Navigating the Wild West: Crypto Regulation in the US Economy

Related Articles

- The Great Labor Shortage: Why Jobs Are Open And Workers Are Scarce

- The Energy Price Rollercoaster: Why Your Bills Are Soaring And What You Can Do

- Navigating The Inflation Maze: What’s In Store For US Consumers In 2024?

- Inflation Vs Recession Risks

- Navigating The Economic Shoals: A Look At Challenges In 2024

Introduction

Discover everything you need to know about Navigating the Wild West: Crypto Regulation in the US Economy

Navigating the Wild West: Crypto Regulation in the US Economy

The world of cryptocurrencies is a whirlwind of innovation, volatility, and uncertainty. While the potential benefits are vast, ranging from decentralized finance to enhanced security, the lack of clear regulatory frameworks has created a landscape rife with both opportunity and risk. In the United States, the journey towards a comprehensive regulatory framework for crypto is ongoing, and the path forward is laden with challenges and potential pitfalls.

A Mosaic of Agencies: The Current Landscape

The current regulatory landscape for crypto in the US is fragmented, with multiple agencies vying for jurisdiction. This patchwork approach creates confusion for both businesses and consumers, hindering the growth of a stable and trustworthy crypto ecosystem.

- Securities and Exchange Commission (SEC): The SEC, traditionally responsible for regulating securities markets, has taken a broad view of crypto, classifying many tokens as securities. This has led to increased scrutiny of initial coin offerings (ICOs) and the trading of crypto assets on exchanges.

- Commodity Futures Trading Commission (CFTC): The CFTC regulates futures and options markets, and it has asserted jurisdiction over certain cryptocurrencies, particularly Bitcoin, classifying them as commodities. This has led to the emergence of regulated crypto futures markets.

- Financial Crimes Enforcement Network (FinCEN): FinCEN focuses on combating money laundering and terrorist financing. It has issued guidance on the application of anti-money laundering (AML) and know-your-customer (KYC) regulations to crypto businesses.

- Federal Reserve: The Federal Reserve has a limited role in crypto regulation but is actively exploring the potential implications of digital currencies for the financial system.

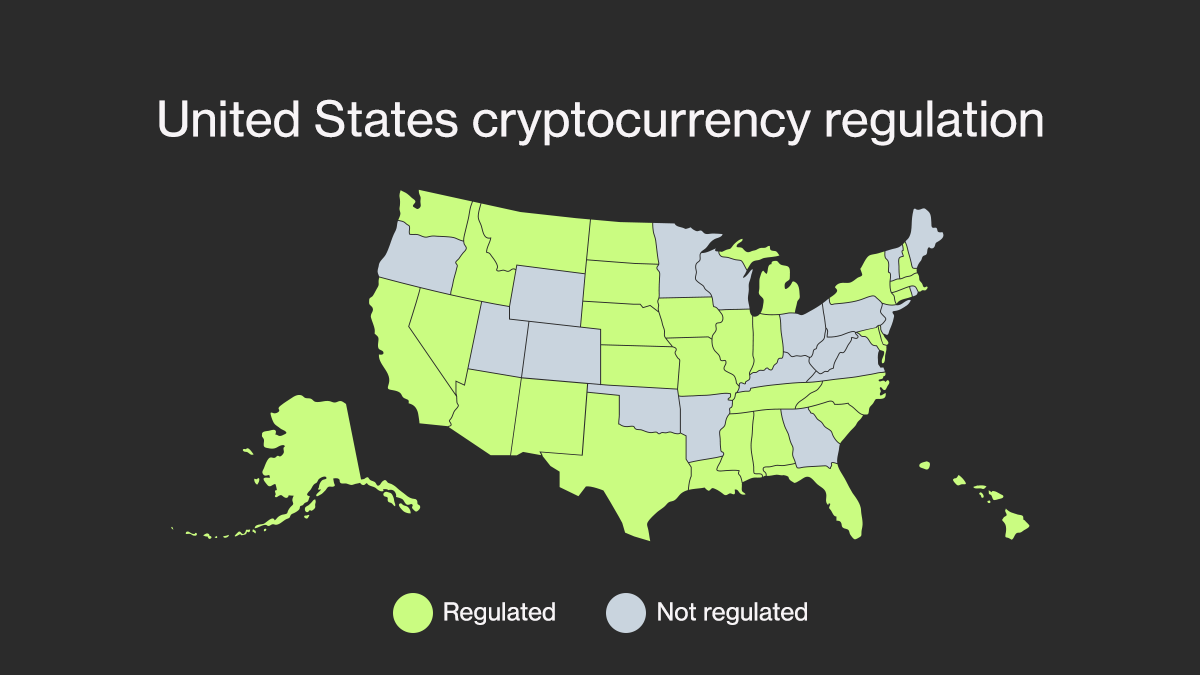

- State Regulators: Many states have enacted their own regulations regarding crypto, further complicating the regulatory landscape.

The Need for Clarity: Challenges and Opportunities

The lack of a cohesive regulatory framework presents several challenges:

- Investor Protection: The lack of clear rules can expose investors to scams, fraud, and market manipulation.

- Financial Stability: The rapid growth of crypto markets poses potential risks to the broader financial system, and the lack of regulation makes it difficult to assess and mitigate these risks.

- Innovation Stifled: Uncertainty about regulatory requirements can discourage innovation and investment in the crypto space.

However, there are also significant opportunities:

- Boosting Financial Inclusion: Cryptocurrencies can potentially provide access to financial services for underserved populations.

- Enhanced Security: Blockchain technology, the foundation of cryptocurrencies, can enhance security and transparency in various sectors.

- Economic Growth: A well-regulated crypto ecosystem can attract investment and foster economic growth.

The Road Ahead: Key Considerations

The US government is grappling with the complexities of regulating crypto. Here are some key considerations:

- Defining Crypto Assets: A crucial step is to clearly define what constitutes a cryptocurrency or digital asset. This will help determine which regulatory framework applies.

- Balancing Innovation and Protection: Regulations need to strike a balance between promoting innovation in the crypto space while ensuring investor protection and financial stability.

- International Cooperation: Cryptocurrencies are global, and effective regulation requires collaboration with other countries to create a harmonized framework.

- Technology Agnostic Approach: Regulations should be technology agnostic, focusing on the underlying economic activities rather than the specific technology used.

The Future of Crypto Regulation in the US

The future of crypto regulation in the US is likely to involve a combination of existing and new regulations, tailored to the unique characteristics of digital assets. The SEC, CFTC, and other agencies are actively working to develop a more comprehensive regulatory framework.

- Stablecoins: Stablecoins, pegged to traditional currencies like the US dollar, have gained significant traction. Regulators are focusing on ensuring the stability and transparency of these assets.

- Decentralized Finance (DeFi): DeFi platforms, which allow for peer-to-peer lending and borrowing without intermediaries, are attracting attention. Regulators are exploring how to apply existing rules to DeFi while fostering innovation.

- Non-Fungible Tokens (NFTs): NFTs, unique digital assets representing ownership of digital or physical items, are rapidly growing in popularity. Regulators are examining their implications for consumer protection and intellectual property rights.

FAQs

Q: What are the risks associated with cryptocurrencies?

A: Cryptocurrencies are highly volatile and subject to market manipulation. They can also be vulnerable to hacking and theft. Additionally, the lack of clear regulations can expose investors to scams and fraud.

Q: How can I invest in cryptocurrencies safely?

A: It’s crucial to research and understand the risks before investing in cryptocurrencies. Consider investing only what you can afford to lose and diversify your portfolio. Use reputable exchanges and wallets, and be wary of unsolicited investment advice.

Q: Is crypto regulation necessary?

A: Crypto regulation is crucial for investor protection, financial stability, and fostering a sustainable and trustworthy crypto ecosystem. It helps to address concerns about fraud, market manipulation, and money laundering.

Q: What is the future of crypto regulation in the US?

A: The future of crypto regulation in the US is likely to involve a combination of existing and new regulations, tailored to the unique characteristics of digital assets. The SEC, CFTC, and other agencies are actively working to develop a more comprehensive regulatory framework.

Conclusion

The US is at a critical juncture in its journey towards a comprehensive regulatory framework for cryptocurrencies. While challenges abound, the potential benefits of a well-regulated crypto ecosystem are immense. As the digital asset landscape continues to evolve, policymakers must strike a delicate balance between innovation and protection, ensuring a future where cryptocurrencies contribute to a more inclusive and secure financial system.

References:

Closure

Thank you for reading! Stay with us for more insights on Navigating the Wild West: Crypto Regulation in the US Economy.

Make sure to follow us for more exciting news and reviews.

We’d love to hear your thoughts about Navigating the Wild West: Crypto Regulation in the US Economy—leave your comments below!

Stay informed with our next updates on Navigating the Wild West: Crypto Regulation in the US Economy and other exciting topics.