potential disruptions impacting the US insurance market in 2025?

Several potential disruptions are on the horizon, including the rapid advancements in technology, changing consumer expectations, and potential regulatory changes. These disruptions may lead to innovative solutions and new competitive strategies, requiring the industry to be agile and adaptable.