Bank Collapse Risk: A Looming Threat to the US Economy?

Related Articles

- Navigating The Inflation Maze: What’s In Store For US Consumers In 2024?

- The Looming Shadow: US Credit Crunch Concerns And What They Mean For You

- The American Comeback: Navigating The Path To Economic Recovery

- The Energy Crisis: A Looming Threat To Our Global Economy

- Inflation In The US: A Deep Dive Into The Rising Costs

Introduction

Uncover the latest details about Bank Collapse Risk: A Looming Threat to the US Economy? in this comprehensive guide.

Bank Collapse Risk: A Looming Threat to the US Economy?

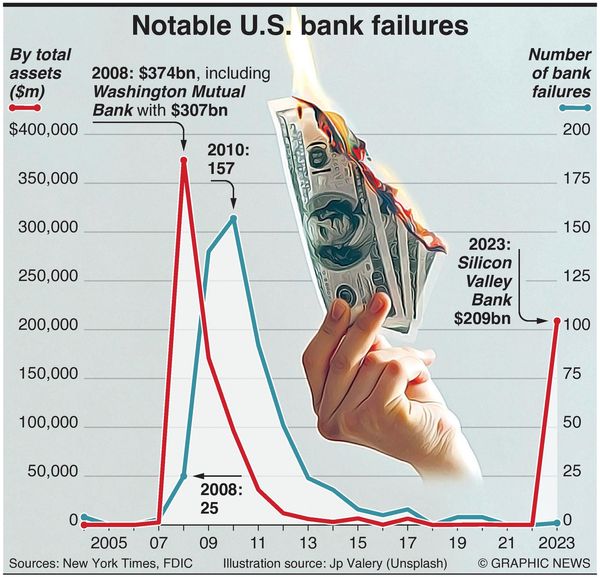

The recent collapse of Silicon Valley Bank (SVB) and Signature Bank sent shockwaves through the financial world, raising concerns about the potential for a wider banking crisis. While the situation has calmed somewhat, the risk of bank collapses remains a real threat to the US economy.

This article will delve into the factors contributing to bank collapse risk, explore the potential consequences for the US economy, and discuss what can be done to mitigate the risks.

Understanding the Risks

Bank collapses can occur due to a variety of factors, including:

- Economic Downturn: A recession or economic slowdown can lead to increased loan defaults, putting pressure on bank balance sheets.

- Interest Rate Hikes: Rising interest rates can make it more expensive for borrowers to repay loans, leading to higher default rates and reduced bank profits.

- Asset Bubbles: When asset prices, such as real estate or stocks, become inflated, they can burst, causing losses for banks that have invested in those assets.

- Poor Risk Management: Banks that fail to adequately assess and manage their risks can become vulnerable to financial shocks.

- Cyberattacks and Fraud: Increasingly sophisticated cyberattacks and fraud can cripple bank operations and lead to significant financial losses.

- Regulatory Failures: Weak or ineffective regulations can allow banks to take on excessive risks, increasing the likelihood of collapse.

The Impact on the US Economy

The consequences of a bank collapse can be far-reaching, impacting the US economy in the following ways:

- Credit Crunch: When banks fail, they may be less willing to lend money, leading to a credit crunch that can stifle economic growth.

- Financial Instability: Bank failures can trigger a loss of confidence in the financial system, leading to panic and a decline in investment.

- Job Losses: Bank collapses can lead to job losses in the financial sector and other industries that rely on bank financing.

- Reduced Consumer Spending: A credit crunch can lead to reduced consumer spending, as people become more hesitant to borrow money.

- Inflation: Bank failures can lead to increased inflation, as banks may be forced to raise interest rates to compensate for losses.

The Role of the Federal Reserve

The Federal Reserve (Fed) plays a crucial role in mitigating the risk of bank collapses. The Fed can:

- Provide Emergency Liquidity: The Fed can provide emergency loans to banks that are facing liquidity problems, preventing them from collapsing.

- Supervise and Regulate Banks: The Fed can set regulations to ensure that banks have adequate capital and are managing their risks effectively.

- Intervene in the Market: The Fed can intervene in the market to stabilize financial conditions, such as by buying bonds or lowering interest rates.

What Can Be Done to Mitigate the Risk?

There are a number of steps that can be taken to mitigate the risk of bank collapses:

- Strengthening Bank Regulations: Regulators should strengthen bank regulations to ensure that banks have adequate capital and are managing their risks effectively.

- Improving Risk Management Practices: Banks need to improve their risk management practices to identify and manage potential threats.

- Promoting Financial Literacy: Consumers need to be financially literate to make informed decisions about their finances and avoid predatory lending practices.

- Diversifying Investments: Banks should diversify their investments to reduce their exposure to specific sectors or asset classes.

- Developing Early Warning Systems: Regulators should develop early warning systems to identify potential risks and take action before they escalate.

- Strengthening Cybersecurity: Banks need to invest in cybersecurity to protect themselves from cyberattacks and fraud.

The Future of Banking

The banking industry is facing a period of significant change, driven by technological advancements, regulatory changes, and evolving customer expectations. Banks need to adapt to these changes to remain competitive and mitigate the risk of collapse.

- Digital Transformation: Banks need to embrace digital technologies to improve their efficiency, enhance customer experiences, and reduce costs.

- Innovation: Banks need to be innovative to develop new products and services that meet the needs of their customers.

- Building Trust: Banks need to build trust with their customers by being transparent, ethical, and responsible.

FAQ

Q: What are the signs of a bank collapse?

A: Some signs of a bank collapse include:

- Decreasing stock price: A sharp decline in a bank’s stock price can indicate investor concerns about its financial health.

- High loan defaults: A significant increase in loan defaults can put pressure on a bank’s balance sheet.

- Reduced liquidity: A bank with low liquidity may struggle to meet its obligations.

- Negative news reports: Negative news reports about a bank’s financial performance or management practices can erode investor confidence.

Q: What can I do to protect my money from a bank collapse?

A: You can protect your money from a bank collapse by:

- Diversifying your investments: Don’t put all your eggs in one basket. Spread your money across different banks and investment vehicles.

- Understanding your deposit insurance: In the US, the FDIC insures deposits up to $250,000 per depositor, per insured bank.

- Keeping your money in a safe place: Store your cash and important documents in a safe place, such as a safe deposit box.

Q: What is the role of the government in preventing bank collapses?

A: The government plays a crucial role in preventing bank collapses through:

- Regulation: The government sets regulations to ensure that banks are financially sound and manage their risks effectively.

- Supervision: The government supervises banks to ensure that they comply with regulations and identify potential problems.

- Deposit insurance: The government provides deposit insurance to protect depositors from losses in case of a bank failure.

- Financial support: The government can provide financial support to banks that are facing financial difficulties, such as through emergency loans or bailouts.

Conclusion

The risk of bank collapses is a serious threat to the US economy. By understanding the factors that contribute to these risks, taking steps to mitigate them, and fostering a culture of financial responsibility, we can work towards a more stable and resilient financial system.

Reference:

- Federal Reserve Bank of New York

- Federal Deposit Insurance Corporation (FDIC)

- Financial Stability Board

Closure

We hope this article has helped you understand everything about Bank Collapse Risk: A Looming Threat to the US Economy?. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Bank Collapse Risk: A Looming Threat to the US Economy?!

We’d love to hear your thoughts about Bank Collapse Risk: A Looming Threat to the US Economy?—leave your comments below!

Stay informed with our next updates on Bank Collapse Risk: A Looming Threat to the US Economy? and other exciting topics.