2025 US Health Insurance Market Trends for Young Adults

Source: precedenceresearch.com

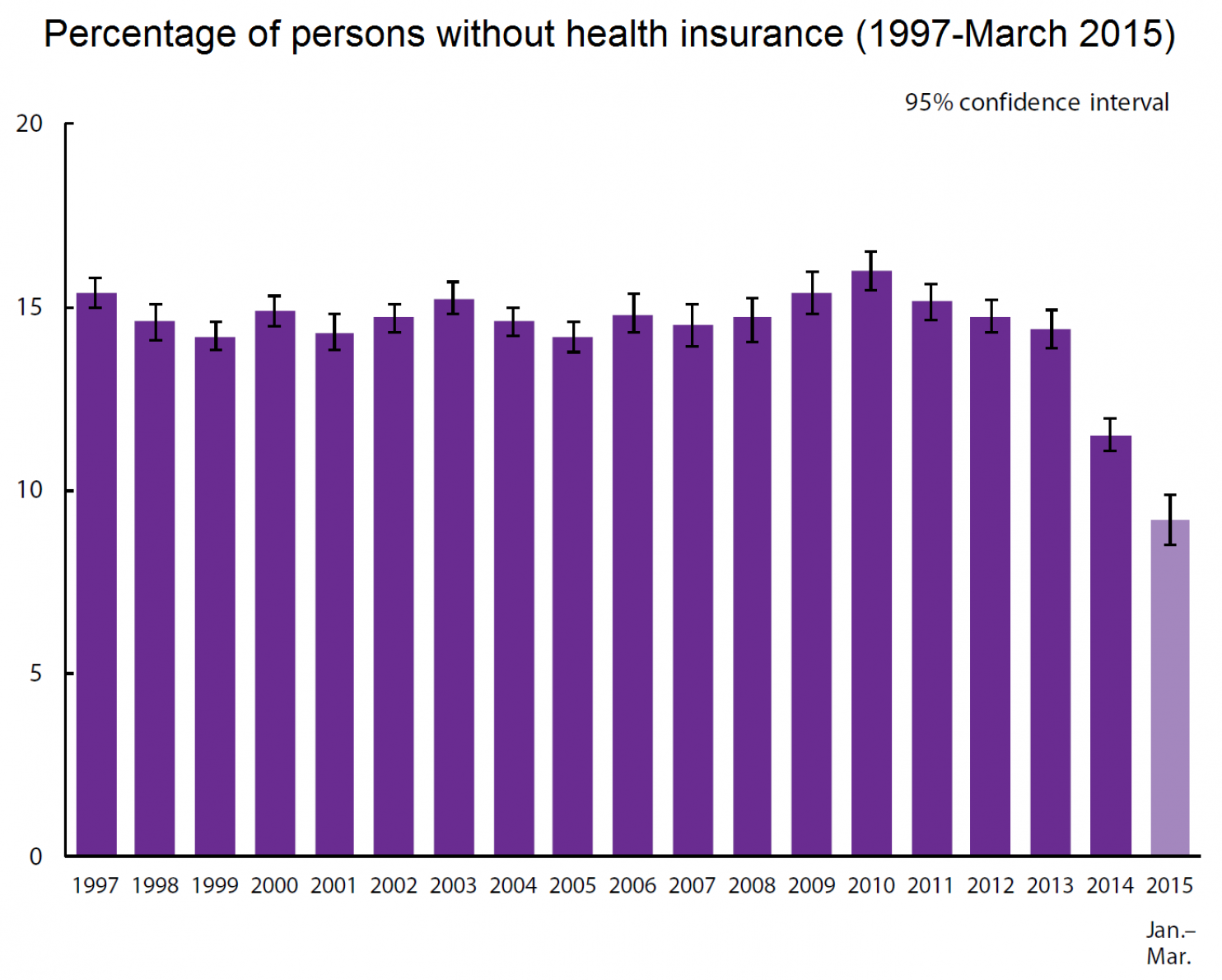

2025 US health insurance market trends for young adults – The US health insurance market is poised for significant changes in 2025, particularly impacting young adults (18-25). This shift is driven by evolving economic landscapes, technological advancements, and changing consumer preferences. Understanding these trends is crucial for both insurers and young adults navigating the complexities of healthcare coverage.

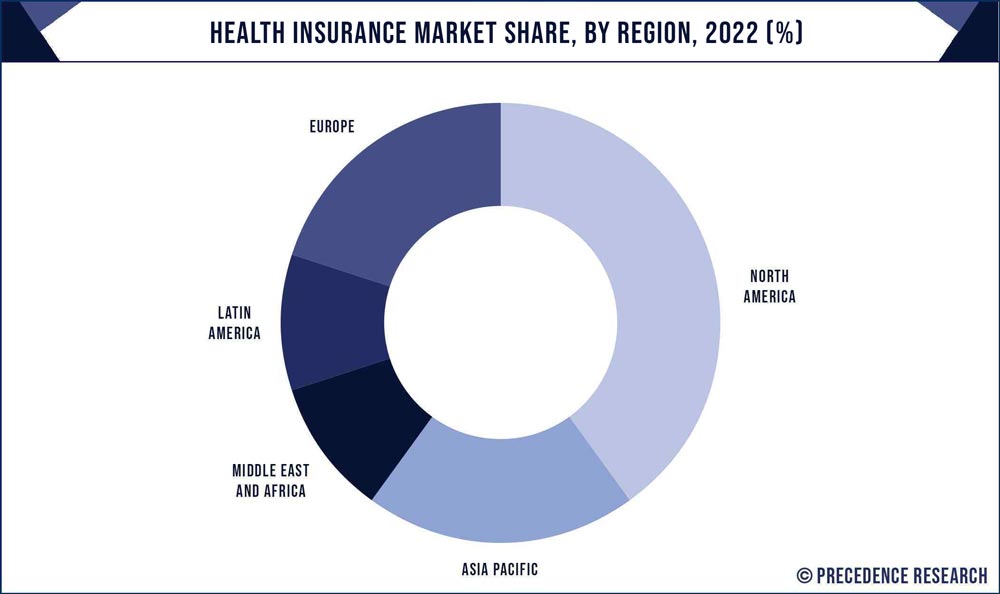

Market Size and Growth Projections

The 2025 US health insurance market for young adults is projected to experience moderate growth, influenced by factors such as economic conditions and the increasing prevalence of employer-sponsored plans. Individual market enrollment is anticipated to remain a significant portion, but with fluctuating rates based on economic pressures and individual choices.

- Individual Plans: Projected growth in individual market enrollment for young adults will likely be linked to job market conditions. A strong economy may see decreased interest in individual plans as employer-sponsored options become more accessible. Conversely, economic downturns could see increased demand for individual market plans.

- Employer-Sponsored Plans: These are anticipated to remain the dominant form of health insurance for young adults, particularly those in stable employment. However, the availability and affordability of these plans are expected to be highly influenced by economic factors.

- Marketplace Plans: The marketplace is expected to see fluctuations in enrollment, depending on subsidies and economic factors. Young adults with lower incomes are likely to be heavily reliant on marketplace plans, which could see a growth spurt if economic support increases.

- Demographic Variations: Projected growth rates for young adults will vary by demographic factors such as education level, income, and location. Higher education levels and higher incomes may correlate with a lower reliance on subsidized plans.

- Economic Impact: Economic downturns could lead to reduced purchasing power and a subsequent decline in enrollment for young adults. Conversely, economic prosperity could increase enrollment in employer-sponsored plans.

- Purchasing Behavior Shifts: Young adults are increasingly prioritizing value and transparency in their health insurance choices. They may be more inclined to choose plans with robust telehealth options or wellness programs.

Pricing and Affordability

Health insurance premiums for young adults in 2025 are anticipated to fluctuate based on various factors, including regional differences and economic conditions. Access to affordable options for young adults with pre-existing conditions will be a key concern.

- Premium Trends: Premiums for young adults are predicted to rise moderately in some regions, while remaining relatively stable in others. Geographic location and employer-sponsored plan availability will significantly influence these trends.

- Pre-existing Conditions: Efforts to increase affordability and accessibility for young adults with pre-existing conditions will likely continue, with government initiatives and innovative pricing models playing a critical role.

- Geographic Variations: The cost of health insurance will vary across different US regions. High-cost areas may see higher premiums, while more affordable regions will likely see more competitive rates.

- Innovative Pricing Models: The emergence of value-based care models and tiered pricing structures are potential solutions to improve affordability, with emphasis on preventative care and wellness programs.

- Government Initiatives: Government subsidies and initiatives aimed at making health insurance more affordable for young adults are expected to continue, with a potential focus on expanding employer-sponsored plans to a wider range of industries.

Coverage Options and Trends, 2025 US health insurance market trends for young adults

Source: peterubel.com

Advancements in health insurance coverage options for young adults in 2025 are expected to focus on value-based care, telehealth integration, and preventative care initiatives.

- Value-Based Care: The adoption of value-based care models is anticipated to increase, potentially impacting the cost and coverage of various services.

- Telehealth: Telehealth services will likely become more integrated into health insurance plans, impacting access to care and reducing costs for young adults.

- Preventative Care and Wellness: Preventative care and wellness programs are expected to gain greater prominence, with health insurers offering incentives for healthy lifestyle choices.

- Technological Integration: Technology will streamline health insurance processes, from managing health records to facilitating claims processing.

Technology and Digitalization

Digital health platforms will significantly impact the 2025 health insurance market for young adults, affecting access to care and cost.

- Digital Health Platforms: Digital platforms are predicted to play a crucial role in connecting young adults with healthcare providers and streamlining the insurance process.

- Telehealth and Mobile Health: Telehealth and mobile health applications will likely become integral to care delivery, increasing access to providers and reducing travel time.

- Data Analytics: Data analytics will be used to personalize health insurance offerings for young adults, potentially leading to more tailored and cost-effective plans.

- Health Record Management: Digital tools will facilitate the management of health records and claims, improving efficiency and transparency.

- AI in Predictive Modeling: AI could be used in predictive modeling for health risks, enabling proactive interventions and preventative measures.

Regulatory Landscape and Policy Changes

The regulatory landscape governing health insurance for young adults in 2025 is expected to evolve, addressing affordability and access concerns.

| Regulatory Area | Potential Hurdle | Potential Solution |

|---|---|---|

| Access to Coverage | Rising costs | Subsidies, government programs |

| Consumer Protection | Lack of transparency | Enhanced disclosure requirements |

| Provider Networks | Limited choices | Incentivize participation of providers |

| Data Privacy | Security concerns | Stricter data privacy standards |

Emerging Health Concerns and Needs

Emerging health concerns and needs will shape the 2025 health insurance market for young adults, particularly mental health.

- Emerging Health Concerns: Mental health concerns and the rising prevalence of chronic conditions are expected to significantly influence insurance coverage needs.

- Mental Health Care: Mental health care and related coverage will likely be a major focus, with greater emphasis on preventative care and early intervention.

- Specialized Coverage: Specialized coverage for emerging health conditions and needs will likely become more prevalent.

Consumer Behavior and Preferences

Source: maximizemarketresearch.com

Consumer behavior among young adults is anticipated to shift in the 2025 health insurance market.

- Insurance Channels: Young adults are expected to increasingly utilize online channels and mobile apps for insurance information and purchasing.

- Information Seeking: Young adults will likely prioritize comprehensive and easily accessible information when making health insurance decisions.

- Consumer Segments: Insurance preferences will vary among different consumer segments, based on factors such as income, location, and lifestyle choices.

- Innovative Communication: Innovative communication and engagement methods will likely play a crucial role in attracting and retaining young adult customers.

Top FAQs

What are the projected growth rates for different types of health insurance plans for young adults in 2025?

While specific numbers are not available in the provided Artikel, the projections indicate significant growth for all plans. Employer-sponsored plans are expected to remain dominant, but individual plans are also anticipated to see increases. The marketplace plans, depending on government subsidies, are likely to exhibit varied growth depending on market conditions and consumer interest.

How will technology impact access to and cost of care for young adults in 2025?

Telehealth and mobile health applications are expected to play a key role. This will likely lead to increased access to care, potentially reducing costs by enabling virtual consultations and remote monitoring. Data analytics will further personalize health insurance offerings, leading to tailored plans and potentially more efficient use of healthcare resources.

What emerging health concerns are expected to impact young adults in 2025, and how will this affect insurance needs?

Mental health concerns are likely to rise, and this will likely increase the need for specialized mental health coverage. Emerging health conditions, along with their potential impacts on insurance costs, are likely to be a major consideration.

What government initiatives might impact the pricing of health insurance for young adults in 2025?

Potential government initiatives could include subsidies, tax credits, or changes to the regulatory landscape. The Artikel suggests that such initiatives will likely focus on increasing affordability and access to coverage. Specific details are not Artikeld in the provided document.