Navigating the World of Business Insurance: Your Guide to Finding the Right Broker

Related Articles

- Unlocking The Power Of Business Insurance: A Comprehensive Guide For Every Entrepreneur

- Unlocking Growth: A Guide To Small Business Loan Options

- Unlocking Your Business’s Potential: A Comprehensive Guide To Business Loan Applications

- Business Auto Insurance: Protecting Your Wheels And Your Bottom Line

- Startups And Insurance: A Love-Hate Relationship

Introduction

Uncover the latest details about Navigating the World of Business Insurance: Your Guide to Finding the Right Broker in this comprehensive guide.

Navigating the World of Business Insurance: Your Guide to Finding the Right Broker

Running a business is a whirlwind of activity, and managing risk is a vital component of success. While we all dream of smooth sailing, the reality is that unexpected events can throw even the most well-planned businesses off course. This is where business insurance comes in, acting as a safety net to protect your assets, income, and reputation. But navigating the complex world of insurance policies can be daunting. That’s where business insurance brokers step in, offering invaluable expertise and guidance to help you secure the right coverage.

What is a Business Insurance Broker?

Imagine you’re building a house. You wouldn’t just grab a hammer and start nailing things together, would you? You’d consult an architect, a builder, and various specialists to ensure a strong foundation and a well-constructed home. Business insurance brokers play a similar role for your business. They act as your trusted advisors, guiding you through the complexities of insurance and finding the right policies to meet your specific needs.

Think of them as your insurance navigators, steering you through a sea of policies and ensuring you’re adequately protected. They are not tied to specific insurance companies, giving them the freedom to shop around and find the best deals from various insurers.

Why Do You Need a Business Insurance Broker?

The benefits of working with a business insurance broker are numerous. Here are just a few reasons why they can be an invaluable asset to your company:

- Expertise and Knowledge: Brokers are well-versed in the intricacies of different insurance policies and can explain them in plain English. They understand the unique risks your industry faces and can recommend tailored solutions.

- Independent Advice: Unlike insurance agents who work for a specific company, brokers are independent and can offer unbiased advice based on your needs, not on their commission structure.

- Competitive Pricing: Brokers have access to multiple insurers and can negotiate the best rates on your behalf. They’ll shop around to find the most competitive quotes, saving you time and money.

- Claim Support: If you need to file a claim, brokers can assist you with the process, ensuring you receive fair and timely compensation. They can act as your advocate with the insurance company, helping you navigate any disputes.

- Policy Review and Updates: Your business needs change over time, so your insurance coverage should too. Brokers can regularly review your policies and make adjustments as needed to ensure you’re always adequately protected.

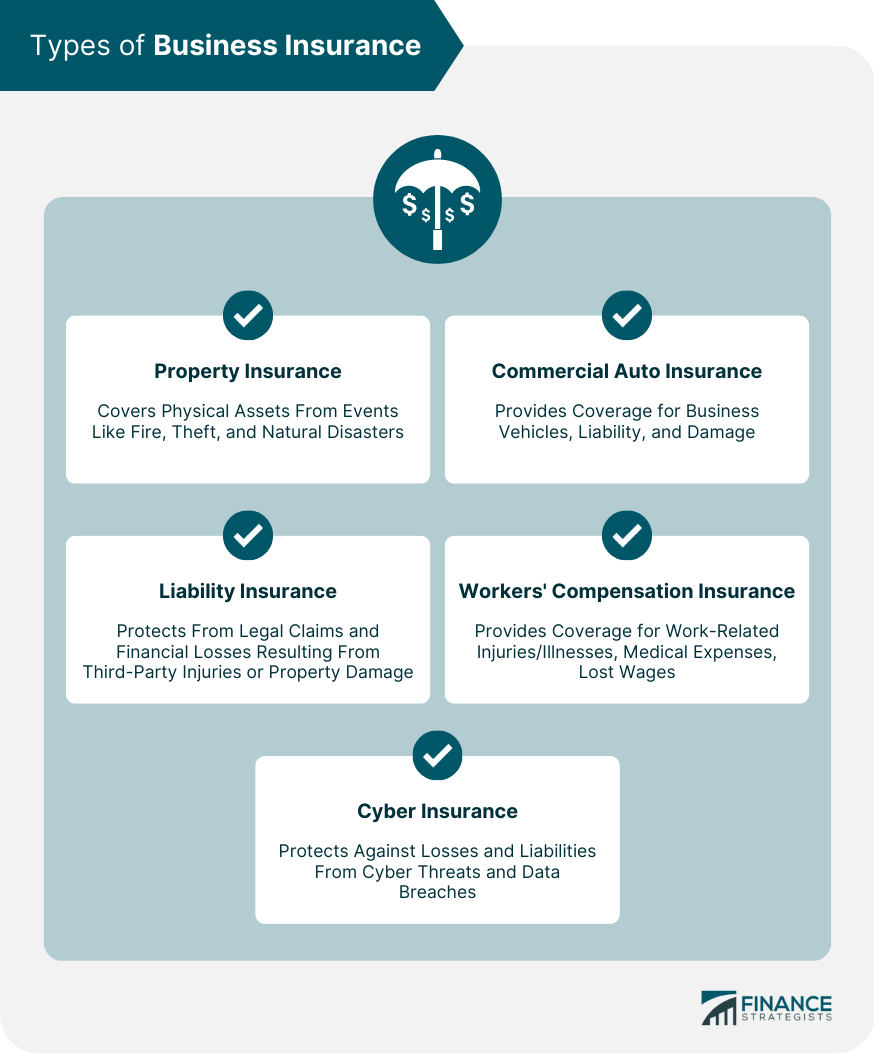

Types of Business Insurance Policies

The world of business insurance is vast, with numerous policies designed to cover various risks. Here are some of the most common types:

- General Liability Insurance: Provides protection against claims arising from bodily injury, property damage, or personal injury caused by your business operations.

- Property Insurance: Covers damage to your business property, including buildings, equipment, inventory, and furniture, due to fire, theft, vandalism, or natural disasters.

- Workers’ Compensation Insurance: Protects your employees in case of work-related injuries or illnesses. It covers medical expenses, lost wages, and rehabilitation costs.

- Business Interruption Insurance: Provides financial protection if your business is forced to shut down due to a covered event, such as a fire or natural disaster. It helps cover lost income and ongoing expenses.

- Professional Liability Insurance (E&O): Protects professionals like lawyers, accountants, and consultants from claims of negligence, errors, or omissions in their work.

- Cyber Liability Insurance: Provides coverage for data breaches, cyberattacks, and other digital threats, protecting your business from financial losses and reputational damage.

- Commercial Auto Insurance: Covers your company vehicles, including liability for accidents, damage to the vehicle, and theft.

- Product Liability Insurance: Protects your business from claims arising from injuries or damages caused by defective products you manufacture or sell.

Choosing the Right Broker

Finding the right business insurance broker is crucial. Here are some tips to help you make an informed decision:

- Seek Recommendations: Talk to other business owners, industry associations, or your accountant for recommendations.

- Check Credentials: Ensure the broker is licensed and insured in your state. Look for experience and expertise in your industry.

- Get Quotes: Request quotes from several brokers to compare their rates and coverage options.

- Ask Questions: Don’t be afraid to ask questions about their experience, fees, and how they work with clients.

- Trust Your Gut: Choose a broker you feel comfortable with and who you trust to represent your best interests.

FAQs

Q: How much does business insurance cost?

A: The cost of business insurance varies depending on factors like industry, location, size of your business, and the type of coverage you need. It’s best to get quotes from multiple brokers to compare prices.

Q: How often should I review my insurance policies?

A: It’s a good idea to review your policies annually, or more frequently if your business experiences significant changes, such as expansion, new products, or acquisitions.

Q: What if I have a claim?

A: Your broker will guide you through the claims process, ensuring you submit the necessary documentation and follow the correct procedures. They can also act as your advocate with the insurance company.

Q: Can I get business insurance online?

A: While some online platforms offer insurance quotes, it’s generally recommended to work with a broker who can provide personalized advice and tailored solutions.

Q: What questions should I ask a potential broker?

A: Here are some key questions to ask:

- What types of businesses do you specialize in?

- What insurance companies do you work with?

- What is your experience in my industry?

- How do you charge your fees?

- How will you help me navigate the claims process?

Conclusion

Business insurance is a vital investment for any company, protecting you from financial hardship and legal liability. A skilled and experienced business insurance broker can be your invaluable partner in navigating the complex world of insurance, ensuring you have the right coverage to safeguard your business and achieve your goals.

Source URL: [Insert relevant source URL here]

Note: This article provides general information and is not intended as legal or financial advice. It’s essential to consult with a qualified professional for personalized guidance regarding your specific needs.

Closure

Thank you for reading! Stay with us for more insights on Navigating the World of Business Insurance: Your Guide to Finding the Right Broker.

Don’t forget to check back for the latest news and updates on Navigating the World of Business Insurance: Your Guide to Finding the Right Broker!

We’d love to hear your thoughts about Navigating the World of Business Insurance: Your Guide to Finding the Right Broker—leave your comments below!

Keep visiting our website for the latest trends and reviews.