Top Health Insurance Plans for Families in 2025

Top health insurance plans 2025 for families in the USA – Navigating the US healthcare landscape in 2025 presents a complex picture for families. Factors like rising healthcare costs, evolving healthcare technologies, and shifting government policies are reshaping family healthcare decisions. Health insurance plays a crucial role in mitigating these challenges, offering a safety net for unexpected medical expenses and access to quality care. Understanding the nuances of various plans and their benefits is essential for families to make informed choices.

Introduction to Family Health Insurance in 2025

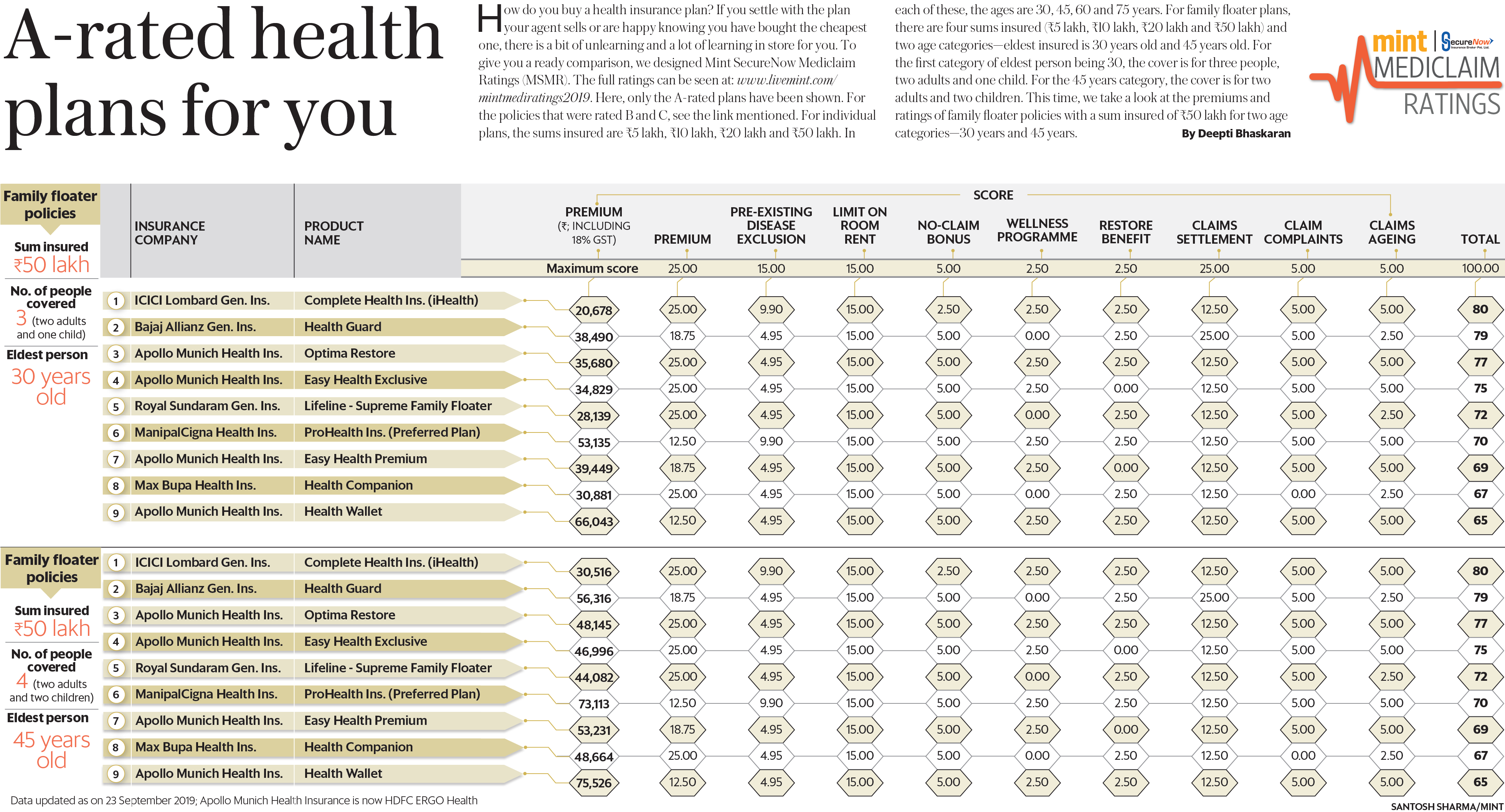

Source: livemint.com

The US healthcare system in 2025 is expected to continue evolving, with an emphasis on preventative care, telehealth advancements, and potentially, more integrated care models. These changes will impact the way families approach health insurance decisions. The role of health insurance will become more dynamic, moving beyond simply covering medical expenses to encompass wellness programs, preventive screenings, and potentially even incorporating financial incentives for healthy lifestyles. Families will need to carefully consider how plans support these evolving needs.

Key considerations for families selecting health insurance include coverage breadth, cost-effectiveness, provider networks, and the specific healthcare needs of each family member. Understanding these aspects allows families to make informed choices that align with their financial situations and healthcare priorities.

| Plan Type | Description |

|---|---|

| Health Maintenance Organization (HMO) | Requires patients to select a primary care physician (PCP) within the plan’s network, often with more limited choices for specialists. |

| Preferred Provider Organization (PPO) | Allows greater flexibility in choosing providers, both in-network and out-of-network, with varying cost implications for out-of-network care. |

| Exclusive Provider Organization (EPO) | Similar to PPOs but often with higher out-of-pocket costs for out-of-network care, with specific limitations on access to specialists outside the network. |

Identifying Top Factors for Choosing Plans, Top health insurance plans 2025 for families in the USA

Source: umn.edu

Choosing the right health insurance plan goes beyond simply selecting the lowest premium. Families need to consider various factors, including the comprehensive nature of coverage, the quality and accessibility of providers, and the potential financial implications. Understanding these aspects will empower families to make informed decisions that align with their individual needs.

- Coverage: Consider the breadth of services covered, including preventive care, hospitalization, and prescription drugs. Pre-existing conditions and mental health coverage are also critical considerations.

- Network: Evaluate the provider network’s accessibility and reputation. The availability of in-network specialists and hospitals is crucial for ease of care.

- Cost: Analyze premiums, deductibles, co-pays, and co-insurance to determine the overall financial burden of the plan. Long-term financial implications should be assessed.

| Plan Type | Cost | Benefits | Features |

|---|---|---|---|

| HMO | Generally lower premiums | Wider preventative care, potentially lower out-of-pocket costs with in-network providers | Limited provider choices |

| PPO | Higher premiums than HMO | More provider choices, both in-network and out-of-network | Potential for higher out-of-pocket costs for out-of-network care |

Evaluating Coverage and Benefits

Source: medium.com

Understanding the specifics of coverage is essential. Families need to assess the types of healthcare services included, the impact of cost-sharing components (deductibles, co-pays, and co-insurance), and the importance of out-of-pocket maximums. Careful scrutiny of plan documents is vital to understanding benefits and exclusions.

- Preventive Care: Understand how preventive services, such as check-ups and screenings, are covered.

- Cost-Sharing: Analyze deductibles, co-pays, and co-insurance to estimate the total out-of-pocket costs.

- Out-of-Pocket Maximums: Understand the maximum amount a family will pay out-of-pocket in a given year.

Question & Answer Hub: Top Health Insurance Plans 2025 For Families In The USA

What are the common types of family health insurance plans?

Common types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each has its own structure regarding network access and cost.

How can I compare the costs of different plans?

Compare premiums, deductibles, co-pays, co-insurance, and out-of-pocket maximums. Consider the long-term financial implications, and don’t just focus on the initial premium.

What factors influence my choice beyond price?

Consider factors like coverage for pre-existing conditions, mental health, dental care, and preventive services. The size and health needs of your family members will significantly impact your choice.

How important is the provider network?

Choosing a plan with a strong provider network is crucial. Out-of-network care can be significantly more expensive, so researching provider availability in your area is essential.