Inflation vs recession risks

Related Articles

- The US Debt Ceiling: A Game Of Chicken With Global Consequences

- Navigating The Inflation Maze: What’s In Store For US Consumers In 2024?

- Navigating The Choppy Waters: A Deep Dive Into Global Supply Chain Disruptions

- Navigating The Choppy Waters: Stock Market Volatility In 2024

- The Rollercoaster Ride Of US Unemployment: A Look At The Trends And What They Mean

Introduction

Welcome to our in-depth look at Inflation vs recession risks

Inflation vs. Recession: Navigating the Economic Crossroads

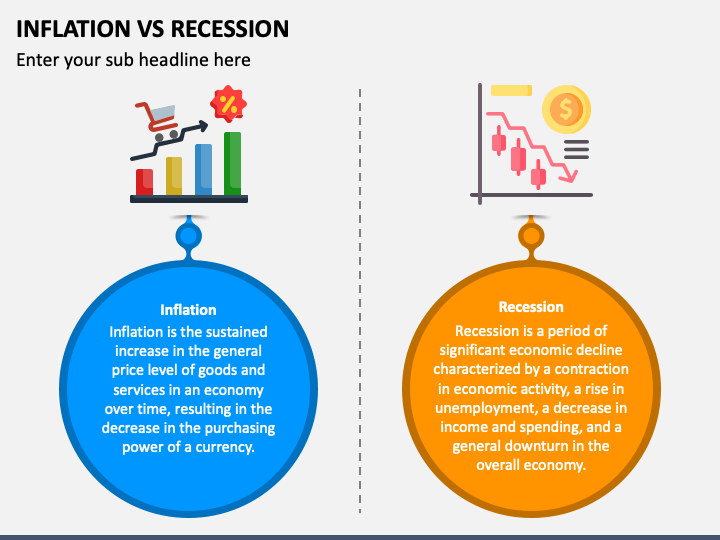

The economic landscape is constantly shifting, presenting us with a complex interplay of forces. Two of the most prominent and often conflicting forces are inflation and recession. Understanding these concepts and their potential impact on our lives is crucial for navigating the economic terrain.

This article will delve into the nuances of inflation and recession, exploring their definitions, causes, and potential consequences. We’ll analyze the relationship between these two economic phenomena, discuss the current state of the global economy, and provide insights into how individuals and businesses can adapt to these challenges.

Inflation: The Rising Cost of Living

Imagine going to the grocery store and finding that the price of your favorite cereal has gone up by 20% from last month. Or, picturing yourself filling up your car with gas and noticing a significant jump in the price per gallon. These scenarios highlight the impact of inflation, which is essentially a sustained increase in the general price level of goods and services in an economy.

Causes of Inflation:

- Demand-Pull Inflation: When demand for goods and services exceeds supply, prices tend to rise. This can be driven by factors like increased consumer spending, government spending, or a surge in investment.

- Cost-Push Inflation: When production costs increase, businesses may pass these costs onto consumers through higher prices. This can be triggered by rising energy prices, labor shortages, or supply chain disruptions.

- Built-in Inflation: This type of inflation occurs when wages and salaries increase, leading to higher production costs and subsequently, higher prices.

- Imported Inflation: When the price of imported goods increases, it can push up overall inflation within the country.

Consequences of Inflation:

- Reduced Purchasing Power: Inflation erodes the value of money, meaning that your money buys less than before. This can make it difficult to afford essential goods and services.

- Increased Interest Rates: As inflation rises, central banks may increase interest rates to cool down the economy. This can make borrowing more expensive for individuals and businesses.

- Uncertainty and Instability: High and unpredictable inflation can create uncertainty for businesses and consumers, leading to reduced investment and economic instability.

Recession: A Period of Economic Contraction

Imagine a scenario where businesses are laying off workers, factories are shutting down, and consumer spending is plummeting. This paints a picture of a recession, which is a significant decline in economic activity characterized by a decrease in real GDP (Gross Domestic Product), a decline in employment, and a reduction in industrial production.

Causes of Recession:

- Demand Shock: A sudden and unexpected decrease in consumer spending or investment can trigger a recession. This can be caused by factors like financial crises, political instability, or a global economic slowdown.

- Supply Shock: Disruptions in the supply chain, such as natural disasters or pandemics, can lead to reduced production and economic contraction.

- Government Policy: Tight monetary policy (high interest rates) or fiscal policy (reduced government spending) can also contribute to a recession.

Consequences of Recession:

- Job Losses: Businesses may lay off workers to reduce costs, leading to increased unemployment.

- Reduced Investment: Businesses may postpone investment decisions due to economic uncertainty, further slowing economic growth.

- Falling Wages: With high unemployment, employers may have more bargaining power, leading to lower wages or wage stagnation.

- Increased Poverty: A recession can lead to an increase in poverty as people lose their jobs and struggle to make ends meet.

Inflation vs. Recession: A Complex Relationship

Inflation and recession are not mutually exclusive. They can coexist, and their interplay can create a complex economic environment.

- Stagflation: This occurs when an economy experiences both high inflation and stagnant economic growth. This situation is particularly challenging as it combines the negative aspects of both inflation and recession.

- Inflationary Recession: This scenario occurs when inflation is high, but the economy is also contracting. This can happen when supply chain disruptions or other cost-push factors lead to rising prices, but consumer demand remains weak.

Current Economic Landscape: Navigating the Crossroads

The global economy is currently facing a confluence of challenges, including high inflation, supply chain disruptions, and geopolitical tensions. Central banks are trying to balance the need to control inflation with the risk of triggering a recession.

Strategies for Individuals and Businesses:

- Individuals:

- Budgeting: Create a realistic budget and prioritize essential spending.

- Savings: Build an emergency fund to cushion against financial shocks.

- Diversification: Invest in a diversified portfolio to mitigate risk.

- Negotiation: Negotiate for higher wages or salaries to keep pace with inflation.

- Businesses:

- Pricing Strategies: Adjust pricing to reflect rising costs without deterring customers.

- Cost Management: Identify and reduce inefficiencies to control costs.

- Innovation: Focus on innovation and product development to stay ahead of the competition.

- Employee Retention: Invest in employee development and retention to maintain productivity.

FAQ

Q: What is the difference between inflation and deflation?

A: Inflation is a general increase in the price level of goods and services, while deflation is a general decrease in the price level. Deflation can be harmful to an economy, as it can lead to reduced investment and consumer spending.

Q: How does the government control inflation?

A: Governments can use monetary policy (controlled by central banks) and fiscal policy (government spending and taxes) to control inflation. Monetary policy tools include adjusting interest rates and controlling the money supply. Fiscal policy tools include government spending on infrastructure, education, and social programs, as well as adjusting tax rates.

Q: How do I protect my savings from inflation?

A: Investing in assets that tend to appreciate in value faster than inflation, such as stocks, real estate, or commodities, can help protect your savings. However, it’s important to remember that these investments also carry risks.

Q: What are the signs of an impending recession?

A: Some warning signs of a potential recession include:

- A decline in consumer spending

- A rise in unemployment

- A decrease in industrial production

- A decline in business investment

- A weakening stock market

Navigating the Economic Future

The economic landscape is constantly evolving, and navigating the challenges of inflation and recession requires a nuanced understanding of these forces. By staying informed, adapting our strategies, and embracing a proactive approach, individuals and businesses can better position themselves to weather the storms and emerge stronger in the face of economic uncertainty.

Source:

- Investopedia: https://www.investopedia.com/

- The Balance: https://www.thebalance.com/

- IMF: https://www.imf.org/

- World Bank: https://www.worldbank.org/

Closure

We hope this article has helped you understand everything about Inflation vs recession risks. Stay tuned for more updates!

Make sure to follow us for more exciting news and reviews.

Feel free to share your experience with Inflation vs recession risks in the comment section.

Keep visiting our website for the latest trends and reviews.