The Fed’s Tightening Grip: How Rate Hikes Impact Stocks and Bonds

Related Article

- Telecommunications: The Unsung Hero Of The Sharing Economy

- Navigating The Shifting Sands: Understanding Flood Insurance Policy Changes

- The Productivity Puzzle: Why American Workers Are Producing Less

- The Future Of Work: How Telecommunications Is Leading The Way

- Navigating The Labyrinth: US Import-Export Challenges In The 21st Century

Introduction

Ready to boost your understanding of the economic landscape with our in-depth look into The Fed’s Tightening Grip: How Rate Hikes Impact Stocks and Bonds!

The Fed’s Tightening Grip: How Rate Hikes Impact Stocks and Bonds

The Federal Reserve, the central bank of the United States, plays a crucial role in managing the economy. One of its primary tools is setting interest rates, known as the federal funds rate. When the Fed raises interest rates, it becomes more expensive for businesses and individuals to borrow money, which can influence economic activity and, in turn, the stock and bond markets.

This article will delve into the intricate relationship between Fed rate hikes and the performance of stocks and bonds, exploring the latest trends, underlying mechanisms, and potential implications for investors.

Understanding the Fed’s Role

The Fed’s main objectives are to maintain price stability (controlling inflation) and promote maximum employment. When inflation rises above the Fed’s target range, it often signals an overheating economy. To cool things down, the Fed raises interest rates, making borrowing more expensive and potentially slowing down economic growth.

Here’s how it works:

- Higher interest rates discourage borrowing: Businesses might delay expansion plans, and consumers might postpone big purchases like cars or homes.

- Increased cost of capital: Companies find it more expensive to finance their operations, which can impact their profitability.

- Attractive alternative to stocks: Bonds, which pay fixed interest rates, become more appealing as their yields rise with higher interest rates. This can lead to investors shifting money from stocks to bonds.

The Impact on Stocks

Short-Term:

- Initial sell-off: Stock prices tend to decline in the short term as investors react to the potential for slower economic growth and reduced corporate earnings.

- Increased volatility: The market becomes more unpredictable as investors grapple with the implications of higher interest rates.

- Sector-specific impacts: Certain sectors, like growth stocks (companies with high growth potential) and technology companies, are particularly vulnerable to rate hikes, as their valuations are often tied to future earnings expectations.

Long-Term:

- Potential for slower growth: While rate hikes can curb inflation, they can also stifle economic growth, impacting corporate profits and potentially leading to lower stock valuations.

- Shift in investment focus: Investors might favor value stocks (companies with strong fundamentals and lower valuations) over growth stocks as the market becomes more risk-averse.

- Impact on earnings: Higher interest rates can impact corporate earnings by increasing borrowing costs and reducing consumer spending.

Example: A company that relies heavily on debt financing will see its interest expenses increase with higher rates, potentially impacting its profitability and stock price.

The Impact on Bonds

Short-Term:

- Bond prices decline: As interest rates rise, the value of existing bonds with fixed interest rates falls. This is because investors can now buy new bonds with higher yields.

- Yield curve steepening: The difference between yields on short-term and long-term bonds (the yield curve) tends to steepen as short-term rates increase faster than long-term rates.

Long-Term:

- Higher returns for investors: Bond investors benefit from higher interest rates, as they receive a greater return on their investments.

- Potential for bond market volatility: As the Fed adjusts rates, the bond market can experience significant volatility, making it challenging for investors to predict bond prices.

Example: If you hold a bond with a 3% coupon rate and the Fed raises rates, a newly issued bond might offer a 4% coupon rate. This makes your existing bond less attractive to investors, leading to a decline in its price.

Recent Trends and Advancements

The Fed’s Aggressive Rate Hikes:

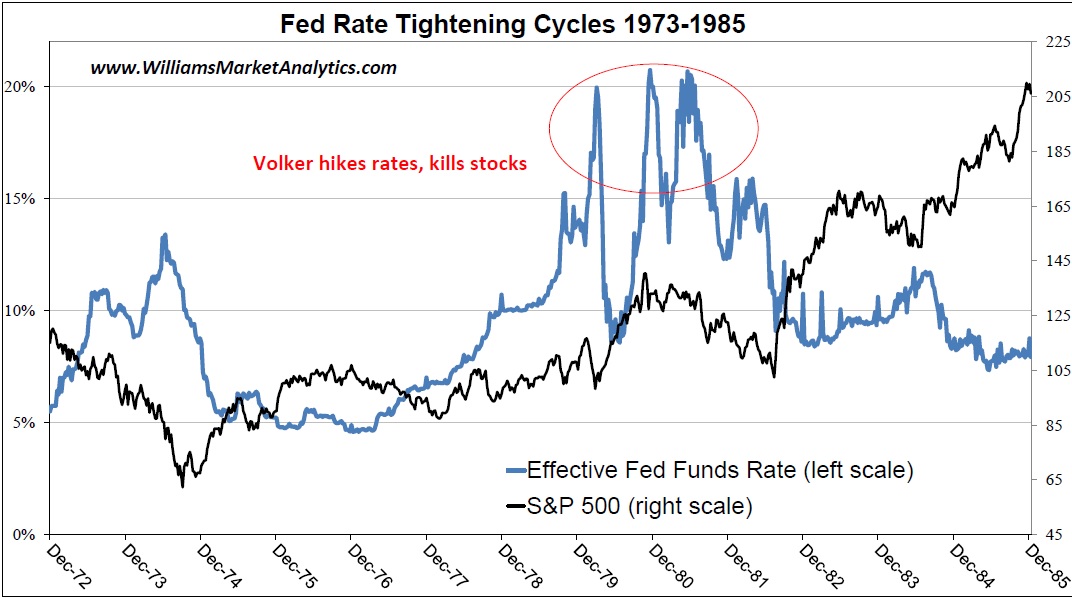

- In 2022, the Fed embarked on an aggressive series of rate hikes, raising interest rates by a total of 4.25 percentage points. This was the most aggressive tightening cycle since the 1980s.

- The Fed’s actions were driven by soaring inflation, which reached a 40-year high in 2022.

- The goal was to cool the economy and bring inflation back to its 2% target.

Impact on the Markets:

- Stock market downturn: The S&P 500 index experienced a significant decline in 2022, falling by over 19%.

- Bond market losses: Bond investors also faced losses as bond yields surged, leading to price declines.

- Market volatility: Both stock and bond markets experienced heightened volatility as investors grappled with the Fed’s actions and their implications for the economy.

The Fed’s Pivot:

- In 2023, the Fed shifted its stance, signaling a potential pause in rate hikes as inflation showed signs of cooling.

- The Fed’s pivot led to a rebound in the stock market, with the S&P 500 index gaining over 15% in the first half of 2023.

Key Considerations:

- Inflation expectations: The Fed’s actions are heavily influenced by inflation expectations. If inflation remains stubbornly high, the Fed may need to continue raising rates.

- Economic growth: The Fed will also monitor economic growth and the labor market to gauge the impact of its rate hikes.

- Global economic conditions: The Fed’s decisions are also influenced by global economic conditions, including interest rate policies in other countries.

Expert Insights

David Rosenberg, Chief Economist and Strategist at Rosenberg Research & Associates:

"The Fed is caught between a rock and a hard place. If they raise rates too aggressively, they risk triggering a recession. If they don’t raise rates enough, they risk fueling inflation. It’s a delicate balancing act."

Mohamed El-Erian, Chief Economic Advisor at Allianz:

"The Fed’s rate hikes are a necessary evil to fight inflation. However, they come at a cost. We are likely to see a slowdown in economic growth and potentially even a recession."

Mark Zandi, Chief Economist at Moody’s Analytics:

"The Fed’s rate hikes have already had a significant impact on the economy. We are seeing a slowdown in consumer spending and business investment."

Navigating the Market

For Investors:

- Diversify your portfolio: Holding a mix of stocks, bonds, and other assets can help mitigate the impact of Fed rate hikes.

- Monitor inflation: Pay close attention to inflation data, as it can provide clues about the Fed’s future actions.

- Seek professional advice: Consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals.

For Businesses:

- Manage borrowing costs: Businesses should carefully manage their debt levels and explore alternative sources of financing.

- Monitor economic conditions: Stay informed about economic trends and the Fed’s policy decisions.

- Adjust business plans: Be prepared to adjust business plans if necessary, based on the changing economic landscape.

FAQ

Q: How do I know when the Fed will raise interest rates?

A: The Fed’s decisions are based on a complex set of economic indicators, including inflation, unemployment, and economic growth. The Fed releases statements and forecasts that provide insights into its thinking.

Q: What are the risks associated with Fed rate hikes?

A: The main risks include a slowdown in economic growth, a recession, and increased market volatility.

Q: How can I protect my investments from Fed rate hikes?

A: Diversifying your portfolio, seeking professional advice, and monitoring economic conditions can help mitigate the impact of Fed rate hikes.

Q: What is the Fed’s target inflation rate?

A: The Fed’s target inflation rate is 2%.

Q: What are the Fed’s other tools for managing the economy?

A: In addition to setting interest rates, the Fed can also use tools like quantitative easing (buying bonds) and reverse repo operations (lending money to banks) to influence the economy.

Conclusion

The Fed’s rate hikes are a powerful tool for managing inflation, but they also carry significant implications for the stock and bond markets. Investors and businesses need to be aware of the potential impacts of these decisions and adjust their strategies accordingly. By understanding the relationship between Fed rate hikes and the markets, investors can make more informed decisions and navigate the complex economic landscape.

Source:

- Federal Reserve Board: https://www.federalreserve.gov/

Conclusion

We’re thrilled you came along to explore The Fed’s Tightening Grip: How Rate Hikes Impact Stocks and Bonds with us and hope it left you inspired and better informed.