Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups

Related Articles

- Protecting Your Business: A Comprehensive Guide To Business Property Insurance

- Protecting Your Business: A Comprehensive Guide To Business Insurance Policies

- The Essential Guide To Business Insurance: Navigating The Complex World Of Protection

- Startups And Insurance: A Love-Hate Relationship

- Unlocking Your Business’s Potential: A Comprehensive Guide To Business Loan Calculators

Introduction

Join us as we explore Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups, packed with exciting updates

Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups

Starting a business is a thrilling adventure, but it’s also a financial rollercoaster. You’ve got the vision, the passion, and the drive, but you might be missing one crucial ingredient: funding. That’s where business loans come in.

This guide will equip you with the knowledge to navigate the often-intimidating world of startup financing, empowering you to secure the resources you need to launch your dream.

Why Do Startups Need Business Loans?

Let’s face it: starting a business is expensive. You’ll need capital for:

- Initial setup costs: This includes everything from office space and equipment to inventory and marketing materials.

- Operational expenses: Rent, utilities, salaries, and ongoing marketing campaigns all require funding.

- Working capital: This refers to the cash you need to cover day-to-day operations, like paying suppliers and managing inventory.

- Unexpected costs: Life throws curveballs. A business loan can act as a safety net for unforeseen expenses.

Types of Business Loans for Startups

The world of business loans is vast and diverse, offering a range of options tailored to different needs and situations. Here are some of the most common types:

1. SBA Loans:

- The Powerhouse: Backed by the Small Business Administration (SBA), these loans are known for their attractive terms, including lower interest rates and longer repayment periods.

- Who Qualifies: SBA loans are generally more accessible to startups than traditional bank loans, but they still require a good credit score and a solid business plan.

- Popular Options:

- SBA 7(a) Loans: The most common SBA loan, offering a wide range of uses, including working capital, equipment purchases, and real estate.

- SBA 504 Loans: Specifically designed for fixed assets like land, buildings, and machinery.

2. Term Loans:

- The Reliable Choice: Term loans provide a fixed amount of money with a set repayment schedule, typically over a period of 5 to 10 years.

- Ideal For: Purchasing equipment, expanding operations, or covering working capital needs.

- Considerations: Term loans usually require collateral, such as real estate or equipment.

3. Lines of Credit:

- The Flexible Friend: A line of credit acts like a revolving credit card for your business, allowing you to draw funds as needed up to a pre-approved limit.

- Best For: Managing cash flow fluctuations, covering unexpected expenses, or funding seasonal business needs.

- Keep in Mind: Interest rates on lines of credit are typically variable, and you’ll only pay interest on the amount you borrow.

4. Equipment Financing:

- The Specialized Solution: This type of loan is specifically designed to finance the purchase of equipment, like machinery, vehicles, or computers.

- Benefits: Often offers lower interest rates and longer repayment terms than traditional loans.

- Key Feature: The equipment itself usually acts as collateral for the loan.

5. Merchant Cash Advances:

- The Quick Fix: MCAs provide a lump sum of cash in exchange for a percentage of your future credit card sales.

- Pros: Fast approval process, minimal documentation requirements, and no collateral needed.

- Cons: High interest rates and potentially short repayment terms can make them expensive.

6. Microloans:

- The Bootstrap Boost: Microloans are small loans, typically under $50,000, specifically for small businesses and startups.

- Who Benefits: Often targeted towards underserved communities and businesses with limited access to traditional financing.

- Where to Find Them: Non-profit organizations and community development financial institutions (CDFIs) are common sources of microloans.

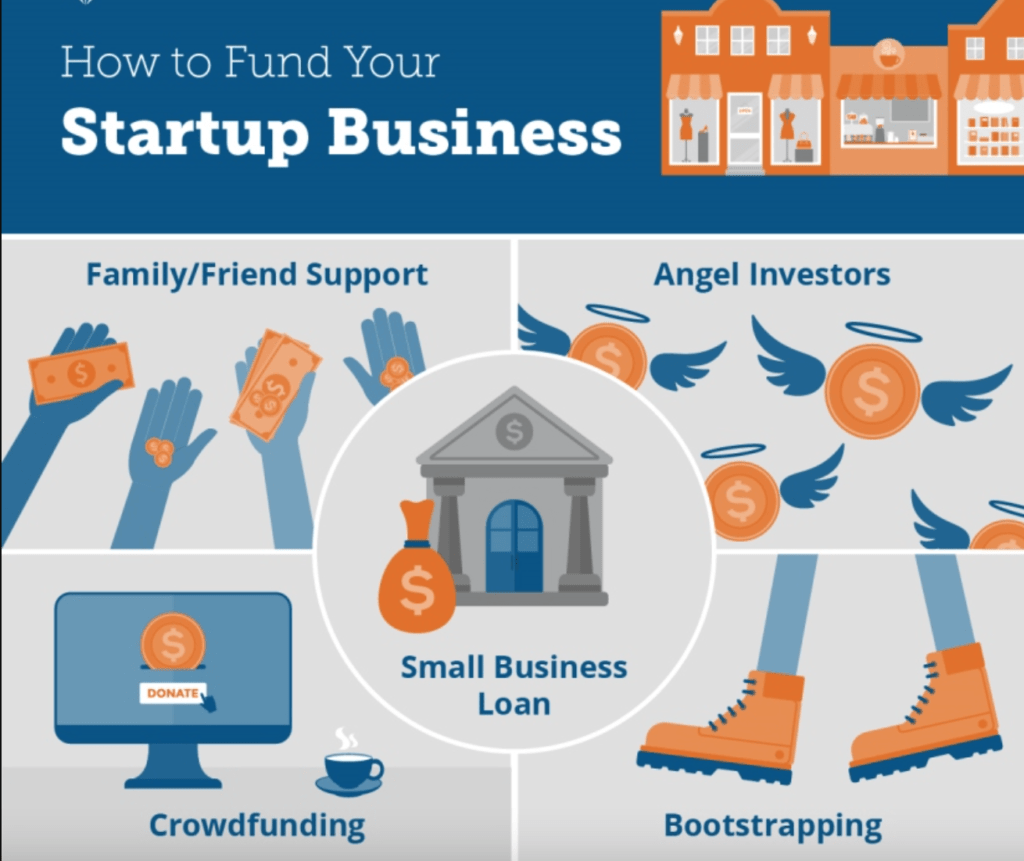

7. Crowdfunding:

- The Community Power: Crowdfunding platforms allow you to raise funds from a large group of individuals, typically through online campaigns.

- Types of Crowdfunding:

- Rewards-based: Backers receive rewards for their contributions, such as early access to your product or services.

- Equity-based: Investors receive ownership shares in your company in exchange for their investment.

- Advantages: Can generate significant funding, build brand awareness, and engage your target audience.

8. Venture Capital:

- The High-Stakes Option: Venture capitalists are investors who provide large sums of money in exchange for equity in high-growth companies.

- Ideal For: Startups with a strong potential for significant returns, often in the tech or healthcare industries.

- Challenges: Requires a strong pitch deck, a proven track record (if possible), and a willingness to share ownership in your company.

9. Angel Investors:

- The Early Stage Champion: Angel investors are wealthy individuals who invest their own money in startups, often in exchange for equity.

- Focus: Typically invest in early-stage companies with high growth potential.

- Key Difference: Angel investors often provide more than just capital; they also offer valuable mentorship and industry connections.

Getting Started: The Loan Application Process

Once you’ve identified the type of loan that best suits your needs, you’ll need to navigate the application process. Here’s a step-by-step guide:

1. Gather Your Documents:

- Business plan: A comprehensive document outlining your business idea, target market, financial projections, and management team.

- Financial statements: Recent balance sheets, income statements, and cash flow statements.

- Personal credit report: Your personal credit score will play a significant role in your loan approval.

- Tax returns: Personal and business tax returns for the past few years.

- Collateral: If required, you’ll need to provide details about any assets you’re willing to use as security for the loan.

2. Choose the Right Lender:

- Banks: Traditional banks often offer a variety of loan products, but they can be more stringent in their requirements.

- Online lenders: Online platforms offer a streamlined application process and often have more flexible eligibility criteria.

- SBA-approved lenders: These lenders specialize in SBA loans and are familiar with the program’s requirements.

- Alternative lenders: Non-traditional lenders, such as merchant cash advance providers or crowdfunding platforms, offer alternative financing options.

3. Shop Around for Rates and Terms:

- Compare interest rates: Look for the lowest interest rate possible, keeping in mind that lower rates often come with longer repayment terms.

- Analyze fees: Be aware of any origination fees, closing costs, or annual percentage rates (APRs) associated with the loan.

- Consider repayment terms: Choose a repayment schedule that aligns with your cash flow projections and avoids putting undue financial strain on your business.

4. Negotiate the Loan Agreement:

- Read the fine print: Thoroughly review the loan agreement before signing to understand the terms and conditions.

- Don’t be afraid to negotiate: If possible, try to negotiate a lower interest rate, longer repayment term, or lower fees.

- Seek legal advice: Consult with a lawyer to ensure you understand the legal implications of the loan agreement.

5. Secure the Loan:

- Fulfill all requirements: Provide all necessary documentation and complete any required credit checks or background checks.

- Close the deal: Once approved, you’ll need to sign the loan agreement and receive the funds.

Tips for Improving Your Loan Application:

- Create a strong business plan: A well-written business plan demonstrates your understanding of the market, your competitive advantage, and your financial projections.

- Build a solid credit history: Maintain a good personal credit score and track your business’s financial performance diligently.

- Demonstrate strong cash flow: Show lenders that you have a reliable source of income to repay the loan.

- Secure collateral: If possible, offer collateral to reduce the lender’s risk and improve your chances of approval.

- Network with investors and lenders: Attend industry events, connect with angel investors, and build relationships with lenders.

Common Mistakes to Avoid:

- Not having a solid business plan: A strong business plan is essential for securing funding.

- Applying for a loan before you’re ready: Ensure you have a clear understanding of your financial needs and a realistic plan for using the loan funds.

- Overlooking the fine print: Carefully review the loan agreement to understand the terms and conditions before signing.

- Not shopping around for the best rates: Compare rates and terms from multiple lenders to get the most favorable offer.

- Neglecting your credit score: Maintain a good personal credit score and track your business’s financial performance.

Managing Your Business Loan:

- Track your payments: Make sure you make your loan payments on time to avoid late fees and penalties.

- Monitor your cash flow: Keep a close eye on your business’s cash flow to ensure you have enough money to cover your loan payments and other expenses.

- Use the loan funds wisely: Invest the loan funds in your business in a way that will generate a return on investment.

- Build a strong relationship with your lender: Communicate with your lender regularly, especially if you encounter any financial difficulties.

FAQs about Business Loans for Startups:

1. What is the average interest rate for a business loan?

Interest rates for business loans vary depending on the lender, the type of loan, your credit score, and other factors. On average, interest rates can range from 5% to 15%.

2. How much can I borrow as a startup?

The amount you can borrow depends on your business’s financial performance, your credit score, and the lender’s lending policies. Microloans can be as low as $5,000, while SBA loans can reach up to $5 million.

3. What are the eligibility requirements for a business loan?

Eligibility requirements vary by lender. Generally, you’ll need a good credit score, a solid business plan, and a track record of financial stability.

4. How long does it take to get approved for a business loan?

The approval process can take anywhere from a few days to several weeks, depending on the lender and the complexity of your application.

5. What happens if I can’t repay my loan?

If you’re unable to repay your loan, your lender may take steps to recover the funds, such as seizing collateral or pursuing legal action.

6. What are the best resources for finding a business loan?

The SBA website is a great resource for information on SBA loans and other financing options. You can also search for lenders online or consult with a business advisor.

7. Can I get a business loan with bad credit?

It can be challenging to get a business loan with bad credit, but it’s not impossible. You may need to consider alternative lenders or explore options like microloans or crowdfunding.

8. What is the difference between debt financing and equity financing?

Debt financing involves borrowing money that you’re obligated to repay with interest. Equity financing involves selling ownership shares in your company in exchange for investment capital.

9. What are some tips for choosing the right lender?

Consider factors such as interest rates, fees, repayment terms, and the lender’s reputation. It’s also important to choose a lender that understands your business and your industry.

10. How can I improve my chances of getting a business loan?

Build a strong business plan, maintain a good credit score, demonstrate strong cash flow, and secure collateral if possible. Networking with investors and lenders can also help.

Conclusion:

Securing a business loan is a crucial step for many startups. By understanding the different types of loans available, carefully navigating the application process, and managing your loan responsibly, you can access the funding you need to turn your entrepreneurial dreams into reality. Remember, while obtaining a loan can be challenging, it’s a worthwhile investment in your business’s future.

References:

- Small Business Administration (SBA)

- U.S. Small Business Administration: Loans

- NerdWallet: Business Loans

- Investopedia: Business Loans

- The Balance: Business Loans

Closure

Thank you for reading! Stay with us for more insights on Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups.

Don’t forget to check back for the latest news and updates on Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups!

We’d love to hear your thoughts about Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups—leave your comments below!

Stay informed with our next updates on Fueling Your Dream: A Comprehensive Guide to Business Loans for Startups and other exciting topics.