Navigating the Economic Seas in 2024: A Guide to the Risks Ahead

Related Articles

- Recession Looming? Navigating The Global Economic Landscape

- Inflationary Wage Pressures: A Tug-of-War Between Workers And Businesses

- The Price Of Progress: Inflation, Wages, And The Growing Gap

- Pumping The Economy: A Deep Dive Into Economic Stimulus Packages

- Charting The Course: Long-Term Economic Trends In The US

Introduction

Welcome to our in-depth look at Navigating the Economic Seas in 2024: A Guide to the Risks Ahead

Navigating the Economic Seas in 2024: A Guide to the Risks Ahead

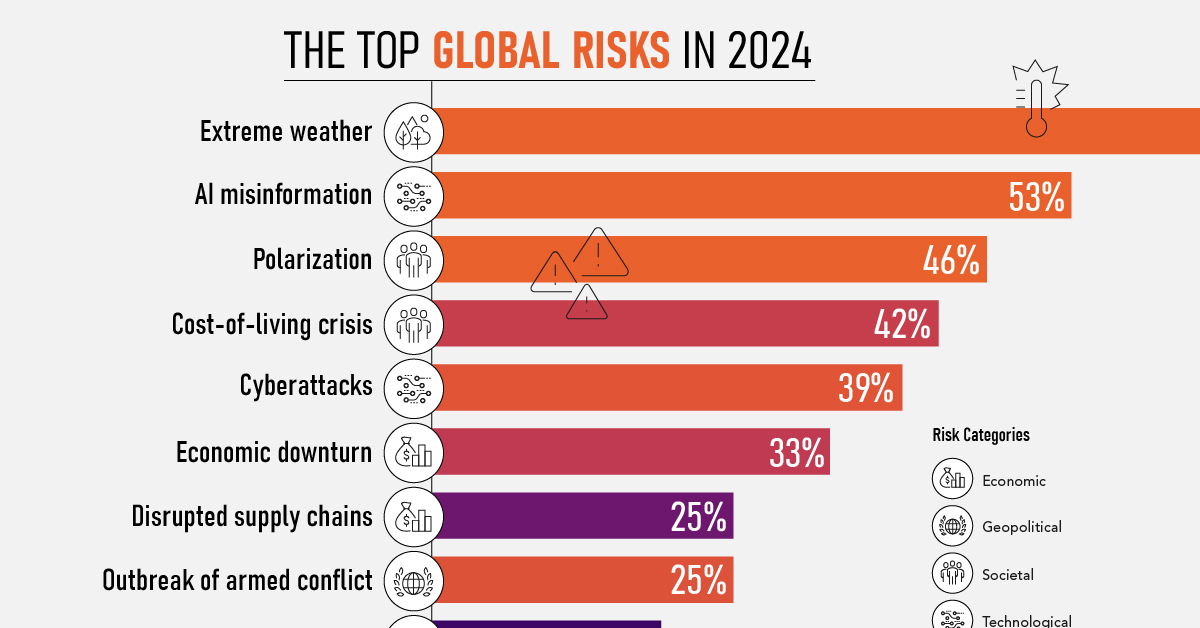

The global economy is a complex beast, constantly evolving and throwing curveballs. 2024 is no exception, promising a year of continued uncertainty and potential headwinds. While the world has navigated the turbulent waters of the pandemic and the ongoing war in Ukraine, a new set of economic risks are emerging, demanding our attention and strategic planning.

This article will dive deep into the key economic risks looming on the horizon for 2024, offering insights into their potential impact and how businesses and individuals can navigate these challenges.

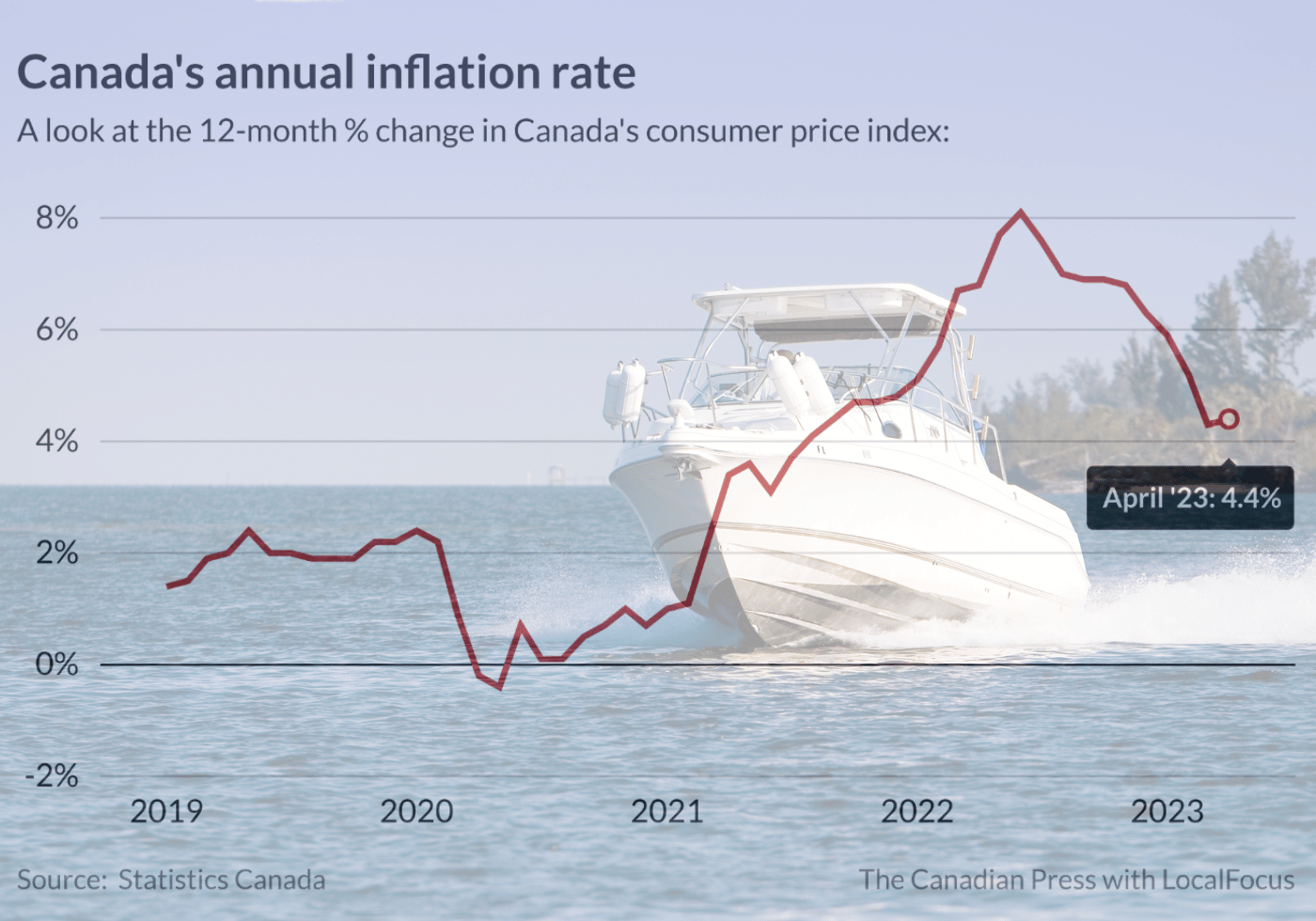

1. Inflation: The Persistent Spectre

Inflation, the persistent increase in prices for goods and services, continues to be a major concern. While central banks have been aggressively raising interest rates to combat it, the fight isn’t over.

Why it matters:

- Eroding purchasing power: Inflation eats away at the value of your money, making everyday expenses more expensive.

- Slower economic growth: High inflation can discourage businesses from investing and consumers from spending, leading to a slowdown in economic activity.

- Uncertainty for businesses: Businesses struggle to predict future costs, making it difficult to plan and invest.

What to do:

- Diversify your investments: Consider investments that can potentially outperform inflation, such as stocks or real estate.

- Negotiate salary increases: If inflation is outpacing your salary growth, negotiate for a raise to maintain your purchasing power.

- Shop smart: Look for deals, compare prices, and consider buying in bulk to mitigate the impact of rising prices.

2. Interest Rate Hikes: The Tightening Grip

Central banks around the world have been hiking interest rates to curb inflation. While this strategy aims to cool down the economy, it comes with its own set of risks.

Why it matters:

- Higher borrowing costs: Businesses and individuals face higher interest rates on loans, making it more expensive to borrow money.

- Potential for recession: Aggressive interest rate hikes can slow down economic activity too much, leading to a recession.

- Impact on financial markets: Rising interest rates can affect the value of bonds and other investments, potentially leading to market volatility.

What to do:

- Review your debt: Consider paying down high-interest debt to minimize the impact of rising interest rates.

- Save more: Build a financial cushion to weather potential economic storms.

- Stay informed: Keep an eye on economic news and central bank announcements to understand how interest rate changes might affect you.

3. Geopolitical Tensions: A Global Headache

The ongoing war in Ukraine, tensions between the US and China, and other geopolitical conflicts are creating uncertainty and volatility in the global economy.

Why it matters:

- Supply chain disruptions: Conflicts can disrupt global supply chains, leading to shortages and price increases.

- Energy market volatility: Geopolitical tensions can influence energy prices, impacting businesses and consumers alike.

- Investment uncertainty: Businesses may hesitate to invest in countries perceived as politically unstable.

What to do:

- Diversify your supply chains: Businesses should consider sourcing goods and services from multiple locations to mitigate the impact of disruptions.

- Monitor global events: Stay informed about geopolitical developments and their potential impact on the economy.

- Invest in resilient sectors: Consider investing in industries that are less susceptible to geopolitical shocks.

4. Climate Change: The Looming Threat

Climate change is no longer a future concern; it’s a present reality with far-reaching economic implications.

Why it matters:

- Extreme weather events: More frequent and intense natural disasters can disrupt businesses, damage infrastructure, and lead to higher insurance costs.

- Rising sea levels: Coastal communities face the threat of rising sea levels, leading to displacement and economic losses.

- Resource scarcity: Climate change can exacerbate resource scarcity, leading to higher prices for food, water, and energy.

What to do:

- Invest in climate-resilient infrastructure: Businesses and governments need to invest in infrastructure that can withstand extreme weather events.

- Support sustainable practices: Encourage and adopt sustainable practices to reduce environmental impact.

- Invest in green technologies: Support the development and adoption of renewable energy and other green technologies.

5. Technological Disruption: The Winds of Change

Rapid technological advancements continue to reshape industries, creating both opportunities and challenges.

Why it matters:

- Job displacement: Automation and artificial intelligence are leading to job displacement in some sectors.

- Increased competition: New technologies can create new competitors, disrupting established markets.

- Cybersecurity risks: Increased reliance on technology raises cybersecurity risks, which can disrupt businesses and impact consumer confidence.

What to do:

- Upskill and reskill: Invest in education and training to adapt to changing job demands.

- Embrace innovation: Stay abreast of technological advancements and explore how they can enhance your business.

- Strengthen cybersecurity: Implement robust cybersecurity measures to protect your data and systems.

6. Debt Levels: A Growing Burden

Global debt levels have reached record highs, posing a potential risk to the economy.

Why it matters:

- Increased risk of default: High debt levels can make it difficult for businesses and governments to repay their obligations, leading to defaults.

- Slower economic growth: High debt burdens can limit investment and economic growth.

- Financial instability: A surge in defaults could trigger a financial crisis.

What to do:

- Manage debt responsibly: Businesses and individuals should prioritize paying down debt and avoid taking on excessive debt.

- Support policies that promote debt reduction: Encourage governments to implement policies that promote fiscal responsibility and reduce debt levels.

- Monitor global debt trends: Stay informed about global debt levels and their potential impact on the economy.

7. Social and Political Unrest: A Threat to Stability

Social and political unrest can disrupt economies, leading to instability and uncertainty.

Why it matters:

- Disruptions to businesses: Protests and riots can disrupt business operations, leading to lost revenue and productivity.

- Investment uncertainty: Businesses may be hesitant to invest in countries experiencing social and political unrest.

- Weakening of institutions: Political instability can weaken institutions, leading to a decline in governance and economic stability.

What to do:

- Engage in constructive dialogue: Businesses should engage in dialogue with stakeholders to address social and political concerns.

- Support responsible governance: Advocate for policies that promote inclusive growth and address inequalities.

- Monitor political developments: Stay informed about political developments and their potential impact on the economy.

8. Inequality: A Growing Divide

Income inequality continues to widen in many countries, posing a risk to social and economic stability.

Why it matters:

- Reduced consumer spending: Inequality can lead to a decline in consumer spending, as a large portion of the population has limited disposable income.

- Social unrest: Inequality can fuel social unrest and political instability.

- Slower economic growth: Inequality can hinder economic growth by limiting access to education, healthcare, and other opportunities for a large segment of the population.

What to do:

- Support policies that promote equality: Advocate for policies that address income inequality, such as progressive taxation and social safety nets.

- Invest in education and training: Support programs that provide access to education and training for all, regardless of background.

- Promote inclusive growth: Encourage businesses to adopt practices that promote inclusivity and reduce inequality.

Navigating the Risks: A Call to Action

The economic risks outlined above present a complex and challenging landscape for 2024. However, by understanding these risks and taking proactive steps, businesses and individuals can navigate these challenges and position themselves for success.

Here are some key takeaways:

- Stay informed: Keep up with economic news and analysis to understand the evolving landscape.

- Be adaptable: Be prepared to adjust your plans and strategies in response to changing economic conditions.

- Diversify: Spread your investments and business activities to mitigate risk.

- Invest in resilience: Build resilience into your business and personal finances to weather economic storms.

- Advocate for positive change: Support policies and initiatives that promote economic stability, sustainability, and inclusivity.

By embracing a proactive and informed approach, we can navigate the economic uncertainties of 2024 and build a more resilient and prosperous future.

FAQ:

Q: What are the biggest economic risks facing the world in 2024?

A: The biggest economic risks in 2024 include persistent inflation, aggressive interest rate hikes, geopolitical tensions, climate change, technological disruption, high debt levels, social and political unrest, and growing inequality.

Q: How can businesses prepare for these economic risks?

A: Businesses can prepare by diversifying their operations, investing in resilience, staying informed about economic trends, and adapting their strategies to changing conditions.

Q: What can individuals do to protect themselves from economic risks?

A: Individuals can protect themselves by managing debt responsibly, building a financial cushion, diversifying their investments, and staying informed about economic developments.

Q: What are the potential consequences of these economic risks?

A: These economic risks could lead to slower economic growth, higher inflation, financial instability, social unrest, and job losses.

Q: What are the most important things to remember about navigating economic risks?

A: The most important things to remember are to stay informed, be adaptable, diversify, invest in resilience, and advocate for positive change.

Sources:

- World Economic Forum: Global Risks Report 2023

- International Monetary Fund: World Economic Outlook

- Bank for International Settlements: Annual Report

- United Nations: Sustainable Development Goals

- World Bank: Global Economic Prospects

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor for personalized advice.

Closure

We hope this article has helped you understand everything about Navigating the Economic Seas in 2024: A Guide to the Risks Ahead. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Navigating the Economic Seas in 2024: A Guide to the Risks Ahead!

We’d love to hear your thoughts about Navigating the Economic Seas in 2024: A Guide to the Risks Ahead—leave your comments below!

Stay informed with our next updates on Navigating the Economic Seas in 2024: A Guide to the Risks Ahead and other exciting topics.