Is the US Housing Market in a Bubble? A Deep Dive into the Current Landscape

Related Articles

- Navigating The Inflation Maze: What’s In Store For US Consumers In 2024?

- Inflation Vs Recession Risks

- The US Debt Ceiling: A Game Of Chicken With Global Consequences

- The Rollercoaster Ride Of US Unemployment: A Look At The Trends And What They Mean

- Navigating The Choppy Waters: A Deep Dive Into Global Supply Chain Disruptions

Introduction

Discover everything you need to know about Is the US Housing Market in a Bubble? A Deep Dive into the Current Landscape

Is the US Housing Market in a Bubble? A Deep Dive into the Current Landscape

The US housing market has always been a rollercoaster ride, with periods of boom and bust. But recent years have seen a surge in home prices, fueled by low interest rates, strong demand, and limited inventory. This has led many to wonder: Are we on the verge of another housing bubble?

This question is complex, with no easy answer. To understand the current situation, we need to delve into the factors driving the market, analyze historical trends, and consider the potential risks and opportunities.

The Forces Shaping the Market

Several key factors have contributed to the recent surge in home prices:

- Low Interest Rates: The Federal Reserve’s historically low interest rates have made mortgages more affordable, driving up demand. This has been a major driver of the housing market’s growth since the 2008 financial crisis.

- Strong Demand: The pandemic has shifted priorities, with many seeking more space and opting for suburban living. This surge in demand has outpaced supply, leading to bidding wars and rising prices.

- Limited Inventory: The housing market has been grappling with a shortage of new homes for years. This is partly due to supply chain disruptions, labor shortages, and rising construction costs.

- Economic Growth: A strong economy, with low unemployment and rising wages, has bolstered purchasing power and fueled demand for homes.

- Investor Activity: Institutional investors and hedge funds have been increasingly active in the housing market, buying up properties and driving up prices.

Historical Echoes: Lessons from Past Bubbles

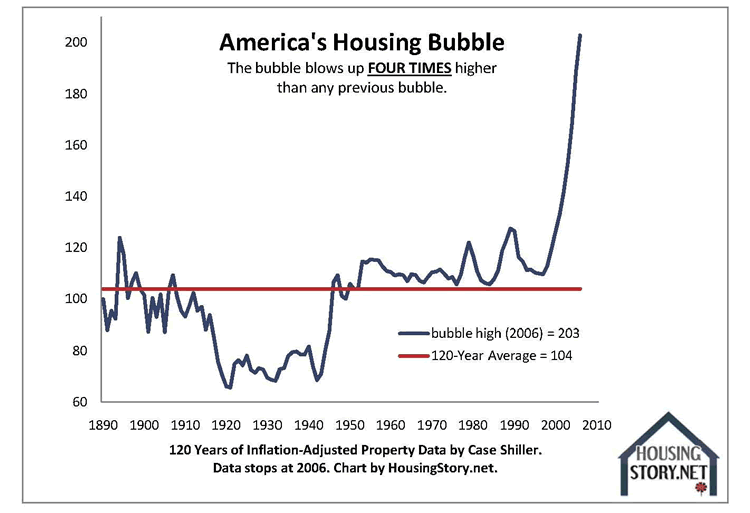

Understanding past housing bubbles is crucial for assessing the current situation. The most notable example is the 2008 housing bubble, which led to the global financial crisis. This bubble was fueled by loose lending standards, subprime mortgages, and speculative buying.

Here’s what we can learn from the 2008 bubble:

- Overvaluation: Prices rose significantly beyond what was supported by fundamentals like income and rents.

- Excessive Leverage: Borrowers took on too much debt, making them vulnerable to even small interest rate increases.

- Speculative Activity: Investors bought properties solely for short-term profits, without considering long-term sustainability.

Signs of a Potential Bubble

While the current situation isn’t identical to the 2008 bubble, there are some concerning similarities:

- Rapid Price Increases: Home prices have risen sharply in recent years, outpacing income growth in many areas.

- Low Inventory: The lack of available homes is driving up competition and pushing prices higher.

- High Demand: While demand is strong, it’s fueled in part by low interest rates, which could change quickly.

- Investor Activity: The increasing role of institutional investors in the market raises concerns about speculative buying.

However, there are also key differences:

- Stronger Economy: The current economic environment is more stable than in 2008, with lower unemployment and higher wages.

- Tighter Lending Standards: Banks are more cautious in their lending practices, with stricter requirements for borrowers.

- Limited Subprime Lending: The prevalence of subprime mortgages, which played a major role in the 2008 crisis, is significantly lower today.

What Does the Future Hold?

Predicting the future of the housing market is always challenging. However, several factors could influence its trajectory:

- Interest Rate Hikes: The Federal Reserve is raising interest rates to combat inflation. This will make mortgages more expensive, potentially slowing down demand.

- Economic Slowdown: A recession could dampen economic activity, leading to job losses and reduced purchasing power, impacting demand.

- Inventory Growth: If more homes are built and listed for sale, it could ease the supply constraints and moderate price growth.

- Government Policies: Regulations and policies, such as tax incentives for homebuyers or restrictions on investor activity, could influence market dynamics.

Navigating the Unpredictable Market

So, are we in a bubble? The answer is nuanced. While there are signs of overvaluation and potential risks, the current situation isn’t a carbon copy of the 2008 crisis.

Here are some key takeaways:

- Stay Informed: Keep abreast of market trends, interest rate changes, and economic forecasts.

- Be Realistic: Don’t get caught up in the hype or chase unrealistic expectations.

- Assess Your Finances: Ensure you can comfortably afford a mortgage and handle potential interest rate increases.

- Consider Your Long-Term Goals: Don’t buy a home solely for speculation or short-term gains.

The housing market is a complex and dynamic system. Understanding the forces at play, analyzing historical trends, and staying informed about potential risks and opportunities will help you navigate this unpredictable landscape.

FAQ

Q: What are the signs of a housing bubble?

A: Signs of a housing bubble include rapid price increases, low inventory, high demand fueled by speculation, and excessive leverage among borrowers.

Q: How can I protect myself from a potential housing bubble?

A: You can protect yourself by being a responsible borrower, avoiding excessive debt, and considering your long-term financial goals. Stay informed about market trends and be prepared for potential interest rate increases.

Q: What is the Federal Reserve’s role in the housing market?

A: The Federal Reserve influences the housing market through interest rate policies. Lower interest rates make mortgages more affordable, stimulating demand, while higher rates can slow down the market.

Q: Is the current housing market a good time to buy?

A: The answer depends on your individual circumstances and financial situation. Consider your long-term goals, affordability, and the potential risks involved.

Q: What are the potential consequences of a housing bubble bursting?

A: A housing bubble burst can lead to significant price declines, foreclosures, and economic instability. It can also impact the broader financial system and lead to job losses.

References:

This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified professional for guidance on your specific situation.

Closure

We hope this article has helped you understand everything about Is the US Housing Market in a Bubble? A Deep Dive into the Current Landscape. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Is the US Housing Market in a Bubble? A Deep Dive into the Current Landscape!

We’d love to hear your thoughts about Is the US Housing Market in a Bubble? A Deep Dive into the Current Landscape—leave your comments below!

Keep visiting our website for the latest trends and reviews.