The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready?

Related Articles

- The Economic Downturn: Navigating The Choppy Waters

- The Insurance Industry’s Digital Transformation: From Paper To Pixels And Beyond

- The Cost Of Inaction: Exploring The Economic Implications Of Climate Policies

- The Rise Of The Machines: How Automation Is Reshaping The Job Market

- The Looming Shadow: Risks Of A US Housing Market Crash

Introduction

Discover everything you need to know about The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready?

The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready?

The insurance industry, long known for its traditional, paper-based processes, is facing a tidal wave of disruption. From technological advancements to changing customer expectations, the landscape is shifting rapidly. But fear not, this isn’t necessarily a bad thing! This disruption is actually paving the way for a more efficient, customer-centric, and innovative insurance industry.

This article will dive into the key drivers of disruption, explore the opportunities and challenges they present, and discuss how insurance companies can navigate this turbulent waters to thrive in the future.

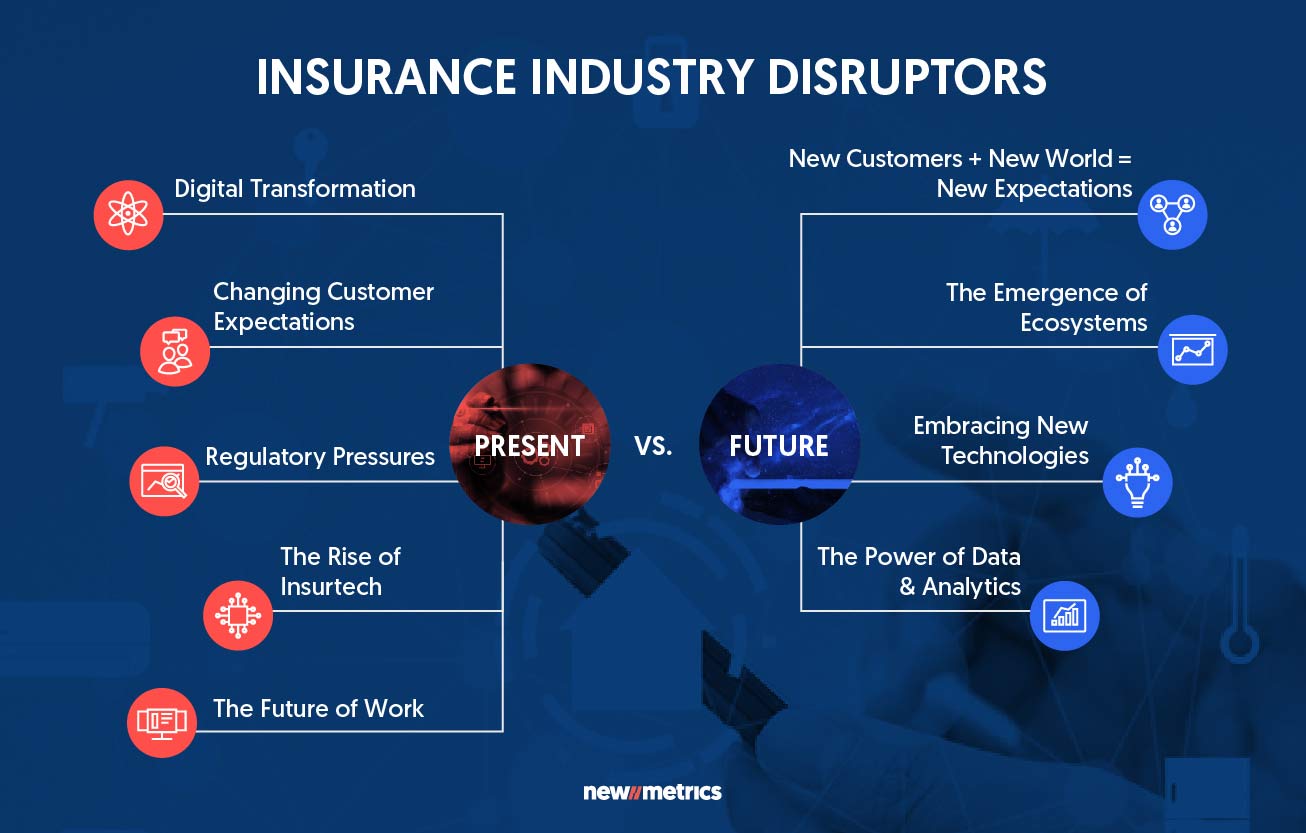

The Forces Shaping the Insurance Landscape

Several key forces are converging to disrupt the insurance industry, forcing it to adapt and innovate.

1. Technology: The Catalyst for Change

- Artificial Intelligence (AI): AI is revolutionizing the insurance industry by automating tasks, improving risk assessment, and enhancing customer service. AI-powered chatbots can answer customer queries 24/7, while sophisticated algorithms can analyze vast amounts of data to predict risk and personalize insurance offerings.

- Big Data and Analytics: Insurance companies are leveraging big data to gain deeper insights into customer behavior, risk factors, and market trends. This allows for more accurate pricing, personalized products, and proactive risk management.

- Internet of Things (IoT): Connected devices are generating a wealth of data that can be used to monitor risk and provide real-time insights. For example, telematics devices in cars can track driving behavior, leading to personalized insurance premiums based on actual driving habits.

- Blockchain: Blockchain technology offers potential for secure and transparent transactions, streamlining processes and reducing fraud. It could also be used to create decentralized insurance marketplaces and facilitate peer-to-peer insurance models.

- Cloud Computing: Cloud-based solutions are enabling insurance companies to access powerful computing resources on demand, reducing infrastructure costs and increasing scalability. This allows for faster innovation and deployment of new products and services.

2. Changing Customer Expectations:

- Digital Natives: Millennials and Gen Z, accustomed to instant gratification and personalized experiences, are demanding digital-first insurance solutions. They want easy-to-use mobile apps, online policy management, and seamless customer service.

- Transparency and Customization: Consumers are increasingly demanding transparency in pricing and coverage. They want personalized insurance products tailored to their specific needs and lifestyles.

- Value for Money: Customers are becoming more price-sensitive and are looking for value for their money. They want insurance products that offer competitive premiums and comprehensive coverage.

3. New Business Models and Competitors:

- Insurtech Startups: A wave of insurtech startups is entering the market, offering innovative solutions and challenging traditional insurance models. These startups are leveraging technology to create more efficient and customer-centric insurance products.

- Alternative Distribution Channels: Insurance companies are exploring new distribution channels beyond traditional agents and brokers. Digital platforms, partnerships with fintech companies, and direct-to-consumer models are gaining traction.

- Peer-to-Peer Insurance: Peer-to-peer insurance models are gaining popularity, allowing individuals to share risk and pool resources directly, bypassing traditional insurance companies.

Opportunities and Challenges

This disruption presents both significant opportunities and challenges for the insurance industry.

Opportunities:

- Improved Efficiency and Cost Savings: Technology can automate many manual tasks, reducing operational costs and freeing up resources for innovation.

- Enhanced Customer Experience: Digital tools and personalized offerings can create a more positive and convenient customer experience.

- New Product Development: Data-driven insights and technological advancements enable the development of innovative insurance products tailored to specific customer needs.

- Increased Market Reach: New distribution channels and digital platforms can expand reach and access new customer segments.

- Enhanced Risk Management: AI and big data analytics can improve risk assessment and prediction, leading to more accurate pricing and proactive risk management.

Challenges:

- Investment in Technology: Adopting new technologies requires significant investment, which can be a challenge for some companies.

- Data Security and Privacy: Handling sensitive customer data requires robust security measures to prevent breaches and maintain trust.

- Adapting to Changing Customer Expectations: Meeting the demands of digitally savvy customers requires a shift in mindset and a focus on user-centric design.

- Competition from Insurtech Startups: Traditional insurance companies face competition from agile and innovative insurtech startups.

- Regulatory Changes: The insurance industry is subject to strict regulations, and adapting to changing regulatory landscapes can be challenging.

Navigating the Disruption: How Insurance Companies Can Thrive

To navigate this turbulent landscape, insurance companies need to embrace a culture of innovation and adapt to the changing customer landscape. Here are some key strategies:

- Embrace Technology: Invest in AI, big data analytics, and other technologies to enhance efficiency, improve customer experience, and develop innovative products.

- Focus on Customer Centricity: Put the customer at the center of everything you do. Understand their needs, preferences, and expectations.

- Develop Digital Capabilities: Build a strong digital presence, including user-friendly mobile apps, online policy management tools, and responsive customer service channels.

- Foster Innovation: Create a culture that encourages experimentation and the development of new products and services.

- Partner with Insurtech Startups: Collaborate with insurtech startups to access their expertise and innovative solutions.

- Stay Ahead of Regulatory Changes: Monitor regulatory developments and adapt your business practices accordingly.

The Future of Insurance: A More Personalized and Digital Landscape

The insurance industry is on the cusp of a major transformation. Technology, changing customer expectations, and new business models are shaping the future of insurance. The companies that embrace this disruption and adapt to the changing landscape will be the ones that thrive in the years to come.

The future of insurance will be:

- Personalized: Insurance products will be tailored to individual needs and lifestyles, based on data and customer insights.

- Digital: Insurance transactions will be conducted primarily online, through mobile apps and digital platforms.

- Data-Driven: AI and big data analytics will play a central role in risk assessment, pricing, and product development.

- Customer-Centric: Insurance companies will focus on providing a seamless and positive customer experience.

- Innovative: New products and services will emerge, leveraging technology to address evolving customer needs.

FAQ:

Q: How will AI impact the insurance industry?

A: AI will revolutionize the insurance industry by automating tasks, improving risk assessment, and enhancing customer service. AI-powered chatbots can answer customer queries 24/7, while sophisticated algorithms can analyze vast amounts of data to predict risk and personalize insurance offerings.

Q: What are the main benefits of using big data in insurance?

A: Big data allows insurance companies to gain deeper insights into customer behavior, risk factors, and market trends. This allows for more accurate pricing, personalized products, and proactive risk management.

Q: How can insurance companies adapt to changing customer expectations?

A: Insurance companies need to focus on providing a digital-first experience, offering personalized products, and ensuring transparency in pricing and coverage. They should also invest in user-friendly mobile apps and online policy management tools.

Q: What are the key challenges faced by insurance companies in the face of disruption?

A: Key challenges include investing in new technologies, ensuring data security and privacy, adapting to changing customer expectations, competing with insurtech startups, and navigating regulatory changes.

Q: What are some examples of innovative insurance products emerging in the market?

A: Examples include usage-based insurance (UBI) that uses telematics data to personalize premiums based on driving behavior, parametric insurance that pays out based on specific events like weather disasters, and micro-insurance products that offer affordable coverage for specific needs.

Q: What is the future of the insurance industry?

A: The future of insurance is likely to be more personalized, digital, data-driven, customer-centric, and innovative. Insurance companies that embrace these trends will be best positioned to thrive in the years to come.

References:

- McKinsey & Company: The Future of Insurance

- Deloitte: Insurtech: The Future of Insurance

- PwC: Insurance 2030: The Future of the Industry

Closure

We hope this article has helped you understand everything about The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready?. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready?!

We’d love to hear your thoughts about The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready?—leave your comments below!

Stay informed with our next updates on The Insurance Industry is Facing a Tsunami of Disruption: Are You Ready? and other exciting topics.