The Business Loan Calculator: Your Roadmap to Financial Success

Related Articles

- Navigating The World Of Business Insurance: A Guide To Using Calculators For Coverage

- Running A Home-Based Business? Don’t Forget The Insurance!

- Navigating The World Of Business Insurance: A Comprehensive Guide

- Navigating The Labyrinth: A Comprehensive Guide To Business Insurance Comparison

- Unlocking The Secrets Of Business Credit Insurance Costs: A Comprehensive Guide

Introduction

Uncover the latest details about The Business Loan Calculator: Your Roadmap to Financial Success in this comprehensive guide.

The Business Loan Calculator: Your Roadmap to Financial Success

Starting a business is an exciting journey, but it often requires financial support. That’s where business loans come in, offering the capital you need to get your venture off the ground, expand operations, or overcome unexpected challenges. But navigating the complex world of loans can be daunting, especially when you’re trying to understand interest rates and repayment terms.

Enter the business loan calculator, your trusty sidekick in the quest for financial clarity. This digital tool empowers you to estimate your loan payments, analyze different loan options, and make informed decisions about your business financing.

Why is a Business Loan Calculator Essential?

Imagine walking into a car dealership without knowing the price of the vehicle. You’d feel lost, right? The same applies to business loans. Without a calculator, you might:

- Overestimate your affordability: You might end up with a loan that stretches your budget thin, leaving you struggling to make payments.

- Underestimate the true cost: You might not realize the full impact of interest rates and fees on your overall loan cost.

- Miss out on better options: You might not explore different loan terms and interest rates, potentially missing out on a more favorable deal.

Unlocking the Power of the Business Loan Calculator

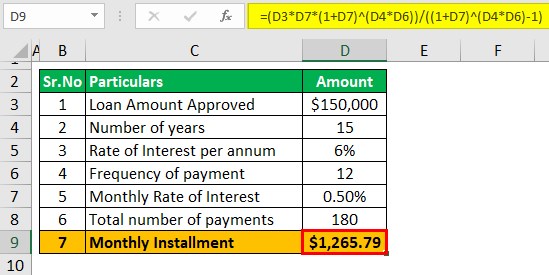

A business loan calculator is a simple yet powerful tool that helps you understand the financial implications of borrowing money. It works by taking into account key factors like:

- Loan amount: The principal amount you’re borrowing.

- Interest rate: The percentage charged on the loan amount, reflecting the cost of borrowing.

- Loan term: The duration of the loan, typically expressed in months or years.

- Payment frequency: How often you’ll make payments (monthly, quarterly, etc.).

By inputting these details, the calculator generates estimates for:

- Monthly payments: The fixed amount you’ll need to pay each month to repay the loan.

- Total interest paid: The total cost of borrowing, calculated as the difference between the total amount repaid and the original loan amount.

- Total loan cost: The sum of the principal amount and the total interest paid, representing the full financial burden of the loan.

Navigating the Calculator: A Step-by-Step Guide

Most business loan calculators have a user-friendly interface, but here’s a breakdown of the typical steps:

- Choose your loan type: Select the type of loan you’re interested in, such as a term loan, SBA loan, line of credit, or equipment financing.

- Enter the loan amount: Input the desired loan amount, based on your business needs.

- Input the interest rate: Enter the interest rate you’re expecting, which can be obtained from potential lenders.

- Select the loan term: Choose the loan term that suits your repayment plan.

- Specify the payment frequency: Indicate how often you’ll make payments (e.g., monthly).

- Review the results: The calculator will display estimated monthly payments, total interest paid, and total loan cost.

Beyond the Basics: Exploring Advanced Features

While basic calculators provide essential information, some offer more advanced features to enhance your analysis:

- Loan amortization schedule: This feature displays a detailed breakdown of your monthly payments, showing how much goes towards principal and interest over the loan term.

- Loan comparison tool: Some calculators allow you to compare different loan offers side-by-side, making it easier to identify the most favorable option.

- Sensitivity analysis: This feature allows you to adjust key variables like interest rate or loan term to see how they impact your monthly payments and total loan cost.

Finding the Right Business Loan Calculator for Your Needs

With numerous calculators available online, choosing the right one can be overwhelming. Consider these factors:

- Accuracy: Look for calculators developed by reputable financial institutions or loan providers.

- User-friendliness: Choose a calculator with a clear and intuitive interface.

- Features: Select a calculator that offers the features you need, such as loan amortization schedules or comparison tools.

- Free or paid: Some calculators are free to use, while others may charge a subscription fee.

Common Business Loan Calculator Mistakes to Avoid

While calculators are incredibly helpful, they’re not foolproof. Avoid these common mistakes:

- Ignoring fees: Many loans come with additional fees, such as origination fees or closing costs. Remember to factor these into your calculations.

- Assuming static interest rates: Interest rates can fluctuate over time. Consider potential rate changes when making your calculations.

- Overlooking your business plan: The calculator is a tool, but it shouldn’t replace a sound business plan. Ensure your loan aligns with your overall financial strategy.

Beyond the Calculator: Essential Considerations for Business Loans

While the calculator provides valuable insights, remember that it’s just one piece of the puzzle. Here are other factors to consider when applying for a business loan:

- Credit score: Your credit score significantly impacts your loan eligibility and interest rate.

- Business history: Lenders assess your business’s track record, including revenue, expenses, and profitability.

- Collateral: Some loans require collateral, such as equipment or real estate, to secure the loan.

- Loan purpose: Clearly define your loan purpose to ensure it aligns with lender requirements.

FAQs about Business Loan Calculators

Q: Are business loan calculators accurate?

A: Reputable calculators use reliable formulas and data, providing accurate estimates. However, remember that interest rates and fees can vary, so it’s always best to consult with a lender for a personalized quote.

Q: Can I use a personal loan calculator for a business loan?

A: While personal and business loan calculators share some similarities, business loan calculators are specifically designed to account for factors relevant to business financing.

Q: What if I don’t know my interest rate yet?

A: You can use a calculator to estimate your payments based on average interest rates for your loan type. However, it’s essential to get a personalized quote from a lender to determine your actual interest rate.

Q: Is a business loan calculator free?

A: Many online calculators are free to use. However, some may require a subscription or charge a fee for advanced features.

Q: Can I use a business loan calculator to compare different loan offers?

A: Some calculators offer comparison tools, allowing you to input multiple loan offers and see their side-by-side comparison.

Q: What are the benefits of using a business loan calculator?

A: A business loan calculator helps you:

- Estimate your monthly payments and total loan cost.

- Compare different loan options.

- Make informed decisions about your business financing.

Conclusion: Empowering Your Business with Financial Clarity

The business loan calculator is an indispensable tool for any entrepreneur seeking financing. By understanding the costs involved, you can make informed decisions about your loan options, ensuring your business thrives and reaches its full potential. Remember, the calculator is a starting point, but it’s essential to consult with lenders and financial advisors to develop a comprehensive financial strategy for your business.

Reference:

https://www.investopedia.com/terms/b/business-loan-calculator.asp

Closure

Thank you for reading! Stay with us for more insights on The Business Loan Calculator: Your Roadmap to Financial Success.

Don’t forget to check back for the latest news and updates on The Business Loan Calculator: Your Roadmap to Financial Success!

Feel free to share your experience with The Business Loan Calculator: Your Roadmap to Financial Success in the comment section.

Stay informed with our next updates on The Business Loan Calculator: Your Roadmap to Financial Success and other exciting topics.