Business Life Insurance: Protecting Your Company’s Future

Related Articles

- Unlocking The Power Of Business Insurance Online: A Comprehensive Guide

- Protecting Your Business: A Guide To Commercial Business Insurance

- Unlocking Your Business Potential: A Guide To Self-Employed Business Loans

- Protecting Your Business: A Comprehensive Guide To Business Insurance Services

- Unlocking Growth: A Guide To Business Loans Without Collateral

Introduction

Uncover the latest details about Business Life Insurance: Protecting Your Company’s Future in this comprehensive guide.

Business Life Insurance: Protecting Your Company’s Future

The world of business is full of uncertainties. Market fluctuations, economic downturns, and unforeseen events can all impact your company’s stability. While you can’t control everything, you can take steps to mitigate risk and secure your business’s future. One powerful tool in your arsenal is business life insurance.

What is Business Life Insurance?

Business life insurance is a type of insurance policy that pays a death benefit to your company upon the death of a key employee or business owner. This financial cushion can help your business navigate the challenges of losing a vital member, ensuring continuity and minimizing disruption.

Types of Business Life Insurance:

There are several types of business life insurance policies, each designed to meet specific needs:

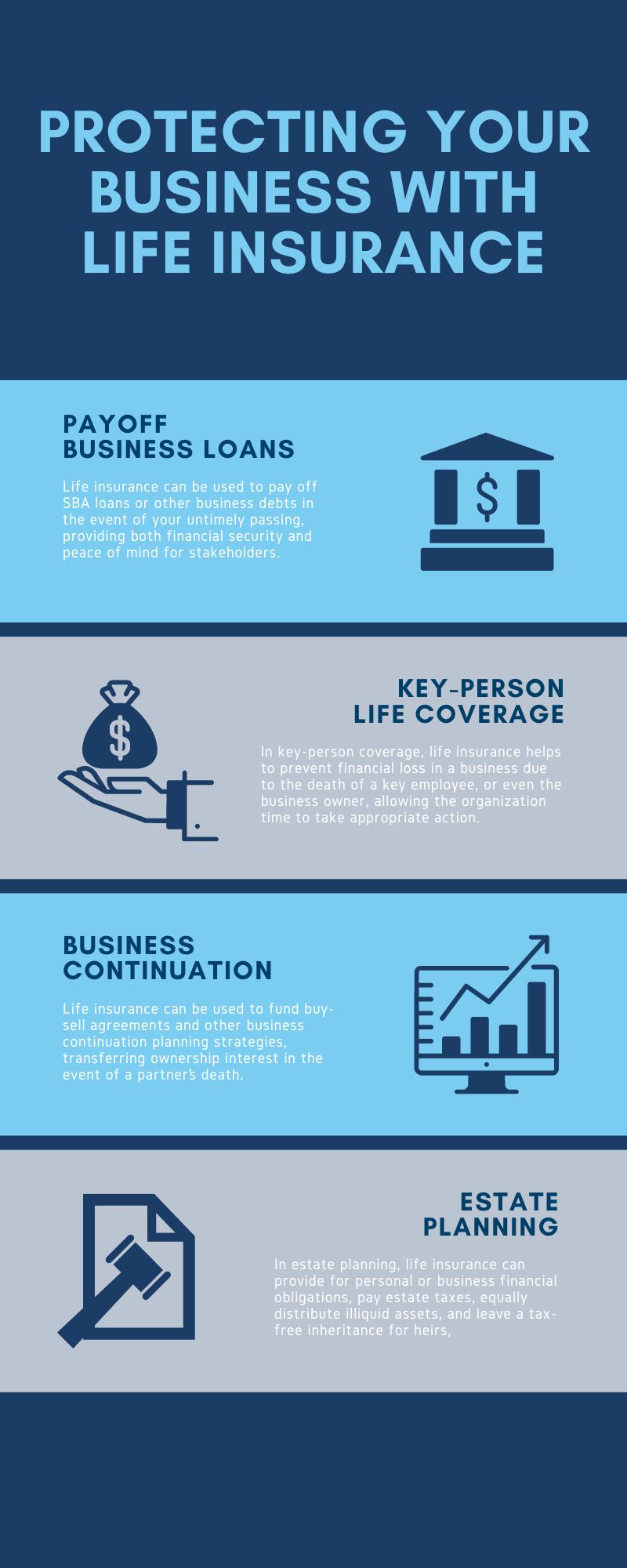

- Key Person Life Insurance: This policy protects your business from the financial loss incurred when a key employee, whose skills and knowledge are crucial to your success, passes away. The death benefit can be used to cover expenses like recruiting and training a replacement, lost revenue, or debt repayment.

- Buy-Sell Agreement Life Insurance: This policy helps ensure a smooth transition of ownership if a business partner or shareholder dies. The death benefit is used to purchase the deceased’s shares, preventing potential disputes and ensuring the remaining partners can maintain control.

- Corporate Owned Life Insurance (COLI): This policy is owned by the company and names the company as the beneficiary. The death benefit can be used for a variety of purposes, including funding employee benefits, paying off debt, or investing in future growth.

Why is Business Life Insurance Important?

- Financial Security: Losing a key employee or business owner can significantly impact your bottom line. Business life insurance provides a financial safety net, helping you cover the financial losses associated with their absence.

- Business Continuity: The death of a key individual can disrupt operations and hinder productivity. Business life insurance can help you bridge the gap, allowing you to hire a replacement, train new employees, or manage the transition smoothly.

- Debt Repayment: Business life insurance can be used to pay off business loans or debts, protecting your company from financial strain during a difficult time.

- Tax Advantages: In some cases, the death benefit from a business life insurance policy may be tax-free.

Choosing the Right Business Life Insurance Policy:

Selecting the right business life insurance policy depends on your company’s specific needs. Consider these factors:

- Key Employees: Identify the individuals whose skills and knowledge are critical to your business’s success.

- Financial Impact: Estimate the financial losses your company would face if a key employee or owner passed away.

- Business Goals: Determine how the death benefit will be used, such as covering expenses, debt repayment, or funding future growth.

- Budget: Consider the cost of the policy and factor it into your overall financial planning.

Benefits of Business Life Insurance:

- Financial Protection: Provides a financial cushion in case of a key employee’s death.

- Business Continuity: Helps ensure a smooth transition and minimizes disruptions to operations.

- Debt Management: Can be used to pay off loans and protect your company from financial strain.

- Tax Advantages: In some cases, the death benefit may be tax-free.

- Peace of Mind: Knowing your business is protected in case of a tragedy provides peace of mind for you and your employees.

FAQs about Business Life Insurance:

1. Who needs business life insurance?

Any business that relies on the skills and knowledge of specific individuals, especially those with unique expertise or leadership roles, should consider business life insurance. This includes small businesses, partnerships, and companies with key executives.

2. How much business life insurance do I need?

The amount of coverage depends on your business’s specific needs and the financial impact of losing a key employee. A financial advisor can help you determine the appropriate coverage amount.

3. What are the different types of business life insurance policies?

There are several types of business life insurance policies, including Key Person Life Insurance, Buy-Sell Agreement Life Insurance, and Corporate Owned Life Insurance (COLI).

4. How much does business life insurance cost?

The cost of business life insurance depends on factors such as the age and health of the insured, the coverage amount, and the type of policy.

5. How do I find a business life insurance agent?

You can find a business life insurance agent through online directories, referrals from other business owners, or by contacting your insurance broker.

6. What are the tax implications of business life insurance?

The tax implications of business life insurance can vary depending on the type of policy and how the death benefit is used. It’s essential to consult with a tax advisor to understand the tax implications.

7. Can I get business life insurance if I have pre-existing health conditions?

Yes, but it may be more expensive or require a higher premium. Some insurers offer specialized policies for individuals with pre-existing conditions.

8. Can I change my business life insurance policy later?

Yes, you can typically change your business life insurance policy later to adjust coverage amounts or beneficiary information. However, there may be restrictions or limitations depending on the policy terms.

9. What happens if my business is sold?

The ownership of the business life insurance policy may transfer to the new owner, or it may be terminated depending on the policy terms.

10. What are the advantages of business life insurance over other types of insurance?

Business life insurance provides specific protection for your business, addressing the unique financial and operational risks associated with losing a key employee or owner. It can be a more cost-effective solution than other types of insurance, such as general liability insurance.

Conclusion:

Business life insurance is a crucial investment that can safeguard your company’s future. By providing financial security and ensuring business continuity, it can help you weather the storms of unexpected events and maintain your company’s success.

Remember, it’s essential to work with a qualified insurance agent to understand your business’s specific needs and choose the right business life insurance policy.

Sources:

- https://www.investopedia.com/terms/b/business-life-insurance.asp

- https://www.thebalance.com/business-life-insurance-4160490

- https://www.nerdwallet.com/articles/insurance/business-life-insurance

- https://www.insurance.com/business/business-life-insurance/

Closure

We hope this article has helped you understand everything about Business Life Insurance: Protecting Your Company’s Future. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Business Life Insurance: Protecting Your Company’s Future!

We’d love to hear your thoughts about Business Life Insurance: Protecting Your Company’s Future—leave your comments below!

Stay informed with our next updates on Business Life Insurance: Protecting Your Company’s Future and other exciting topics.