Unlocking Business Growth: A Deep Dive into Business Credit Loan Interest Rates

Related Articles

- Navigating The Maze Of Business Health Insurance Rates: A Comprehensive Guide

- Unlocking The Power Of Business Insurance: A Comprehensive Guide For Every Entrepreneur

- Securing Your Business Dreams: A Guide To Collateralized Business Loans

- Navigating The World Of Business Liability Insurance Quotes: A Guide For Every Entrepreneur

- Fueling Your Business Growth: A Comprehensive Guide To Business Loans For Existing Businesses

Introduction

Join us as we explore Unlocking Business Growth: A Deep Dive into Business Credit Loan Interest Rates, packed with exciting updates

Unlocking Business Growth: A Deep Dive into Business Credit Loan Interest Rates

Starting and running a business is a journey filled with excitement, challenges, and a constant need for capital. Whether you’re looking to expand operations, invest in new equipment, or simply manage cash flow, business loans can be a vital lifeline. But navigating the world of business credit loan interest rates can feel like deciphering a foreign language. Fear not, entrepreneurs! This comprehensive guide will demystify the intricacies of interest rates and equip you with the knowledge to secure the best possible terms for your business.

The Basics: Understanding Interest Rates

At its core, an interest rate is the cost of borrowing money. Lenders charge interest to compensate for the risk they take in loaning you their funds. Think of it like renting a car – you pay a fee to use the car for a certain period. Similarly, you pay interest to use the lender’s money for a specific duration.

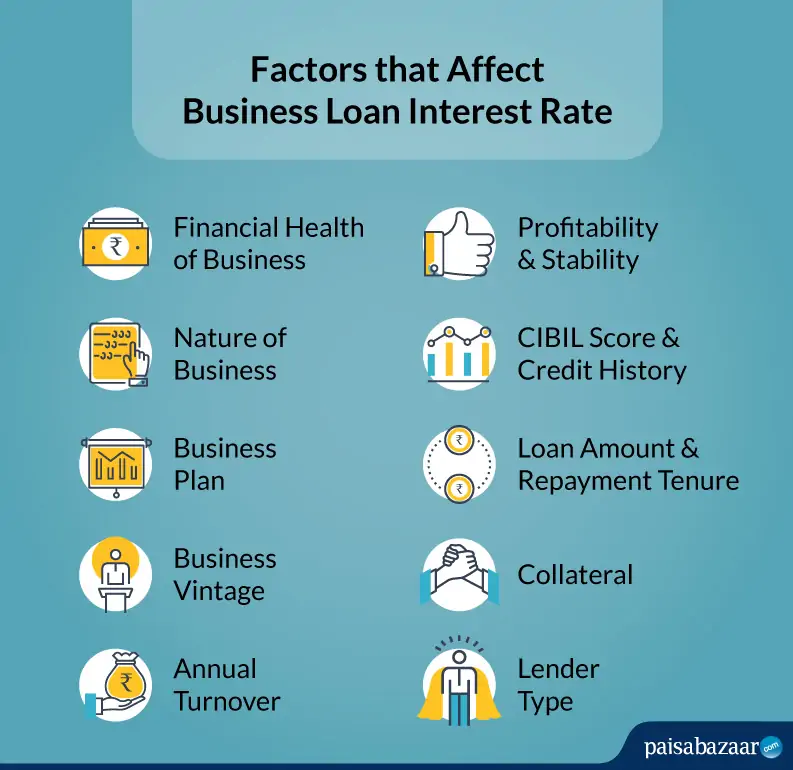

Business Credit Loan Interest Rates: A Complex Landscape

Unlike personal loans, business credit loan interest rates are influenced by a multitude of factors. Understanding these factors is crucial for securing competitive rates and ultimately, minimizing your borrowing costs.

1. Your Credit Score: The Foundation of Trust

Your business credit score is the single most important factor determining your interest rate. It’s a numerical representation of your business’s creditworthiness, reflecting your history of paying bills on time and managing debt responsibly. A higher credit score signals to lenders that you’re a reliable borrower, making them more likely to offer lower interest rates.

2. The Loan Type: Choosing the Right Tool for the Job

Different types of business loans come with different interest rates. Here’s a quick overview:

- Term Loans: These are traditional loans with fixed monthly payments over a set period. They offer predictable budgeting but often have higher interest rates than other options.

- Lines of Credit: Think of a line of credit as a revolving credit card for your business. You have access to a predetermined amount of funds, and you only pay interest on the amount you use. Interest rates are typically variable and can fluctuate based on market conditions.

- Equipment Loans: These loans are specifically designed for financing equipment purchases. Interest rates are usually fixed and can be lower than traditional term loans due to the collateral provided (the equipment itself).

- Small Business Administration (SBA) Loans: Backed by the government, SBA loans are known for their competitive interest rates and flexible terms. They’re a great option for businesses struggling to secure conventional financing.

3. Loan Amount: The Bigger the Borrow, the Lower the Rate (Sometimes)

Generally, larger loan amounts tend to attract lower interest rates. Lenders see larger loans as less risky, as the borrower has a greater capacity to repay. However, this isn’t always the case, and other factors like credit score and loan type can override this trend.

4. Loan Term: Time is Money (and Interest)

The longer the loan term, the lower the monthly payment. However, it also means you’ll pay more interest over the life of the loan. Shorter terms typically result in higher monthly payments but lower overall interest costs.

5. Industry and Business Model: Playing the Risk Game

Lenders assess the inherent risks associated with your industry and business model. Industries with higher volatility or lower profit margins might face higher interest rates. Similarly, businesses with a proven track record and strong financials are often considered less risky and therefore eligible for lower rates.

6. Collateral: Securing the Deal with Assets

Collateral is an asset that you pledge to the lender as security for the loan. If you default on the loan, the lender can seize the collateral to recover their losses. Offering collateral typically helps secure lower interest rates, as it reduces the lender’s risk.

7. Personal Guarantees: Putting Your Personal Finances on the Line

A personal guarantee is a promise to repay the loan personally if your business fails to do so. Lenders often require personal guarantees for smaller businesses or those with limited credit history. This can lower interest rates as it strengthens the lender’s confidence in repayment.

8. Relationship with the Lender: Building Trust for Better Rates

Developing a strong relationship with your lender can lead to better loan terms, including lower interest rates. This can involve maintaining a positive payment history, communicating proactively, and demonstrating your commitment to your business.

9. Market Conditions: The Economy’s Influence

The overall economic climate can significantly impact interest rates. When interest rates are low, businesses can generally secure loans at more favorable terms. Conversely, during periods of economic uncertainty, lenders might raise rates to offset increased risk.

10. Lender Competition: Shopping Around for the Best Deal

Just like when buying a car, shopping around for business loans can help you secure the best possible interest rate. Don’t be afraid to compare offers from multiple lenders and negotiate terms.

Factors Beyond Your Control

While many factors influencing interest rates are within your control, there are some that are not:

- The Federal Reserve’s Interest Rate Policies: The Federal Reserve sets the benchmark interest rate, which influences the rates charged by banks and other lenders.

- Inflation: High inflation can lead to higher interest rates as lenders seek to protect their investments from eroding purchasing power.

Tips for Securing Lower Interest Rates

- Build Strong Business Credit: Pay bills on time, maintain low debt utilization, and monitor your business credit score regularly.

- Shop Around: Compare offers from multiple lenders to find the most competitive rates.

- Negotiate: Don’t be afraid to negotiate terms with lenders, especially if you have a strong credit score and a solid business plan.

- Consider Collateral: If possible, offer collateral to reduce lender risk and potentially secure lower interest rates.

- Maintain a Healthy Financial Profile: Ensure your business has a strong cash flow, profitability, and healthy debt-to-equity ratio.

- Develop a Strong Business Plan: A well-written business plan demonstrates your understanding of your industry, market, and financial projections, making you a more attractive borrower.

FAQs: Getting Answers to Your Burning Questions

Q: What is a good business credit score?

A: A good business credit score is generally considered to be 700 or above. However, the specific score required for a loan depends on the lender and the type of loan you’re seeking.

Q: How can I improve my business credit score?

A: Pay bills on time, maintain low debt utilization, and monitor your credit report for errors. You can also establish business credit by applying for trade credit lines with suppliers and obtaining a business credit card.

Q: How often should I check my business credit score?

A: It’s best to check your business credit score at least once a year, or more frequently if you’re planning to apply for a loan.

Q: What are the risks of taking out a business loan?

A: The main risks of taking out a business loan include defaulting on the loan, incurring high interest costs, and potentially jeopardizing your business’s financial stability if you can’t meet the repayment obligations.

Q: What are some alternatives to traditional business loans?

A: Alternatives to traditional business loans include crowdfunding, invoice financing, and peer-to-peer lending.

Q: What should I do if I’m denied a business loan?

A: If you’re denied a business loan, it’s important to understand the reasons for the denial. You can then work to address those issues, such as improving your credit score or strengthening your business plan.

Conclusion: Navigating the Path to Business Success

Understanding business credit loan interest rates is a crucial step towards securing the financing your business needs. By carefully considering the factors that influence rates, taking proactive steps to improve your creditworthiness, and shopping around for the best deals, you can minimize your borrowing costs and position your business for long-term success. Remember, knowledge is power in the world of business finance!

References:

- https://www.sba.gov/

- https://www.experian.com/business/

- https://www.dunsandbradstreet.com/

- https://www.nav.com/

- https://www.creditkarma.com/

Closure

We hope this article has helped you understand everything about Unlocking Business Growth: A Deep Dive into Business Credit Loan Interest Rates. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

We’d love to hear your thoughts about Unlocking Business Growth: A Deep Dive into Business Credit Loan Interest Rates—leave your comments below!

Stay informed with our next updates on Unlocking Business Growth: A Deep Dive into Business Credit Loan Interest Rates and other exciting topics.