Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes

Related Articles

- Bank Collapse Risk: A Looming Threat To The US Economy?

- Navigating The Pandemic’s Aftermath: A Deep Dive Into Insurance Claims

- Powering Up Your Future: A Guide To Renewable Energy Insurance

- The Looming Shadow: Risks Of A US Housing Market Crash

- Inflation Vs Recession Risks

Introduction

Join us as we explore Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes, packed with exciting updates

Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes

Flood insurance is a vital safety net for homeowners and businesses in flood-prone areas. But like the tides themselves, the landscape of flood insurance policies is constantly changing. Recent years have seen a wave of adjustments, driven by factors like climate change, evolving risk assessments, and a need to ensure the long-term viability of the National Flood Insurance Program (NFIP). Understanding these changes is crucial for policyholders, as they can impact premiums, coverage, and even eligibility.

The NFIP: A Foundation Under Pressure

The NFIP, administered by FEMA, is the primary provider of flood insurance in the United States. It’s a crucial program, offering affordable coverage to millions of Americans who live in flood-prone areas. However, the NFIP has been facing financial challenges for years. The program has been operating at a deficit for decades, with payouts exceeding premiums collected. This imbalance is largely due to factors like increasing flood events, rising property values, and the program’s subsidized rates.

The 2012 Biggert-Waters Flood Insurance Reform Act

One of the most significant recent changes came with the passage of the Biggert-Waters Flood Insurance Reform Act in 2012. This act aimed to address the NFIP’s financial instability by implementing several key reforms, including:

- Elimination of Subsidies: The Act gradually phased out subsidies for properties built before 1974, leading to higher premiums for some policyholders.

- Risk-Based Premiums: The Act moved towards a more risk-based pricing model, meaning premiums would more accurately reflect the risk of flooding for a particular property.

- Increased Flood Insurance Rates: The Act mandated a gradual increase in flood insurance premiums, with rates rising over time to reflect the true cost of risk.

The 2014 Homeowner Flood Insurance Affordability Act (HFA)

The HFA, passed in 2014, aimed to address some of the unintended consequences of the Biggert-Waters Act. It rolled back some of the more drastic premium increases and introduced a number of affordability measures, such as:

- Rate Caps: The HFA limited the amount by which premiums could increase annually.

- Grandfathering: Properties that had flood insurance before October 1, 2013, were grandfathered in at lower premiums.

- Flood Insurance Rate Maps (FIRMs) Updates: The HFA required FEMA to review and update FIRMs, which determine flood risks for specific areas.

The 2017 Tax Cuts and Jobs Act

This act extended the NFIP for another decade and made some adjustments to the program’s funding and administration. It also allowed for the creation of private flood insurance options, potentially increasing competition in the market.

The Impact of Climate Change

The changing climate is adding another layer of complexity to flood insurance. As sea levels rise and weather patterns become more extreme, the frequency and severity of flooding events are increasing. This means that flood risks are becoming more significant, and insurance premiums are likely to reflect this reality.

Key Changes You Need to Know

Here’s a breakdown of some of the most significant changes affecting flood insurance:

- Increased Premiums: As risk assessments become more sophisticated and flood events become more frequent, premiums are likely to continue rising.

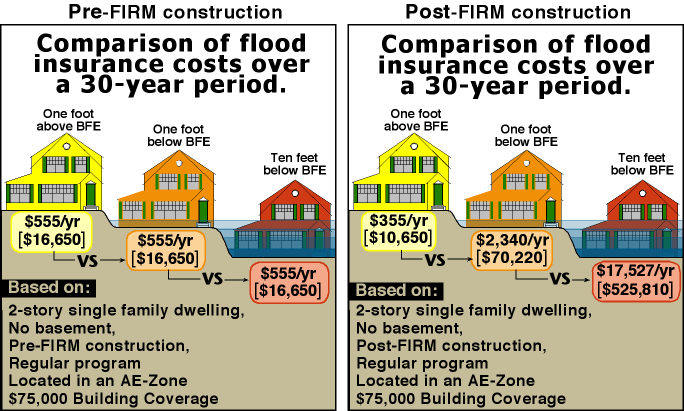

- Risk-Based Pricing: Premiums are now calculated based on a property’s individual risk of flooding, taking into account factors like elevation, proximity to water bodies, and flood history.

- Flood Insurance Rate Maps (FIRMs) Updates: FEMA is constantly updating FIRMs, and these changes can affect your flood risk and insurance premiums.

- New Construction Requirements: The NFIP has implemented new construction requirements for homes built in flood-prone areas, aiming to minimize future flood damage.

- Private Flood Insurance Options: The emergence of private flood insurance providers offers policyholders additional options and potentially more competitive rates.

What These Changes Mean for You

These changes have a significant impact on homeowners and businesses:

- Higher Premiums: You may see your flood insurance premiums increase as the program moves towards a more risk-based pricing model.

- Potential Eligibility Changes: Flood risk assessments and FIRMs updates can affect your eligibility for flood insurance and the cost of coverage.

- New Construction Requirements: If you’re building a new home in a flood-prone area, you’ll need to comply with new construction requirements to ensure your property is flood-resistant.

- More Choice: The availability of private flood insurance options gives you more choices and potentially better rates.

Navigating the Changes: Key Actions for Policyholders

Here’s what you can do to stay informed and protect yourself:

- Review Your Flood Insurance Policy: Understand your current coverage, deductibles, and limitations.

- Check for FIRMs Updates: Stay informed about any changes to flood risk assessments in your area.

- Consider Risk Reduction Measures: Take steps to mitigate flood risks, such as elevating your home or installing flood barriers.

- Explore Private Flood Insurance Options: Compare rates and coverage from different providers.

- Stay Informed: Keep up-to-date on the latest changes to the NFIP and flood insurance policies.

FAQs: Flood Insurance Policy Changes

Q: What is the NFIP, and why are changes being made?

A: The NFIP is the primary provider of flood insurance in the United States. Changes are being made to address the program’s financial challenges, which are driven by increasing flood events, rising property values, and the program’s subsidized rates.

Q: How will these changes affect my premiums?

A: You may see your flood insurance premiums increase as the program moves towards a more risk-based pricing model and as flood risks become more significant.

Q: What is a Flood Insurance Rate Map (FIRM), and how does it affect me?

A: A FIRM is a map that shows flood risks for specific areas. Changes to FIRMs can affect your flood risk and insurance premiums.

Q: What are some steps I can take to reduce my flood risk?

A: You can take steps to mitigate flood risks, such as elevating your home, installing flood barriers, and maintaining your property to prevent water damage.

Q: Should I consider private flood insurance?

A: The availability of private flood insurance options gives you more choices and potentially better rates. Compare rates and coverage from different providers to see if private flood insurance is right for you.

Conclusion

The landscape of flood insurance is constantly evolving. Understanding these changes is essential for protecting your home and finances. By staying informed, reviewing your policy, and taking steps to mitigate flood risks, you can navigate the shifting sands of flood insurance and ensure you have the coverage you need.

Reference:

FEMA – National Flood Insurance Program

Closure

We hope this article has helped you understand everything about Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes. Stay tuned for more updates!

Don’t forget to check back for the latest news and updates on Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes!

We’d love to hear your thoughts about Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes—leave your comments below!

Stay informed with our next updates on Navigating the Shifting Sands: Understanding Flood Insurance Policy Changes and other exciting topics.