Inflation’s Bite: How Rising Prices Threaten Your Retirement Dreams

Related Articles

- Inflation In The US: A Deep Dive Into The Rising Costs

- Navigating The Economic Waters: A Look At The US Forecast

- The Productivity Puzzle: Why American Workers Are Producing Less

- Unlocking The Secrets Of The Federal Reserve Balance Sheet: A Guide For The Curious

- Navigating The Inflation Maze: What’s In Store For US Consumers In 2024?

Introduction

Join us as we explore Inflation’s Bite: How Rising Prices Threaten Your Retirement Dreams, packed with exciting updates

Inflation’s Bite: How Rising Prices Threaten Your Retirement Dreams

Retirement. A time for relaxation, travel, and pursuing passions. But for many, this idyllic picture is clouded by a looming threat: inflation. The relentless rise in prices can eat away at your savings, leaving you with less purchasing power and jeopardizing your golden years.

This article will delve into the impact of inflation on retirement, exploring how it affects your nest egg, your retirement plans, and your overall financial well-being. We’ll also provide practical strategies to mitigate the effects of inflation and safeguard your retirement dreams.

Understanding Inflation’s Bite

Inflation, simply put, is the rate at which prices for goods and services increase over time. While a little inflation is considered normal and healthy for a growing economy, high inflation can have significant consequences, especially for retirees.

The Impact on Your Nest Egg

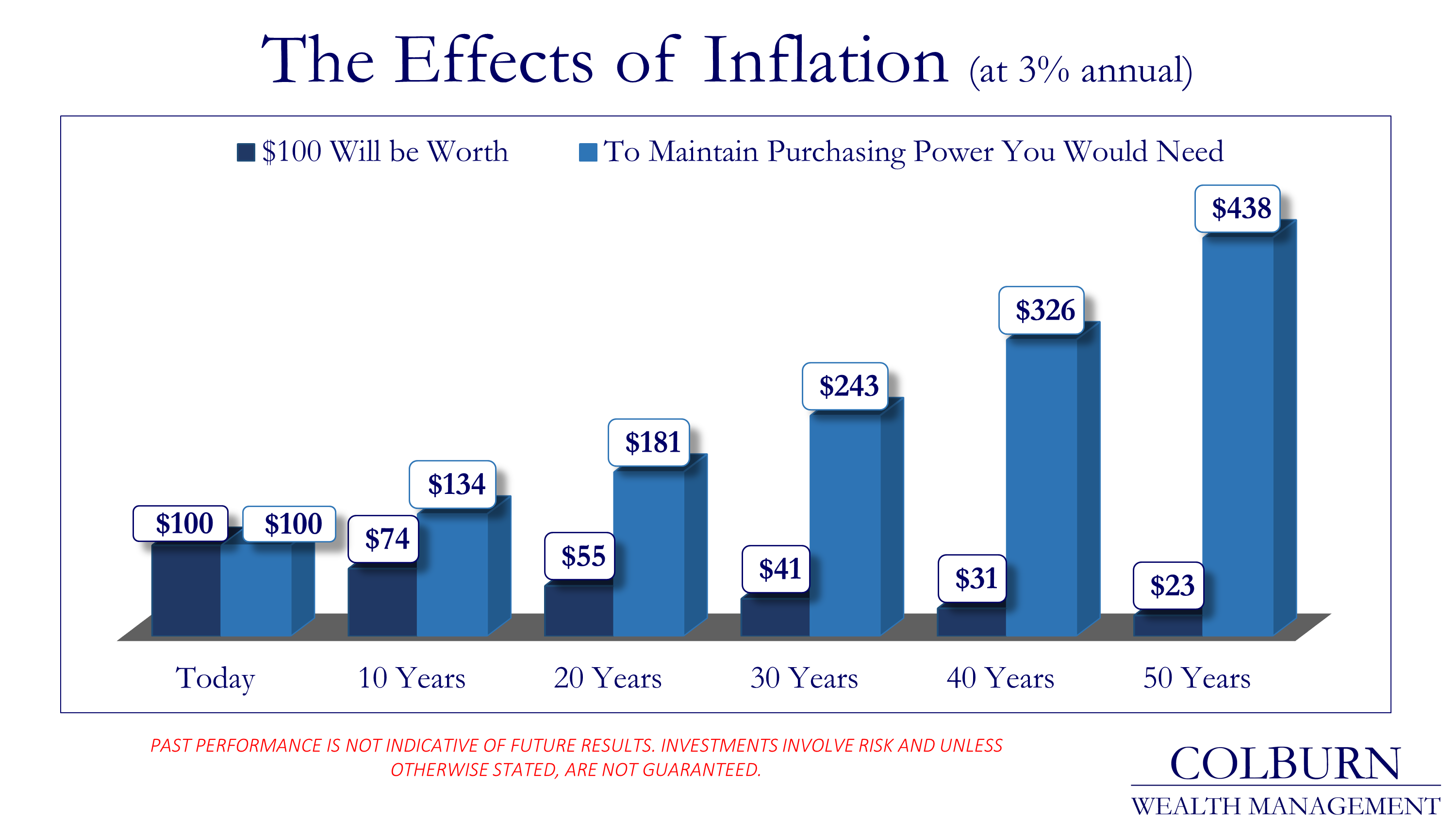

- Eroding Purchasing Power: The most immediate impact of inflation is the erosion of your purchasing power. Imagine your retirement savings are worth $1 million today. If inflation averages 3% per year, in 20 years, your $1 million will only be worth $553,676 in today’s dollars. That’s a significant loss in buying power.

- Decreased Investment Returns: Inflation can also impact your investment returns. While stocks and bonds may generate returns, they often lag behind inflation, meaning your real return (after accounting for inflation) may be lower than expected.

- Increased Expenses: As inflation rises, the cost of essentials like healthcare, housing, and utilities increases, putting a strain on your retirement budget.

The Impact on Your Retirement Plans

- Delayed Retirement: Inflation can force you to delay retirement. You may need to work longer to accumulate enough savings to cover rising living expenses and maintain your desired lifestyle.

- Reduced Spending Power: Even if you retire on time, inflation can significantly impact your spending power. You may have to cut back on travel, hobbies, or other discretionary spending.

- Higher Healthcare Costs: Healthcare costs are particularly vulnerable to inflation. As you age, healthcare expenses are likely to increase, further straining your retirement budget.

Protecting Your Retirement from Inflation

While inflation is a formidable foe, it’s not unbeatable. You can take steps to mitigate its impact and safeguard your retirement:

- Invest Wisely: Diversify your portfolio across different asset classes, including stocks, bonds, and real estate. Consider investing in inflation-resistant assets like commodities and Treasury Inflation-Protected Securities (TIPS).

- Adjust Your Retirement Plans: Re-evaluate your retirement goals and adjust your savings plan accordingly. You may need to save more or delay retirement to account for the impact of inflation.

- Maximize Social Security Benefits: Ensure you’re receiving the maximum Social Security benefits you’re eligible for. This can provide a valuable source of income in retirement.

- Reduce Your Expenses: Look for ways to reduce your spending, both now and in retirement. This could involve downsizing your home, cutting back on unnecessary expenses, or finding alternative ways to enjoy your hobbies.

- Consider Part-Time Work: Even after retiring, you might consider part-time work to supplement your income and combat the effects of inflation.

- Stay Informed: Stay up-to-date on inflation trends and adjust your investment and spending strategies accordingly.

FAQs

Q: How can I calculate the impact of inflation on my retirement savings?

A: There are online inflation calculators that can help you estimate the impact of inflation on your savings over time. Simply input your savings amount, the expected inflation rate, and the number of years you’re planning to retire.

Q: What is the best way to invest for retirement in an inflationary environment?

A: Diversifying your portfolio is crucial. Consider investing in a mix of stocks, bonds, real estate, and inflation-resistant assets like commodities and TIPS. Consult with a financial advisor for personalized investment advice.

Q: How can I reduce my expenses in retirement?

A: Look for areas where you can cut back, such as dining out less, reducing your housing costs, or finding cheaper ways to enjoy your hobbies. You can also consider downsizing your home or moving to a lower-cost area.

Q: How can I ensure I’m receiving the maximum Social Security benefits?

A: Visit the Social Security Administration website to learn about your eligibility and how to maximize your benefits. You may need to work longer or delay claiming benefits to receive the highest possible payout.

Conclusion

Inflation is a reality that can significantly impact your retirement plans. By understanding its impact, implementing proactive strategies, and making informed financial decisions, you can mitigate the effects of inflation and ensure a comfortable and fulfilling retirement. Remember, planning and taking action are key to protecting your retirement dreams from the erosive power of inflation.

References

- U.S. Bureau of Labor Statistics

- Social Security Administration

- Investopedia

- Financial Planning Association

Closure

We hope this article has helped you understand everything about Inflation’s Bite: How Rising Prices Threaten Your Retirement Dreams. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Inflation’s Bite: How Rising Prices Threaten Your Retirement Dreams!

We’d love to hear your thoughts about Inflation’s Bite: How Rising Prices Threaten Your Retirement Dreams—leave your comments below!

Keep visiting our website for the latest trends and reviews.