The Business Loan Approval Process: A Guide for Entrepreneurs

Related Articles

- Demystifying Business Insurance Costs: A Guide For Every Entrepreneur

- Unlocking Your Business Dreams: Navigating Business Loans With Less-Than-Perfect Credit

- Unlocking Growth: A Guide To Small Business Loan Options

- Unlocking The Power Of Business Insurance: A Comprehensive Guide For Every Entrepreneur

- Finding The Perfect Fit: A Guide To Navigating Small Business Loans

Introduction

Join us as we explore The Business Loan Approval Process: A Guide for Entrepreneurs, packed with exciting updates

The Business Loan Approval Process: A Guide for Entrepreneurs

Getting a business loan can be a game-changer for your company. It can help you fund expansion, purchase equipment, manage cash flow, or even weather a tough economic storm. But navigating the business loan approval process can feel like a labyrinth.

Don’t worry, we’re here to guide you through it. This comprehensive guide will demystify the process, explaining each step, the factors that influence approval, and the key strategies for success.

Understanding the Basics

Before we dive into the nitty-gritty, let’s understand the fundamental principles of business loan approval.

- Creditworthiness: Lenders evaluate your business’s ability to repay the loan. This involves assessing your financial history, credit score, and overall financial health.

- Collateral: Some loans require collateral, which is an asset you pledge to the lender as security. This could be real estate, equipment, or inventory.

- Purpose of the Loan: Lenders want to know why you need the loan and how it will benefit your business. A clear and well-defined business plan is crucial.

- Loan Terms: This includes the interest rate, repayment period, and any associated fees. Lenders consider your financial situation and the loan amount to determine the best terms.

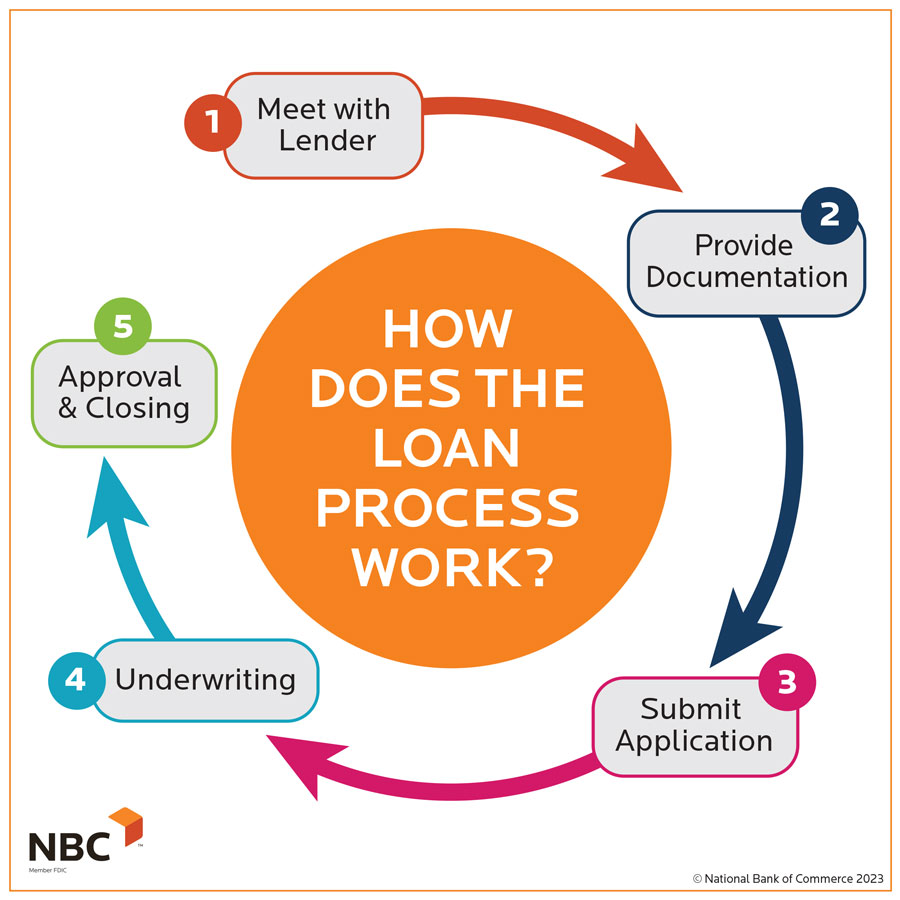

Step-by-Step Guide to Business Loan Approval

Now, let’s break down the typical business loan approval process, step-by-step:

1. Preparation: Laying the Foundation for Success

This is the most crucial stage, as it sets the stage for your loan application.

- Self-Assessment: Before approaching any lender, take a hard look at your business.

- Financial Health: Analyze your income statements, balance sheets, and cash flow statements. Identify any weaknesses or areas for improvement.

- Credit History: Check your business credit score. If it’s less than ideal, work on improving it before applying.

- Loan Needs: Define the specific purpose of the loan and the amount you need.

- Business Plan: A well-crafted business plan is your roadmap to success. It should outline your business goals, target market, marketing strategies, financial projections, and management team.

- Collateral: If you plan to use collateral, assess its value and ensure it meets the lender’s requirements.

2. Choosing the Right Lender

Not all lenders are created equal. Research and compare different options based on:

- Loan Types: Consider the various types of business loans available, such as term loans, lines of credit, SBA loans, and equipment financing.

- Interest Rates and Fees: Compare interest rates, origination fees, and other charges.

- Loan Requirements: Evaluate the eligibility criteria and the specific documents each lender requires.

- Reputation and Customer Service: Look for lenders with a strong reputation for fair practices and excellent customer service.

3. Submitting Your Application

Once you’ve chosen a lender, you’ll need to submit your loan application. This typically involves:

- Application Form: Complete the lender’s application form, providing accurate and detailed information about your business.

- Supporting Documents: Gather the necessary documentation, including:

- Financial statements (income statements, balance sheets, cash flow statements)

- Business tax returns (past 2-3 years)

- Business plan

- Personal financial statements (for loans that require personal guarantees)

- Proof of collateral (if applicable)

- Industry-specific documents (e.g., licenses, permits)

4. Underwriting and Evaluation

After submitting your application, the lender’s underwriting team will review your information. This process involves:

- Credit Check: Verifying your credit history and credit score.

- Financial Analysis: Examining your financial statements and projections to assess your business’s financial health and ability to repay the loan.

- Collateral Valuation: If you’re using collateral, the lender will assess its value and determine if it’s sufficient to cover the loan amount.

- Industry Research: The lender may research your industry to assess its overall health and potential risks.

5. Loan Approval or Denial

The lender will make a decision based on their assessment.

- Approval: If approved, you’ll receive a loan offer outlining the terms and conditions. This includes the interest rate, repayment period, and any associated fees.

- Denial: If denied, the lender will typically provide reasons for the denial. This can help you address any weaknesses in your application and improve your chances of getting approved in the future.

6. Loan Closing and Disbursement

Once you accept the loan offer, you’ll need to sign the loan agreement and provide any remaining required documentation.

- Loan Agreement: This legally binding document outlines the terms and conditions of the loan.

- Disbursement: The lender will then disburse the loan funds according to the agreed-upon schedule.

Factors Influencing Loan Approval

Several factors can influence your chances of getting a business loan approved.

- Credit Score: A good credit score is essential for securing favorable loan terms. Aim for a score of 700 or above.

- Time in Business: Lenders prefer businesses with a proven track record. The longer you’ve been in business, the better your chances of approval.

- Financial Health: Strong financial statements, including a healthy cash flow, are crucial.

- Loan Purpose: Lenders are more likely to approve loans for productive purposes, such as expanding your business or purchasing equipment.

- Debt-to-Equity Ratio: Lenders prefer businesses with a low debt-to-equity ratio, indicating a healthy financial position.

- Industry: Certain industries are considered riskier than others, which can affect loan approval.

- Economic Conditions: Economic downturns can make lenders more cautious about lending.

Tips for Increasing Your Chances of Approval

- Build a Strong Credit History: Pay your bills on time, manage your credit card usage, and avoid excessive debt.

- Improve Your Financial Statements: Focus on increasing revenue, controlling expenses, and maintaining a healthy cash flow.

- Develop a Detailed Business Plan: A well-written business plan demonstrates your understanding of the market, your business model, and your financial projections.

- Choose the Right Lender: Shop around and compare different loan options to find the best fit for your business needs.

- Prepare Thoroughly: Gather all the necessary documentation and present a complete and accurate application.

- Maintain Open Communication: Be proactive and communicate with the lender throughout the process.

- Consider Alternative Financing Options: If you’re struggling to get approved for a traditional bank loan, explore alternative financing options, such as crowdfunding, merchant cash advances, or invoice factoring.

FAQs about Business Loan Approval

1. What are the common reasons for business loan denial?

Common reasons for denial include:

- Poor credit score: A low credit score indicates a higher risk to the lender.

- Weak financial performance: Financial statements showing declining revenue, high debt levels, or negative cash flow can raise concerns.

- Insufficient collateral: Lenders may require collateral to secure the loan, and if the collateral is inadequate, it can lead to denial.

- Unclear business plan: A poorly written or unrealistic business plan can raise doubts about your business’s viability.

- Lack of experience: Lenders may be hesitant to lend to businesses with no track record or limited experience in the industry.

2. What is a personal guarantee, and why do lenders require it?

A personal guarantee is a legal agreement where you, as the business owner, personally promise to repay the loan if your business fails to do so. Lenders often require personal guarantees for small businesses, especially for larger loans or when the business has limited assets.

3. How long does the business loan approval process typically take?

The approval process can vary depending on the lender, the loan type, and the complexity of your application. However, it typically takes anywhere from a few weeks to several months.

4. What happens after my loan is approved?

Once approved, you’ll sign the loan agreement and receive the loan funds. You’ll then be responsible for making regular payments according to the loan terms.

5. What should I do if my loan application is denied?

If denied, review the reasons provided by the lender and address any weaknesses in your application. You can also try applying to different lenders or exploring alternative financing options.

6. How can I improve my chances of getting approved for a business loan?

To increase your chances of approval, focus on building a strong credit history, improving your financial statements, developing a detailed business plan, and choosing the right lender.

7. What are some common business loan scams to watch out for?

Be wary of lenders who:

- Offer loans with unrealistically low interest rates or no credit checks.

- Pressure you to make a decision quickly.

- Require upfront fees or payments.

- Don’t provide clear loan terms and conditions.

Conclusion

Securing a business loan can be a challenging but rewarding process. By understanding the steps involved, the factors that influence approval, and the strategies for success, you can increase your chances of getting the funding you need to grow your business. Remember, thorough preparation, a strong business plan, and a good credit history are key to a successful loan application.

Source URL:

This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial professional before making any financial decisions.

[Insert relevant website URL]

Closure

Thank you for reading! Stay with us for more insights on The Business Loan Approval Process: A Guide for Entrepreneurs.

Don’t forget to check back for the latest news and updates on The Business Loan Approval Process: A Guide for Entrepreneurs!

We’d love to hear your thoughts about The Business Loan Approval Process: A Guide for Entrepreneurs—leave your comments below!

Keep visiting our website for the latest trends and reviews.