Fixed Rate Business Loans: Your Steady Path to Success

Related Articles

- The Essential Guide To Business Insurance: Navigating The Complex World Of Protection

- The Business Loan Credit Report: Your Company’s Financial Passport

- Protecting Your Business: A Comprehensive Guide To Insurance Options

- Unlocking Growth: A Comprehensive Guide To Business Loan Options

- The Business Loan Approval Process: A Guide For Entrepreneurs

Introduction

Uncover the latest details about Fixed Rate Business Loans: Your Steady Path to Success in this comprehensive guide.

Fixed Rate Business Loans: Your Steady Path to Success

In the world of business financing, navigating the complexities of interest rates can feel like a constant gamble. One minute you’re riding the wave of low rates, the next you’re facing the uncertainty of fluctuating costs. This is where fixed rate business loans step in, offering a lifeline of predictable payments and financial stability.

But before you dive headfirst into a fixed rate loan, it’s crucial to understand the ins and outs of this financing option. This guide will equip you with the knowledge to make informed decisions and confidently choose the best path for your business.

What is a Fixed Rate Business Loan?

Imagine a financial agreement where your monthly payments remain the same, regardless of market fluctuations. That’s the beauty of a fixed rate business loan. The interest rate is locked in for the duration of the loan term, creating a predictable financial roadmap for your business.

Think of it like a steady compass guiding you through the choppy waters of market volatility. You know exactly how much you’ll be paying each month, allowing you to budget effectively and focus on growing your business.

Why Choose a Fixed Rate Business Loan?

Here’s why businesses often prefer the stability of fixed rates:

- Predictable Payments: Fixed rates eliminate the risk of fluctuating interest costs, allowing you to forecast your monthly expenses with accuracy. This stability simplifies your financial planning and budgeting, reducing the stress of unpredictable payments.

- Peace of Mind: Knowing your interest rate won’t change for the entire loan term provides a sense of security. This allows you to focus on your business goals without the worry of unexpected financial burdens.

- Long-Term Planning: Fixed rates empower you to make long-term financial decisions with confidence. You can confidently invest in equipment, expand operations, or pursue growth opportunities knowing your loan payments are stable.

Fixed Rate vs. Variable Rate: The Great Debate

The choice between fixed and variable rate loans is a common dilemma for businesses. While fixed rates offer predictability, variable rates can potentially offer lower initial interest rates. Here’s a quick comparison:

Fixed Rate:

- Pros: Predictable payments, stability, peace of mind, good for long-term planning.

- Cons: May have a higher initial interest rate compared to variable rates.

Variable Rate:

- Pros: Potential for lower initial interest rates, may benefit from declining interest rates.

- Cons: Unpredictable payments, risk of rising interest rates, can make budgeting challenging.

Ultimately, the best choice depends on your individual business needs and risk tolerance.

Factors to Consider When Choosing a Fixed Rate Loan

Before you commit to a fixed rate business loan, consider these key factors:

- Loan Term: The length of the loan term directly impacts your monthly payments and the total interest you’ll pay. Shorter terms generally have higher monthly payments but lower overall interest costs.

- Interest Rate: Compare interest rates from different lenders to secure the best deal. Don’t be afraid to negotiate, especially if you have a strong credit history and a solid business plan.

- Loan Amount: The amount you borrow influences your monthly payments and the total cost of the loan. Borrow only what you need and ensure you can comfortably handle the repayments.

- Fees: Lenders often charge origination fees, closing costs, or other fees associated with the loan. Factor these costs into your overall borrowing decision.

- Credit Score: Your credit score significantly impacts the interest rate you’ll be offered. A strong credit history can lead to lower interest rates and more favorable loan terms.

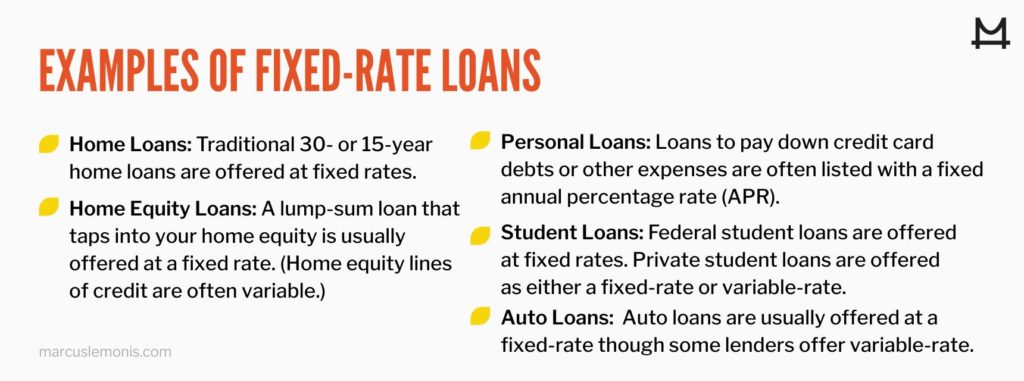

Types of Fixed Rate Business Loans

The world of fixed rate business loans offers a variety of options to cater to different business needs. Here are some common types:

- Term Loans: These loans provide a fixed amount of money with a fixed repayment schedule. They are often used for equipment purchases, expansion projects, or working capital.

- Lines of Credit: A line of credit provides a flexible source of funding that you can access as needed. While the interest rate is fixed, your payments fluctuate based on your usage.

- SBA Loans: Small Business Administration (SBA) loans offer favorable terms and lower interest rates for small businesses. Some SBA loans have fixed interest rates, providing stability for your business.

- Commercial Real Estate Loans: These loans are specifically designed for financing commercial properties, such as office buildings, retail spaces, or industrial facilities. Fixed rates provide predictable payments for your real estate investments.

Tips for Getting the Best Fixed Rate Loan

- Shop Around: Compare interest rates and loan terms from multiple lenders to find the most competitive offer.

- Build Strong Credit: A good credit score opens doors to lower interest rates and more favorable loan terms. Maintain a healthy credit history by paying bills on time and keeping credit utilization low.

- Prepare a Solid Business Plan: A well-crafted business plan demonstrates your business’s potential and strengthens your loan application.

- Negotiate: Don’t be afraid to negotiate the interest rate and loan terms with lenders. Be prepared to showcase your business’s strengths and potential for success.

- Consider Your Long-Term Needs: Think about your business’s long-term financial goals and choose a loan term and interest rate that aligns with your plans.

The Benefits of Fixed Rate Business Loans

- Predictable Budgeting: Fixed rates simplify budgeting by eliminating the risk of fluctuating interest costs. You can accurately predict your monthly expenses, allowing you to make informed financial decisions.

- Financial Stability: Fixed rate loans provide a sense of security, knowing your payments will remain consistent throughout the loan term. This stability reduces financial stress and allows you to focus on growing your business.

- Long-Term Planning: Fixed rates empower you to make long-term financial plans with confidence. You can invest in expansion projects, acquire equipment, or pursue growth opportunities knowing your loan payments are stable.

- Reduced Risk: Fixed rates eliminate the risk of rising interest rates, protecting your business from unpredictable financial burdens. This stability can be crucial in uncertain economic times.

Conclusion

Fixed rate business loans offer a reliable and predictable financing solution for businesses of all sizes. They provide the stability and peace of mind you need to navigate the complexities of the financial landscape. By understanding the benefits and factors to consider, you can make informed decisions and choose the best fixed rate loan for your business.

Remember, a strong credit history, a solid business plan, and thorough research are key to securing the most favorable terms. With careful planning and a strategic approach, a fixed rate business loan can be a powerful tool to propel your business towards success.

FAQ

Q: What is the difference between a fixed rate and a variable rate business loan?

A: A fixed rate loan locks in the interest rate for the entire loan term, ensuring predictable payments. A variable rate loan’s interest rate can fluctuate based on market conditions, making payments unpredictable.

Q: How do I know if a fixed rate loan is right for my business?

A: Consider your risk tolerance, financial planning needs, and long-term business goals. If you prefer predictable payments and stability, a fixed rate loan might be a good fit.

Q: What factors influence the interest rate on a fixed rate business loan?

A: Your credit score, business history, loan amount, loan term, and lender’s current rates all play a role in determining your interest rate.

Q: How can I get the best interest rate on a fixed rate business loan?

A: Shop around, compare rates from different lenders, build a strong credit history, prepare a solid business plan, and negotiate terms.

Q: Are there any risks associated with fixed rate business loans?

A: The main risk is that you might miss out on potentially lower interest rates if rates decline during the loan term. However, you gain stability and predictability in return.

Q: What are some common types of fixed rate business loans?

A: Term loans, lines of credit, SBA loans, and commercial real estate loans are common types of fixed rate loans.

Q: What are some tips for securing a fixed rate business loan?

A: Build strong credit, prepare a solid business plan, shop around for lenders, negotiate terms, and consider your long-term needs.

Q: What are the benefits of fixed rate business loans?

A: Predictable budgeting, financial stability, long-term planning, and reduced risk are some of the key benefits of fixed rate loans.

Resources:

- Small Business Administration (SBA): https://www.sba.gov/

- U.S. Small Business Administration: Business Loans: https://www.sba.gov/funding-programs/loans

- The Balance: Business Loans: https://www.thebalance.com/business-loans-3974918

- Investopedia: Business Loans: https://www.investopedia.com/terms/b/businessloan.asp

Closure

We hope this article has helped you understand everything about Fixed Rate Business Loans: Your Steady Path to Success. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Fixed Rate Business Loans: Your Steady Path to Success in the comment section.

Keep visiting our website for the latest trends and reviews.