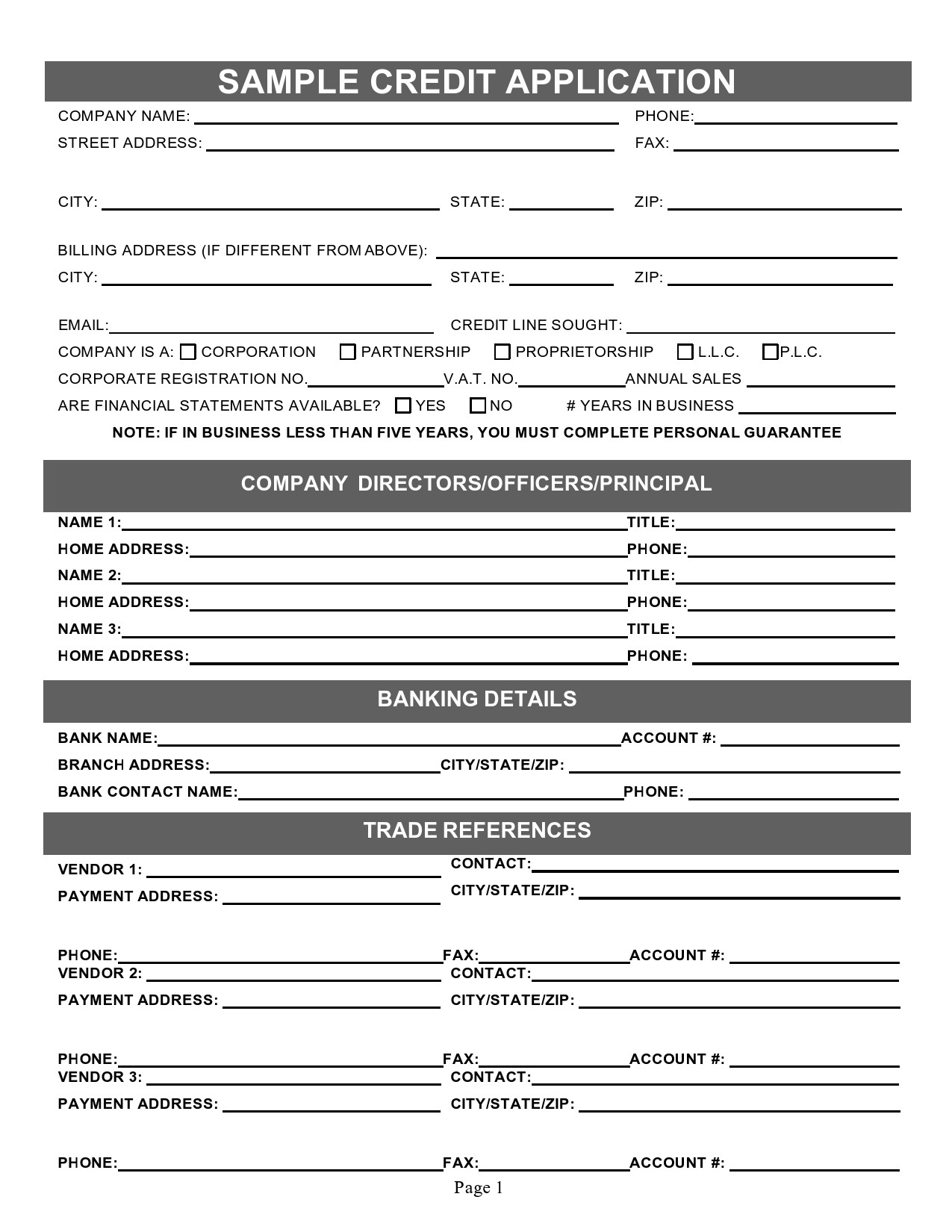

Business credit loan application

Related Article

- Apple Pay Setup Guide

- Android App Monetization Strategies

- The IPhone 15 Pro Max: A Deep Dive Into Apple’s Latest Flagship

- Apple One: Your All-in-One Apple Subscription For A Seamless Digital Life

- Capturing The Magic: A Deep Dive Into IOS Screen Recording

Introduction

With enthusiasm, let’s uncover the essential aspects of Business credit loan application and why it’s relevant to you. Our aim is to provide you with fresh insights and valuable knowledge about this intriguing topic. Let’s begin and discover what Business credit loan application has to offer!}

Video About

Unlocking Growth: A Guide to Business Credit Loan Applications in the U.S.

Picture this: You’ve got a brilliant business idea, a dedicated team, and a burning desire to succeed. But there’s one key ingredient missing: the capital to fuel your growth. This is where business credit loans come in, offering a lifeline to entrepreneurs looking to expand operations, purchase equipment, or simply manage cash flow.

Navigating the world of business credit loans can feel overwhelming, especially with the constant evolution of the market. This comprehensive guide will equip you with the knowledge and strategies to confidently apply for a loan and secure the funding you need to achieve your business goals.

Understanding the Landscape: Business Credit Loans in the U.S.

The U.S. market offers a diverse range of business credit loan options, each catering to specific needs and risk profiles. Here’s a breakdown of the most common types:

1. SBA Loans:

- What they are: Backed by the Small Business Administration (SBA), these loans offer favorable terms like lower interest rates and longer repayment periods. They are designed to support small businesses with limited credit history or those struggling to secure traditional financing.

- Key features:

- Government guarantee: The SBA guarantees a portion of the loan, making it less risky for lenders.

- Flexible terms: Longer repayment periods and lower interest rates compared to conventional loans.

- Access to resources: The SBA offers guidance and resources to help businesses navigate the loan application process.

- Popular programs:

- 7(a) Loan: The most common SBA loan program, offering a wide range of uses, including working capital, equipment purchases, and real estate.

- 504 Loan: Designed to finance fixed assets like land, buildings, and machinery.

- Microloan Program: Provides small loans up to $50,000 for startups and small businesses.

2. Conventional Business Loans:

- What they are: Offered by commercial banks, credit unions, and online lenders, these loans are typically based on the borrower’s creditworthiness and business performance.

- Key features:

- Competitive interest rates: Often lower than alternative financing options.

- Flexible repayment terms: Can be tailored to meet individual business needs.

- Quick approval process: Some lenders offer expedited approval for qualified borrowers.

- Types:

- Term Loans: Fixed-rate loans with a set repayment schedule.

- Lines of Credit: Flexible credit lines that allow businesses to borrow funds as needed.

- Equipment Loans: Specifically designed to finance the purchase of equipment.

3. Alternative Business Loans:

- What they are: These loans cater to businesses that may not qualify for traditional financing due to factors like limited credit history or revenue.

- Key features:

- Faster approval process: Often available with minimal documentation and quick turnaround times.

- Flexible eligibility criteria: May be available to businesses with less than perfect credit scores.

- Higher interest rates: Typically come with higher interest rates and fees compared to traditional loans.

- Types:

- Merchant Cash Advances: Businesses receive a lump sum of cash in exchange for a percentage of future sales.

- Invoice Financing: Businesses can receive funding based on the value of their unpaid invoices.

- Online Business Loans: Offered by online lenders and typically processed quickly.

The Evolution of Business Credit Loan Applications: Embracing Digital Transformation

The traditional process of applying for a business loan often involved mountains of paperwork, lengthy processing times, and multiple trips to the bank. However, the digital revolution has drastically transformed the landscape, offering streamlined, efficient, and user-friendly experiences.

Here’s how technology is shaping the future of business credit loan applications:

- Online Application Platforms: Many lenders now offer user-friendly online platforms that allow businesses to apply for loans completely online. These platforms simplify the application process, eliminating the need for physical paperwork and enabling quicker processing.

- Automated Underwriting: AI-powered underwriting systems are becoming increasingly common, analyzing vast amounts of data to assess loan applications and make faster, more accurate credit decisions.

- Digital Document Verification: Digital document verification tools allow lenders to verify business documents electronically, eliminating the need for physical signatures and accelerating the application process.

- Personalized Loan Recommendations: Advanced algorithms analyze business data to provide customized loan recommendations tailored to individual needs and financial situations.

- Real-Time Tracking: Online portals provide borrowers with real-time updates on the status of their loan application, offering transparency and peace of mind.

The Future is Frictionless: Trends Shaping the Business Credit Loan Landscape

The future of business credit loan applications is bright, with innovative solutions emerging to enhance accessibility, speed, and user experience. Here are some key trends to watch:

- Open Banking: Open banking allows businesses to share their financial data securely with lenders, enabling faster and more accurate credit assessments.

- Alternative Data: Lenders are increasingly using alternative data sources, such as social media activity and online reviews, to assess creditworthiness, expanding access to financing for businesses with limited traditional credit history.

- Artificial Intelligence (AI): AI is revolutionizing loan processing, automating tasks, improving risk assessment, and providing personalized loan recommendations.

- Blockchain Technology: Blockchain offers secure and transparent record-keeping, enhancing the efficiency and security of loan transactions.

- Mobile-First Applications: Mobile-friendly loan application platforms are making it easier for businesses to apply for loans anytime, anywhere.

Navigating the Application Process: A Step-by-Step Guide

Ready to take the plunge and apply for a business credit loan? Here’s a comprehensive guide to ensure a smooth and successful application process:

1. Preparation is Key:

- Assess your needs: Determine the purpose of the loan, the amount you require, and the repayment terms that work best for your business.

- Gather essential documents: Prepare all necessary documents, including:

- Business plan

- Financial statements (profit and loss, balance sheet, cash flow statement)

- Tax returns

- Personal credit report

- Bank statements

- Understand your credit score: Check your personal and business credit scores to identify areas for improvement.

2. Choose the Right Lender:

- Research your options: Explore different lenders, comparing interest rates, fees, repayment terms, and eligibility requirements.

- Consider your business needs: Choose a lender that specializes in loans for your industry or business size.

- Read reviews and testimonials: Seek feedback from other businesses that have worked with the lender.

3. Complete the Application:

- Be accurate and thorough: Provide complete and accurate information on the application form.

- Submit all required documents: Ensure that all necessary documents are included with your application.

- Communicate effectively: Stay in touch with the lender and answer any questions promptly.

4. Be Prepared for Underwriting:

- Understand the process: The lender will review your application and conduct due diligence to assess your creditworthiness and business viability.

- Be transparent and upfront: Be honest about your financial situation and any challenges your business may be facing.

- Respond to requests promptly: Provide any additional information or documents requested by the lender.

5. Negotiate the Loan Agreement:

- Review the terms carefully: Read the loan agreement thoroughly and understand all the terms and conditions.

- Negotiate favorable terms: Discuss interest rates, fees, repayment terms, and any other provisions that may be negotiable.

- Seek legal advice: If necessary, consult with a legal professional to review the loan agreement before signing.

Expert Insights: Tips from the Pros

Here are some valuable insights from experienced professionals on how to navigate the business credit loan application process:

- "Start building your business credit early." – **[Expert Name], [

Conclusion

In conclusion, we hope this article has provided you with helpful insights about Business credit loan application. We appreciate your attention to our article and hope you found it informative and useful. Stay tuned for more exciting articles and updates!