Navigating the Maze: A Comprehensive Guide to Business Loan Interest Rate Comparison

Related Articles

- Unlocking Your Business Potential: A Guide To Self-Employed Business Loans

- Unlocking Peace Of Mind: A Comprehensive Guide To Business Insurance Plans

- Protecting Your Business: A Guide To Finding The Right Insurance Near You

- Business Life Insurance: Protecting Your Business And Your Legacy

- Unlocking Your Business Potential: Navigating The World Of No-Collateral Loans

Introduction

Discover everything you need to know about Navigating the Maze: A Comprehensive Guide to Business Loan Interest Rate Comparison

Navigating the Maze: A Comprehensive Guide to Business Loan Interest Rate Comparison

Starting a business or expanding an existing one often requires a financial boost. This is where business loans come in, offering the capital you need to fuel your growth. But with a plethora of lenders and loan options available, finding the right loan with the best interest rate can feel like navigating a maze. Fear not! This comprehensive guide will equip you with the knowledge and tools to confidently compare business loan interest rates and secure the most advantageous financing for your venture.

Understanding the Basics: What is Interest Rate and Why Does it Matter?

Simply put, the interest rate is the cost of borrowing money. When you take out a business loan, you agree to pay back the principal amount borrowed, plus an additional charge, the interest, over a specified period. The lower the interest rate, the less you’ll pay in interest over the life of the loan, saving you money and boosting your bottom line.

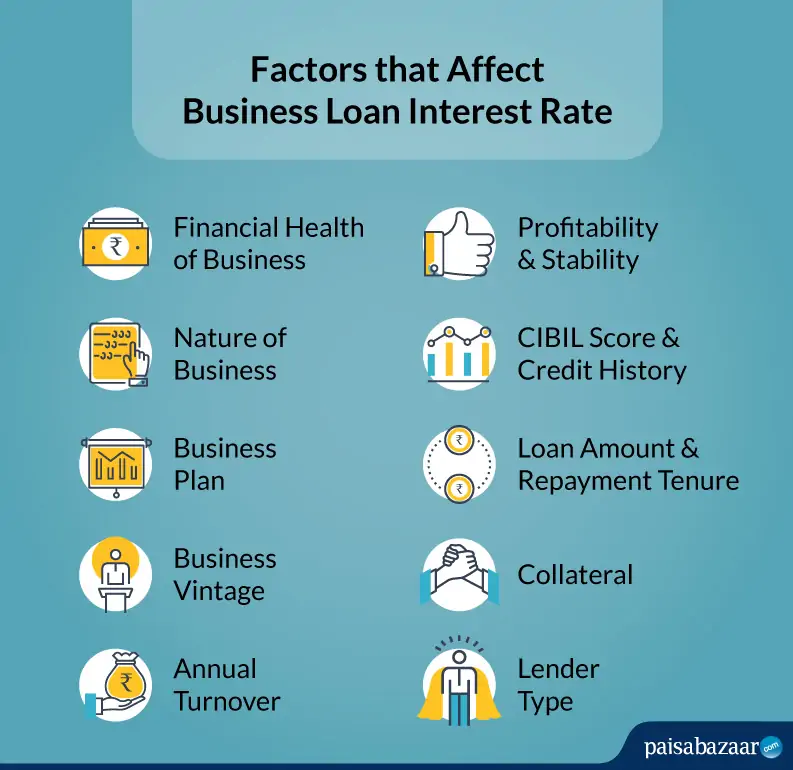

Factors Influencing Business Loan Interest Rates

Numerous factors contribute to the interest rate you qualify for. Understanding these factors empowers you to improve your chances of securing a competitive rate:

- Your Credit Score: This is the cornerstone of loan approval and interest rate determination. A higher credit score (above 700) signifies a lower risk to lenders, resulting in lower interest rates.

- Loan Amount: Larger loans generally come with lower interest rates. Lenders see larger loans as a sign of a more established business with a stronger financial foundation.

- Loan Term: Longer loan terms (e.g., 10 years) typically result in lower monthly payments but come with higher overall interest costs. Shorter terms (e.g., 5 years) mean higher monthly payments but lower total interest paid.

- Loan Type: Different loan types carry different interest rates. For example, SBA loans often have lower rates than conventional business loans due to government guarantees.

- Industry: Some industries are considered riskier than others, leading to higher interest rates.

- Collateral: Offering collateral (assets like real estate or equipment) can often secure lower interest rates as it provides lenders with additional security.

- Debt-to-Equity Ratio: A higher debt-to-equity ratio (meaning more debt relative to equity) can indicate a higher risk to lenders, potentially leading to higher interest rates.

- Lender Reputation: Different lenders have varying lending criteria and interest rate policies. Researching and comparing multiple lenders is crucial.

Key Strategies for Finding the Best Business Loan Interest Rates

Now that you understand the factors influencing interest rates, let’s dive into actionable strategies to maximize your chances of securing a favorable rate:

- Improve Your Credit Score: Before applying for a loan, take steps to improve your credit score. This includes paying bills on time, reducing credit card balances, and avoiding unnecessary credit inquiries.

- Shop Around: Don’t settle for the first offer you receive. Compare rates from multiple lenders, both online and traditional institutions.

- Consider SBA Loans: Small Business Administration (SBA) loans often offer lower interest rates than conventional loans due to government guarantees.

- Negotiate: Don’t be afraid to negotiate with lenders. Highlight your strong financial history, collateral, and business plan to demonstrate your trustworthiness and commitment.

- Explore Alternative Financing Options: If traditional bank loans aren’t suitable, explore alternative financing options like peer-to-peer lending, crowdfunding, or merchant cash advances. These options might have higher interest rates but can provide flexibility and faster approval times.

- Build a Strong Business Plan: A well-written business plan showcasing your business’s viability and growth potential can impress lenders and potentially secure a lower interest rate.

Tools and Resources for Comparing Business Loan Interest Rates

Several tools and resources can assist you in comparing business loan interest rates:

- Online Loan Comparison Websites: Websites like LendingTree, NerdWallet, and Bankrate allow you to compare offers from multiple lenders simultaneously.

- Financial Advisors: A financial advisor can provide personalized guidance and help you navigate the complex world of business loans.

- Local Chambers of Commerce: Your local chamber of commerce may offer resources and connections to lenders in your area.

- Small Business Development Centers (SBDCs): SBDCs provide free business counseling and can assist you in finding the right loan options.

The Importance of Transparency and Understanding Loan Terms

When comparing loan offers, it’s crucial to go beyond the headline interest rate and carefully examine the loan terms:

- APR (Annual Percentage Rate): This includes the interest rate plus other loan fees, providing a more comprehensive picture of the loan’s true cost.

- Loan Fees: Understand any origination fees, closing costs, or other fees associated with the loan.

- Prepayment Penalties: Some loans may include prepayment penalties if you repay the loan early.

- Loan Term: Consider the impact of the loan term on your monthly payments and overall interest costs.

- Loan Covenants: These are conditions that you agree to meet while repaying the loan, such as maintaining a certain credit score or financial performance.

Common Mistakes to Avoid When Comparing Business Loan Interest Rates

Here are some common mistakes to avoid when comparing business loan interest rates:

- Focusing Solely on the Interest Rate: Don’t solely focus on the lowest interest rate. Consider the overall loan terms, fees, and repayment flexibility.

- Not Shopping Around: Don’t settle for the first offer you receive. Compare offers from multiple lenders to find the best deal.

- Ignoring Your Credit Score: A good credit score is crucial for securing a favorable interest rate. Take steps to improve your credit score before applying for a loan.

- Not Understanding Loan Terms: Carefully read the loan agreement and understand all the terms and conditions before signing.

Frequently Asked Questions (FAQs)

1. What is a good business loan interest rate?

A good business loan interest rate depends on several factors, including your credit score, loan amount, and loan type. Generally, rates below 10% are considered favorable, but it’s important to compare offers from multiple lenders.

2. How can I improve my chances of getting a lower interest rate?

Improving your credit score, building a strong business plan, and offering collateral can all help you secure a lower interest rate.

3. What are some alternative financing options if I can’t get a traditional bank loan?

Alternative financing options include peer-to-peer lending, crowdfunding, merchant cash advances, and invoice financing.

4. What are some red flags to watch out for when comparing loan offers?

Red flags include high fees, prepayment penalties, and unclear loan terms. Always read the loan agreement carefully before signing.

5. How can I find a reputable lender?

Research lenders online, check their reviews, and contact your local chamber of commerce or SBDC for recommendations.

Conclusion: Empower Yourself to Find the Best Loan for Your Business

Securing a business loan with a competitive interest rate is a crucial step in your journey to success. By understanding the factors influencing interest rates, employing effective comparison strategies, and avoiding common mistakes, you can navigate the loan market confidently and secure the financing that best supports your business goals. Remember, knowledge is power, and armed with the right information, you can find the perfect loan to propel your business forward.

Source:

Closure

We hope this article has helped you understand everything about Navigating the Maze: A Comprehensive Guide to Business Loan Interest Rate Comparison. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Navigating the Maze: A Comprehensive Guide to Business Loan Interest Rate Comparison!

Feel free to share your experience with Navigating the Maze: A Comprehensive Guide to Business Loan Interest Rate Comparison in the comment section.

Keep visiting our website for the latest trends and reviews.